Woori Bank Becomes First in Korea to Display Bitcoin Prices in Trading Room

Woori Bank has begun displaying Bitcoin prices inside its main trading room in Seoul, placing the cryptocurrency alongside core financial indicators such as the won–dollar exchange rate and stock market data.

Key Takeaways:

- Woori Bank is the first Korean commercial bank to display Bitcoin prices in its main trading room.

- The move reflects Bitcoin’s rising role in global market sentiment as Korean banks expand deeper into digital asset infrastructure.

- Upcoming regulations could position major banks like Woori as central players in South Korea’s future digital finance landscape.

The move marks the first time a commercial bank in South Korea has integrated a crypto price feed directly into its frontline dealing environment, the space where traders handle foreign exchange, bonds and derivatives.

Bitcoin Now Seen as Market Signal, Says Woori Bank Official

A Woori Bank official said the decision reflects the growing weight of digital assets in global finance, noting that Bitcoin has increasingly become a signal for broader market sentiment.

“As digital assets continue to grow in prominence and influence in global financial markets, we determined that they should be monitored as a key indicator to better read overall market trends,” the official said.

The update comes as Korean banks step deeper into digital asset infrastructure.

Hana Financial Group this week signed a partnership with Dunamu, operator of the Upbit exchange, to incorporate blockchain tools into services ranging from overseas remittances to financial data systems.

While Woori has yet to announce a formal partnership with a crypto exchange, senior executives have repeatedly indicated that the bank intends to expand into digital asset services.

CEO Jung Jin-wan said in October that payments and digital asset ecosystems are “increasingly interconnected,” suggesting the sector could open new revenue avenues for banks.

— Vivek Sen (@Vivek4real_) December 5, 2025

SOUTH KOREAN BANKING GIANT WOORI BANK JUST STARTED DISPLAYING #BITCOIN PRICE IN THEIR DEALING ROOM

BANKS ARE COMING!! pic.twitter.com/NBiXXhBLe0

Regulators are also shaping a clearer path. The government and ruling Democratic Party are examining a proposal that would restrict issuance of won-based stablecoins to bank-led consortia with majority bank ownership.

If enacted, the framework could position major lenders like Woori as central players in future stablecoin markets.

As reported, South Korean investors turned the Chuseok holiday into a high-risk trading week, pouring $1.24 billion into US tech and crypto-linked assets while local markets were closed between October 3 and 9.

The frenzy was led by leveraged ETFs and high-growth stocks, as traders sought to ride Wall Street’s momentum amid optimism surrounding US tech resilience and domestic stimulus hopes.

South Korea to Extend Crypto Travel Rule to Sub-$700 Transactions

Last week, South Korea revealed that it is preparing one of its most aggressive crackdowns on cryptocurrency-related financial crime by expanding its travel rule requirements.

The new threshold covers transactions under 1 million won ($680), which until now allowed users to bypass identity checks by breaking transfers into smaller amounts

The Financial Intelligence Unit (FIU) will also introduce pre-emptive account-freezing powers in serious cases, allowing investigators to lock suspicious accounts before funds can be moved beyond recovery.

Officials said legislative amendments are expected to be submitted to the National Assembly in the first half of 2026, with South Korea also expanding coordination with global regulators such as the Financial Action Task Force to align with international standards.

The post Woori Bank Becomes First in Korea to Display Bitcoin Prices in Trading Room appeared first on Cryptonews.

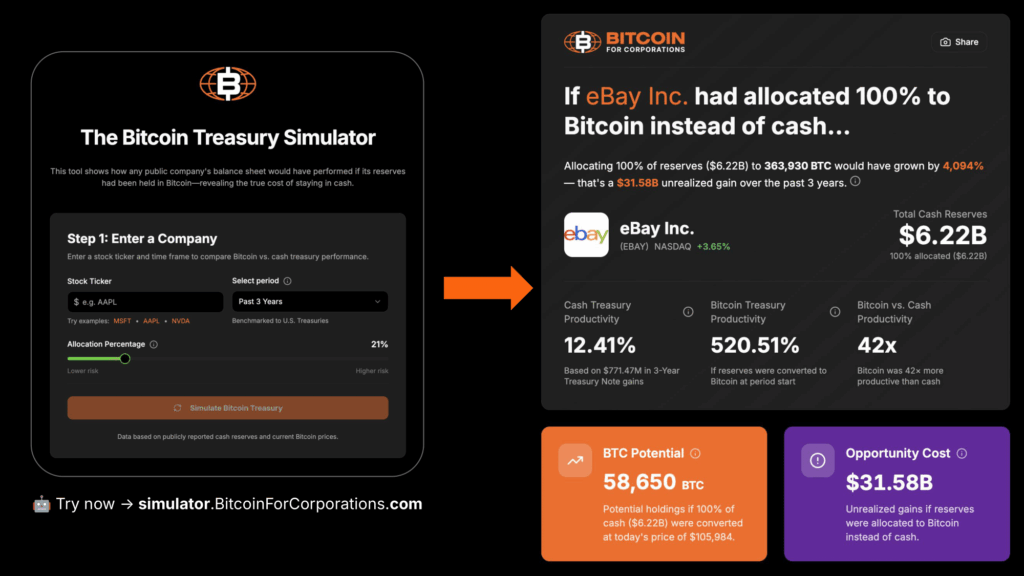

Try the simulator:

Try the simulator: