Here Is XRP Price If 10 Fortune 500 Companies Add It to Their Balance Sheets

How could the XRP price react if the top 10 Fortune 500 companies decide to add XRP to their balance sheets? Notably, as U.S.

How could the XRP price react if the top 10 Fortune 500 companies decide to add XRP to their balance sheets? Notably, as U.S.

A famous member of the XRP community shared a list of macro and crypto-related catalysts that motivated him to increase his XRP position today. The broader crypto market continued its downturn yesterday, plummeting 2.87% over the past 24 hours to $3.05 trillion.

A Bitcoin investor recently shared four reasons he chose to sell all his BTC tokens and re-invest everything in XRP. Pseudonymous market commentator Crypto X AiMan is going all in on XRP.

A crypto analyst has made an unexpected declaration, predicting that XRP investors could become extremely rich in just a few months. This bold claim comes with a new technical analysis, suggesting that XRP is now entering a pivotal price area that previously triggered explosive rallies. Despite the cryptocurrency’s low price and recent downtrend, the analyst remains confident that XRP could mirror past trends and skyrocket to new highs.

In a recent X post, popular market analyst ‘Steph Is Crypto’ issued a dramatic warning to XRP holders, announcing that investors will become extremely rich within the next three months. The analyst’s bold prediction elicited mixed reactions from the XRP community, with some expressing optimism and others skepticism.

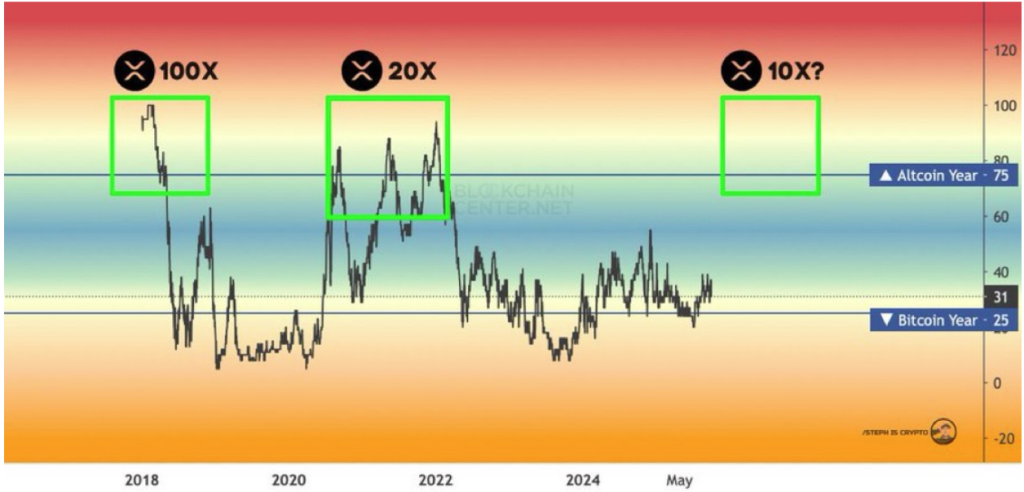

Steph Is Crypto shared a price chart with colored bands to support his ambitious claims, tracking XRP’s performance through multiple past bull cycles. The chart highlights a recurring pattern in which XRP enters a higher-colored zone during periods often associated with altcoin strength. In previous cycles, those moments were followed by unexpected, explosive upward price moves.

During the bull cycle in 2018, XRP skyrocketed by 100x, pushing its price up towards its current all-time high of $3.84. A similar uptrend occurred again during the 2020 to 2022 cycle, with XRP entering a prolonged bull phase that saw its price rally by 20x. According to Steph Is Crypto, the current chart setup appears similar to these past bullish phases.

His chart analysis suggests that XRP is once again approaching the same colored region that previously marked the start of strong price rallies. While the scale of the projected acceleration this time may differ from the peaks seen in the last two cycles, Steph Is Crypto remains confident that it will still be substantial enough to make holders significantly wealthy by March 2026.

Crypto market analyst ChartNerd has released a fresh technical analysis of XRP, suggesting that the cryptocurrency continues to show strong positive signals. According to him, XRP’s monthly SuperTrend remains firmly bullish. He emphasized that maintaining a price above the green SuperTrend line near $1.30 signals a long-term upward trajectory, with no red trends currently indicating the onset of a bear market.

ChartNerd shared a chart with a SuperTrend overlay where green lines represent bullish conditions and red lines highlight previous bear markets. The current monthly candles for XRP remain well above the green zone, reinforcing the belief that broader market conditions favor an upside. The analyst interprets this as confirmation that XRP’s long-term price trend is still predominantly bullish.

Historical data on the chart also indicate that past declines in XRP coincided with prolonged red SuperTrend phases. This happened before the big 2017 and 2020 breakout, with each recovery triggered once the price moved back above the green SuperTrend line.

Featured image from Unsplash, chart from TradingView

With only a few weeks left before the end of 2025, Shiba Inu community members are now considering whether SHIB might reach $0.0001 next year. The broader Shiba Inu community entered 2025 with strong optimism, expecting SHIB to reach a new all-time high of at least $0.0001, in line with the typical four-year market cycle.

Jake Claver, CEO of Digital Ascension Group, has issued a new caution to XRP holders. In his latest disclosure, he noted that while many holders hope for the next major price breakout, only a few are prepared for the real challenges that come after profits appear.

XRP has erased all the gains it made in early December 2024, pushing investors to shift their attention to what 2026 may hold for the token. The prolonged market downturn continues to wreak havoc on the global crypto landscape, and XRP is no exception.

MetaMask, the most widely used Ethereum wallet, is moving directly into the prediction market arena through a new integration with Polymarket, giving users the ability to trade event outcomes from inside their wallets.

Key Takeaways:

“You can now trade on the future outcome of real world events inside your wallet,” Consensys’ Gabriela Helfet wrote, adding that users will also earn MetaMask Rewards points for every prediction placed.

The integration creates a new on-ramp for Polymarket and introduces “one tap funding,” allowing users to deposit with any token from any EVM-compatible chain.

The move further tightens the link between everyday crypto wallets and decentralized betting platforms, positioning MetaMask as a gateway not only to Web3 apps but also to real-world event speculation.

Polymarket has surged in popularity over the past year, fueled in part by heightened attention during the 2024 US election cycle.

Former President Donald Trump’s embrace of crypto and a more relaxed regulatory climate helped push the platform back into the US market.

The company is now reportedly exploring a valuation of up to $15 billion, following a $2 billion strategic investment from Intercontinental Exchange, the parent of the NYSE.

Predicting on MetaMask only takes a few seconds.

— MetaMask.eth

We've enabled 1-click funding with any EVM token, or you can get started instantly if you have an existing @polymarket account! pic.twitter.com/zZtrQPDu3m(@MetaMask) December 5, 2025

For MetaMask, the move comes as the wallet expands beyond its Ethereum-focused roots. In October, it launched multichain accounts that support both EVM and non-EVM networks, including Solana.

The wallet is also preparing for the rollout of a native MASK token, as parent company Consensys gears up for a potential IPO.

The move comes as Polymarket is recruiting staff for an internal market-making team that would trade against its own customers, mirroring a controversial feature already used by rival Kalshi that has drawn criticism and legal challenges.

As reported, the New York-based prediction market startup has approached traders, including sports bettors, to join the new unit, people familiar with the matter said, requesting anonymity because the plans remain private.

Prediction markets have crossed $13 billion in cumulative trading volume, marking a record high even as broader crypto markets cool.

The surge has drawn in major players across tech and finance, including Fanatics, Coinbase, and MetaMask, all of which have recently launched or expanded event-trading platforms.

Against this backdrop, YZi Labs, the venture firm founded by Binance co-founder Changpeng “CZ” Zhao, has been intensifying its involvement in the sector.

YZi-backed Opinion has emerged as one of the most surprising breakout platforms. Launched on BNB Chain in October, it recorded nearly $1.5 billion in weekly trading volume within its first month, briefly overtaking established names such as Kalshi and Polymarket.

Meanwhile, prediction markets platform Kalshi has secured a major media breakthrough after signing a partnership with CNN, making the company the network’s official prediction markets partner while closing a $1 billion funding round at an $11 billion valuation.

The post MetaMask Enters Prediction Markets With Polymarket Integration appeared first on Cryptonews.

The Bitcoin market continues to experience high levels of investor uncertainty, as indicated by the unstable price action of the past week. In the last month alone, the leading cryptocurrency has lost about 14% of its value, strengthening fears of an impending bear market. Notably, renowned market expert Ali Martinez has shared some insight on this speculation, highlighting a key technical development that historically precedes an extended downtrend.

In an X post on Friday, Martinez presents an on-chain analysis that identifies a key price zone for determining Bitcoin’s price trajectory amid current market volatility. Using data from the Bitcoin Investor Tool metric from Glassnode, the analyst has discovered that extended downtrends in Bitcoin often start once the price falls below its 730-day Simple Moving Average (SMA), a level currently sitting at $82,150. For context, the chart below shows that the 730-day SMA (green), an important long-term indicator, has historically acted as a structural support level during major market cycles. When Bitcoin decisively loses this line, momentum tends to shift, leading to deeper corrections and lengthier bearish periods as seen between 2015-2016, 2019, and 2022-2023.

However, the chart also presents some bullish insights. Larger cyclical metrics, including the 730-day SMA × 5 band (pink) sitting at $410,771, remain well above the current price, indicating that macro overvaluation is not yet a concern, as the leading cryptocurrency remains far from an overheated zone. According to Ali Martinez, as long as Bitcoin holds above $82,150, the potential for any prolonged downtrend synonymous with a bear market remains minimal, ensuring the bull structure remains intact.

In other developments, on-chain analytics firm Sentora reports that the Bitcoin market recorded an $805 million increase in weekly exchange net outflows, indicating that a significant portion of market investors are unfazed by the recent price correction. Instead, they are opting to transfer more of their investment off crypto exchanges, suggesting an intention to hold in anticipation of future price appreciation. Meanwhile, total Bitcoin network fees reached $1.96 million, representing a 7.69% gain from the previous week and indicating an increase in transactions and network activity during this period. At the time of writing, Bitcoin trades at $89,693 following a 2.71% price decline in the last 24 hours.

A veteran Bitcoin investor has disclosed plans to invest $1 million in XRP after the founder of PhoenixReborn raised an alarm about an imminent price collapse. Specifically, in a post on X, the PhoenixReborn founder tweeted that an XRP flash crash is “imminent.” The post drew significant attention.

ExtraVod, a market commentator, recently suggested that an XRP flash crash may be imminent, but projects a possible recovery from the lows. Notably, XRP has continued to face downward pressure since hitting a peak of $2.21 on Dec.

How much would the XRP price grow if XRP's market cap appreciated by up to $1 trillion? XRP has been the subject of discussions and speculations over the past few days, especially following the launch of its first pure spot-based ETF, the Canary Capital XRP ETF (XRPC).

A widely followed early Bitcoin investor, known as NoLimit on X, has released long-term price targets for top crypto assets like XRP and Bitcoin through 2029. His projections come as Bitcoin trades at $92,370 and XRP sits at $2.09, offering a multi-year outlook amid growing expectations for the next major crypto cycle.

Following the launch of spot XRP ETFs, conversations around whether XRP could face a supply shock have gained momentum. This renewed interest has intensified on the back of a drop in exchange reserves on platforms like Binance.

XRP researcher Ripple Bull Winkle has stressed that new XRP ETFs will require millions of XRP to meet demand. In his commentary, he argued that the public “won’t realize what happened until it’s too late”.

Many in the crypto space have echoed a familiar sentiment over recent months: “The four-year crypto market cycle is dead.” Experts from the Bull Theory assert that while the four-year cycle may have come to an end, the Bitcoin bull run itself is merely delayed and could stretch until 2027.

In a recent post on social media platform X, formerly known as Twitter, the Bull Theory analysts noted that the concept of Bitcoin adhering to a neat four-year cycle is weakening.

They highlighted that significant price movements over the last decade weren’t solely driven by Halving events; rather, they were influenced by shifts in global liquidity.

The analysts pointed to the current landscape of stablecoin liquidity, which remains high despite recent downturns, indicating that larger investors are still engaged in the market, poised to invest when appropriate macroeconomic conditions arise.

In the US, Treasury policies are emerging as pivotal catalysts. The recent buybacks are notable, but the analysts emphasize that the larger narrative lies in the Treasury General Account (TGA) balance, which is currently around $940 billion—almost $90 billion above its normal range.

This surplus cash is likely to flow back into the financial system, enhancing financing conditions and adding liquidity that typically gravitates toward risk assets.

Globally, the trends appear even more promising. China has been injecting liquidity for several months, while Japan recently announced a stimulus package worth approximately $135 billion, alongside efforts to simplify cryptocurrency regulations.

Canada is also moving toward easing its monetary policy, and the US Federal Reserve (Fed) has officially halted its quantitative tightening (QT) measures—a historical precursor to some form of liquidity expansion.

The analysts explained that when major economies adopt expansive monetary policies simultaneously, risk assets like Bitcoin tend to respond more rapidly than traditional stocks or broader markets.

Additionally, potential policy tools, such as the Supplementary Leverage Ratio (SLR) exemption—implemented in 2020 to allow banks more flexibility in expanding their balance sheets—could return, resulting in increased credit creation and overall market liquidity.

There is also a political dimension to consider. President Trump has discussed potential tax reforms, including abolishing income tax and distributing $2,000 tariff dividends.

Furthermore, the likelihood of a new Federal Reserve chair who supports liquidity assistance and is constructive toward cryptocurrency could bolster conditions for economic growth.

Extended Bitcoin UptrendHistorically, whenever the Institute for Supply Management’s Purchasing Managers’ Index (ISM PMI) surpasses 55, it has been followed by periods of altcoin season. The probability of this occurring in 2026 appears high, according to the Bull Theory.

The convergence of rising stablecoin liquidity, the Treasury’s injection of cash back into markets, global quantitative easing, the cessation of QT in the US, potential bank-lending relief, pro-market policy shifts in 2026, and major players entering the crypto sector suggests a very different scenario than the old four-year halving model.

The analysts concluded that if liquidity expands concurrently across the US, Japan, China, Canada, and other significant economies, Bitcoin is unlikely to move counter to that trend.

Therefore, rather than experiencing a sharp rally followed by a prolonged bear market, the current environment indicates a more extended and broader uptrend that could span through 2026 and into 2027.

Featured image from DALL-E, chart from TradingView.com

Despite the Bitcoin price recovery above the crucial $90,000 threshold—a level that has historically served as a supportive floor for the cryptocurrency—the market is exhibiting signs that a further correction may be imminent.

Market expert Rekt Fencer recently shared insights on social media platform X, formerly known as Twitter, suggesting that the Bitcoin price might be forming what he calls a “massive bull trap.”

This term refers to a deceptive bullish signal in which the price briefly surpasses a resistance level, in this case, the $90,000 mark, only to reverse into a decline. Such movements can entrap investors who bought in during the peak, leading to significant losses.

Fencer pointed out a troubling pattern reminiscent of early 2022 when Bitcoin reclaimed its 50-week moving average (MA)—currently positioned above $102,300—before experiencing a severe decline of roughly 60%, plummeting below $20,000 by June of that year.

He indicated that the recent price recovery following major drops to $84,000 should not be interpreted as a signal of near-term success, especially since the Bitcoin price is currently trading under the 50-week MA.

If historical trends repeat, this could mean that Bitcoin might see a significant drop, potentially reaching around $36,200, which could potentially represent the low point of the bearish cycle for the cryptocurrency. On the other hand, there are analysts who retain a bullish outlook.

Market researcher and analyst Miles Deutscher expressed a confident sentiment, stating he believes there is a 91.5% likelihood that the Bitcoin price has hit its bottom, based on his analysis of key developments.

He noted that recent weeks have been dominated by negative news stories, including concerns surrounding Tether (USDT) and the implications of China’s actions on crypto, which he asserts often mark local price bottoms.

Moreover, Deutscher pointed out a shift in market flows from predominantly bearish to bullish. He explained that the trading environment has recently seen a resurgence in buying momentum, with large investors, or “OG whales,” ceasing their selling. This change has been reflected in the order books, indicating a possible stabilization in market sentiment.

Additionally, the liquidity landscape appears to be shifting, with market conditions tightening in recent months. The potential appointment of a new Federal Reserve chair known for dovish policies, coupled with the official end of quantitative tightening (QT), could further influence market dynamics in favor of buyers.

Deutscher concluded by emphasizing that given the extreme levels of fear, uncertainty, and doubt (FUD) in the market, combined with improvements in trading flows, he believes that the odds favor the notion that the Bitcoin price has indeed reached its bottom.

Featured image from DALL-E, chart from TradingView.com

Polymarket is recruiting staff for an internal market-making team that would trade against its own customers, mirroring a controversial feature already used by rival Kalshi that has drawn criticism and legal challenges.

According to Bloomberg, the New York-based prediction market startup has approached traders, including sports bettors, to join the new unit, people familiar with the matter said, requesting anonymity because the plans remain private.

Polymarket declined to comment on the recruitment effort.

The move comes as the platform prepares its full U.S. relaunch after securing regulatory clearance from the Commodity Futures Trading Commission, having paid a $1.4 million penalty in 2022 for operating an unregistered derivatives exchange.

Kalshi already operates an in-house trading arm, Kalshi Trading, which places bids on the exchange and effectively takes opposing positions to customers’ bets.

Company executives have defended the unit as necessary to create liquidity and improve the user experience.

Still, critics argue it creates inherent conflicts of interest and makes Kalshi resemble a traditional sportsbook rather than a neutral peer-to-peer platform.

Some are now claiming that the company is a gambling company and not a prediction company.

“Let’s just call a spade a spade, it’s gambling, lots of things are gambling,” a X user said.

— Martin Shkreli (@MartinShkreli) December 5, 2025

it has been decided by the courtshttps://t.co/lU0S6XWrkA

A proposed class action lawsuit filed last month alleges that Kalshi Trading sets betting lines that disadvantage customers, claiming “consumers place bets on Kalshi, they face off against money provided by a sophisticated market maker on the other side of the ledger.“

Kalshi co-founder Luana Lopes Lara dismissed the lawsuit as a “pure smear campaign” on social media.

She stated that Kalshi Trading operates unprofitably and receives “no preferential access or treatment.”

However, the legal challenge shows mounting concerns about whether prediction markets function as advertised, neutral platforms where users with differing opinions trade directly with each other.

1. Rebrand gambling as asset allocation

— Harry Crane (@HarryDCrane) December 5, 2025

2. Rebrand sportsbook as truth engine

3. Rebrand bets as predictions

4. Spin up in-house market maker to c̶o̶m̶p̶e̶t̶e̶ collaborate with c̶u̶s̶t̶o̶m̶e̶r̶s̶ fellow investors for the greater good

It's really noble if you think about it. https://t.co/UQx67fg3DI

Polymarket’s decision to build an internal trading desk arrives as the company executes its return to American markets following years offshore.

In December, the CFTC issued a no-action letter covering QCX LLC and QC Clearing LLC, two entities Polymarket acquired earlier in 2025 for $112 million to gain licensed designated contract market status and regulated clearing capabilities.

The agency granted temporary relief from certain swap data reporting requirements, allowing the platform to operate within the same framework governing federally supervised U.S. trading venues.

— Cryptonews.com (@cryptonews) November 25, 2025

Prediction market platform Polymarket says it has received an Amended Order of Designation from the CFTC.#Crypto #CFTChttps://t.co/H44tIIxPaz

Founder and CEO Shayne Coplan confirmed receiving “the green light to go live in the USA” and credited CFTC staff for completing the process in record time.

The regulatory clearance caps a lengthy journey that intensified in November 2024 when the FBI raided Coplan’s Manhattan residence and seized electronic devices as part of an investigation into whether Americans continued accessing the site through VPNs despite the 2022 ban.

Despite being barred from U.S. operations since 2022, Polymarket expanded aggressively overseas, recording roughly $6 billion in wagers during the first half of 2025 alone.

The platform gained global attention during the 2024 presidential election cycle, as its markets closely tracked Donald Trump’s odds of winning.

Prediction markets rely heavily on market makers willing to take less popular trades, as the platforms match buyers with sellers on binary yes-or-no contracts.

Both Polymarket and Kalshi have offered incentives rewarding heavy users who provide liquidity, while a small number of traditional financial trading firms, including Susquehanna International Group and Jump Trading, have begun serving as external market makers on Kalshi.

— Cryptonews.com (@cryptonews) November 25, 2025

@GalaxyDigital is in talks to provide liquidity on Polymarket and Kalshi, reflecting the growing momentum of prediction markets among retail traders and Wall Street.#PredictionMarkets #Galaxy https://t.co/2wgytQSkZ4

Mike Novogratz’s Galaxy Digital is currently in talks with both platforms to become a liquidity provider, with Novogratz telling Bloomberg that the firm is “doing some small-scale experimenting with market-making on prediction markets.“

The broader debate centers on whether prediction markets genuinely differ from traditional gambling operations.

During a public appearance last month, Coplan called conventional sportsbooks a “scam” that “rip off the consumer,” positioning Polymarket as a transparent alternative where users trade against each other rather than facing house odds designed to extract profits.

The post Polymarket to Launch In-House Trading Desk That Bets Against Users: Report appeared first on Cryptonews.

Bitcoin appears to be weakening a crucial resistance mark, signaling that a momentous breakout to higher price levels is not far-fetched. Bitcoin trades near $91,000, down less than 2% over the past 24 hours.