BlackRock Bitcoin ETF sheds $2.7 billion in longest outflow streak on record

Bitocin treasury companies continue to accumulate a significant amount of BTC despite current market conditions and now control around 5% of the total BTC supply. These companies are led by Michael Saylor’s Strategy and Metaplanet, which have recently raised fresh capital to buy the dip.

Bitcoin Treasuries data shows that the top 100 public Bitcoin treasury companies currently hold 1,058,929 BTC, while all public companies combined hold 1,061,697. Notably, Strategy is the largest public Bitcoin holder with 650,000 BTC. Michael Saylor’s company yesterday announced another 130 BTC purchase for $11.7 million.

Meanwhile, the second-largest Bitcoin treasury company is BTC miner MARA holdings, which holds 53,250 BTC. Tether-backed Twenty One Capital, Metaplanet, and Bitcoin Standard Treasury Company complete the top 5, with 43,514, 30,823, and 30,021 BTC, respectively. Meanwhile, companies like Coinbase, Bullish, and Trump Media are among the top 10 largest BTC treasury companies.

It is worth noting that these public companies account for only a part of the Bitcoin treasuries. Further data from Bitcoin Treasuries shows that there is currently 4 million BTC in treasuries as a whole, including the coins held by governments, private companies, exchanges, DeFi platforms, and ETFs.

BlackRock is currently the second-largest Bitcoin holder, only behind Satoshi Nakamoto. Strategy is third on the list, while Binance and the U.S. government complete the top 5, with BTC holdings of 628,868 and 323,588, respectively. The 4 million BTC held by these treasury companies as a group accounts for 19% of the total Bitcoin supply.

Bitcoin treasury companies such as Strategy and Metaplanet have raised new capital amid the recent crash to buy more BTC. Saylor’s company recently raised $836 million from its STRE offering, which it used to buy 8,178 BTC. Meanwhile, Metaplanet raised $130 million to expand its BTC treasury.

More Bitcoin treasury companies are set to emerge as $10 trillion asset manager, Vanguard, will start offering BTC ETFs from today. Notably, some companies gain BTC exposure through these ETFs rather than buying Bitcoin directly. On-chain analytics platform Arkham Intelligence revealed that the largest U.S. bank, JPMorgan, holds $300 million worth of BlackRock’s BTC ETF.

Meanwhile, it is worth mentioning that Bitcoin treasuries such as Strategy are coming under immense pressure amid the current market downtrend. Strategy’s CEO, Phong Le, admitted that they might have to sell Bitcoin as a last resort to fund dividend payments if their mNAV drops below 1x and they can no longer raise capital.

At the time of writing, the Bitcoin price is trading at around $87,000, up in the last 24 hours, according to data from CoinMarketCap.

Bitcoin Magazine

World’s Second Largest Asset Manager Vanguard Opens Its Platform to Bitcoin and Crypto ETFs: Bloomberg

Vanguard Group will allow bitcoin and crypto-linked exchange-traded funds and mutual funds to trade on its platform, reversing a policy that for years barred retail clients from accessing digital-asset products through the firm.

Starting Tuesday, Vanguard brokerage customers will be able to trade ETFs and mutual funds that primarily hold select cryptocurrencies, including Bitcoin and other crypto, according to Bloomberg reporting.

The move marks a shift for the world’s second-largest asset manager, which has long argued that digital assets were too volatile and speculative for long-term portfolios.

The decision follows growing demand from both retail and institutional investors and comes after the approval of spot Bitcoin ETFs in January 2024 ushered billions of dollars into regulated crypto products.

BlackRock’s iShares Bitcoin Trust, the largest of those funds, peaked near $100 billion in assets earlier this fall and still manages about $70 billion despite recent price declines.

A Bitcoin ETF lets investors gain exposure to Bitcoin without actually buying or storing the cryptocurrency themselves.

Instead, the fund holds Bitcoin (or Bitcoin-related contracts) while investors simply buy shares on a stock exchange, with the share price moving alongside Bitcoin’s market value. It’s a convenient and easy way to get invested in Bitcoin.

JUST IN: $11 trillion Vanguard to finally allow clients access to #Bitcoin ETFs starting tomorrow — Bloomberg pic.twitter.com/Zwh9N7EbzH

— Bitcoin Magazine (@BitcoinMagazine) December 1, 2025

Vanguard’s change opens access to crypto funds for more than 50 million brokerage customers who collectively oversee more than $11 trillion in assets, as of September 1, 2025.

“Cryptocurrency ETFs and mutual funds have been tested through periods of market volatility, performing as designed while maintaining liquidity,” Andrew Kadjeski, Vanguard’s head of brokerage and investments, told Bloomberg.

He added that back-office processes for servicing crypto funds have matured as investor preferences evolve.

The policy shift comes more than a year after Salim Ramji, formerly a top executive at BlackRock and a longtime blockchain advocate, took over as Vanguard chief executive.

While Vanguard will support most crypto funds that meet regulatory requirements, the firm said it will not launch its own crypto products and will continue to exclude funds linked to meme coins.

“While Vanguard has no plans to launch its own crypto products, we serve millions of investors with diverse needs,” Kadjeski said.

Crypto-linked ETFs remain among the fastest-growing segments in U.S. fund industry history, even after a sharp market pullback, underscoring rising investor appetite for regulated exposure to digital assets.

BlackRock recently increased internal exposure to its IBIT spot Bitcoin ETF, with its Strategic Income Opportunities Portfolio now holding 2.39 million shares worth $155.8 million — up 14% since June.

Bitcoin jumped on the news, trading above $86,500 at the time of writing.

This post World’s Second Largest Asset Manager Vanguard Opens Its Platform to Bitcoin and Crypto ETFs: Bloomberg first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin is currently trading near $91,700, roughly 3% higher over the past 24 hours, shifting attention from last week’s stress towards whether the market can rebuild depth and attract steady cash demand.

Sentiment, however, still sits in fear territory even after the bounce, indicating that positioning remains defensive and that confidence in a floor is still tentative. The discussion now centers on durability rather than round-number optics, since $100,000 has served as the more meaningful pivot in recent months, while $90,000 functions mainly as a waystation inside the current range.

A recovery that sticks usually appears alongside thicker order books on BTC and ETH pairs, narrower spreads through the U.S. session, and funding that drifts toward neutral. Those conditions suggest that market makers are willing to warehouse inventory and that spot buyers are replacing short squeezes that fade late in the day.

When these signs strengthen together, intraday strength more often carries into the close; when they move in different directions, early gains tend to weaken as liquidity thins after hours.

Stablecoin issuance and exchange balances help separate real cash inflows from position covering. Net issuance that turns higher for several sessions frequently aligns with firmer spot settlement, while flat or negative supply can undercut rebounds even when prices look better intraday.

Order-book ladders around key U.S. data windows provide another read, since repeated gaps in depth leave the market vulnerable to cross-asset shocks.

Spot Bitcoin and ETF flow direction continues to shape day-to-day closes. A turn toward creations in U.S. spot products generally supports stronger finishes, while persistent redemptions tend to cap rallies during the afternoon handoff.

The pace of those flows has tracked risk appetite in other markets, which is why late moves in equity futures often spill into crypto when depth is still rebuilding.

Macro context remains part of the setup. A firmer dollar or tighter financial conditions can reduce the willingness of traders to hold risk through event windows, while relief on rates can ease those drags and stabilize spreads.

You are more powerful not as an individual, but with the support of a family.

— Strategy (@Strategy) November 27, 2025

To our team, our shareholders, and the Bitcoin community, thank you for being part of ours.

Happy Thanksgiving from Strategy. pic.twitter.com/Bs01DiqlPp

Correlations have tightened during stress, so policy headlines or earnings guidance from large tech firms have continued to influence crypto, especially when liquidity is patchy.

For now, a price north of $90,000 eases the strain without settling the argument about trend. A convincing turn usually arrives when spot books thicken through New York hours and into the evening, when funding and basis settle toward neutral rather than swinging from one side to the other, when ETF creations start to outpace redemptions for more than a day, and when net stablecoin issuance rises in a way that points to new cash rather than recycled leverage.

Absent that mix, strength tends to exhaust itself before the close and the day finishes softer than it began, which keeps confidence brittle and keeps traders alert to policy headlines or earnings surprises that can drain bids in a few ticks. The market looks better than it did last week, yet it still trades like a place where one unwelcome headline can send price back to test the same ledges it just climbed.

The post Bitcoin Above $91K Eases Stress – But Depth, Flows and Stablecoins Still Call the Shots appeared first on Cryptonews.

Bitcoin Magazine

Abu Dhabi Tripled Its Bitcoin Bet In Q3 Before the Crypto Market Crash

The Abu Dhabi Investment Council (ADIC) expanded its exposure to Bitcoin ahead of the cryptocurrency’s sharp downturn, more than tripling its stake in BlackRock’s iShares Bitcoin Trust (IBIT) during the third quarter, regulatory filings show.

ADIC — an independently run investment unit within Mubadala Investment Co. — increased its holdings to nearly 8 million IBIT shares as of Sept. 30.

The position was valued at about $518 million at the time, up from 2.4 million shares three months earlier, according to Bloomberg reporting.

The accumulation by the Abu Dhabi council came just weeks before Bitcoin surged to a record high in early October and then slid below $92,000 as leveraged bets unwound across the market.

The Abu Dhabi council says the move is part of a broader, long-term diversification strategy. A spokesperson described Bitcoin as a digital counterpart to gold and said the allocation is intended to sit alongside the fund’s traditional store-of-value assets.

The buying wasn’t isolated. Mubadala separately reported holding 8.7 million IBIT shares valued at $567 million at the end of the third quarter, unchanged from the prior filing.

Other major institutions, including Harvard, also added to IBIT positions in the same period.

Still, investor appetite has cooled since the October selloff. U.S. spot Bitcoin ETFs have seen roughly $3.1 billion in outflows so far in November, according to Bloomberg data.

IBIT alone suffered a single-day record of $523 million in redemptions after Bitcoin broke below a key price level that left many ETF investors underwater.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) November 19, 2025Abu Dhabi has tripled their position in #Bitcoin, Bloomberg reports

pic.twitter.com/KYVBIa4qbV

ADIC’s increased allocation is notable given Abu Dhabi’s financial reach and its growing ambition to establish itself as a global crypto hub. The emirate’s wealth funds collectively oversee more than $1.7 trillion, and Mubadala has already been a major player in the region’s digital-asset expansion.

Earlier this year, MGX — a tech investment firm backed by Mubadala — acquired a $2 billion stake in Binance using a stablecoin tied to the family of U.S. President Donald Trump.

Inside ADIC, the push into Bitcoin aligns with a broader shift toward global expansion. The council, initially created in 2007 and later folded under Mubadala’s structure, continues to operate with its own mandate and investment strategy.

It has recently strengthened its leadership team, adding executives such as Alain Carrier, former head of international business at Canada Pension Plan Investment Board, and Ben Samild, previously the investment chief at Australia’s sovereign wealth fund, according to Bloomberg.

While crypto’s volatility remains a concern for global investors, Abu Dhabi’s stance underscores a different calculus: large sovereign funds are increasingly comfortable treating Bitcoin as a long-term strategic asset.

Other governments are moving in the same direction. El Salvador added more than $100 million in Bitcoin this week, the Czech central bank disclosed its first crypto purchase, and Kazakhstan is building a national cryptocurrency reserve fund that could reach $1 billion.

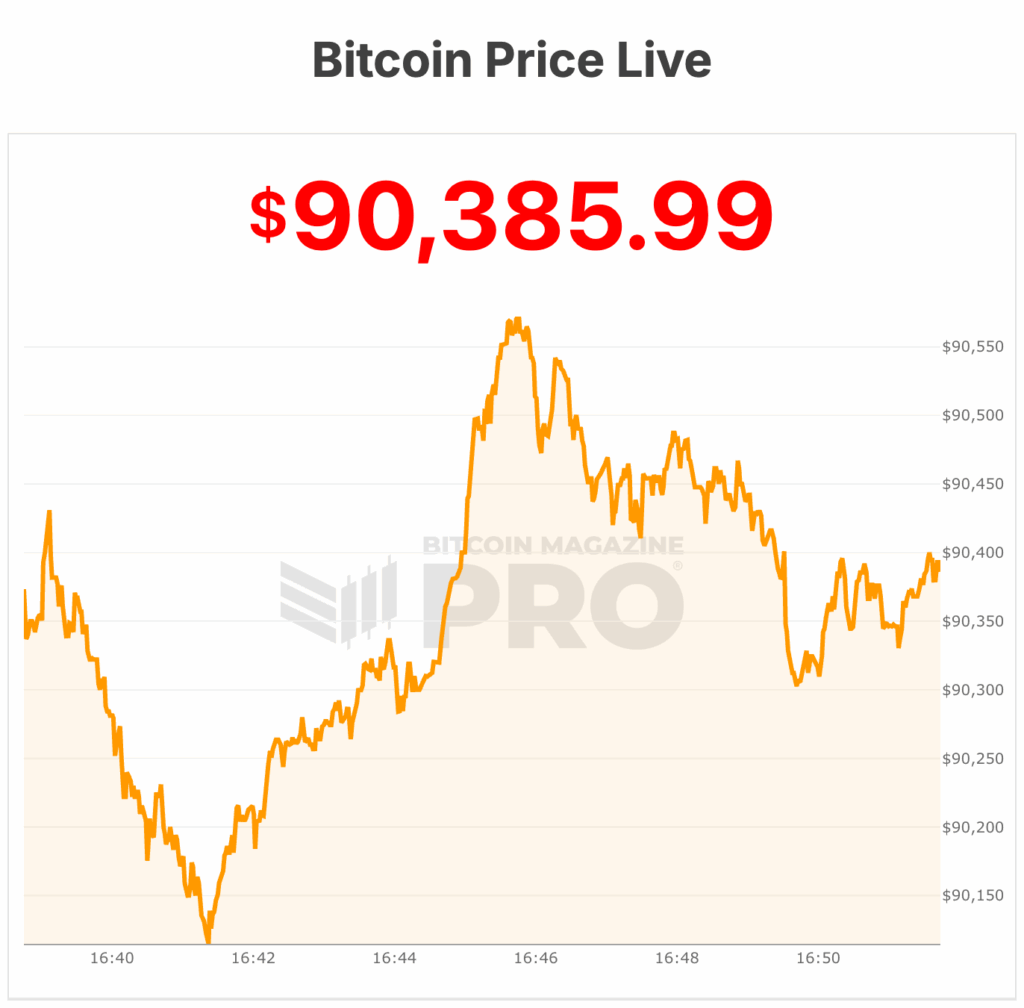

Bitcoin’s price is currently at the $90,300 range.

This post Abu Dhabi Tripled Its Bitcoin Bet In Q3 Before the Crypto Market Crash first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

The cryptocurrency market is poised for a new addition with the likely debut of the first spot XRP exchange-traded fund, issued by Canary Capital.

On Wednesday, Nasdaq confirmed it had accepted the Form 8-A filing for the Canary XRP ETF, under the ticker XRPC, signalling formal readiness to list the asset.

While the announcement stirred excitement among ETF watchers, the fund still lacks the US Securities and Exchange Commission’s final approval to begin trading.

This has left its launch in limbo, even as industry observers anticipate a possible debut on Thursday.

Canary’s ETF becomes the sixth single-asset crypto fund to reach this milestone following earlier approvals for Bitcoin, Ether, Solana, Litecoin and Hedera.

However, this fund’s progression highlights a more complex regulatory backdrop, influenced by recent shifts in SEC processes during the US government shutdown.

Nasdaq formally notified the SEC that it had received and filed the Form 8-A for Canary’s XRP ETF.

Bloomberg’s ETF analyst Eric Balchunas shared the update on X, stating that “The official listing notice for XRPC has arrived from Nasdaq.”

Despite this progress, the ETF has not yet received the green light to commence trading. The letter issued by Nasdaq confirmed approval of the listing but did not equate to SEC authorisation.

Observers have clarified that the letter is a procedural step and part of the process to join the registrant’s request for the fund to become effective.

Some in the crypto community highlighted the difference, noting that the Nasdaq letter does not declare the fund effective but only acknowledges the listing certification.

The SEC has not issued an effectiveness order, which means trading cannot begin until that step is completed.

Following the Nasdaq filing, Canary Capital launched its official website for the ETF.

Nate Geraci, president of NovaDius Wealth Management, posted about the development, signalling that Canary was likely to be the first to market with an XRP-backed ETF.

If approved, the XRPC ETF will join the growing roster of single-asset crypto ETFs now available to investors. These include Bitcoin, Ether, Solana, Litecoin and Hedera.

Eleanor Terrett of Crypto America also indicated on X that Nasdaq had cleared XRPC for a market open launch, which further raised expectations for an imminent debut. However, the fund cannot proceed to trading without confirmation from the SEC.

Canary’s ETF launch coincides with the recent end of the longest US government shutdown in history.

On Wednesday, President Donald Trump signed legislation that officially reopened government operations.

During the shutdown, ETFs for Solana, Litecoin and Hedera began trading under automatic effectiveness provisions.

These mechanisms allowed trading to begin without active SEC approval during periods when regulatory processes were delayed.

This approach was not used in earlier launches of Bitcoin and Ether ETFs, which both started trading only after formal authorisation from the regulator.

It remains unclear which approach the XRPC fund will follow.

Without a current effectiveness order, Canary’s ETF may be subject to additional delays, unless it qualifies under the same automatic provisions used during the shutdown period.

Although Nasdaq has certified the listing and Canary’s infrastructure appears ready, the fate of the XRPC ETF ultimately depends on the SEC.

Canary’s website launch and market interest reflect growing anticipation, but trading cannot begin until regulators give their final approval.

Although Nasdaq certified the listing and Canary Capital launched its website, the fund did not begin trading immediately after 28 October, the initially anticipated date.

Without a final effectiveness order from the SEC, the ETF remains in limbo. Until that regulatory step is completed, XRPC cannot begin trading, and the market continues to await confirmation.

The post Nasdaq certifies XRP ETF as Canary Capital prepares to enter crypto fund arena appeared first on CoinJournal.

Bitcoin Magazine

JPMorgan Just Boosted its Bitcoin ETF Holdings by 64%

JPMorgan disclosed a sharp increase in its holdings of the Bitcoin ETF IBIT, signaling rising institutional interest in cryptocurrency exposure.

According to 13F filings, the bank reported holding 5,284,190 shares of IBIT, valued at $343 million as of September 30.

This marks a 64% increase from its previous disclosure of 3,217,056 shares as of June.

The filing also revealed that JPMorgan holds IBIT options, including $68 million in call options and $133 million in puts. 13F filings aggregate holdings across all bank divisions, including high-net-worth clients, meaning these positions may not be limited to the bank’s own balance sheet.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) November 7, 2025JP Morgan reported holding 5,284,190 shares of #Bitcoin ETF IBIT worth $343 million, a 64% increase from the previous disclosure. pic.twitter.com/nccPXk0krX

Bitcoin itself has remained volatile in recent months, hovering just above $100,000, but institutional flows like JPMorgan’s ETF holdings underscore confidence in its long-term prospects.

The bank’s sizable purchase also coincides with renewed interest in regulated investment vehicles, such as ETFs.

JPMorgan analysts recently said that Bitcoin now appears undervalued relative to gold after a sharp October sell-off pushed its price down more than 20% from its recent record high of $126,000.

The decline was driven by leveraged liquidations in the futures market and market anxiety following a $128 million Balancer hack.

According to analyst Nikolaos Panigirtzoglou of JPMorgan, the ratio of open interest in perpetual futures to Bitcoin’s market cap has since normalized, signaling that most excess leverage has been flushed out.

The bank’s analysis also shows Bitcoin is trading at a discount to gold when adjusting for volatility. As gold prices climbed above $4,000 per ounce, its volatility rose, while Bitcoin’s has eased.

To reach parity with gold’s private-sector investment value on a risk-adjusted basis, analysts estimate Bitcoin would need to rise toward $170,000 — roughly two-thirds higher than recent levels.

JPMorgan forecasts “significant upside” over the next six to twelve months if current conditions persist, reinforcing the case for Bitcoin as an alternative or accomplice to gold as a risk-averse asset.

At the same time, JPMorgan is preparing to let institutional clients use Bitcoin as collateral for loans by the end of 2025, expanding beyond its current acceptance of crypto-linked ETFs.

At the time of writing, Bitcoin is price near $100,000 at $101,290 per Bitcoin Magazine Pro data. Earlier this quarter in October, Bitcoin hit an all-time high above $126,000. The price is down roughly 20% from all-time highs.

This post JPMorgan Just Boosted its Bitcoin ETF Holdings by 64% first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

BlackRock Expands Global Bitcoin Strategy with Australian ETF Launch

BlackRock, the world’s largest asset manager, is reportedly planning to launch the iShares Bitcoin ETF (ASX: IBIT) on the Australian Securities Exchange, extending its global Bitcoin investment strategy to the Asia-Pacific region.

Expected to debut in mid-November 2025, IBIT will give Australian investors regulated exposure to Bitcoin through a traditional stock exchange structure, removing the need for offshore accounts or direct crypto custody.

The ETF will carry a management fee of 0.39% and will wrap the U.S.-listed iShares Bitcoin Trust (NASDAQ: IBIT), which has become one of the most successful ETF launches in history since its January 2024 debut.

The Australian listing places the country alongside major jurisdictions such as the United States, Germany, and Switzerland where Bitcoin ETFs are already active.

The move also reflects growing institutional demand for Bitcoin across the Asia-Pacific region as more investors seek regulated access to the asset.

The announcement follows the Australian Securities and Investments Commission’s updated guidance reclassifying most digital assets as financial products, requiring service providers to obtain an Australian Financial Services Licence by June 2026.

While Bitcoin itself is not a financial product, funds and platforms offering Bitcoin exposure will operate under this regulatory framework, providing additional investor protection and market transparency.

In other words, a Bitcoin ETP or ETF lets investors gain exposure to Bitcoin without actually buying or storing the cryptocurrency themselves.

Instead, the fund holds Bitcoin (or Bitcoin-related contracts) while investors simply buy shares on a stock exchange, with the share price moving alongside Bitcoin’s market value. It’s a convenient and easy way to get invested in Bitcoin.

The announcement comes as Bitcoin trades down from record highs around $104,000, supported by rising inflows into global ETFs and accelerating institutional adoption.

Earlier last month, BlackRock officially listed its iShares Bitcoin ETP (IB1T) on the London Stock Exchange following the FCA’s decision to relax rules on crypto investment products.

The physically backed fund allowed retail investors to gain Bitcoin exposure without directly holding the asset, with custody managed by Coinbase.

Just like with this launch in Australia, the launch was viewed as timely amid rising UK crypto adoption, offering a regulated and accessible entry point for investors.

Last June, Monochrome Asset Management announced their Bitcoin ETF (IBTC) in Australia. The ETF traded under the ticker IBTC and carried a management fee of 0.98%.

This post BlackRock Expands Global Bitcoin Strategy with Australian ETF Launch first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

T. Rowe Price Joins Crypto ETF Race With SEC Filing for Active Fund

T. Rowe Price, one of the largest U.S. asset management firms, has filed with the Securities and Exchange Commission (SEC) to launch a cryptocurrency-focused exchange-traded fund (ETF).

The proposed fund, named the T. Rowe Price Active Crypto ETF, aims to outperform the FTSE US Listed Cryptocurrency Index, which tracks the ten largest U.S.-listed cryptocurrencies by market capitalization that meet SEC listing standards.

Unlike passive funds, the ETF can overweight or underweight assets relative to the Index and may invest in crypto not included in it, though all holdings must meet eligibility criteria, according to the SEC filing.

The filing comes as a semi-surprise to market observers. Bloomberg senior ETF analyst Eric Balchunas described it as a “semi-shock,” noting that T. Rowe Price, a top-five active manager largely known for traditional mutual funds, is now entering the nascent but increasingly crowded crypto ETF space.

“There’s going to be a land rush for this space,” he tweeted.

Shares will trade on NYSE Arca. Investors can buy and sell shares like a stock, but it still carries the usual crypto risks.

JUST IN:

— Bitcoin Magazine (@BitcoinMagazine) October 22, 2025$1.77 trillion T Rowe Price files for an Active Crypto ETF. pic.twitter.com/yas0sEpvJO

In the past, Dominic Rizzo, who manages some of T. Rowe Price’s ETFs, has emphasized his belief and long-term conviction in crypto, decentralized finance (DeFi), and stablecoins.

“Over the long run, I think there are going to be plenty of applications that utilize these technologies,” Rizzo said, in reference to crypto.

Exchange-traded funds have become a popular way for traditional investors to gain exposure to crypto, without holding the assets directly. Bitcoin ETFs offer investors a regulated and accessible way to gain exposure to Bitcoin.

The first U.S. Bitcoin-linked ETF, ProShares Bitcoin Strategy ETF (BITO), launched on October 19, 2021, tracking Bitcoin futures contracts. However, it wasn’t until January 10, 2024, that the U.S. SEC approved the first spot Bitcoin ETFs, allowing funds to directly hold Bitcoin

The largest Bitcoin ETF by assets under management is the iShares Bitcoin Trust (IBIT), managed by BlackRock. IBIT holds over $100 billion in assets, representing over 3% of the total Bitcoin supply.

Other notable spot Bitcoin ETFs include Fidelity’s Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB), each managing billions in assets.

Bitcoin whales are increasingly using ETFs and moving their holdings from cold storage into U.S. spot Bitcoin ETFs, using tax-neutral “in-kind” transactions that convert Bitcoin into fund shares without selling.

This shift integrates Bitcoin into traditional finance, making it easier to borrow against, use as collateral, and include in estate planning, with firms like BlackRock already processing billions in such transfers.

This post T. Rowe Price Joins Crypto ETF Race With SEC Filing for Active Fund first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Bitcoin Magazine

Bitcoin Whales Are Moving On-Chain Wealth Onto Wall Street Via BlackRock’s IBIT

A quiet migration is underway among Bitcoin’s wealthiest holders — from cold storage to custodians.

A new wave of U.S. exchange-traded funds (ETFs) is allowing longtime Bitcoiners to fold their holdings into the traditional financial system without selling a single sat.

The change comes after regulators approved “in-kind” transactions for spot Bitcoin ETFs this summer, a mechanism that lets investors deposit Bitcoin directly into a fund in exchange for shares, according to Bloomberg reporting.

This mechanism is a tax-neutral move standard across equities and commodities ETFs.

The result: volatile digital assets become regulated, reportable holdings on brokerage statements, instantly easier to borrow against, pledge as collateral, or include in estate plans.

BlackRock, the world’s largest asset manager, has already processed over $3 billion worth of these conversions, according to Robbie Mitchnick, head of digital assets at the firm. Bitwise Asset Management says it now fields daily inquiries from investors looking to bring private Bitcoin holdings into managed portfolios. Liquidity provider Galaxy has also facilitated several such transfers, per Bloomberg.

The shift marks another ironic evolution for Bitcoin — the asset designed to exist outside the banking system is now being absorbed by it.

As ETFs integrate Bitcoin into brokerage infrastructure, even many anti-establishment investors are realizing that some of TradFi’s tools — custody, leverage, and estate planning — can’t easily be replicated on-chain.

Some holders are transferring only part of their Bitcoin, while others are consolidating everything into ETFs for simplicity. This trend could expand Wall Street’s involvement with Bitcoin, bridging the gap between the crypto world and established finance.

BlackRock’s iShares Bitcoin Trust ETF (IBIT), launched just 22 months ago, recently reached over $100 billion in assets under management, making it the firm’s most profitable fund.

Generating approximately $244.5 million in annual revenue, IBIT has surpassed long-standing BlackRock ETFs, including the 25-year-old iShares Russell 1000 Growth ETF, in both growth speed and profitability.

Last quarter, the fund also overtook Coinbase Global’s Deribit platform to become the world’s largest venue for Bitcoin options.

On top of this, BlackRock is simultaneously developing technology to tokenize a wide array of assets, from equities and bonds to real estate, aiming to connect the $4.5 trillion global digital wallet market to the U.S.-based investment products.

This post Bitcoin Whales Are Moving On-Chain Wealth Onto Wall Street Via BlackRock’s IBIT first appeared on Bitcoin Magazine and is written by Micah Zimmerman.