75% Chance Crypto Is ‘Crossing The Chasm’ Now, Says Moonrock Capital Boss

Moonrock Capital founder Simon Dedic says the crypto industry is nearing a decisive transition from an early-adopter niche to a mainstream market, assigning a 75% probability that the sector will “finish crossing the chasm and enter the early-majority phase next year.”

Is The Crypto Market Crossing The Chasm?

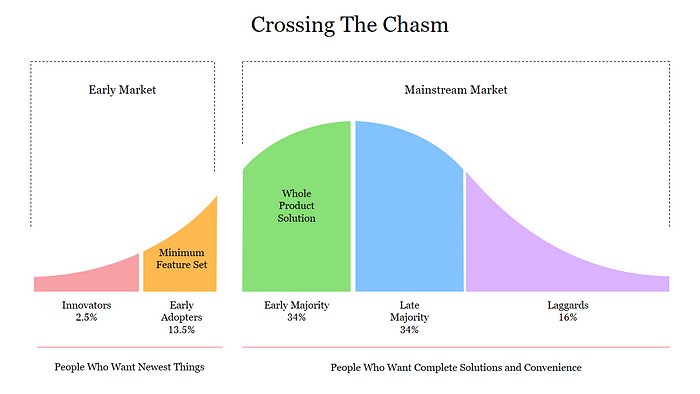

Dedic frames his outlook using the classic technology adoption curve, which splits the market into innovators (2.5%), early adopters (13.5%), an early majority (34%), late majority (34%) and laggards (16%). The critical “chasm” lies between early adopters—“people who want newest things” and accept a minimum feature set—and the early majority, who demand a “whole product solution” and prioritize complete, convenient offerings.

In his base case, Dedic argues that crypto is now close to exiting that chasm. If so, he says, “the classic 4-year cycles are dead. The market will have matured and will increasingly correlate with macro cycles and industry fundamentals rather than self-fulfilling narratives.” Under this scenario, pricing would be governed less by reflexive narratives around halvings or “altseason” and more by the sector’s real economic role and its interaction with broader financial conditions.

He assigns a 20% probability to a less advanced stage of adoption in which the industry is “still in the early-adopter phase and only now beginning to cross the chasm.” In that case, he believes crypto could face “a 1-3 year bear market while the industry finds itself and pushes toward early-majority adoption.” Here, the established four-year pattern could remain intact, with another prolonged downturn before mainstream product-market fit is fully achieved.

The remaining 5% is reserved for a failure scenario in which the sector never secures such fit. “We get stuck in the chasm and never find true mainstream pmf,” Dedic writes, warning that crypto could then “turn into a zero sum game and we will just PvP trade money from one to the other.”

Dedic makes clear he views that outcome as unlikely. He cites “regulatory tailwinds, institutional adoption, and the accelerating fundamentals of our industry” as reasons to believe the market is already in scenario one, “standing right in front of the biggest adoption wave crypto has ever seen, and likely ever will see.”

He also argues that market structure and culture must evolve alongside adoption. “The 4 year cycles and simple narrative chasing are dead,” he says. While “the onchain online casino will always be part of our identity, it will shrink into a niche. It’s time for the industry to mature and start playing the serious game.”

For Dedic, that conviction is not theoretical. “An incredible decade lies ahead for those willing to evolve,” he concludes, adding that he is “betting basically all my money on the idea that this is only just getting started.”

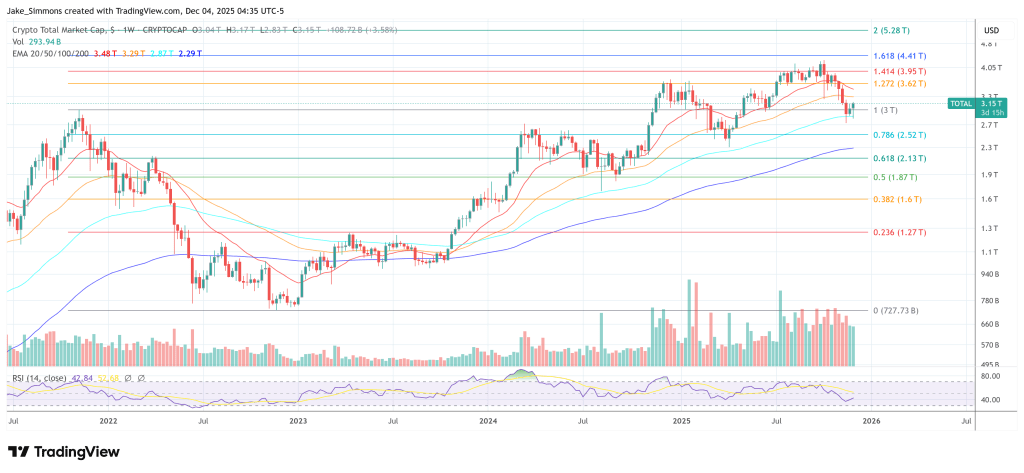

At press time, the total crypto market cap stood at $3.15 trillion.