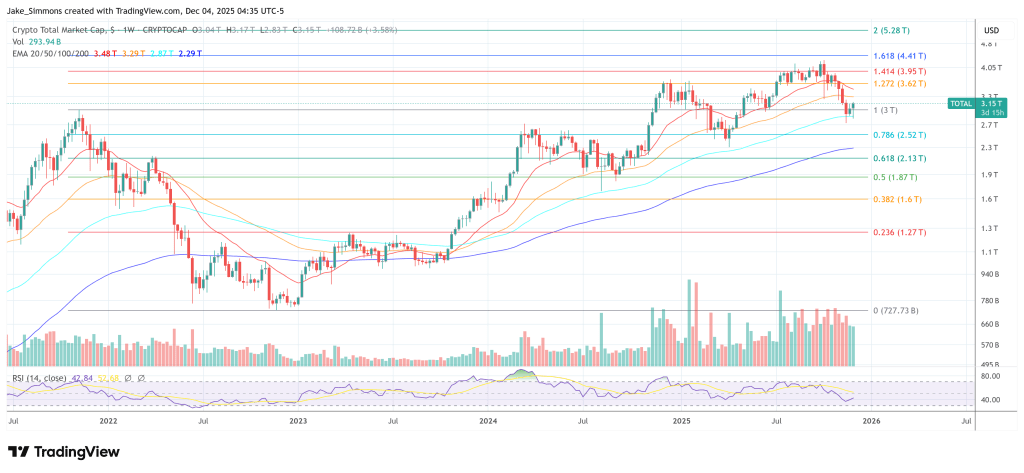

Crypto Enters First Net-Positive Liquidity Since 2022, Says Delphi Digital

Crypto research firm Delphi Digital argues that global dollar liquidity has quietly flipped from a structural headwind to a marginal tailwind for risk assets for the first time since early 2022 – with 2026 emerging as the key inflection point for digital assets.

In a macro thread on X, Delphi says “the Fed’s rate path heading into next year is the clearest it’s been in years.” Futures imply another 25-basis-point cut by December 2025, taking the federal funds rate to roughly 3.5–3.75%. “The forward curve prices at least 3 more cuts through 2026, putting us in the low 3s by year-end if the path holds,” the firm notes.

Short-term benchmarks have already adjusted. According to Delphi, “SOFR and fed funds have drifted toward the high 3% range. Real rates have rolled over from their 2023–2024 peaks. But nothing has collapsed. This is a controlled descent rather than a pivot.” The characterization is important: this is not a return to zero rates, but a gradual easing that removes pressure on duration and high-beta assets.

The more consequential shift is in the liquidity plumbing. “QT ends on December 1. The TGA is set to draw down rather than refill. The RRP has been fully depleted,” Delphi writes. “Together, these create the first net positive liquidity environment since early 2022.”

Crypto Bulls Can Rejoice As The Macro Regime Is Shifting

In a follow-up post, the firm is explicit: “The Fed’s liquidity buffer is gone. Reverse Repo Balances collapsed from over $2 trillion at the peak to practically zero.” In 2023, a swollen RRP allowed the Treasury to refill its General Account without directly draining bank reserves, because money-market funds could absorb issuance out of the RRP. “With the RRP now at the floor, that buffer no longer exists,” Delphi warns.

From here, “any future Treasury issuance or TGA rebuild has to come directly out of bank reserves.” That forces a policy choice. As Delphi puts it, “The Fed is left with two options: let reserves drift lower and risk another repo spike or expand the balance sheet to provide liquidity directly. Given how badly 2019 went, the second path is far more likely.”

In that scenario, the central bank would shift from shrinking its balance sheet to adding reserves, reversing a core dynamic of the past two years. “Combined with QT ending and the TGA set to draw down, marginal liquidity is turning net positive for the first time since early 2022,” Delphi concludes. “A key headwind for crypto could be fading.”

For the crypto market, the firm frames 2026 as the pivotal year: “2026 is the year policy stops being a headwind and becomes a mild tailwind. The kind that favors duration, large caps, gold, and digital assets with structural demand behind them.”

Rather than calling for an immediate price spike, Delphi’s thesis is that the macro regime is shifting toward a more supportive, liquidity-positive backdrop for Bitcoin and larger crypto assets as policy eases and the era of aggressive balance-sheet contraction comes to an end.

At press time, the total crypto market cap was at $3.1 trillion.