Hidden XRP Accumulation: CEO Points To Secret Buys By The Wealthiest Families

Reports have disclosed that some extremely wealthy family offices are adding XRP to their holdings, a move that market watchers say could influence demand for the token.

According to Jake Claver, CEO of Digital Ascension Group, a close contact overheard members of an affluent family tied to a major US food brand discussing sizable XRP positions while being driven from Disney World to their hotel in Orlando. Claver also said he has spoken with several large family offices that are making allocations into XRP.

Billionaire Interest And Anecdotal Claims

Claver said many of these investors are not looking for quick gains but for ways to preserve capital over the long run. He said only 38% of global family offices are even considering crypto exposure today, and that some of the families he has spoken with are now exploring XRP as part of a hedge.

Claver emphasized a mindset common among long-term investors: “You should only have to get rich once,” he said, describing how some families build a steady core position surrounded by diversification.

ETF Inflows And Market Numbers

Based on reports, the new XRP exchange-traded funds have pulled substantial supply from exchanges and OTC desks since launch. Over 400 million XRP have been taken up by ETFs, and inflows have topped $887 million with total assets above $906 million as of Wednesday.

Some sources count these moves within nine days of launch; others reference a 15-day window, which suggests reporting on timing has varied. Price action has stayed fairly steady near $2, but many traders are watching whether ETF demand eventually pressures that level.

On-Chain Activity And Holder ConcentrationRecord-Breaking XRP Velocity: A Surge in On-Chain Activity

“Such a surge typically signifies high liquidity and substantial involvement from traders or significant movements by whales.” – By @CryptoOnchain

Full analysis

https://t.co/AgXG0JK5Ig pic.twitter.com/H04OICWRIW

— CryptoQuant.com (@cryptoquant_com) December 4, 2025

Blockchain data shows there are roughly 7 million XRP wallets, and about half of those hold fewer than one hundred XRP. That concentration of ownership is being pointed to by some as a factor that could magnify price moves if larger buyers step in.

On December 2, the XRP Ledger’s velocity metric jumped to 0.0324, a yearly high according to CryptoQuant, driven by large transfers and heightened on-ledger circulation. Reports noted that several whales moved XRP at levels not seen earlier this year, a sign some big players may be repositioning.

What Investors And Observers Are WatchingObservers say the key things to monitor are ETF flows, on-chain metrics like velocity, and whether large family offices publicly disclose allocations. Ripple’s existing ties with certain banks and projects are often cited as part of the story for institutional adoption, though other platforms also aim at broad use by banks.

For now, the picture mixes solid market activity — including ETF inflows and a jump in velocity — with ongoing chatter about billionaire buying. The market signals suggest growing institutional interest, while the family-office stories add another layer to how people are interpreting the trend.

Featured image from Unsplash, chart from TradingView

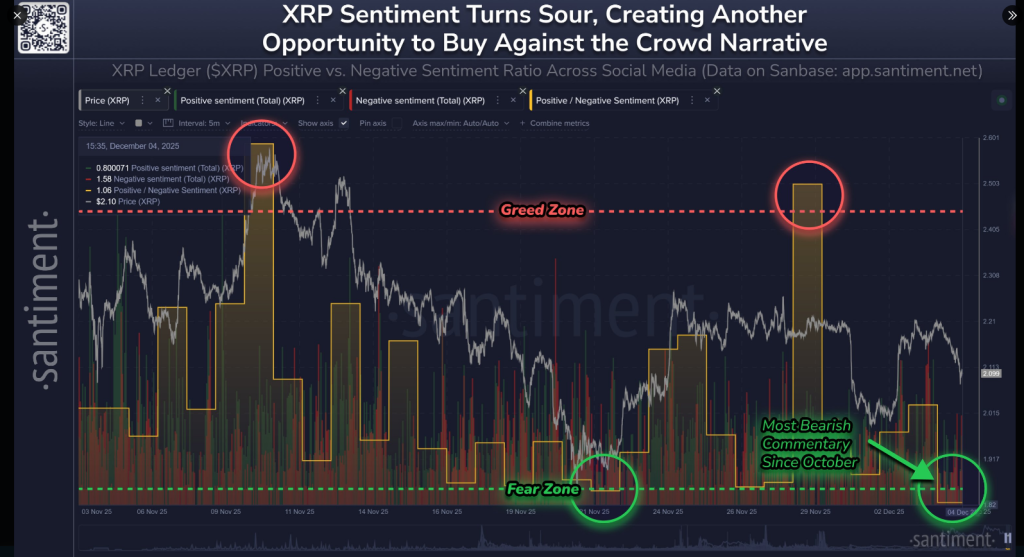

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data.

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data. Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

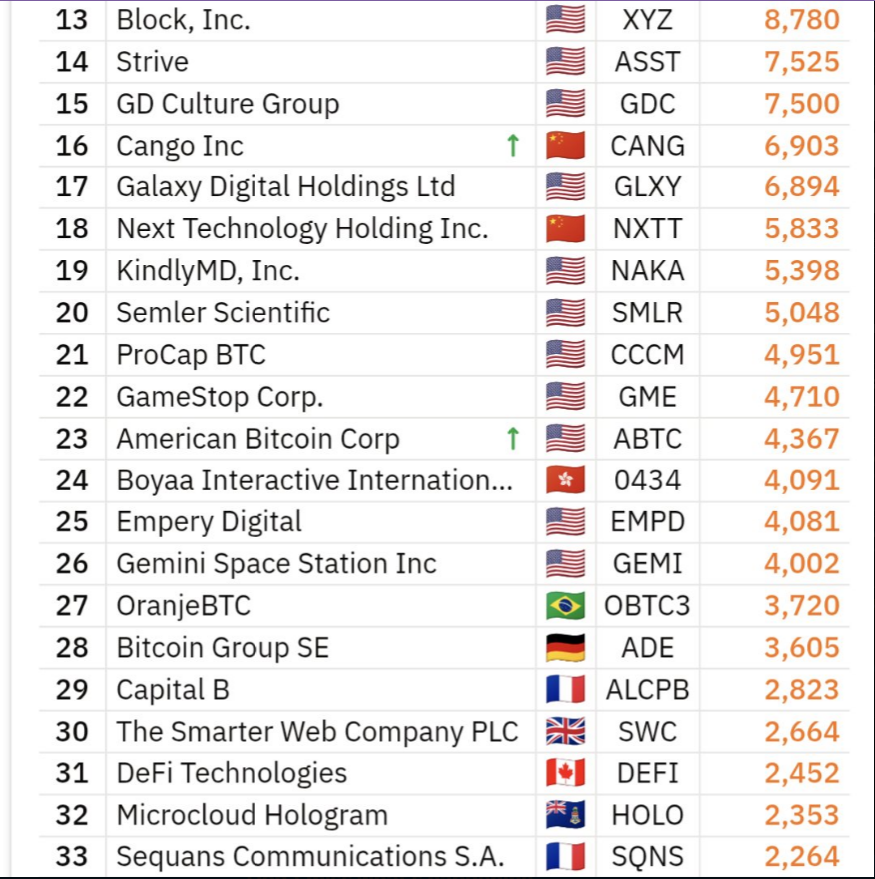

Bitcoin 100 Ranking: 23

Bitcoin 100 Ranking: 23

UK Eyes

UK Eyes