BlackRock’s Bitcoin ETF Bleeds $2.7B in Longest Outflow Streak Since Launch

BlackRock’s iShares Bitcoin Trust has logged its longest stretch of weekly withdrawals since the fund launched in January 2024, marking a sharp turn in institutional sentiment toward Bitcoin even as prices steady.

Key Takeaways:

- BlackRock’s iShares Bitcoin Trust has entered its longest outflow streak to date, with over $2.7 billion withdrawn in five weeks.

- The reversal follows October’s sharp crypto-market liquidation, which erased more than $1 trillion in value and halted IBIT’s months of steady inflows.

- Analysts warn the trend signals weakening institutional appetite.

Investors pulled more than $2.7 billion from the fund over the five weeks ending Nov. 28, according to data from SoSoValue.

Redemptions continued on Thursday with an additional $113 million, putting the ETF on track for a sixth consecutive week of outflows.

IBIT Faces Reversal as Crypto Wipeout Ends Months of Steady Inflows

IBIT, which manages more than $71 billion in assets, has been the flagship vehicle for traditional investors seeking regulated exposure to Bitcoin.

However, flows have reversed direction since early October, when a violent liquidation across crypto markets triggered a sell-off that erased more than $1 trillion in digital-asset value.

The shift stands in contrast to the steady inflows that helped propel Bitcoin higher earlier in the year.

Last week, speaking in São Paulo, BlackRock business development director Cristiano Castro said the company’s Bitcoin ETFs had become one of its strongest revenue engines, calling their rapid ascent “a big surprise” as investor allocations surged throughout the year.

Castro also downplayed outflow concerns, noting that “ETFs are very liquid and powerful instruments.”

“What we’ve been seeing is perfectly normal; any asset that starts to experience compression usually has this effect, especially in an instrument that is heavily controlled by retail investors,” he added.

$ETH ETF outflow of $41,500,000

— Ted (@TedPillows) December 5, 2025yesterday.

BlackRock bought $28,400,000 in Ethereum. pic.twitter.com/LudLAdu0rg

Bitcoin has clawed back some losses this week, but analysts say ETF flows paint a clearer picture of institutional caution.

In a recent report, Glassnode wrote that the outflow streak “marks a clear reversal from the persistent inflow regime that supported price earlier in the year, and reflects a cooling of new capital allocation into the asset.”

The firm noted that investor positioning has become more defensive as volatility and funding pressure remain elevated.

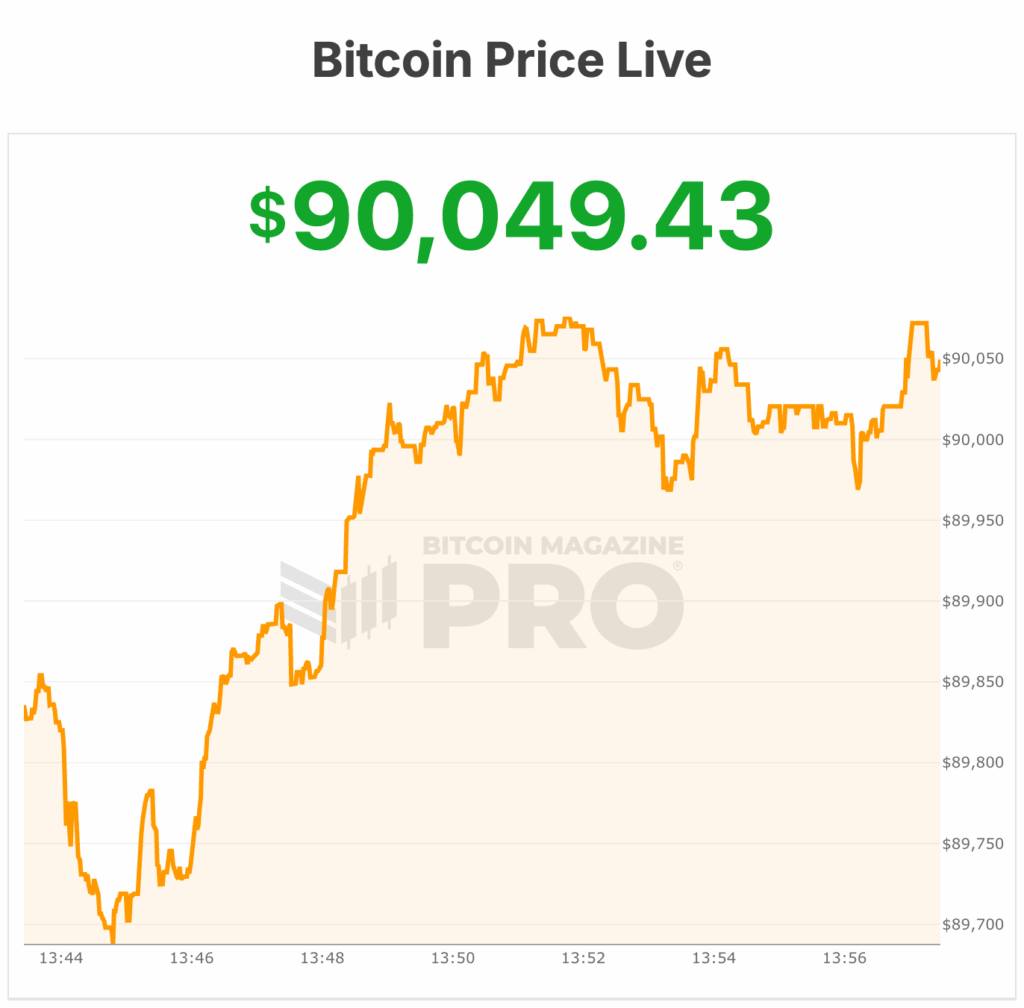

Despite the turbulence, Bitcoin traded around $92,000 in London on Friday morning, still down 27% from its October peak.

Spot Chainlink ETF Pulls $41M on First Day

As reported, Grayscale’s first US spot exchange-traded fund tied to Chainlink opened with solid demand, adding another data point to the debate over whether appetite for altcoins can survive a cooling crypto market.

The product ended its debut session with $41 million in net inflows and about $13 million in trading volume.

The figures placed Chainlink among the stronger ETF launches this year and suggested that, at least for some investors, regulated vehicles remain the preferred route into higher-risk digital assets.

The new Chainlink ETF comes amid the rollout of a wave of new altcoin ETFs.

Over the past month, issuers have launched products tied to Solana, XRP, and Dogecoin, with more XRP and Dogecoin funds set to list next week.

The Canary Capital XRP ETF (XRPC) debuted with $58 million in net inflows, the highest opening-day haul for any ETF this year, edging out the Bitwise Solana Staking ETF (BSOL), which launched with $57 million.

The post BlackRock’s Bitcoin ETF Bleeds $2.7B in Longest Outflow Streak Since Launch appeared first on Cryptonews.

ESMA’s Natasha Cazenave has outlined how tokenization has reshaped EU markets and raised legal and investor protection questions.

ESMA’s Natasha Cazenave has outlined how tokenization has reshaped EU markets and raised legal and investor protection questions. Skynet projects RWA tokenization to hit $16T by 2030, with institutions driving growth amid ongoing security and access challenges.

Skynet projects RWA tokenization to hit $16T by 2030, with institutions driving growth amid ongoing security and access challenges.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

UK appoints digital lead to coordinate financial market tokenization, signaling institutional interest in blockchain-based infrastructure.

𝓜𝓮𝓶𝓮 𝓦𝓱𝓪𝓵𝓮

𝓜𝓮𝓶𝓮 𝓦𝓱𝓪𝓵𝓮  (@MeMeWhAle0)

(@MeMeWhAle0)