Reading view

The ISS Is Out of Parking Spots for the First Time Ever. Here’s Why

All eight docking ports at the ISS are occupied. That's never happened before.

Rocket Report: Blunder at Baikonur; do launchers really need rocket engines?

Welcome to Edition 8.21 of the Rocket Report! We’re back after the Thanksgiving holiday with more launch news. Most of the big stories over the last couple of weeks came from abroad. Russian rockets and launch pads didn’t fare so well. China’s launch industry celebrated several key missions. SpaceX was busy, too, with seven launches over the last two weeks, six of them carrying more Starlink Internet satellites into orbit. We expect between 15 and 20 more orbital launch attempts worldwide before the end of the year.

As always, we welcome reader submissions. If you don’t want to miss an issue, please subscribe using the box below (the form will not appear on AMP-enabled versions of the site). Each report will include information on small-, medium-, and heavy-lift rockets, as well as a quick look ahead at the next three launches on the calendar.

Another Sarmat failure. A Russian intercontinental ballistic missile (ICBM) fired from an underground silo on the country’s southern steppe on November 28 on a scheduled test to deliver a dummy warhead to a remote impact zone nearly 4,000 miles away. The missile didn’t even make it 4,000 feet, Ars reports. Russia’s military has been silent on the accident, but the missile’s crash was seen and heard for miles around the Dombarovsky air base in Orenburg Oblast near the Russian-Kazakh border. A video posted by the Russian blog site MilitaryRussia.ru on Telegram and widely shared on other social media platforms showed the missile veering off course immediately after launch before cartwheeling upside down, losing power, and then crashing a short distance from the launch site.

© Korea Aerospace Research Institute

SpaceX is blasting toward a new Falcon 9 milestone

For the sixth year in a row, SpaceX is on course to set a new annual launch record for the Falcon 9 rocket, highlighting SpaceX’s increasing dominance in orbital launch activity, as well as the success of its reusable booster system in enabling frequent, cost-effective flights. The Elon Musk-led spaceflight company is set to complete […]

The post SpaceX is blasting toward a new Falcon 9 milestone appeared first on Digital Trends.

Congress warned that NASA’s current plan for Artemis “cannot work”

In recent months, it has begun dawning on US lawmakers that, absent significant intervention, China will land humans on the Moon before the United States can return there with the Artemis Program.

So far, legislators have yet to take meaningful action on this—a $10 billion infusion into NASA’s budget this summer essentially provided zero funding for efforts needed to land humans on the Moon this decade. But now a subcommittee of the House Committee on Space, Science, and Technology has begun reviewing the space agency’s policy, expressing concerns about Chinese competition in civil spaceflight.

During a hearing on Thursday in Washington, DC, the subcommittee members asked a panel of experts how NASA could maintain its global leadership in space over China in general, and more specifically, how to improve the Artemis Program to reach the Moon more quickly.

© Liu Guoxing/VCG via Getty Images

China tried to copy SpaceX’s Falcon 9 landing, but this is what happened

SpaceX has been successfully landing the first stage of its Falcon 9 rocket for the last decade. Doing so allows SpaceX to use a single booster for multiple missions, enabling it to slash launch costs and increase launch frequency. Few other companies have made any real effort to emulate SpaceX’s feat with a first-stage booster, […]

The post China tried to copy SpaceX’s Falcon 9 landing, but this is what happened appeared first on Digital Trends.

Russian Cosmonaut Kicked Off SpaceX Mission Over Alleged National Security Violation

The incident could strain Roscosmos’s partnership with NASA as the agency finds itself more reliant on the U.S. than ever.

SpaceX given big boost for Starship launches from Cape Canaveral

SpaceX has been given a major boost for its Starship operations at Cape Canaveral in Florida after the Department of the Air Force (DAF) gave the green light for the company to develop the Space Launch Complex-37 (SLC-37) launch facility. Preparatory construction work at the site began earlier this year, but the nod from DAF […]

The post SpaceX given big boost for Starship launches from Cape Canaveral appeared first on Digital Trends.

Bitcoin Reflects Energy As The ‘True Currency,’ Elon Musk Says

Tesla and SpaceX chief Elon Musk has stoked fresh debate about Bitcoin after a recent social post in which he said the cryptocurrency is “based on energy” and that energy cannot be faked. The comment, posted on X, quickly drew attention from investors and politicians alike.

Musk’s remark landed as markets moved. Bitcoin was down, and trading roughly around $86,500 at the time of the post, and crypto coverage noted a flurry of reactions across social feeds and trading desks. Some market watchers saw the statement as a boost for BTC’s narrative as an inflation hedge.

Musk Frames Bitcoin As ‘Energy Money’

According to Musk, the act of mining ties Bitcoin to physical energy: miners consume electricity to secure the network and mint new coins, which he said makes Bitcoin harder to fake than printed fiat.

In a fresh clip shared from Nikhil Kamath’s interview, Musk makes his stance clear:

Out now @elonmusk pic.twitter.com/dQVLniUgWA

— Nikhil Kamath (@nikhilkamathcio) November 30, 2025

The line of argument presents energy use not as a flaw but as a kind of proof that creates scarcity. Several crypto outlets ran pieces unpacking the idea and how it contrasts with past criticism Musk voiced about mining’s environmental toll.

Market Moves And Political Echoes

Traders and some policy figures reacted quickly. Bitcoin backers posted support, while others urged caution. Meanwhile, separate coverage noted that SpaceX recently moved almost $270 million worth of Bitcoin, a move that traders flagged as potentially market-swaying. Those on both sides of the debate said Musk’s post could influence investor sentiment, at least in the short run.

The core of the claim is simple: you cannot manufacture energy the way a central bank can print more currency. That idea appeals to people worried about rising public spending on tech and AI, which some analysts say could put pressure on fiat money.

But critics point out a gap: energy used to mine Bitcoin does not become a stored reserve like gold. It is consumed. Value, they argue, still relies heavily on trust and demand, not energy alone.

Past Stance And Ongoing QuestionsMusk’s comment marks a visible shift from his earlier stance in 2021 when Tesla paused Bitcoin payments over mining energy concerns.

Since then, the mining sector has changed in parts, with more projects claiming use of renewables, while others still depend on fossil fuels. The debate now mixes technical, economic and political threads, making clear answers hard to find.

Featured image from Lovepik, chart from TradingView

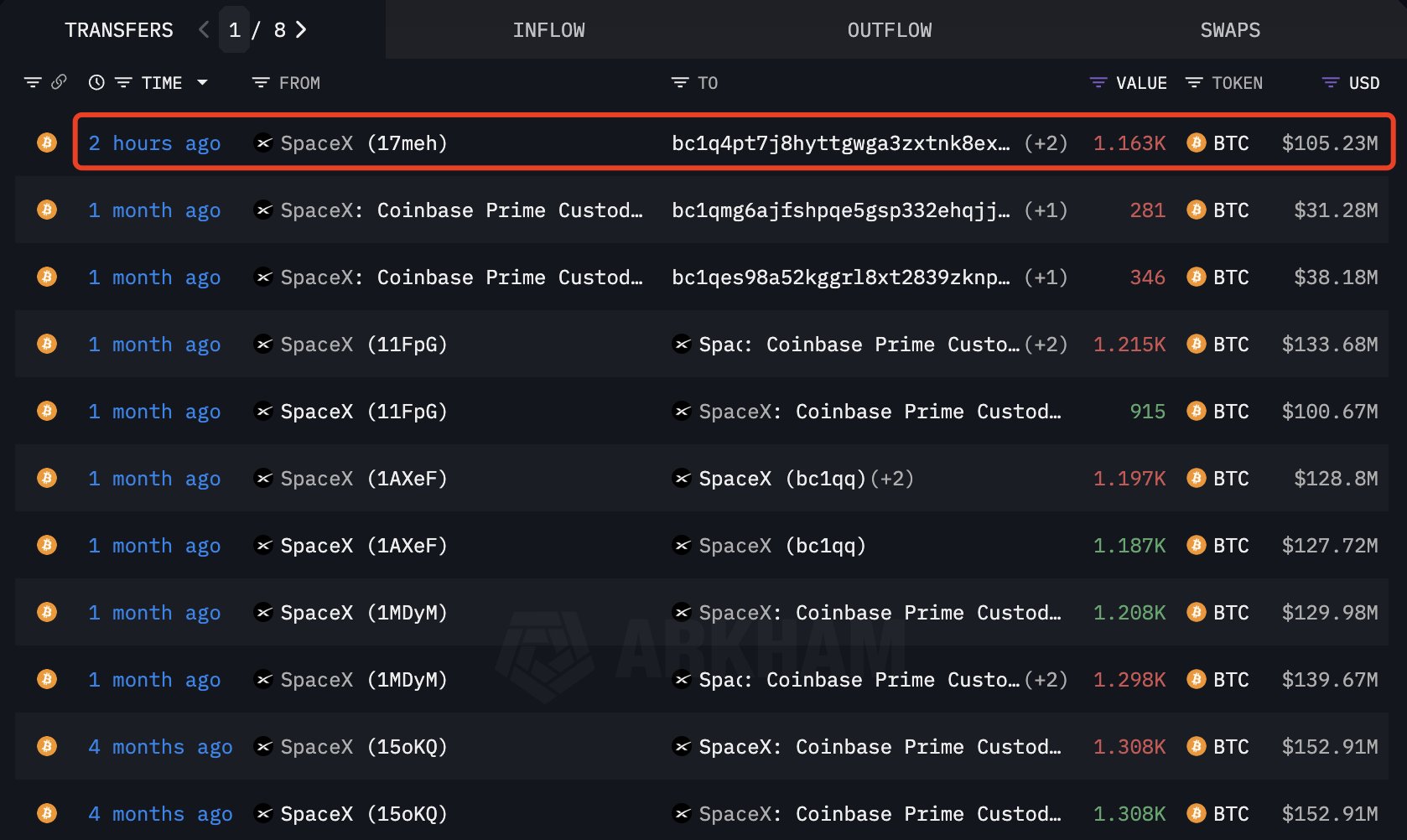

Elon Musk’s SpaceX Moves $105 Million In Bitcoin, Is It Time For Selling?

Elon Musk’s SpaceX quietly shifted 1,163 BTC, worth about $105.23 million, into new wallets this week, leading to questions over whether the aerospace giant is preparing for a sale or simply reorganizing its reserves. Blockchain tracker Arkham Intelligence first spotted the transaction on November 27, noting that the bitcoins were moved from a long-dormant treasury wallet into a new address.

The move happened just as Bitcoin reclaimed $91,000, and the size of the transaction could be an early signal of selling pressure.

SpaceX’s Bitcoin Transfer: Is This Selling Pressure?

Data from Arkham Intelligence shows that SpaceX executed the $105.23 million transfer in a single large movement. Although the transfer was substantial, a quick look at SpaceX’s treasury behavior in recent months shows that the activity points to internal restructuring rather than liquidation. Still, the scale of the transaction has left investors asking whether this could be an early signal of selling pressure.

Intelligence data shows that the funds were pushed into a new wallet with no immediate ties to exchanges. This difference is important because transfers to exchanges often come with selling activity.

Instead, the pattern follows an earlier transaction in late October, when SpaceX moved 281 BTC into a newly created address without any subsequent liquidation. Interestingly, this 281 BTC transfer was preceded by a similar transfer of 1,215 BTC worth $133.68 million in October.

The consistency of these movements suggests a gradual upgrade or redistribution of cold-storage arrangements, something that major corporations tend to do periodically to maintain custody security. According to Lookonchain, the recent transfer of 1,163 BTC to the new address “bc1q4p” was possibly made to Coinbase Prime for custody.

SpaceX’s balance is substantial even after the recent movement, with roughly 6,095 BTC still under its control, an amount currently valued at $555.637 million and large enough to place the company among the biggest private corporate holders of Bitcoin.

Tesla, Musk’s other major enterprise, sits even higher on the leaderboard with 11,509 BTC valued at $1.05 billion, ranking it as the 17th largest publicly traded Bitcoin-holding company in the world.

Could SpaceX’s Movements Still Impact Market Sentiment?

Despite the absence of clear evidence of selling intent, large transfers tied to high-profile companies like SpaceX inevitably influence sentiment. Bitcoin had just regained the $91,000 region at the time of the transfer, and traders immediately questioned whether Musk’s company might be preparing to offload part of its holdings, especially given the company’s sell-off history during the 2022 bear market.

Bitcoin is still stabilizing after a price crash encouraged in part by Owen Gunden, one of the earliest high-profile holders, who unloaded hundreds of millions of dollars’ worth of BTC and helped drag the price below $90,000 on November 20. However, the evidence behind SpaceX’s current transfer is still pointing to consolidation rather than liquidation.

SpaceX Moves $105M In Bitcoin As Custody Shift Toward Coinbase Prime Continues

Bitcoin has finally broken above the $90,000 mark after days of struggling to reclaim this key psychological level. The move comes during a period of sharp volatility and persistent selling pressure that continues to dominate market sentiment.

Analysts remain divided, but a growing number are calling for the official start of a bear market as BTC trades nearly 30% below its all-time high and fails to establish a convincing recovery structure. Fear remains elevated, and confidence among both retail and institutional investors is weakening.

Adding to the uncertainty, new data from Arkham reveals that SpaceX transferred out another 1,163 BTC—worth approximately $105.23 million—just a few hours ago. The transfer appears to have been routed to Coinbase Prime, suggesting a potential custody shift by the company. Such large movements often spark concern in the market, as they may signal repositioning, selling preparation, or treasury adjustments by major corporate holders.

While Bitcoin’s push above $90K provides temporary relief, it does little to change the broader narrative: the market remains under pressure, liquidity is thinning, and macro-driven uncertainty continues to shape price action. The coming sessions will determine whether BTC can build momentum or slip back into deeper correction territory.

SpaceX’s Bitcoin Movements Add New Layer of Market Uncertainty

According to data from Arkham, SpaceX currently holds 6,095.45 BTC, valued at roughly $550 million at today’s prices. This substantial treasury position places the company among the larger corporate Bitcoin holders, and its recent on-chain activity has quickly drawn attention across the market.

The latest transfer—1,163 BTC moved just hours ago—marks a meaningful shift in activity for SpaceX, especially considering the company has been largely inactive in terms of BTC movements for months.

Arkham reports that this is SpaceX’s first notable transaction since October 29, when the company transferred 281 BTC to a new wallet address. While the motives behind these transfers remain unknown, traders typically monitor such moves closely, as large corporate holders can influence market sentiment.

Transfers to Coinbase Prime—as suspected in the latest movement—often suggest custody adjustments, treasury restructuring, or preparations for strategic repositioning.

For now, there is no clear indication that SpaceX is reducing its Bitcoin exposure. However, the renewed on-chain activity comes at a sensitive moment for the market, which is struggling with selling pressure, fear, and broad speculation about an emerging bear phase.

As long as major smart-money entities remain active, Bitcoin’s short-term direction may continue to experience heightened volatility.

Attempted Recovery but Still Under Pressure

Bitcoin is showing signs of recovery after plunging to new local lows last week, with the price now pushing back above $91,000. The chart shows a sharp bounce from the sub-$82,000 zone, which acted as a temporary support during the capitulation phase. However, despite this rebound, BTC remains below all major moving averages—the 50-day, 100-day, and 200-day—which reinforces the broader bearish structure.

The recent upswing reflects short-term relief rather than a confirmed trend reversal. Volume spiked heavily during the sell-off, indicating forced liquidations and panic selling. But the current bounce is happening on lighter volume, suggesting that buyers are cautious and not yet committing with strong conviction.

Structurally, Bitcoin must reclaim the $95,000–$98,000 zone, where the 50-day and 100-day moving averages converge.

This area represents the first major resistance cluster and will determine whether the market is transitioning into a recovery or simply forming a lower high before another leg down. Failure to break above this band could invite renewed selling pressure.

Featured image from ChatGPT, chart from TradingView.com

NASA’s $4.5 Billion Starliner Deal With Boeing Cut to Just 4 Flights After Embarrassing Failures

The capsule will fly a cargo mission to the ISS early next year, with no crew on board this time.

Rivals object to SpaceX’s Starship plans in Florida—who’s interfering with whom?

The commander of the military unit responsible for running the Cape Canaveral spaceport in Florida expects SpaceX to begin launching Starship rockets there next year.

Launch companies with facilities near SpaceX’s Starship pads are not pleased. SpaceX’s two chief rivals, Blue Origin and United Launch Alliance, complained last year that SpaceX’s proposal of launching as many as 120 Starships per year from Florida’s Space Coast could force them to routinely clear personnel from their launch pads for safety reasons.

This isn’t the first time Blue Origin and ULA have tried to throw up roadblocks in front of SpaceX. The companies sought to prevent NASA from leasing a disused launch pad to SpaceX in 2013, but they lost the fight.

© SpaceX

China’s Simulated Attack Shows How It Could Jam Musk’s Starlink Over Taiwan

To overcome the constellation's evasive nature, China would need a swarm of hundreds of drones, a new study finds.

SpaceX’s upgraded Starship suffers explosion during testing

Rocket Report: SpaceX’s next-gen booster fails; Pegasus will fly again

Welcome to Edition 8.20 of the Rocket Report! For the second week in a row, Blue Origin dominated the headlines with news about its New Glenn rocket. After a stunning success November 13 with the launch and landing of the second New Glenn rocket, Jeff Bezos’ space company revealed a roadmap this week showing how engineers will supercharge the vehicle with more engines. Meanwhile, in South Texas, SpaceX took a step toward the first flight of the next-generation Starship rocket. There will be no Rocket Report next week due to the Thanksgiving holiday in the United States. We look forward to resuming delivery of all the news in space lift the first week of December.

As always, we welcome reader submissions. If you don’t want to miss an issue, please subscribe using the box below (the form will not appear on AMP-enabled versions of the site). Each report will include information on small-, medium-, and heavy-lift rockets, as well as a quick look ahead at the next three launches on the calendar.

Northrop’s Pegasus rocket wins a rare contract. A startup named Katalyst Space Technologies won a $30 million contract from NASA in August to build a robotic rescue mission for the agency’s Neil Gehrels Swift Observatory in low-Earth orbit. Swift, in space since 2004, is a unique instrument designed to study gamma-ray bursts, the most powerful explosions in the Universe. The spacecraft lacks a propulsion system and its orbit is subject to atmospheric drag, and NASA says it is “racing against the clock” to boost Swift’s orbit and extend its lifetime before it falls back to Earth. On Wednesday, Katalyst announced it selected Northrop Grumman’s air-launched Pegasus XL rocket to send the rescue craft into orbit next year.

© Manuel Mazzanti/NurPhoto via Getty Images

Newest Starship booster is significantly damaged during testing early Friday

During the pre-dawn hours in South Texas on Friday morning, SpaceX’s next-generation Starship first stage suffered some sort of major damage during pre-launch testing.

The company had only rolled the massive rocket out of the factory a day earlier, noting the beginning of its test campaign, it said on the social media site X: “The first operations will test the booster’s redesigned propellant systems and its structural strength.”

That testing commenced on Thursday night at the Massey’s Test Site a couple of miles down the road from the company’s main production site at Starbase Texas. However an independent video showed the rocket’s lower half undergo an explosive (or possibly implosive) event at 4:04 am CT (10:04 UTC) Friday.

© SpaceX

Blue Origin reveals a super-heavy variant of its New Glenn rocket that is taller than a Saturn V

US spy satellites built by SpaceX send signals in the “wrong direction”

About 170 Starshield satellites built by SpaceX for the US government’s National Reconnaissance Office (NRO) have been sending signals in the wrong direction, a satellite researcher found.

The SpaceX-built spy satellites are helping the NRO greatly expand its satellite surveillance capabilities, but the purpose of these signals is unknown. The signals are sent from space to Earth in a frequency band that’s allocated internationally for Earth-to-space and space-to-space transmissions.

There have been no public complaints of interference caused by the surprising Starshield emissions. But the researcher who found them says they highlight a troubling lack of transparency in how the US government manages the use of spectrum and a failure to coordinate spectrum usage with other countries.

© SpaceX

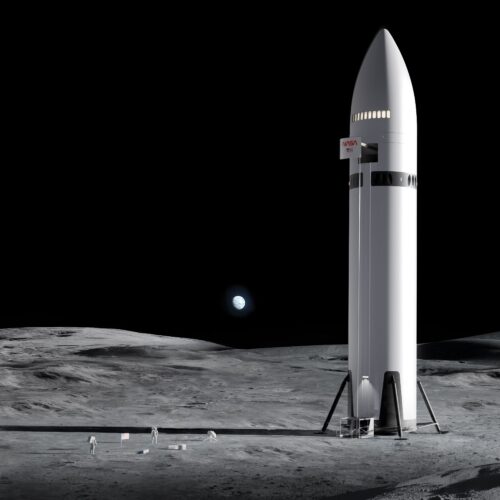

What would a “simplified” Starship plan for the Moon actually look like?

In what will likely be his most consequential act as NASA’s interim leader, Sean Duffy said last month that the space agency was “opening up” its competition to develop a lunar lander that will put humans on the surface of the Moon.

As part of this move, Duffy asked NASA’s current lunar lander contractors, SpaceX and Blue Origin, for more nimble plans. Neither has specified those plans publicly, but a recent update from SpaceX referenced a “simplified” version of the Starship system it’s building to help NASA return humans to the Moon.

“Since the contract was awarded, we have been consistently responsive to NASA as requirements for Artemis III have changed and have shared ideas on how to simplify the mission to align with national priorities,” the company said. “In response to the latest calls, we’ve shared and are formally assessing a simplified mission architecture and concept of operations that we believe will result in a faster return to the Moon while simultaneously improving crew safety.”

© SpaceX