Gold Buys Hit New Highs — Is Bitcoin About To Join The Party?

Reports have disclosed that central banks around the globe have stepped up purchases of gold this year, with one month standing out. In October 2025, officials bought 53 tons of gold, a level that analysts say is the highest monthly demand seen this year. These moves reflect growing concern about inflation, weaker currencies and rising geopolitical risk.

Central Bank Buying Surges

According to data cited by financial outlets, 2025 is on track to be the fourth-highest year this century for institutional gold accumulation when measured net year-to-date through October. Analysts at Deutsche Bank put gold’s share of central-bank reserves at about 24%, a level not seen since the 1990s. Those figures help explain why governments that once moved away from bullion are returning to it now.

Bitcoin Enters The Conversation

Some banks and market researchers are now asking whether Bitcoin could play a similar role for national treasuries. Based on reports from major financial firms, Deutsche Bank projects that Bitcoin could appear on central-bank balance sheets by 2030 as a complementary reserve asset.

Central banks are ramping up gold purchases:

Global central banks purchased +53 tonnes of gold in October, the most since November 2024.

This marks a +194% jump compared to July, and the 3rd-straight monthly acceleration.

In the first 10 months of the year, central banks have… pic.twitter.com/7pZWyEjjvf

— The Kobeissi Letter (@KobeissiLetter) December 4, 2025

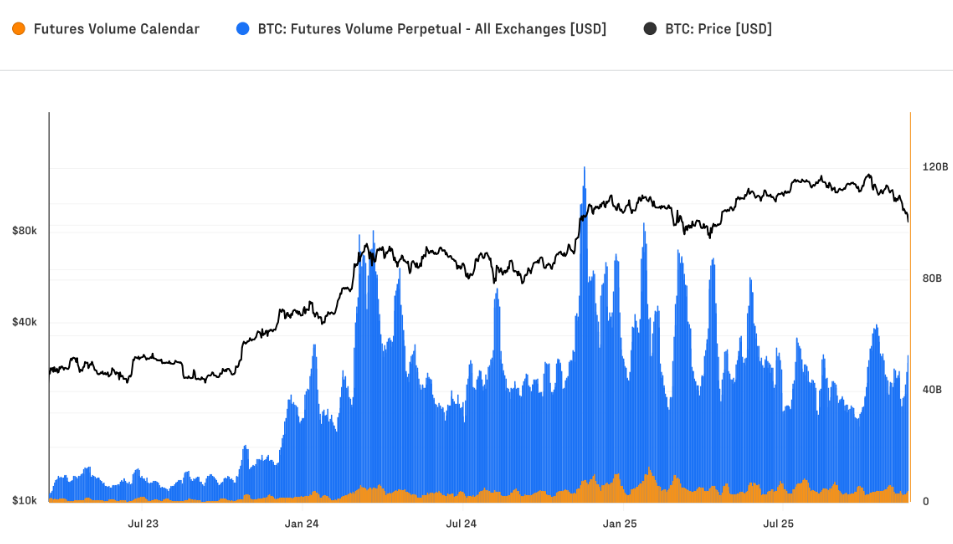

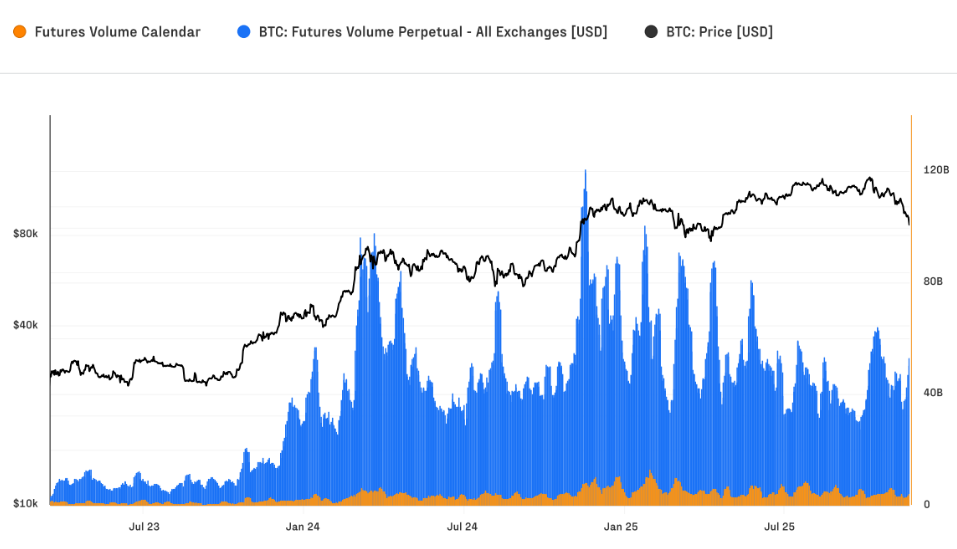

Bitcoin’s market profile has changed: liquidity has risen, and price swings have been less extreme during recent months even though volatility remains higher than older reserve assets. Bitcoin also reached a record above $123,500 in recent trading, a price point that has captured wide attention.

A Few Banks Are Testing The IdeaA small number of central banks are now at least studying the idea more seriously. The Czech National Bank, for example, has discussed the possibility of a “test allocation” to learn how crypto might behave inside a reserve mix. Those conversations tend to focus on custody, accounting rules and how to report gains or losses, rather than immediate buying.

Risk is the main reason most central banks have not moved faster. Bitcoin still shows larger price swings than standard reserve assets, and global rules for how to hold and audit crypto are not uniform. Based on expert commentary, regulators and auditors would need clear guidance before many central banks felt comfortable adding crypto to official reserves.

What This Could Mean For MarketsIf even a handful of national banks were to allocate a small share of reserves to Bitcoin, demand could rise sharply and change how markets view the asset. A modest sovereign allocation would not replace gold or the US dollar, but it could give Bitcoin a stronger role as a hedge for countries facing currency weakness or rising inflation. At the same time, such a move would push more work into custody and compliance services, which would have to scale up quickly.

Gold buying by central banks is already significant — 53 tons in one month and about 24% of reserves in gold for some — and that Bitcoin is being discussed as a possible next step for some policymakers. The path from discussion to adoption is uncertain, and many technical and legal questions remain. Still, the debate has moved from theory to test runs and official reports, making this one of the more closely watched trends in global finance this year.

Featured image from Unsplash, chart from TradingView

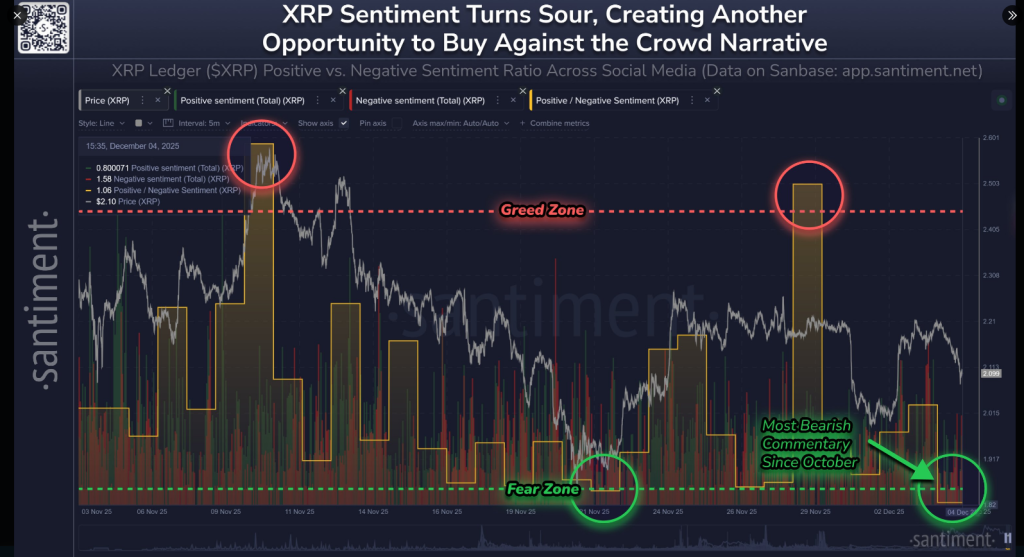

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data.

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data. Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

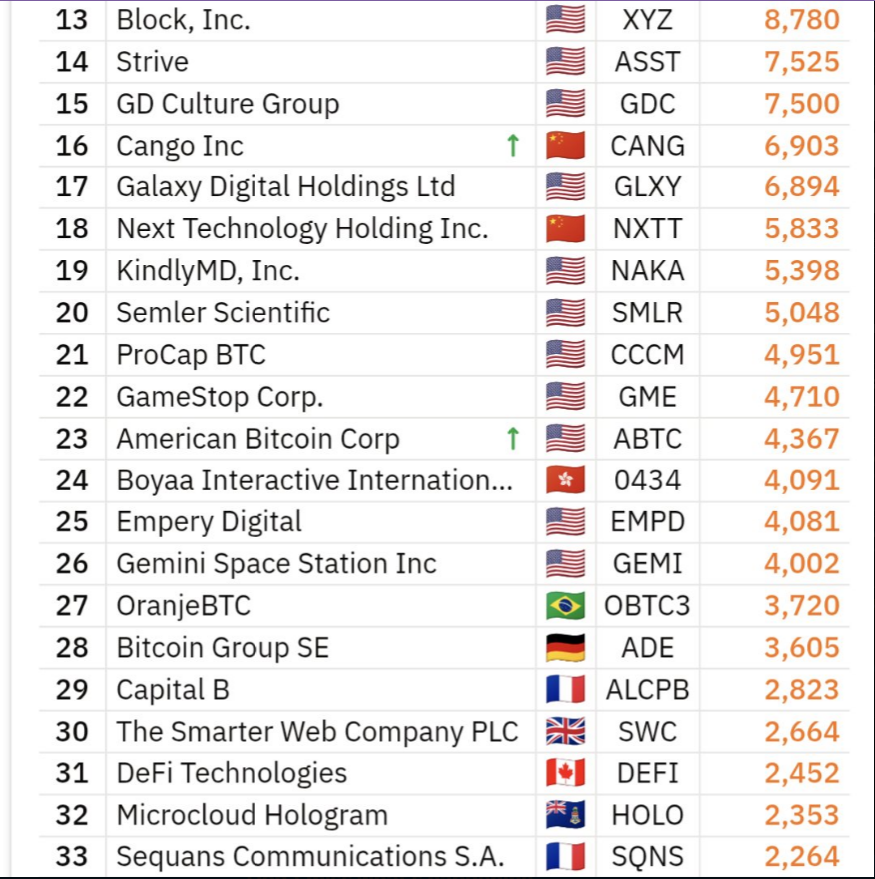

Bitcoin 100 Ranking: 23

Bitcoin 100 Ranking: 23

UK Eyes

UK Eyes