Reading view

3 Prime Video documentaries you’ll actually watch this weekend (December 5 - 7)

Not all documentaries are grisly true-crime investigations. And as we head into the holiday season, it's nice to see that Prime Video's library of docs includes a nice selection of fascinating and uplifting titles that will redeem your faith in humanity.

Netflix is buying Warner Bros. and HBO for $82.7 billion, and it could help you save money

Netflix has struck a definitive $82.7 billion deal to acquire Warner Bros. and the full HBO catalog, marking the largest streaming merger since Disney bought Fox.

The post Netflix is buying Warner Bros. and HBO for $82.7 billion, and it could help you save money appeared first on Digital Trends.

Stop Asking Walton Goggins If He’ll Play the ‘Fallout’ Games

The actor has once again reminded the world that being part of a video game adaptation doesn't mean you have to have had video game experience.

Bowers & Wilkins Px8 headphones drop to $499 in luxury audio deal

High-end wireless headphones at this level don’t go on sale very often. Right now, the Bowers & Wilkins Px8 over-ear headphones are down to $499.45, a sizable cut from their $699.00 list price. If you’ve been eyeing a true luxury alternative to the usual Sony and Bose suspects, this is one of the more tempting […]

The post Bowers & Wilkins Px8 headphones drop to $499 in luxury audio deal appeared first on Digital Trends.

Why The Bitcoin Bear Market Is Almost Finished

Bitcoin Magazine

Why The Bitcoin Bear Market Is Almost Finished

Bitcoin has struggled to maintain a sustained correlation with Gold, recently only moving in unison during market downturns. However, examining Bitcoin’s price action through the lens of Gold rather than USD reveals a more complete picture of the current market cycle. By measuring Bitcoin’s true purchasing power against comparable assets, we can identify potential support levels and gauge where the bear market cycle may be approaching its conclusion.

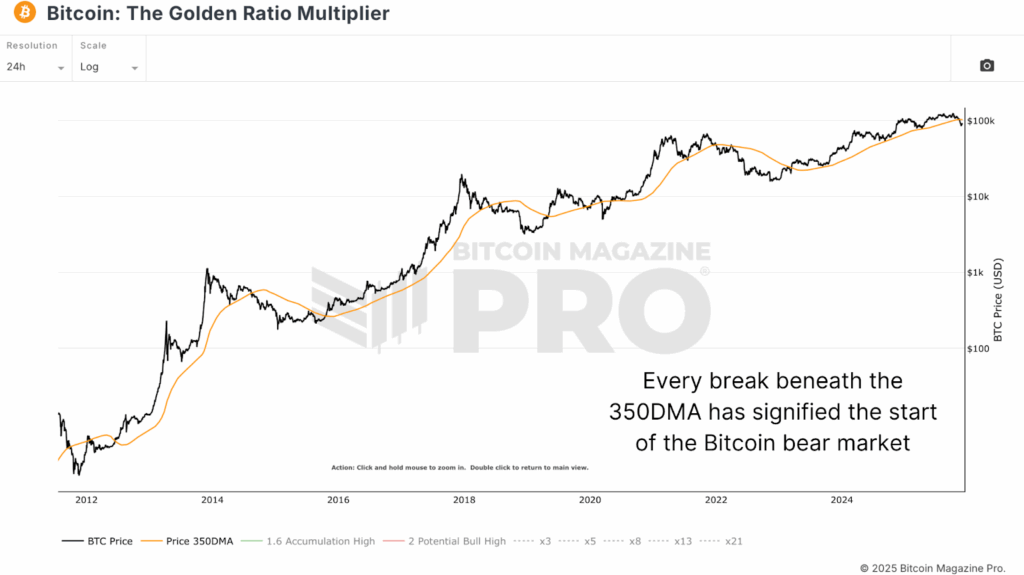

Bitcoin Bear Market Officially Begins Below Key Support

Breaking beneath the 350-day moving average at about $100,000 and the significant psychological 6-figure barrier marked the functional entry into bear market territory, with Bitcoin declining approximately 20% immediately thereafter. From a technical perspective, trading beneath The Golden Ratio Multiplier moving average has historically indicated Bitcoin entering a bear cycle, though the narrative becomes more interesting when measured against Gold rather than USD.

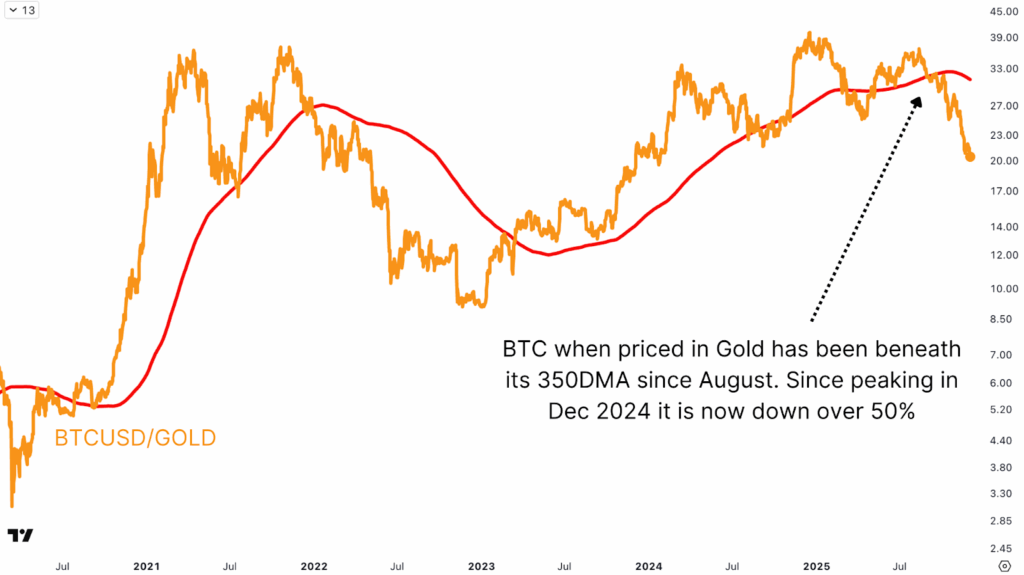

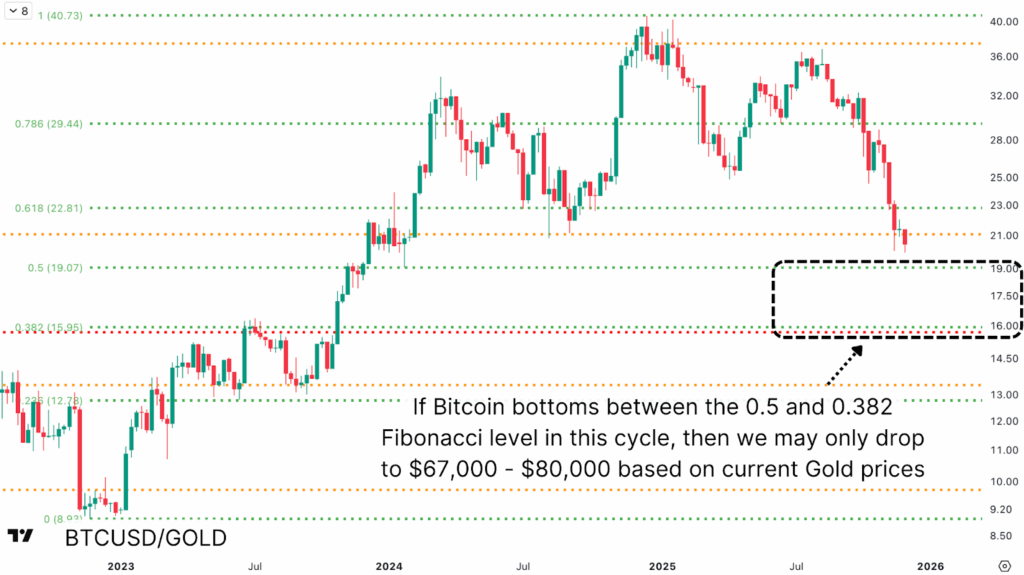

The Bitcoin versus Gold chart tells a notably different story than the USD chart. Bitcoin topped out in December 2024 and has since declined over 50% from that level, whereas the USD valuation peaked in October 2025, significantly beneath the highs set the prior year. This divergence suggests that Bitcoin may have been in a bear market for considerably longer than most observers realize. Looking at historical Bitcoin bear cycles when measured in Gold, we can see patterns that suggest the current pullback may already be approaching critical support zones.

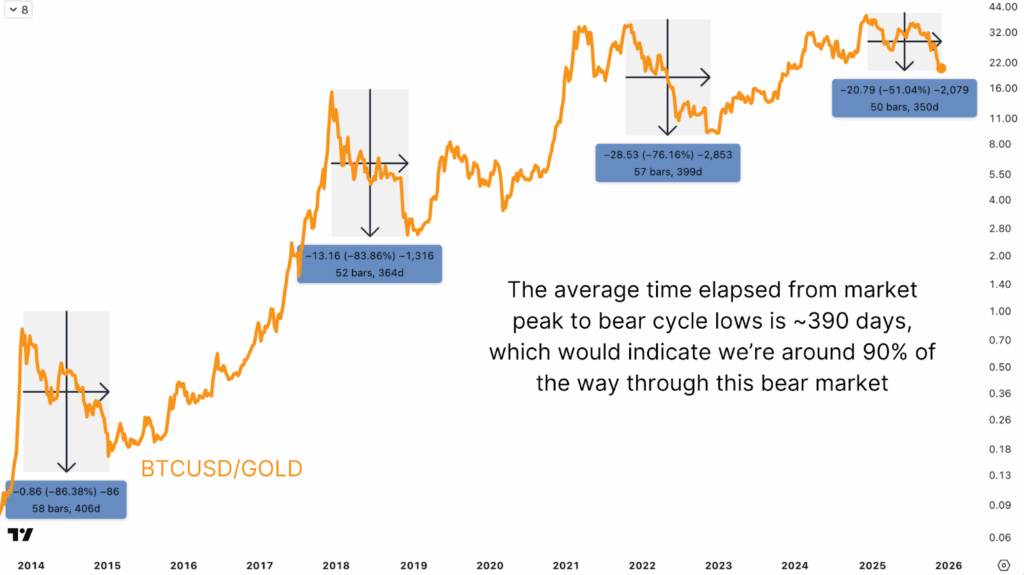

The 2015 bear cycle bottomed at an 86% retracement lasting 406 days. The 2017 cycle saw 364 days and an 84% decline. The previous bear cycle produced a 76% drawdown over 399 days. Currently, at the time of this analysis, Bitcoin is down 51% in 350 days when measured against Gold. While percentage drawdowns have been diminishing as Bitcoin’s market cap grows and more capital flows into the market, this trend reflects the rising tide of institutional adoption and lost Bitcoin supply rather than a fundamental change in cycle dynamics.

Multi-Cycle Confluence Signals Bitcoin Bear Market Bottom Approaching

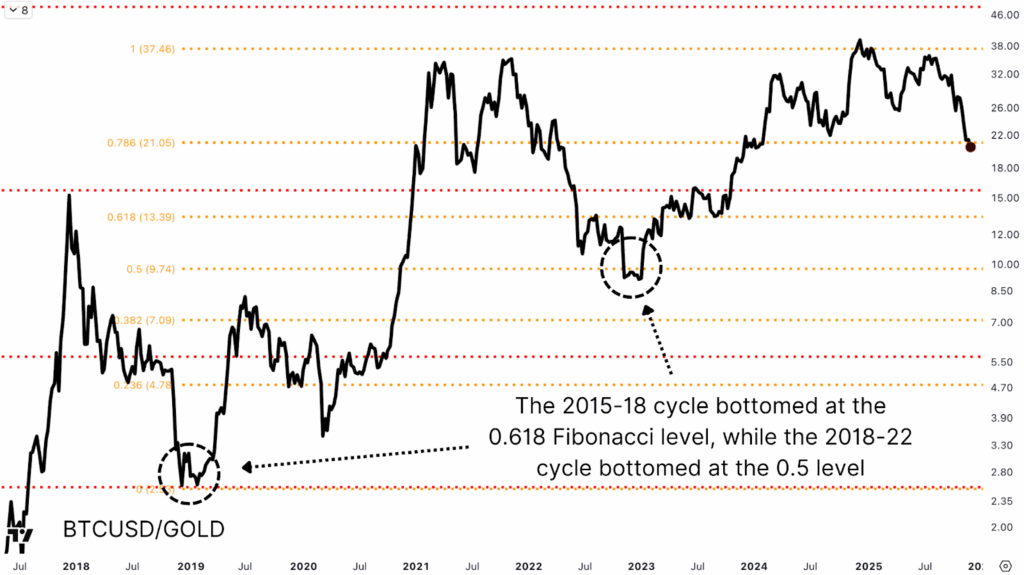

Rather than relying solely on percentage drawdowns and time elapsed, Fibonacci retracement levels mapped across multiple cycles provide greater precision. Using a Fibonacci retracement tool from bottom to top across historical cycles reveals striking levels of confluence.

In the 2015-2018 cycle, the bear market bottom occurred at the 0.618 Fibonacci level, which corresponded to approximately 2.56 ounces of Gold per Bitcoin. The resulting price action marked the bottom with remarkable clarity, far cleaner than the equivalent USD chart. Moving forward to the 2018-2022 cycle, the bear market bottom aligned almost perfectly with the 0.5 level at approximately 9.74 ounces of Gold per Bitcoin. This level later acted as meaningful resistance-turned-support once Bitcoin reclaimed it during the subsequent bull market.

Translating Bitcoin Bear Market Gold Ratios Back to USD Price Targets

From the previous bear market low through the current bull cycle high, the 0.618 Fibonacci level sits at approximately 22.81 ounces of Gold per Bitcoin, while the 0.5 level rests at 19.07 ounces. Current price action is trading near the midpoint of these two levels, presenting what may be an attractive accumulation zone from a purchasing power perspective.

Multiple Fibonacci levels from different cycles create additional confluence. The 0.786 level from the current cycle translates to approximately 21.05 ounces of Gold, corresponding to a Bitcoin price around $89,160. The 0.618 level from the previous cycle aligns near $80,000 again. These convergence zones suggest that if Bitcoin were to decline further, the next meaningful technical target would be around $67,000, derived from the 0.382 Fibonacci retracement level at approximately 15.95 ounces of Gold per Bitcoin.

Conclusion: The Bitcoin Bear Market May Be 90% Complete Already

Bitcoin has likely been in a bear market for substantially longer than USD-only analysis suggests, with purchasing power already declining significantly since December 2024, when measured against Gold and other comparable assets. Historical Fibonacci retracement levels, when properly calibrated across multiple cycles and converted back into USD terms, point toward potential support confluence in the $67,000 to $80,000 range. While this analysis is inherently theoretical and unlikely to play out with perfect precision, the convergence of multiple data points across time horizons and valuation frameworks suggests the bear market may be approaching its conclusion sooner than many anticipate.

For a more in-depth look into this topic, watch our most recent YouTube video here: Proof This Bitcoin Bear Market May Be OVER Already

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post Why The Bitcoin Bear Market Is Almost Finished first appeared on Bitcoin Magazine and is written by Matt Crosby.

3 Prime Video shows to binge-watch this weekend (December 5 - 7)

As we enter the first of the last weekends of 2025, I dare say it is the season to be bingeful with your time off. This weekend, for the most part, I’m keeping it fun and sweet with my Amazon Prime Video selections, but I wouldn’t be me if I didn’t throw something sideways at you, just for gasps and laughs.

Nic Cage Is Playing Ben Reilly in ‘Spider-Noir’

Spider-Man Noir is swinging to Prime Video next year... but not with the name you're expecting.

Alexa+ on Prime Video can drop you straight into that scene you love to rewatch

The latest Alexa+ feature lets you jump to a scene without rewinding or forwarding on Prime Video. Describe the moment like “the train fight” or “the proposal in the rain,” and Alexa+ will instantly play that exact scene.

The post Alexa+ on Prime Video can drop you straight into that scene you love to rewatch appeared first on Digital Trends.

Walton Goggins Would Rather Spend Hours in ‘Fallout’ Ghoul Makeup Than Any Time in Power Armor

The giant, hulking suits of the Brotherhood of Steel on Amazon's 'Fallout' adaptation can either make you feel good... or feel very bad.

Day One Ventures’ Masha Bucher on why every founder needs to be an influencer

Prime Video pulls eerily emotionless AI-generated anime dubs after complaints

Amazon Prime Video has scaled back an experiment that created laughable anime dubs with generative AI.

In March, Amazon announced that its streaming service would start including “AI-aided dubbing on licensed movies and series that would not have been dubbed otherwise.” In late November, some AI-generated English and Spanish dubs of anime popped up, including dubs for the Banana Fish series and the movie No Game No Life: Zero. The dubs appear to be part of a beta launch, and users have been able to select “English (AI beta)” or “Spanish (AI beta)” as an audio language option in supported titles.

“Absolutely disrespectful”

Not everyone likes dubbed content. Some people insist on watching movies and shows in their original language to experience the media more authentically, with the passion and talent of the original actors. But you don’t need to be against dubs to see what’s wrong with the ones Prime Video tested.

© Amazon

Amazon Fire TV’s new AI feature lets you jump to scenes by describing them to Alexa+

Beats Pill portable speaker drops to $99.95 (33% off) on Amazon

If your “speaker” is still just your phone on max volume, this is a very straightforward upgrade. The Beats Pill portable Bluetooth speaker in Matte Black is currently $99.95 on Amazon, down from $149.95, which works out to about 33% off. You’re getting a compact, throw-it-in-your-bag speaker that’s built for loud, punchy sound, up to […]

The post Beats Pill portable speaker drops to $99.95 (33% off) on Amazon appeared first on Digital Trends.

Thinking about a bigger TV? These Amazon deals make it hard to say no

If you’ve been looking for an excuse to upgrade your TV, these Amazon deals make a pretty good argument. From a super-affordable 50-inch 4K set for everyday streaming, to a 75-inch QLED with high refresh rates for gaming, all the way up to a 98-inch giant for home theater, there’s something here for almost every […]

The post Thinking about a bigger TV? These Amazon deals make it hard to say no appeared first on Digital Trends.

Amazon Quietly Rolls Back Its AI Anime Dubs After Massive Backlash

As quickly as they arrived, many of Prime Video's controversial generated dubs have been removed from the streamer.

A Pivotal Moment for Bitcoin Price

Bitcoin Magazine

A Pivotal Moment for Bitcoin Price

As the Federal Reserve prepares to end Quantitative Tightening (QT), the bitcoin price stands at a critical macroeconomic inflection point. With odds for a December rate cut now pricing it in as almost a certainty, the stage is set for a potential shift in monetary policy that could fundamentally alter the trajectory of Bitcoin and broader risk assets. History suggests that when the Fed’s balance sheet stops contracting, Bitcoin typically experiences significant bullish catalysts.

Balance Sheet Reversals and the Bitcoin Price

The Fed balance sheet versus Bitcoin chart reveals a compelling pattern. Over Bitcoin’s history, there have been only three previous instances where QT ended and the federal balance sheet began flatlining or expanding. The first occurred on October 27, 2010, followed almost immediately by a massive Bitcoin bull rally. The second instance on September 26, 2012, again resulted in an explosive rally into the 2013 double-peak cycle. The third signal came in 2019, though this one was complicated by the COVID-19 pandemic and initial market crash—yet it eventually drove Bitcoin from around $3,000 to over $67,000.

Business Cycle Impact on Bitcoin Price

Bitcoin’s recent stagnation despite rising Global M2 suggests that monetary liquidity alone isn’t driving prices. Instead, the asset appears increasingly correlated with traditional business cycle indicators, particularly the U.S. Purchasing Managers Index (PMI). This metric measures manufacturing confidence and economic activity, and its correlation with S&P 500 yearly returns is striking: when PMI rises, equities typically deliver outsized returns; when PMI falls, markets enter periods of underperformance or recession.

A leading indicator for PMI trends is the copper-to-gold ratio. This relationship is nearly perfectly correlated, but copper often leads, bottoming ahead of PMI rallies and topping before PMI declines. Currently, the Copper/Gold ratio appears to be bottoming out, aligning with the historical timeline of Fed balance sheet reversals. This suggests the traditional business cycle may be about to turn favorable again after a period of economic softening.

Conclusion: Next Move for Bitcoin Price

The end of QT, combined with a resurgent Copper/Gold ratio and historical precedent spanning Bitcoin’s entire existence, suggests that monetary conditions are about to become materially more favorable. While Bitcoin has recently lagged traditional assets, this underperformance appears tied to deteriorating economic confidence rather than fundamental weakness in Bitcoin itself. As both monetary policy and business cycle indicators potentially turn positive, the confluence of these forces could mark the beginning of a significant trend reversal. Bitcoin stands positioned to benefit from this dual tailwind, making the coming weeks and months critical for monitoring whether these historical signals finally translate into sustained price appreciation.

For deeper data, charts, and professional insights into bitcoin price trends, visit BitcoinMagazinePro.com. Subscribe to Bitcoin Magazine Pro on YouTube for more expert market insights and analysis!

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

This post A Pivotal Moment for Bitcoin Price first appeared on Bitcoin Magazine and is written by Matt Crosby.

Best new movies and shows on Prime Video in December 2025

This is it, the last month of 2025, and you know what that means—Prime Video's new Originals lineup for December is heavy on the holiday-themed stuff, with a dusting of other intriguing titles to take the chill off the colder weather.

XGIMI MoGo 4 Laser Projector review: Portability and versatility with limited brightness

The XGIMI MoGo 4 Laser Projector is slick and portable with built-in Google TV functionality and plenty of connectivity options. Although you can take this projector almost anywhere, its limited brightness and battery life dull some of its potential.

Converting a 1980s Broadcast Camera to HDMI

Although it might seem like there was a sudden step change from analog to digital sometime in the late 1900s, it was actually a slow, gradual change from things like record players to iPods or from magnetic tape to hard disk drives. Some of these changes happened slowly within the same piece of hardware, too. Take the Sony DXC-3000A, a broadcast camera from the 1980s. Although it outputs an analog signal, this actually has a discrete pixel CCD sensor capturing video. [Colby] decided to finish the digitization of this camera and converted it to output HDMI instead of the analog signal it was built for.

The analog signals it outputs are those that many of us are familiar with, though: composite video. This was an analog standard that only recently vanished from consumer electronics, and has a bit of a bad reputation that [Colby] thinks is mostly undeserved. But since so many semi-modern things had analog video outputs like these, inspiration was taken from a Wii mod chip that converts these consoles to HDMI. Unfortunately his first trials with one of these had confused colors, but it led him to a related chip which more easily outputted the correct colors. With a new PCB in hand with this chip, a Feather RP2040, and an HDMI port the camera is readily outputting digital video that any modern hardware can receive.

Besides being an interesting build, the project highlights a few other things. First of all, this Sony camera has a complete set of schematics, a manual meant for the end user, and almost complete user serviceability built in by design. In our modern world of planned obsolescence, religious devotion to proprietary software and hardware, and general user-unfriendliness this 1980s design is a breath of fresh air, and perhaps one of the reasons that so many people are converting old analog cameras to digital instead of buying modern equipment.