Crypto Interest Fades Among US Investors as Risk Tolerance Declines: FINRA Study

Interest in crypto among US investors has cooled significantly, with fewer considering new purchases despite maintained ownership levels, according to a comprehensive study released by the FINRA Investor Education Foundation.

The findings reveal a broader retreat from high-risk investment behaviors as market conditions and investor attitudes shift dramatically from the pandemic-era surge.

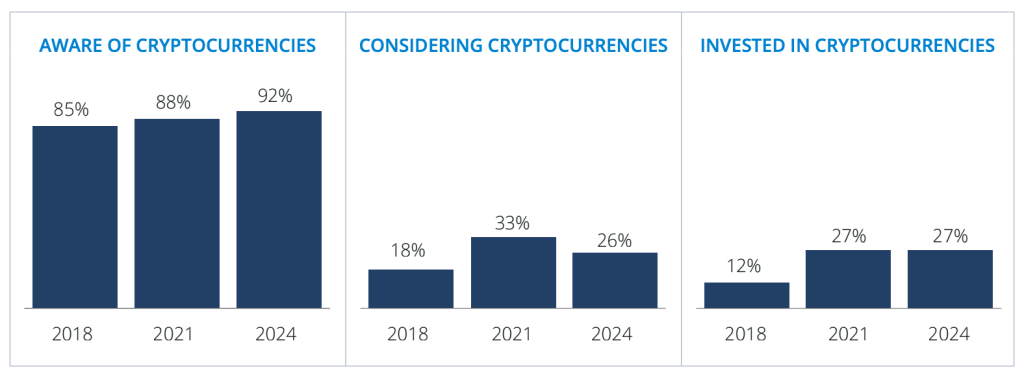

The Financial Industry Regulatory Authority study, based on survey data from 2,861 US investors with non-retirement investment accounts, found that while 27% still hold cryptocurrency, unchanged from 2021, only 26% are now considering purchasing digital assets, down sharply from 33% three years earlier.

New Investors Retreat as Market Enthusiasm Wanes

The pace of Americans entering the investment market has slowed dramatically since the cryptocurrency boom years.

Only 8% of current investors began investing within the past two years, a steep drop from 21% who started during the two years preceding the 2021 study.

The shift suggests the tide of pandemic-era market participation has entirely ebbed, with younger adults particularly affected by the reversal.

Young investors under 35 saw their participation rate fall from 32% in 2021 to 26% in 2024, erasing gains made during the market surge.

Similarly, investment rates declined among people of color and men, reversing increases observed just three years earlier.

The median age of investors who entered the market around 2019-2021 rose from 31 to 38, indicating many younger participants left the market entirely.

Beyond slower entry rates, investors pulled back from various high-risk positions. Cryptocurrency is now viewed as extremely or very risky by 66% of those aware of digital assets, up from 58% in 2021.

The percentage holding penny stocks, REITs, private placements, and structured notes all declined to 2018 levels after brief increases.

Risk Appetite Shrinks Across Demographics

Investors’ willingness to embrace substantial portfolio risk dropped to just 8% in 2024 from 12% in 2021, with the decline most pronounced among younger market participants.

Among investors under 35, those willing to take substantial risks fell from 24% to 15%, creating a notable contradiction; 62% of this age group still believe they need big risks to reach financial goals.

“The latest FINRA Foundation research on investors provides rich insights into how market conditions, technology and generational shifts are changing the profile of investing and reshaping investor behaviors and attitudes,” said Jonathan Sokobin, FINRA Foundation Chair and Chief Economist.

Despite reduced risk appetite, younger investors continue to engage in behaviors that carry greater potential losses.

43% of those under 35 trade options, compared to 10% of investors 55 and older, while 22% make margin purchases, versus just 4% of older participants.

Meanwhile, 13% of all investors report buying meme stocks or viral investments, including 29% of those under 35.

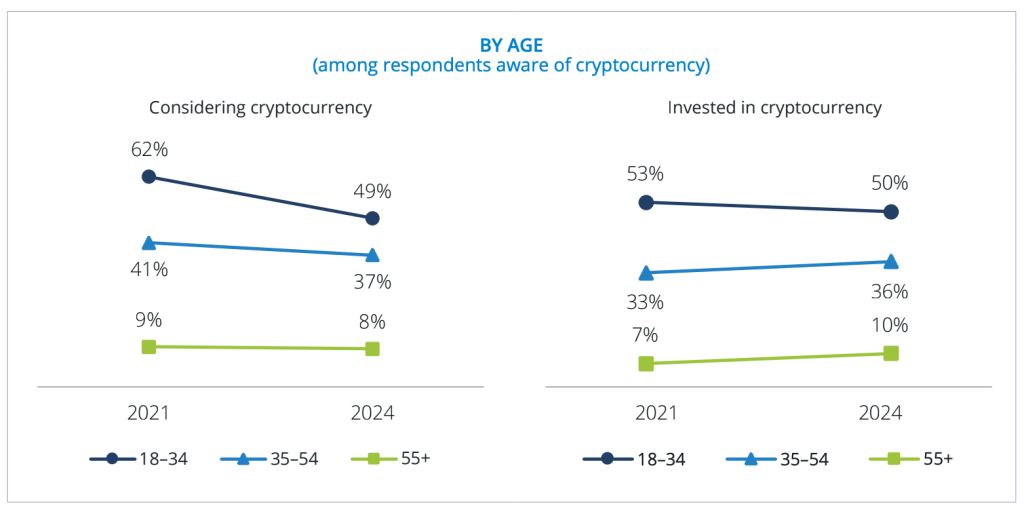

The crypto decline appears most dramatic among new investors. Those with less than 2 years’ experience who are considering digital assets dropped from 61% in 2021 to 48% in 2024, while consideration among experienced investors fell less sharply.

Among investors under 35 specifically, cryptocurrency consideration plummeted from 62% to 49%, compared to smaller declines in older age groups.

Social Media Influence Grows Despite Market Caution

The study found social media “Finfluencers” now guide investment decisions for 26% of investors, rising to 61% among those under 35.

YouTube remains the dominant platform for investment information, with 30% overall usage, rising to 61% among younger investors.

Word of mouth from friends and family emerged as the top information source for 85% of investors under 35, surpassing recommendations from financial professionals at 67%.

Concern over investment fraud has risen somewhat, with 37% of investors worried about losing money to scams, up from 31% in 2021.

However, the vast majority, 89%, do not believe they have been targeted in investment fraud.

When presented with a fraudulent offer promising “guaranteed, risk-free 25% annual returns,” half of investors said they would invest, revealing significant gaps in fraud awareness.

FINRA Foundation President Gerri Walsh emphasized the continuing importance of investor education.

“They still struggle with gaps in investing knowledge and risk assessment, which can leave them vulnerable to costly missteps,” Walsh said. “Investor education efforts remain critically important.“

Notably, the findings oppose broader market trends showing that crypto adoption continues to grow, with separate surveys indicating that over 50 million American adults now own digital assets.

Another also links declining homeownership affordability to increased crypto speculation among younger generations seeking alternative wealth-building strategies.

The post Crypto Interest Fades Among US Investors as Risk Tolerance Declines: FINRA Study appeared first on Cryptonews.