Bitcoin Bull Run Set To Last Until 2027, Analysts Highlight Influential Factors

Many in the crypto space have echoed a familiar sentiment over recent months: “The four-year crypto market cycle is dead.” Experts from the Bull Theory assert that while the four-year cycle may have come to an end, the Bitcoin bull run itself is merely delayed and could stretch until 2027.

Why The Four-Year Cycle May Be Ending

In a recent post on social media platform X, formerly known as Twitter, the Bull Theory analysts noted that the concept of Bitcoin adhering to a neat four-year cycle is weakening.

They highlighted that significant price movements over the last decade weren’t solely driven by Halving events; rather, they were influenced by shifts in global liquidity.

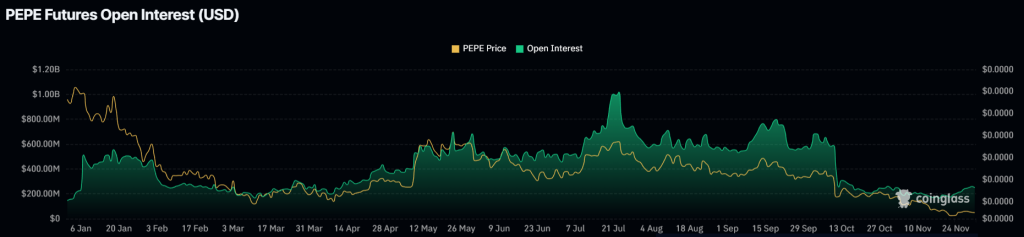

The analysts pointed to the current landscape of stablecoin liquidity, which remains high despite recent downturns, indicating that larger investors are still engaged in the market, poised to invest when appropriate macroeconomic conditions arise.

In the US, Treasury policies are emerging as pivotal catalysts. The recent buybacks are notable, but the analysts emphasize that the larger narrative lies in the Treasury General Account (TGA) balance, which is currently around $940 billion—almost $90 billion above its normal range.

This surplus cash is likely to flow back into the financial system, enhancing financing conditions and adding liquidity that typically gravitates toward risk assets.

Globally, the trends appear even more promising. China has been injecting liquidity for several months, while Japan recently announced a stimulus package worth approximately $135 billion, alongside efforts to simplify cryptocurrency regulations.

Canada is also moving toward easing its monetary policy, and the US Federal Reserve (Fed) has officially halted its quantitative tightening (QT) measures—a historical precursor to some form of liquidity expansion.

Political And Monetary Factors Align To Create Bullish Condition

The analysts explained that when major economies adopt expansive monetary policies simultaneously, risk assets like Bitcoin tend to respond more rapidly than traditional stocks or broader markets.

Additionally, potential policy tools, such as the Supplementary Leverage Ratio (SLR) exemption—implemented in 2020 to allow banks more flexibility in expanding their balance sheets—could return, resulting in increased credit creation and overall market liquidity.

There is also a political dimension to consider. President Trump has discussed potential tax reforms, including abolishing income tax and distributing $2,000 tariff dividends.

Furthermore, the likelihood of a new Federal Reserve chair who supports liquidity assistance and is constructive toward cryptocurrency could bolster conditions for economic growth.

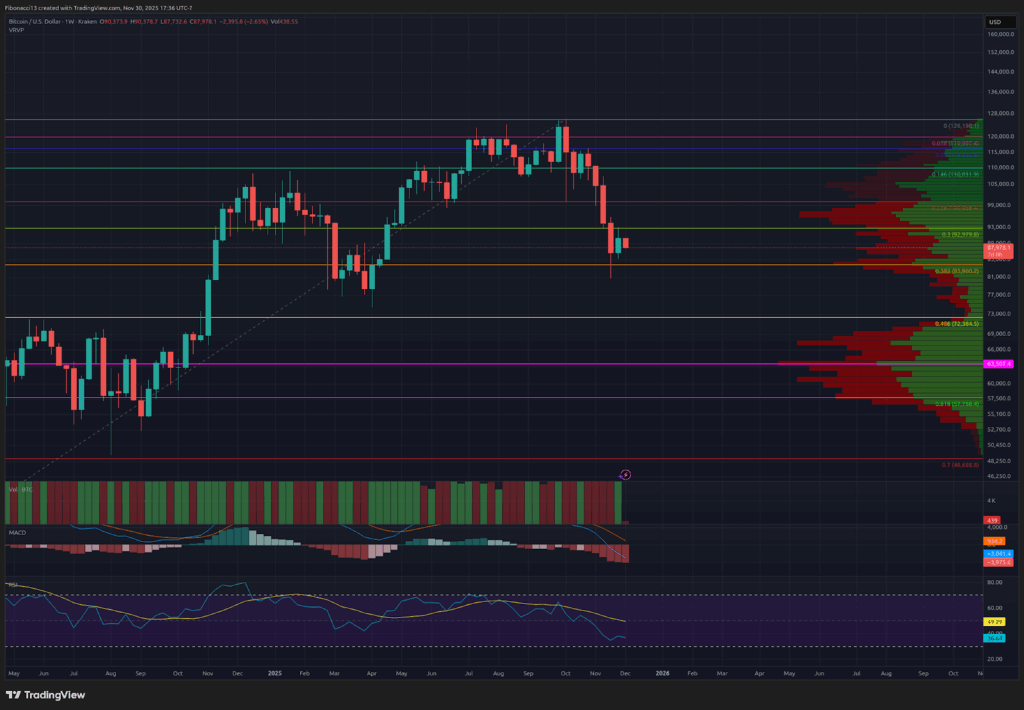

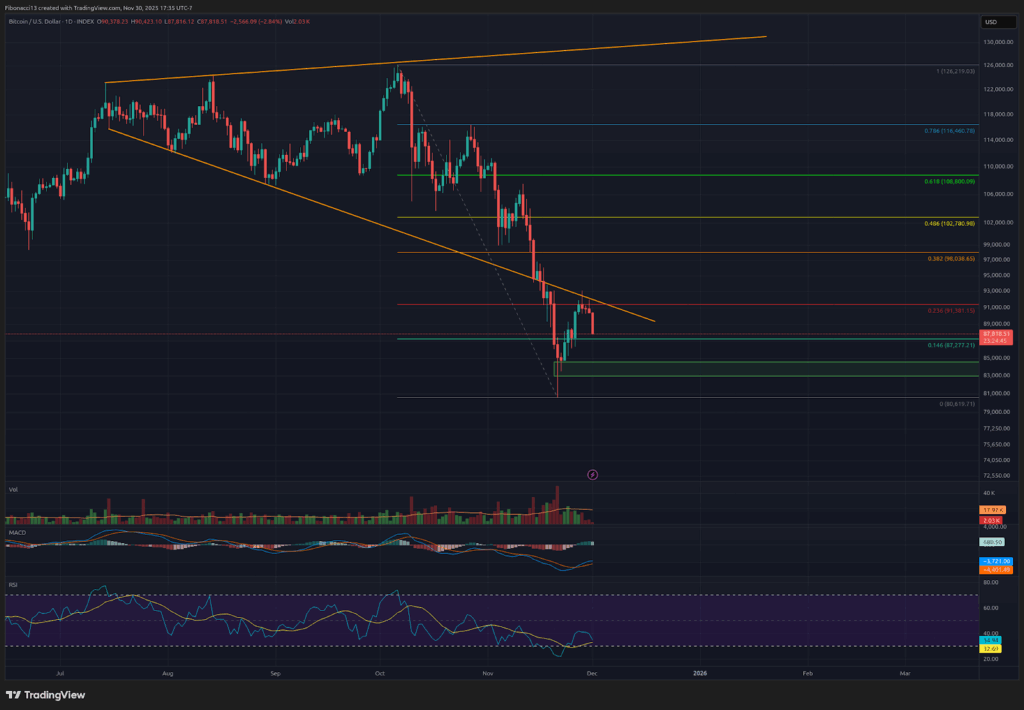

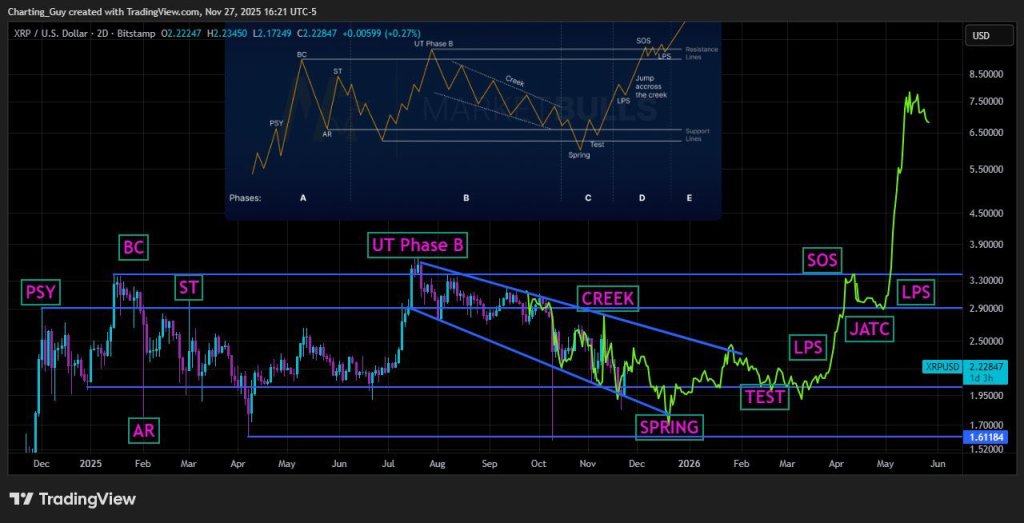

Extended Bitcoin UptrendHistorically, whenever the Institute for Supply Management’s Purchasing Managers’ Index (ISM PMI) surpasses 55, it has been followed by periods of altcoin season. The probability of this occurring in 2026 appears high, according to the Bull Theory.

The convergence of rising stablecoin liquidity, the Treasury’s injection of cash back into markets, global quantitative easing, the cessation of QT in the US, potential bank-lending relief, pro-market policy shifts in 2026, and major players entering the crypto sector suggests a very different scenario than the old four-year halving model.

The analysts concluded that if liquidity expands concurrently across the US, Japan, China, Canada, and other significant economies, Bitcoin is unlikely to move counter to that trend.

Therefore, rather than experiencing a sharp rally followed by a prolonged bear market, the current environment indicates a more extended and broader uptrend that could span through 2026 and into 2027.

Featured image from DALL-E, chart from TradingView.com

NEWS: Vanguard, the world’s 2nd largest asset manager with about $11T in AUM, has made

NEWS: Vanguard, the world’s 2nd largest asset manager with about $11T in AUM, has made