Decentralized stablecoin protocol USPD hit by $1M exploit

The International Monetary Fund on Thursday released a new global assessment of the stablecoin market, warning that fragmented regulatory frameworks across countries are now creating structural “roadblocks” that threaten financial stability, weaken oversight, and slow the development of cross-border payments.

In its report titled “Understanding Stablecoins,” the IMF reviewed how major economies, including the United States, the United Kingdom, the European Union, and Japan, regulate stablecoins and found that national approaches remain widely inconsistent.

Stablecoins have the potential to reshape cross-border payments and capital flows. They offer opportunities, but also bring new risks—financial integrity, regulatory oversight, consumer protection, capital flow management, monetary sovereignty, and more. Learn more:… pic.twitter.com/cOlZKuqLDF

— IMF (@IMFNews) December 4, 2025

While some countries treat stablecoins as securities, others regulate them as payment instruments, permit only bank-issued tokens, or leave large parts of the market unregulated.

The IMF said this regulatory patchwork allows stablecoins to move across borders faster than oversight can follow.

Issuers can operate from lightly regulated jurisdictions while serving users in stricter markets, limiting authorities’ ability to monitor reserves, redemptions, liquidity management, and anti-money laundering controls.

The fund warned that this creates regulatory arbitrage and weakens global supervision.

The report also pointed to technical fragmentation. Stablecoins increasingly operate across different blockchains and exchanges that are not always interoperable.

According to the IMF, this lack of coordination raises transaction costs, slows market development, and creates barriers to efficient global payments.

Differences in national regulatory treatment further complicate cross-border usage and settlement.

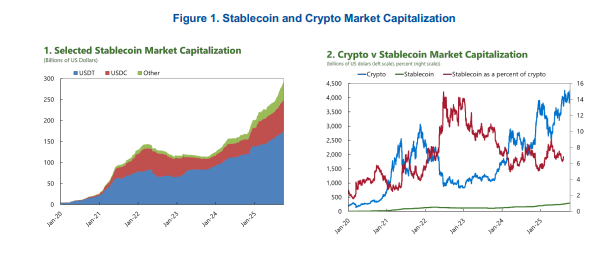

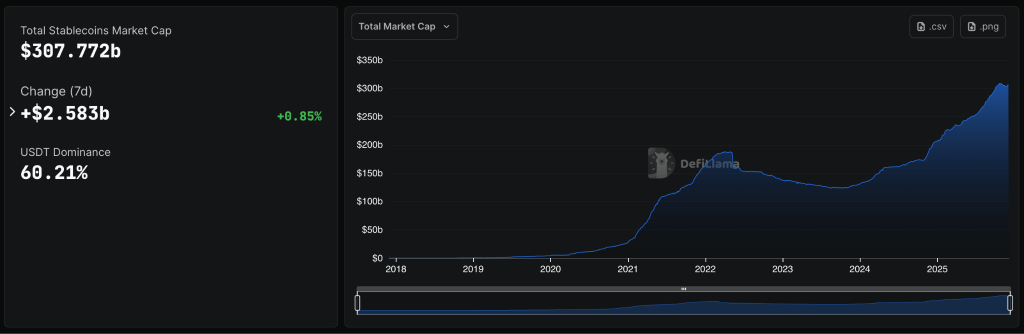

Stablecoins remain dominated by U.S. dollar-denominated tokens. The IMF said the global stablecoin market is now worth more than $300 billion. Tether’s USDT and Circle’s USDC make up the majority of that supply. About 40% of USDC’s reserves are held in short-term U.S. treasuries, while roughly 75% of USDT’s reserves are in short-term treasuries, with another 5% held in Bitcoin.

The concentration of reserves in government debt markets links stablecoins directly to traditional financial systems

Widespread use of foreign-currency stablecoins can weaken domestic monetary control, lower demand for local currency, and accelerate digital dollarization. Stablecoins also make it easier to bypass capital controls through unhosted wallets and offshore platforms.

In addition to monetary concerns, the fund cited broader financial stability concerns. Large-scale redemptions could force rapid sales of Treasury bills and repo assets, potentially disrupting short-term funding markets that are critical for monetary policy transmission.

The IMF also noted that the increasing interconnection between stablecoin issuers, banks, custodians, crypto exchanges, and funds also increases the risk of contagion spreading from digital markets into the wider financial system.

To address these risks, the IMF released new global policy guidelines intended to reduce fragmentation. It called for harmonized definitions of stablecoins, consistent rules for reserve assets, and shared cross-border monitoring frameworks.

The fund said issuers should be subject to the principle of “same activity, same risk, same regulation,” regardless of whether the issuer is a bank, fintech company, or crypto platform.

The IMF also said stablecoins should be backed only by high-quality liquid assets such as short-term government securities, with strict limits on risky holdings. Issuers must guarantee full one-to-one redemption at par, on demand, at all times.

Strong international coordination on anti-money laundering enforcement, licensing, and supervision of large global stablecoin arrangements was also included in the new guidance.

The IMF’s warning comes as regulatory pressure is rising worldwide. In Europe, the European Central Bank recently warned that stablecoins, despite their small footprint in the euro area, now pose spillover risks due to their growing ties to U.S. Treasury markets.

— Cryptonews.com (@cryptonews) November 24, 2025

The ECB warns that stablecoins are growing fast, now topping $280B, with rising spillover risks as USDT and USDC dominate 90% of the market. #Stablecoins #ECBhttps://t.co/ef16HZzqYL

The European Systemic Risk Board has also called for urgent safeguards against cross-border stablecoin structures operating under the EU’s MiCA framework.

In China, the central bank has described stablecoins as a threat to financial stability and monetary sovereignty, while the Bank of England and Basel regulators are reassessing how banks should hold capital against stablecoin exposure as usage expands.

The IMF concluded that without consistent global regulation, stablecoins could bypass national safeguards, destabilize vulnerable economies, and transmit financial shocks across borders at high speed.

The post IMF Warns: Fragmented Stablecoin Rules Create “Roadblocks” – New Guidelines Released appeared first on Cryptonews.

During a panel session moderated by CryptoNews during Binance Blockchain Week, panelists examined the accelerating evolution of stablecoins, from retail adoption and cross-border payments to tokenized settlement and institutional frameworks. Speakers included Sam Elfarra (Tron DAO), Marcelo Sacomori (Braza Bank), and Daniel Lee (Banking Circle).

A clear exploration of how stablecoins are evolving into a global financial utility and the infrastructure required to keep them secure, liquid, and accessible.

— Binance (@binance) December 4, 2025

Moderated by @Tanzeel_Akhtar

Speakers:Sam Elfarra | Community Spokesperson | Tron DAO

Daniel Lee | Head of Web3… pic.twitter.com/rhdqs3wr4D

Opening the discussion, the moderator positioned stablecoins as the fastest-growing category in digital assets, citing issuance and wallet counts rising by around 50% and daily trading volumes now surpassing Visa. The conversation focused on usability, reliability during volatility, the emergence of bank-issued tokens, and the infrastructure required to support tokenized settlement.

Marcelo Sacomori, representing Brazil’s largest stablecoin dealer, detailed Braza Bank’s issuance of BRL- and USD-linked tokens driven by FX demand and corporate payments. He stressed transparent reserves, independent verification, and liquidity as pillars of trust. Brazil’s regulatory clarity, he said, has accelerated institutional uptake and consumer confidence.

“Once you use stablecoins for payments, you’ll never want to go back to traditional ways. I think, in two years, stablecoins will no longer be a niche product,” said Sacomori.

Banking Circle’s Daniel Lee explained that tokenized real-world assets cannot scale without a tokenized settlement capable of atomic, near-instant transfer. He outlined the distinction between tokenized deposits and bearer stablecoins, adding that EU e-money token frameworks create regulated, bankruptcy-remote structures suitable for institutions.

Speaking for Tron DAO, Sam Elfarra described strong momentum across LATAM, Africa, Southeast Asia, and the Middle East, where users seek affordability, reliability, and dollar stability. Tron’s uptime and operational resilience, he noted, have supported high transaction throughput even during periods of market volatility.

Closing the session, it was concluded that stablecoins are no longer a niche experiment but are rapidly becoming the backbone of global value exchange—reshaping how money moves, is stored, and, in the near future, how tokenized assets will settle.

The post Stablecoin Adoption and Tokenized Settlement Take Center Stage at Binance Blockchain Week appeared first on Cryptonews.

As the sector continues to gain global momentum, Taiwanese authorities have announced that a locally issued stablecoin could be launched next year, pending the imminent approval of the country’s regulatory crypto framework and related legislation.

On Wednesday, Taiwan’s Financial Supervisory Commission (FSC) Chairman Peng Jin-long revealed that the island’s first regulated stablecoin could debut in the latter half of 2026, local news outlet Focus Taiwan reported.

The FSC chair affirmed that the Virtual Assets Service Act (VASA), which incorporates stablecoin regulation, could be passed during its third hearing in the next legislative session, scheduled for this week, after clearing initial reviews with a “high level of consensus.”

After the framework’s approval, stablecoin-centered regulations would be developed within six months, setting the launch of a locally issued token pegged to the New Taiwan Dollar (NTD) or the US Dollar (USD) to the second half of the year.

The VASA supports the efforts by Taiwanese authorities to establish a comprehensive crypto framework that promotes industry growth and safeguards investors. Last year, the FSC announced an overhaul of the Anti-Money Laundering (AML) framework to include crypto businesses, introducing stricter AML guidelines for Virtual Asset Service Providers (VASPs) and requiring all crypto firms to complete the AML registration by September 2025.

In January, Peng stated that investors could have a “convenient” entrance to crypto assets in the future through stablecoins, which could serve as a bridge between the country’s legal tender and virtual currency.

In March, the FSC published the finalized draft of its landmark crypto legislation, which the VASA’s draft proposed authorizing banks to issue stablecoins pegged to the New Taiwan Dollar or the US Dollar.

Meanwhile, Premier Cho Jung-tai and Central Bank Governor Yang Chin-long recently expressed support for a formal Bitcoin (BTC) policy, pledging to study the flagship cryptocurrency as a strategic reserve asset, accelerate pro-BTC rulemaking, and pilot treasury exposure through government-seized assets.

At the legislative hearing, the FSC’s chair highlighted that the bill’s draft draws from the European Union (EU)’s Markets in Crypto-Assets Regulation (MiCA). He explained that the Virtual Assets Service Act doesn’t require stablecoins to be issued exclusively by financial institutions, which has been a divisive topic in other jurisdictions.

As reported by Bitcoinist, South Korea’s long-awaited stablecoin legislation could be delayed until next year as the Korean Financial Services Commission clashes with the Bank of Korea (BOK) over the role of banks in the sector.

A local news media outlet recently noted that the BOK and regulators agree that financial institutions must be involved in the issuance of won-pegged tokens, but differ on the extent of their role.

The central bank is pushing for a consortium of banks owning at least 51% of any stablecoin issuer seeking regulatory approval. Meanwhile, regulators are concerned that giving a majority stake to banks could reduce participation from tech companies and limit the market’s innovation. Earlier this week, authorities set December 10 as the deadline for the government to deliver a draft bill.

Unlike South Korea’s financial authorities, Focus Taiwan reported that the regulator and the central bank have agreed that only financial institutions will be allowed to issue stablecoins in the initial stage to reduce risk management, suggesting that companies could join at a later stage of the project.

Former Citadel employees Ian Krotinsky and Aashiq Dheeraj have secured $17 million in funding for Fin, a stablecoin-powered payments app designed to enable instant cross-border money transfers without the complexity of traditional crypto platforms.

According to a Fortune report, Pantera Capital led the round, with participation from Sequoia and Samsung Next, as the startup prepares to pilot with import-export businesses next month.

The funding arrives amid explosive growth in the stablecoin sector, which now exceeds $300 billion in total market capitalization.

Krotinsky and Dheeraj discovered the friction in international payments while building side projects at Citadel, when they attempted to pay $50 to users who reached the front page of a Reddit-like platform they created.

Fin targets a gap in existing payment systems by focusing on large-value transactions in the hundreds of thousands or millions of dollars.

The app allows users to send money to other Fin users, bank accounts, or crypto wallets, leveraging stablecoin rails to reduce transfer fees compared to traditional banking channels dramatically.

Krotinsky described the platform as “built as the payments app of the future,” emphasizing that it leverages the benefits of stablecoins “without all the complexity” and will work anywhere in the world.

The startup shared an exclusive walkthrough with Fortune, revealing a simple yet elegant design prioritizing user-friendliness over technical jargon.

Traditional wire transfers through commercial banks can take several days and incur substantial fees, particularly for international transactions between countries with different financial systems.

Fin aims to disrupt this model by offering near-instant settlement for scenarios such as Swiss watch dealers selling to US customers or domestic transfers exceeding the limits imposed by Venmo and Zelle, which cannot process payments of $100,000 instantly due to delays or verification holds.

The company plans to generate revenue through transaction fees, though these will remain cheaper than alternatives, plus interest earned on stablecoins held in Fin wallets.

While the app has not launched publicly, the pilot program with businesses in the import-export space represents the first step toward broader commercial availability.

Krotinsky positioned his startup against major commercial banks like JPMorgan Chase and Barclays rather than crypto-native competitors.

He argued that large financial institutions have built payment products incorrectly for decades and will struggle to migrate existing systems onto stablecoin rails.

“I think we have the opportunity of being the next largest payments app in the world,” Krotinsky said. “People are going to be surprised at how quickly we move to get there.“

Fin’s funding follows major institutional moves into stablecoin infrastructure.

Citadel Securities, the market maker founded by Ken Griffin, invested $200 million in crypto exchange Kraken at a $20 billion valuation in November, deepening Wall Street’s commitment to digital assets after years of hesitation over regulatory uncertainty.

The firm also participated in Ripple’s $500 million funding round alongside Fortress Investment Group, which shows traditional finance is showing interest in established crypto platforms as regulatory clarity improves under the Trump administration.

Most recently, ten major European banks formed a consortium to launch a euro-backed stablecoin by mid-2026, addressing concerns about overwhelming reliance on dollar-denominated tokens, which currently account for 99.58% of the global stablecoin market.

— Cryptonews.com (@cryptonews) December 1, 2025

Sony Bank plans to roll out its 1:1 USD-pegged stablecoin for payments and settlement within its gaming and anime business.#SonyBank #SonyStablecoin $USDStablecoinhttps://t.co/8wVvOWo89Z

Sony Bank is also reportedly preparing to issue a GENIUS-regulated US dollar stablecoin for American customers as early as fiscal 2026, aiming to reduce payment fees across its gaming and anime businesses.

While there is a massive ongoing innovation in stablecoins with big firms positioning themselves for what they see as the next wave of financial revolution, Standard Chartered recently warned that over $1 trillion could flow from emerging-market banks into stablecoins by 2028 as global adoption accelerates.

In fact, Federal regulators are also advancing implementation of the GENIUS Act, with the FDIC expected to publish its first stablecoin rule framework later this month.

Acting FDIC Chair Travis Hill confirmed the agency is drafting rules for how stablecoin issuers will apply for approval, with separate prudential standards planned for early next year.

The post Ex-Citadel Engineers Raise $17M for Stablecoin Payments Startup Fin appeared first on Cryptonews.

A consortium of major European banks has formed Qivalis, a new entity in Amsterdam to launch a euro-pegged stablecoin in 2026.

Back in September, nine big European banks announced a consortium aimed at developing and launching a euro-based stablecoin, a digital asset that will have its price pegged to the euro (EUR).

Currently, stablecoins are overwhelmingly dominated by the US dollar (USD), with USDT and USDC, the two largest such cryptocurrencies in the space, accounting for 85% of the market. The consortium’s euro stablecoin intends to provide a real alternative to the USD tokens.

The nine banks that initially kickstarted the plan included ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International. As announced in a press release, a tenth European bank in France’s BNP Paribas has now joined the effort.

BNP Paribas is the second largest bank in the bloc and eighth largest globally with over $2.8 trillion in assets. The list of banks part of the consortium already included some heavy-hitters, but BNP Paribas now adding its backing further elevates the project.

BNP Paribas is classified as a global systemically important bank (G-SIB) by the Financial Stability Board, meaning that its stability is integral to the world financial order. Netherlands’ ING, another member of the consortium, is also included in a lower bucket of the same category.

In the initial announcement, the banks had noted that they had formed a new company in the Netherlands to handle the issuance of the euro stablecoin. As revealed by the consortium’s CaixaBank, the Amsterdam-based firm has now been incorporated and named Qivalis.

Qivalis is working on obtaining an electronic money institution license from the Dutch Central Bank, seeking to launch the euro-denominated stablecoin in the second half of 2026. This asset will be compliant with Markets in Crypto Assets Regulation (MiCAR), the EU’s framework for digital assets.

Jan-Oliver Sell has been lined up to serve as Qivalis’ CEO. Sell has previously had roles at Coinbase Germany and Binance. “A native Euro stablecoin isn’t just about convenience – it’s about monetary autonomy in the digital age,” noted the CEO.

Caixabank has said that the consortium is open to more banks joining. In October, Bloomberg reported that America’s Citigroup would be joining the group, but so far, the bank’s name hasn’t appeared in any subsequent press release related to the stablecoin project.

In some other news, PayPal’s PYUSD has witnessed some sharp growth since September, as DeFi analytics firm DefiLlama has highlighted in an X post.

As displayed in the above chart, PayPal’s stablecoin had a supply of $1.2 billion in September, but today that figure has sharply gone up to $3.8 billion.

At the time of writing, Bitcoin is trading around $92,800, up more than 7% over the last week.

Taiwan could roll out its first domestically issued stablecoin by the second half of 2026 as lawmakers move forward with legislation to regulate digital assets, though key design choices, including which currency the token will track, remain unresolved.

Key Takeaways:

According to local media, Financial Supervisory Commission chair Peng Jin-long told lawmakers this week that the draft Virtual Assets Service Act has cleared initial cabinet reviews and could pass its third reading in the next legislative session.

Rules specific to stablecoins would follow within six months of approval, pointing to a possible late-2026 release at the earliest.

The draft law does not confine issuance to banks, but Peng said financial institutions will take the lead in the early stages, reflecting a cautious approach as regulators open the door to domestic digital tokens.

The FSC is coordinating policy development with the Central Bank of the Republic of China (Taiwan), which has long enforced strict controls to keep the Taiwan dollar from circulating overseas.

That constraint is shaping the stablecoin debate. A token pegged to the Taiwan dollar would collide with existing foreign-exchange rules, as the currency is not allowed to circulate offshore.

A US dollar-backed stablecoin, by contrast, would avoid the thorniest regulatory issues and align more closely with global settlement use cases tied to cross-border payments.

Stablecoins, by design, move value across borders with speed and low cost, features that could undercut decades of policy aimed at keeping the local currency onshore and preventing unofficial offshore pricing.

Regulators are now drafting guardrails requiring full reserve backing, strict segregation of client assets and domestic custody to limit risk at launch.

What remains undecided is the anchor currency itself. Peng said the final choice will depend on market demand, with no commitment yet to either the US dollar or the Taiwan dollar.

As reported, Taiwan’s government is moving closer to integrating Bitcoin into its national reserve strategy, with the island’s Executive Yuan and Central Bank agreeing to evaluate Bitcoin as a potential strategic asset and explore pilot holdings using seized BTC currently awaiting auction.

BREAKING: TAIWAN'S CENTRAL BANK TO OFFICIALLY PILOT A STRATEGIC #BITCOIN RESERVE

— The Bitcoin Historian (@pete_rizzo_) November 12, 2025

THIS IS ABSOLUTELY MASSIVEpic.twitter.com/V6Xd6uyc6p

In August, Taiwanese prosecutors indicted 14 individuals in the nation’s largest crypto money-laundering case, exposing a NT$2.3 billion ($75 million) fraud that deceived over 1,500 victims through fake crypto exchange franchises.

The operation, led by Shi Qiren, ran more than 40 storefronts under names like “CoinW” and “BiXiang Technology,” posing as licensed exchanges while secretly funneling investor funds into overseas crypto accounts.

Authorities seized cash, crypto, and luxury assets worth over NT$100 million, while Shi faces up to 25 years in prison for fraud, money laundering, and organized crime.

The group’s success hinged on exploiting regulatory blind spots in Taiwan’s crypto oversight. By claiming false approval from the Financial Supervisory Commission, the network built investor trust, collected hefty franchise fees, and used “deposit machines” to mimic legitimate exchange operations.

Prosecutors described the scheme as “systematic fraud” that leveraged Taiwan’s crypto curiosity and weak enforcement.

The post Taiwan Targets Late-2026 Launch for First Domestic Stablecoin appeared first on Cryptonews.

Regulators are facing growing pressure from Congress to accelerate implementation of the United States’ new stablecoin law, with Rep. Bryan Steil warning that the one-year rulemaking deadline is approaching.

During a House Financial Services Committee hearing on Tuesday, Steil urged agency heads to provide concrete updates on their progress in rolling out the Guiding and Establishing National Innovation for U.S. Stablecoins Act, which President Donald Trump signed into law on July 18.

The Genius Act, signed into law on July 18, 2025, is the first U.S. statute to impose a unified federal structure on stablecoin issuers.

The law gives regulators until July 18, 2026, to complete the full set of implementing rules, although the framework will not take effect until the earlier of two dates: January 18, 2027, or 120 days after final regulations are published.

That timeline pressurizes agencies preparing the first wave of proposals.

Steil said the committee has seen cases where Congress passes a bill but implementing regulations arrive late or stall.

— Bryan Steil (@RepBryanSteil) December 2, 2025

Breaking Crypto Update

⁰NCUA Chair @kylehauptman confirms we are on track to implement the GENIUS Act by July 18. pic.twitter.com/Elvgme0f75

He told regulators that delivering the GENIUS Act on schedule is essential, especially as stablecoins play an increasingly important role in global dollar liquidity and digital-asset markets.

During the exchange, NCUA Chairman Kyle Hauptman assured lawmakers that the credit union regulator expects its first GENIUS-related rulemaking to focus on the application process for issuers.

Hauptman said the agencies involved understand the July deadline and are working to meet it.

The hearing brought together leaders from the Federal Reserve, the Office of the Comptroller of the Currency, the National Credit Union Administration, and the Federal Deposit Insurance Corporation.

In prepared remarks released before the hearing, FDIC Acting Chair Travis Hill said his agency expects to publish its first proposal later this month, establishing the application process for stablecoin issuers supervised by the FDIC.

— Cryptonews.com (@cryptonews) December 2, 2025

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month.#Stablecoin #FDIChttps://t.co/yuIdMYcRek

Hill said the FDIC’s responsibilities extend well beyond licensing, noting that the law tasks his agency with defining the capital, liquidity, and reserve standards that bank-issued stablecoins must meet.

He said a separate proposal detailing prudential standards is planned for early next year, setting up a two-step regulatory rollout.

The GENIUS Act would require stablecoin issuers to maintain one-to-one backing with U.S. dollars or high-quality liquid assets and introduce annual audits for firms whose tokens exceed a $50 billion market cap.

It also outlines the first federal standards for foreign-issued stablecoins, giving Washington a clearer framework for overseeing offshore projects.

Federal agencies have already begun laying groundwork for implementation.

The Treasury Department has opened multiple public consultations to gather industry input on stablecoin rule designed and how illicit-finance risks should be monitored.

— Cryptonews.com (@cryptonews) August 19, 2025

The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act. #Treasury #GENIUSActhttps://t.co/7Bu5ExndQt

Treasury Secretary Scott Bessent said the feedback will shape ongoing research into compliance tools, including their effectiveness and privacy impact.

He called the GENIUS Act “essential” to maintaining U.S. leadership in the stablecoin market.

The legislative process, however, continues to feature political flashpoints.

During the latest hearing, Rep. Maxine Waters raised concerns about whether a sitting president should hold business interests in sectors they regulate, referencing President Trump’s link to the World Liberty Financial project.

She said the situation highlights unresolved conflict-of-interest questions that Congress must address.

Regulatory momentum is advancing in parallel with broader market-structure efforts on Capitol Hill.

The House passed its digital-asset package, the CLARITY Act, earlier this year, assigning oversight responsibilities between the Commodity Futures Trading Commission and the Securities and Exchange Commission based on token classifications.

— Cryptonews.com (@cryptonews) July 16, 2025

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.#GeniusAct #Trumphttps://t.co/Lm2tCBbimp

The bill still awaits Senate consideration, and analysts say its prospects remain unclear.

Another key proposal, the Anti-CBDC Surveillance State Act, is also pending in the Senate.

It would bar the Federal Reserve from issuing a retail central bank digital currency without explicit congressional authorization, a step supporters argue is necessary to safeguard financial privacy.

The post Rep. Steil Demands Regulators Fast-Track GENIUS Act as Stablecoin Law Deadline Looms appeared first on Cryptonews.

Ten major European banks have formed a consortium to launch a euro-backed stablecoin by mid-2026, in a decisive push to counter U.S. dollar dominance in the $300+ billion global stablecoin market.

BNP Paribas joined nine European lenders, including ING, UniCredit, CaixaBank, Danske Bank, SEB, Raiffeisen Bank International, Banca Sella, KBC, and DekaBank, to develop a MiCA-compliant digital payment instrument through a newly established entity called Qivalis, based in Amsterdam.

The initiative comes as European regulators grow increasingly concerned about the bloc’s overwhelming reliance on dollar-denominated tokens, which account for 99.58% of the market, while euro-pegged alternatives remain marginal, with just $649 million in circulation.

Qivalis has assembled an experienced leadership team to guide the project from regulatory approval through commercial launch.

Jan-Oliver Sell, former Managing Director at Coinbase Germany who secured the first crypto custody license from BaFin, will serve as CEO alongside CFO Floris Lugt, who previously led Digital Assets Wholesale Banking at ING.

Sir Howard Davies, former Chairman of the Financial Services Authority and RBS, will chair the Supervisory Board, bringing decades of regulatory and banking expertise to the initiative. All appointments remain subject to regulatory approval.

The consortium already applied for an electronic money institution license with the Dutch Central Bank.

“The launch of a euro-denominated stablecoin, backed by a consortium of European Banks, represents a watershed moment for European digital commerce and financial innovation,” Sell said, emphasizing that the initiative addresses monetary autonomy concerns in the digital age.

The consortium remains open to additional banks joining the initiative, aiming to drive broader industry participation in the payment innovation.

The banking initiative follows mounting warnings from European financial authorities about the dangers posed by dollar-backed tokens.

Dutch central bank governor Olaf Sleijpen cautioned that rapid stablecoin growth could force the ECB to reconsider monetary policy if instability triggers mass sell-offs of underlying assets, primarily U.S. Treasuries.

“If stablecoins in the US increase at the same pace as they have been increasing, they will become systemically relevant at a certain point,” he told the Financial Times, acknowledging uncertainty over whether the central bank would respond with rate cuts or increases.

— Cryptonews.com (@cryptonews) November 17, 2025

ECB flags systemic risks from dollar stablecoins as European banks prepare euro-backed token launch to counter U.S. market dominance.https://t.co/lluC5ZaIH1

The European Systemic Risk Board, chaired by ECB President Christine Lagarde, escalated concerns in October by identifying vulnerabilities in multi-issuer stablecoin models where EU-regulated entities hold reserves locally while non-EU partners manage identical tokens backed abroad.

The ESRB endorsed a recommendation to ban such structures, warning that stress-driven redemptions could overwhelm European reserves and expose the bloc to offshore liabilities.

European Stability Mechanism Managing Director Pierre Gramegna also reinforced the urgency during an October hearing, declaring that “Europe should not be dependent on U.S. dollar-denominated stablecoins, which are currently dominating markets.“

Lagarde compared the risks to past banking crises, in which liquidity mismatches and inadequate reserves destabilized institutions across borders.

The consortium’s stablecoin will enable 24/7 access to efficient cross-border payments, programmable transactions, and improvements in supply chain management and digital asset settlements.

“We believe this development requires an industry-wide approach, and it’s imperative that banks adopt the same standards,” said Lugt.

The initiative aims to provide near-instant, low-cost payment and settlement capabilities while maintaining compliance with MiCA regulations.

Beyond the banking consortium’s efforts, the ECB continues advancing its digital euro project, with Executive Board member Piero Cipollone describing recent consensus on customer holding limits as a major breakthrough toward a potential 2029 launch.

“The middle of 2029 could be a fair assessment,” he said.

The European Parliament is also expected to adopt a legislative framework position by May 2026, while member states aim to reach a general agreement by year-end.

— Cryptonews.com (@cryptonews) November 14, 2025

The @EU_Commission wants ESMA to directly supervise all crypto firms, replacing MiCA’s national regulator model.#MiCA #ESMAhttps://t.co/iOR7YOdqah

Looking ahead, Europe is pursuing a dual approach of private-sector stablecoin development and public digital currency initiatives to modernize payment infrastructure and reduce its reliance on U.S.-dominated systems and private payment giants such as Visa and PayPal.

The post 10 EU Banks Unite to Launch Euro Stablecoin by 2026 appeared first on Cryptonews.

The U.S. Federal Deposit Insurance Corporation (FDIC) is preparing to publish its first formal proposal outlining how stablecoin issuers will operate under the GENIUS Act, according to acting chairman Travis Hill.

The rulemaking package is expected to be submitted to the House Financial Services Committee before the end of December, marking a major step toward implementing the country’s new federal stablecoin framework.

The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), signed into law in July, created a multi-agency oversight system for payment stablecoins.

Under the law, only licensed issuers are allowed to offer stablecoins to U.S. users, with oversight divided between the FDIC, Federal Reserve, Treasury, and other regulators.

Hill said the FDIC has been developing application procedures and prudential standards that will apply to stablecoin-issuing subsidiaries of FDIC-supervised institutions.

These standards include capital requirements, liquidity expectations, and reserve asset diversification rules designed to ensure issuers can meet redemptions during periods of stress.

The agency also expects to release a separate proposal early next year detailing the financial and operational requirements stablecoin issuers must meet once approved.

Hill noted that the FDIC has taken a cautious but constructive approach toward banks exploring digital-asset services, ensuring activities remain “safe and sound.” Part of the agency’s ongoing work includes responding to recommendations from the President’s Working Group on Digital Asset Markets.

One area receiving particular attention is tokenized deposits, digital representations of bank deposits issued on blockchain networks. Hill confirmed that new guidance is being drafted to clarify how these instruments fit within existing banking rules, reflecting growing industry interest in tokenization for payments and settlement.

Other regulators are advancing their own responsibilities under the GENIUS Act. Federal Reserve Vice Chair for Supervision Michelle Bowman stated that the central bank is collaborating with banking agencies to establish capital, liquidity, and diversification standards for stablecoin issuers.

Treasury Continues Public Consultation ProcessThe U.S. Department of the Treasury has also played a central role in implementing the GENIUS Act.

In September, it released an Advance Notice of Proposed Rulemaking (ANPRM) seeking public feedback on its stablecoin oversight approach. The comment period, which ran through early November, invited input from industry participants, academics, and consumer groups.

The Treasury stated that the consultation aims to strike a balance between innovation and financial stability concerns. Public submissions will help build the final proposals, which will govern non-bank stablecoin issuers and related digital asset activities.

Related Reading: Crypto Crackdown: House GOP Discovers 30 Firms Debanked In Operation Chokepoint 2.0

With the FDIC’s first proposal now nearing completion, federal agencies are entering the next phase of what is expected to be a multi-month rulemaking process. Once draft rules are released, they will undergo public review before final guidelines are adopted and phased in across the stablecoin market.

Cover image from ChatGPT, BTCUSD chart from Tradingview

According to prepared testimony from Acting FDIC Chair Travis Hill, the agency expects to publish a proposed rule that lays out how stablecoin issuers will apply for federal oversight before the end of December 2025.

Based on reports, the initial proposal will focus on the “application framework” — the paperwork, disclosures and standards firms must meet to seek approval as regulated stablecoin issuers.

The proposal is not the final set of bank-level rules; it will outline the process, while a second proposal that spells out capital, liquidity and reserve requirements is slated for early next year.

Reports have disclosed that the GENIUS Act, the law behind this process, named the FDIC as a lead regulator for bank-related stablecoins and set deadlines for implementing agencies to act.

The move is expected to provide clearer guidance for firms that want to issue USD-pegged coins under federal supervision. Some firms could alter their timelines or pause launches until the rules are final.

Stablecoin: How The Law Got HereThe GENIUS Act was passed by Congress in mid-2025 and signed into law by US President Donald Trump on July 18, 2025. The Senate approved the bill by a 68–30 vote and the House backed it 308–122.

The statute lays out which agencies do what, and it requires a sequence of rulemakings, such as capital and liquidity standards, that regulators must implement.

Officials say the FDIC’s first proposed rule will be followed by a public comment period, giving industry groups, banks and nonbank firms a chance to respond.

After that, prudential measures aimed at FDIC-supervised issuers — the rules that set minimum capital cushions and reserve asset standards — will be proposed early next year.

Analysts and industry observers will be watching closely to see whether the FDIC limits its oversight mainly to bank-sponsored stablecoins or seeks a broader scope.

They will also pay attention to how strict the capital and liquidity requirements will be when the rules are proposed in early 2026.

Coordination with other regulatory agencies will be another key focus, since the GENIUS Act assigns responsibilities across several federal regulators.

Featured image from Unsplash, chart from TradingView

Tether, the issuer of USDT, has long been considered one of the most stable assets in the crypto market, but a recent report suggests that a crash in the Bitcoin price could jeopardize the stablecoin’s solvency. Arthur Hayes, co-founder and CIO of BitMEX, has revealed that a portion of USDT’s reserves is allocated to BTC, potentially exposing it to heightened market volatility.

In a recent report shared on X earlier this week, Hayes outlined market risks that could have a devastating impact on Tether’s USDT. The BitMEX founder explained that the stablecoin issuer has been executing a large-scale interest rate trade, likely betting on a Federal Reserve (FED) rate cut.

He stated that the stablecoin issuer has accumulated significant positions in Bitcoin and gold to hedge against falling interest income. As a result, Hayes has warned that if Tether’s positions in both gold and Bitcoin were to decline by roughly 30%, it could wipe out its entire equity, theoretically putting USDT at risk of insolvency.

Since stablecoins are typically backed by the US dollar, the crypto founder has stated that a severe drop in Tether’s reserve value could trigger panic amongst USDT holders and crypto exchanges. In such a scenario, they might demand immediate insight into the stablecoin issuer’s balance sheet to gauge solvency risk. Hayes has also suggested that the mainstream media could further amplify the concerns, creating widespread market alarm.

Following Hayes’ statements on X, Tether’s USDT has come under scrutiny, with crypto analysts debating the resilience of its reserves. A former Citi Research lead, Joseph Ayoub, challenged Hayes’ claims, arguing that even if Bitcoin and gold prices were to crash 30%, a USDT insolvency remains highly unlikely.

He highlighted that the BitMEX co-founder had missed three key points in his post. Ayoub noted that Tether’s publicly disclosed assets do not represent the entirety of its corporate holdings. According to him, when Tether issues USDT, it maintains a separate equity balance sheet that is not publicly reported. The reserve numbers that are eventually disclosed are intended to show how USDT is backed. At the same time, the company maintains a balance sheet for equity investments, mining operations, corporate reserves, possibly more Bitcoin, and the rest distributed as dividends to shareholders.

Ayoub also described Tether’s core operations as highly profitable and efficient. He stated that the company holds over $100 billion in interest-yielding treasuries, generating roughly $10 billion in liquid profit annually while operating a relatively small team. The former Citi research lead estimated that the stablecoin issuer’s equity is likely valued at between $50 billion and $100 billion, providing it with a substantial cushion against losses in its crypto and gold holdings.

Finally, Ayoub disclosed that Tether operates like traditional banks, maintaining only 5-10% of deposits in liquid assets, while the remaining 85% are held in longer-term investments. He also noted that the stablecoin issuer is significantly better collateralized than banks, adding that with their ability to print money, bankruptcy is virtually impossible.

XRP may be holding above the $2 price mark for a brief period, but the leading altcoin is still facing heightened bearish pressures at that level due to a broader market pullback on Monday. Even with the ongoing downward trend in price, XRP is still experiencing robust engagement as evidenced by the massive surge in activity on the XRP Ledger.

Prices are constantly dwindling along with the entire crypto market, but the XRP Ledger is seeing sharp engagement within the bearish period. After months of quiet and reduced adoption, the Ledger has roared back to life, recording one of its strongest growth waves yet.

Arthur, a community member and official partner of the BingX cryptocurrency exchange, shared this surge in activity on the social media platform X. This isn’t a mild rise; it’s a growth wave with significant weight behind it, the kind that indicates an expanding utility rather than fleeting speculation.

Furthermore, the sharp growth in activity suggests that more investors are choosing to conduct their day-to-day XRP operations on the Ledger, reflecting a renewed conviction in the network. The Ledger’s current activity spike is centered around the rise in Account Set transactions to a point not seen in years.

After navigating through XRPL metrics, the expert revealed that more than 40,000 Account Set transactions were carried out on the Ledger, marking its highest level in years. Such a massive wave of transactions to a new peak suggests that the Ledger may be speeding into its next phase in a market where many chains find it difficult to sustain momentum.

At the same time, there was also a surge in Automated Market Maker (AMM) bids just after November 23 concluded, indicating that preparations are taking place on the network. With Ripple’s stablecoin RLUSD approvals, AMM rollout, and the onboarding of institutional investors at an accelerated rate, it simply implies that the Ledger is picking up pace.

While the price of XRP has pulled back, the decline appears to be heavily impacting investors’ sentiment toward the altcoin. Its derivatives market has significantly lost its weight in a single and steep decline as Open Interest (OI) experiences a sharp drop.

In a report from Glassnode, a leading on-chain data analytics platform, the token’s futures open interest fell from 1.7 billion XRP in early October to 0.7 billion XRP by the end of November. This figure represents a more than 59% flush out from October to November alone.

The funding rates have also followed suit, recording a drop from 0.001% to 0.001% in the 7-day Simple Moving Average (SMA). A combination of the drop in open interest and funding rates marks a structural pause in the altcoin’s speculators’ appetite to bet heavily on an upward direction. At the time of writing, the altcoin was trading at $2.02 after falling by over 1% in the last 24 hours.

US regulators are moving quickly to build the country’s new stablecoin supervision system, with federal agencies preparing detailed rulemaking as the GENIUS Act begins to shape policy.

The Federal Deposit Insurance Corporation is set to publish an application framework for payment stablecoin issuers later this month, marking one of the earliest steps in implementing the law signed by President Donald Trump earlier this year.

Alongside the FDIC, the Federal Reserve, and the Treasury Department are working on their own regulatory responsibilities, signalling a coordinated effort to bring stablecoins under a clearer, more structured oversight regime.

The FDIC has confirmed through written testimony scheduled for delivery to the House Financial Services Committee on December 2 that it is close to releasing a proposed rule outlining how payment stablecoin issuers will apply for approval.

The agency began the process earlier this year as part of its duty to implement the GENIUS Act, and the first formal proposal is expected before the end of the month.

Another proposal focusing on prudential requirements for FDIC-supervised issuers is planned for early next year.

Once the application framework is published, the agency will gather public comments before moving toward a final rule, a phase that typically spans several months.

The GENIUS Act introduces a national structure that requires federal and state regulators to coordinate their supervision of stablecoin issuers.

Under the law, the FDIC will oversee and license subsidiaries of insured depository institutions that issue payment stablecoins.

The agency will also set out capital rules, liquidity expectations, and reserve diversification standards.

Much of this work will roll out over the coming year, as several rulemakings are needed to meet the obligations laid out in the legislation.

The FDIC is also consulting recommendations released in July by the President’s Working Group on Digital Asset Markets, which urged regulators to clarify digital asset activities allowed for banks, including asset and liability tokenisation.

In addition to its stablecoin responsibilities, the FDIC is preparing new guidance aimed at clarifying how tokenised deposits will be treated under federal regulation.

This area has gained attention as banks explore digital versions of traditional deposit products.

The forthcoming guidance is expected to help institutions understand which activities fall within supervisory boundaries and how they will be monitored.

The Federal Reserve will join the FDIC at Tuesday’s House hearing, with Vice Chair for Supervision Michelle Bowman detailing the central bank’s work on stablecoin rules.

The Federal Reserve is coordinating with other banking regulators to craft capital, liquidity, and diversification standards required under the GENIUS Act.

The focus includes creating clarity for banks engaged in digital asset activities and providing regulatory feedback on new use cases as they emerge.

This joint push aims to ensure the banking system can support digital asset development while maintaining stability and compliance.

Other agencies are also advancing their obligations under the GENIUS Act.

The Treasury Department has already completed its public consultations, which concluded in November, and is developing its own rules.

These efforts will run in parallel with the FDIC and Federal Reserve processes, contributing to the broader national framework being built to govern stablecoins across the US.

The post Regulators ramp up US stablecoin rules as GENIUS Act takes effect appeared first on CoinJournal.