Cardano Price Prediction: Crypto Researcher Says New Hydra Upgrade Not 100% Secure – Could All Wallets Get Drained?

A prominent Cardano supporter just warned the community that the layer-2 scaling solution Hydra may not be as safe as they think. Are investors’ funds at risk, and does this justify a bearish Cardano price prediction?

If you want to use Hydra, you trust the operators of Hydra Head.

— Cardano YOD₳ (@JaromirTesar) December 4, 2025

You are only in control of your funds if you are one of the Hydra Head operators.

When you lock ADA into a Hydra Head, you sign a transaction with your private key. The transaction sends ADA into an on-chain… pic.twitter.com/hbh78guPLY

In a lengthy X post, a pseudonymous user named YODA, known for his support of the Cardano network for years, highlighted a potential flaw in the design of Hydra. This technical weakness would supposedly allow node operators to have a say on what happens with users’ tokens.

He clarified that the funds locked up in the L2 and delegated to third-party Hydra Heads (validators) are fully in control of the latter, not the owner.

In theory, if Hydra Heads collude and introduce false transactions, they would be able to sign them without necessarily having access to the private keys of the original owner of the ADA tokens.

“Every update requires signatures from all Hydra Head operators. Those signatures are made using the private keys of the operators, not the users,” YODA emphasized.

He added: “If they collude, they can ALL sign a malicious snapshot that splits all the funds between them.”

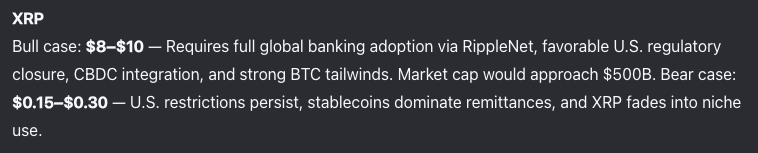

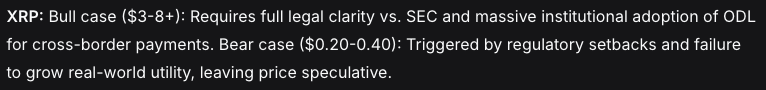

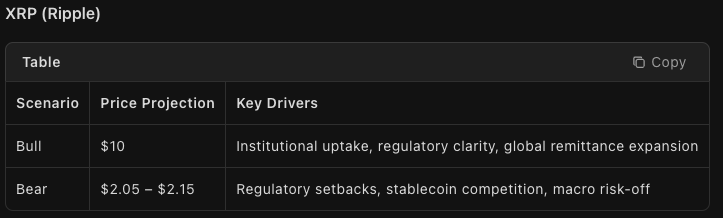

Cardano Price Prediction: ADA Finds Support at $0.40 But Bearish Trend Persists

Aside from Dogecoin (DOGE), Cardano (ADA) has been one of the worst-performing top 10 tokens this year, with total losses now reaching 49%.

The daily chart shows that the token has found support temporarily at $0.40.

However, ADA has been on a strong downtrend and is not yet showing signs of a trend reversal. The price needs to climb above $0.52 to reverse this downtrend.

Otherwise, ADA may face a much more dramatic correction to $0.32, meaning a total downside risk of 25%.

Well-established tokens like ADA have struggled to reach higher highs during this cycle. However, a new crypto presale called Maxi Doge ($MAXI) has managed to raise over $4 million in just a few weeks to launch its community-centered meme coin.

Maxi Doge ($MAXI) is The New Dogecoin-Themed Meme Coin

Maxi Doge ($MAXI) is an Ethereum meme coin that aims to bring together an army of like-minded ‘degens’ who are not afraid to make YOLO trades to get out of mom’s basement.

Through fun competitions like Maxi Gains and Maxi Ripped, token holders will compete by showcasing their highest-yielding traders to earn rewards and bragging rights.

They also get exclusive access to a hub through which they can share ideas, insights, setups, and more.

This is a vibrant community that fully embraces the energy that comes with bull markets.

Finally, up to 25% of the presale’s proceeds will be used to invest in high-potential projects.

The gains will be used to fund the project’s marketing efforts to make $MAXI known.

To buy $MAXI before the presale ends, simply head to the official Maxi Doge website and link up a compatible wallet like Best Wallet.

Either swap USDT or ETH to get this token or use a bank card instead.

Visit the Official Maxi Doge Website HereThe post Cardano Price Prediction: Crypto Researcher Says New Hydra Upgrade Not 100% Secure – Could All Wallets Get Drained? appeared first on Cryptonews.