Key Updates On The US Crypto Market Structure Bill: What You Need To Know

The anticipated crypto market structure bill, or namely the CLARITY Act, designed to provide essential regulatory clarity for digital assets in the United States, is approaching critical dates in the Senate. However, it faces significant complexities related to stablecoin yield, conflicts of interest, and decentralized finance (DeFi).

Senate Divided On Crypto Market Structure Bill

Legal expert and Chief Legal Officer of Variant Jake Chervinsky, reports that the Senate is divided into two committees: Banking, which is handling the securities law aspect, and Agriculture, responsible for the commodities law portion.

Both committees have published drafts of their work this fall, with the next step being markup, a process where hearings will be held to vote on amendments before sending the bill to the Senate floor for a full vote.

However, both committees are cautious and are unlikely to proceed with markup until they resolve ongoing disputes. Among these, three significant issues stand out.

The first major concern involves stablecoin yield. In the GENIUS Act, banks lobbied for a prohibition on interest payments, meaning stablecoin issuers cannot offer holders any form of interest or yield.

While the current prohibition prevents direct yield payments to holders, it does not address non-yield rewards or yield provided by third parties. Banks consider this gap a “loophole” and are advocating for broader restrictions to be included in the market structure bill.

Conflicts Of Interest And DeFi Regulations Stall Progress

The second issue revolves around conflicts of interest. Some Democratic senators have indicated they would not support the market structure legislation unless it includes provisions that restrict the President’s family from conducting business in the crypto space.

The third and perhaps most crucial issue pertains to DeFi. It is important to note that market structure legislation primarily addresses centralized platforms that exercise custody over user funds and transactions.

Chervinsky believes the bill should primarily focus on protecting DeFi, but traditional finance (TradFi) stakeholders have been pushing Congress to categorize virtually all entities in the crypto sector—developers, validators, and others—as intermediaries.

The expert emphasized that the success of any market structure bill hinges on ensuring robust protections for developers since the viability of the crypto industry relies on their contributions.

Given the intricate nature of these issues and the swiftly approaching holiday break, Chervinsky noted that it is possible that discussions about market structure could extend into January.

Senate Markup Set For December 17-18Market analyst MartyParty provided another update on December 4, indicating that the bipartisan Digital Asset Market Structure Bill is gaining significant momentum in Congress, with a markup session in the Senate Banking Committee tentatively scheduled for December 17-18, just before the holiday recess

If successfully passed, he states that the bill could establish clearer pathways for tokenized real-world assets (RWAs) and mitigate “debanking” risks, paving the way for compliant exchanges and potentially stimulating market volumes following the Commodity Futures Trading Commission (CFTC) approvals for spot crypto trading.

This “regulatory convergence” is seen as a catalyst that could drive liquidity and energize the next bull market, reinforcing President Trump’s vision for the US to emerge as the “crypto capital of the world.”

Featured image from DALL-E, chart from TradingView.com

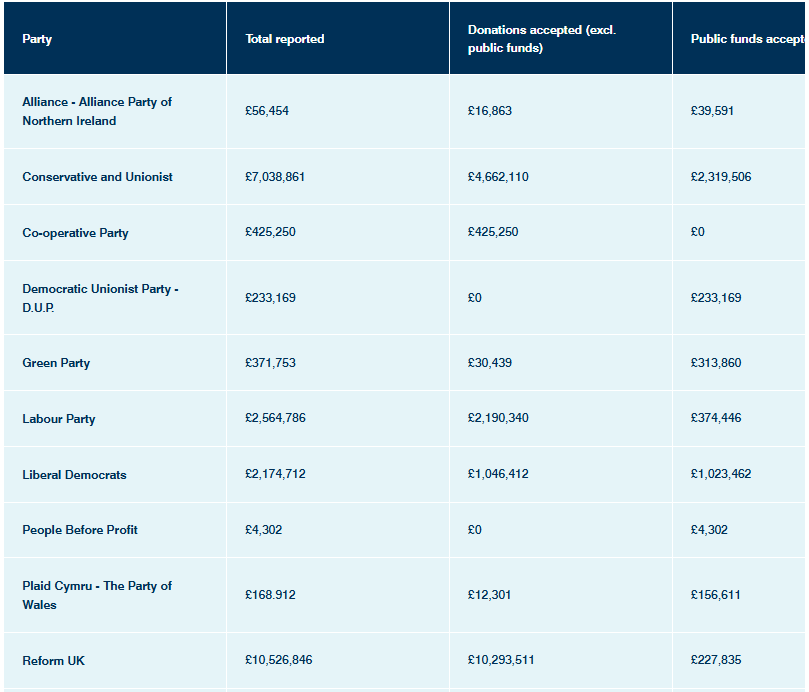

UK considers crypto political donation ban, threatening @Nifel_Farage Reform UK’s campaign and fundraising amid foreign interference and money-laundering concerns.

UK considers crypto political donation ban, threatening @Nifel_Farage Reform UK’s campaign and fundraising amid foreign interference and money-laundering concerns.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month.

The Federal Deposit Insurance Corporation will publish its first US stablecoin rule framework later this month. The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.

The U.S. Treasury is calling on the public for feedback on how financial institutions can prevent crypto risks as part of the GENIUS Act.  GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.