XRP ETFs Record 13-Day Streak As SOL Funds See Largest Outflows Since Launch

As institutional demand intensifies and the crypto market recovers, US spot XRP Exchange-Traded Funds (ETFs) continue to lead the sector with a 13-day streak and over $200 million in positive net flows this week, outshining Solana (SOL) ETFs, which recorded their third day of outflows in seven days.

XRP Funds Lead Crypto ETF Inflows

Spot XRP exchange-traded funds have extended their record-breaking streak after registering their thirteenth consecutive day of positive net flows, with $50.27 million in inflows on December 3.

The investment products have seen a remarkable performance since the launch of Canary Capital’s XRPC, the first single-token XRP spot ETF, on November 13, positioning the funds as the fastest-growing altcoin-based category.

Notably, XRPC surpassed all initial expectations and debuted on Nasdaq with a total volume of $58 million, recording around $357.54 million in positive net flows in 13 days. Last week, the second group of XRP funds went live, becoming the largest US ETF launches of 2025 with over $60 million in net inflows each during their first day.

Moreover, the category, led by Grayscale’s GXRP and Franklin Templeton’s XRPZ, surpassed other major ETFs in single-day inflows, including those based on the largest cryptocurrencies by market capitalization, Solana, Bitcoin (BTC), and Ether (ETH).

Amid this week’s market recovery, XRP ETFs saw $89.65 million on Monday, $67.7 million the following day, and an additional $50.27 million on Wednesday, for a cumulative net inflow of $207.66 million during the first three days of December.

As a result, the leading category surpassed both Bitcoin ETFs’ $52.4 million and Ethereum ETFs’ $51.3 million positive net flows, respectively, during the same three-day period.

With a total of $874.28 million in inflows in 13 days, spot XRP ETFs have surpassed the $618.62 million total inflows of SOL ETFs, which held the record among the second wave of altcoin-based investment products.

Solana ETFs Demand Loses Steam

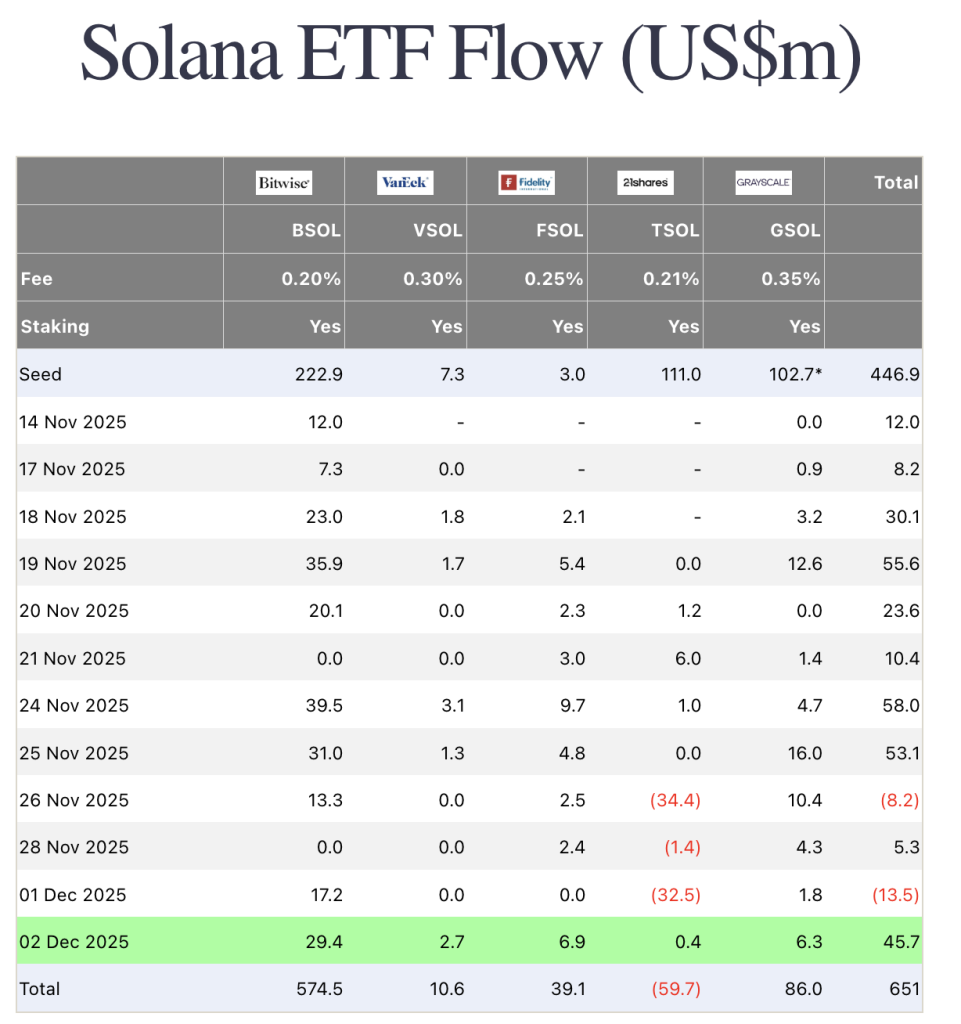

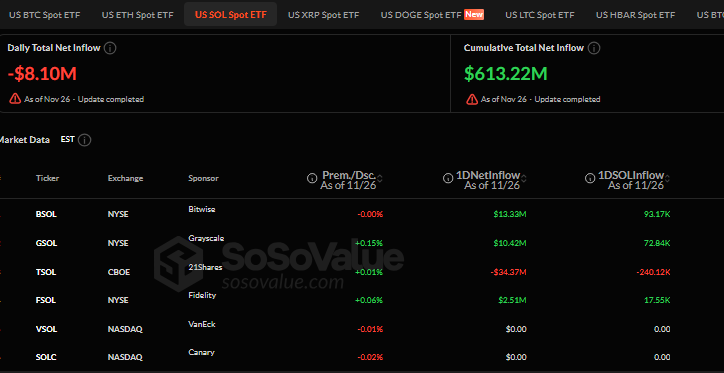

While XRP ETFs take the spotlight, Solana funds’ momentum has slowed, seeing their largest days of outflows this week. According to SoSovalue data, the investment products recorded $32.9 million in outflows on December 3, marking their third negative net flows day since the category debuted on October 28.

Despite pulling out positive net flows, Bitwise’s BSOL, Fidelity’s FSOL, and Grayscale’s GSOL were unable to absorb 21Shares’ TSOL $41.8 million in outflows. This performance also marks the fourth negative day for TSOL over the past week.

As reported by NewsBTC, Solana ETFs experienced a record performance in November despite the market correction, with $613 million in inflows during their 22 consecutive day positive streak.

However, the remarkable streak ended a week ago when TSOL registered negative net flows for the first time, and the category was unable to absorb them, recording outflows of $8.1 million.

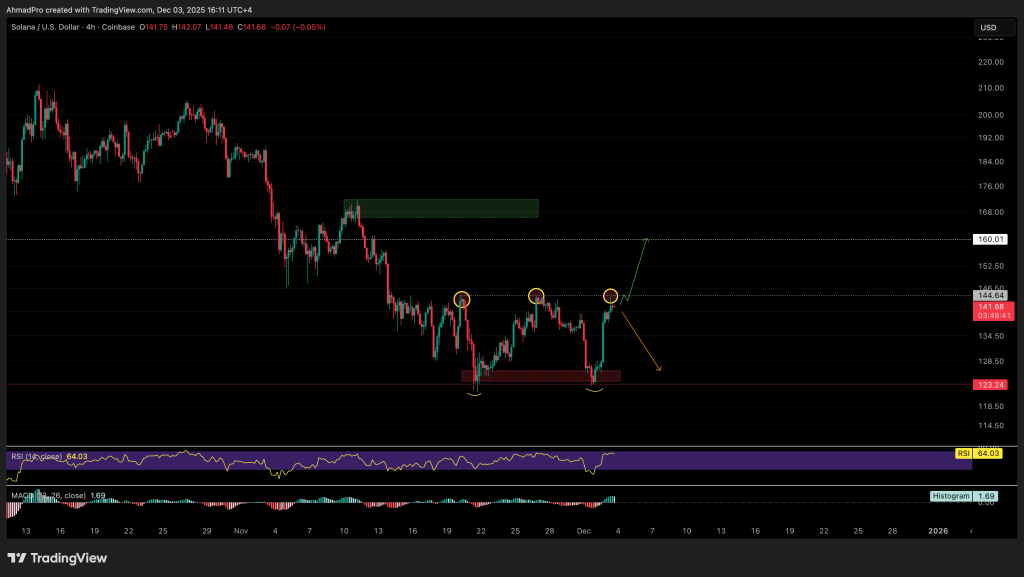

SOL-based investment products started December with outflows worth $13.5 million, which were followed by strong inflows worth $45.77 million on Tuesday. On December 3, the funds registered $32.19 million in outflows, amounting to a negative net flow of $700,000 for the first half of the week, despite the altcoin’s recent price recovery.