Today's NYT Strands Hints, Answers and Help for Dec. 7 #644

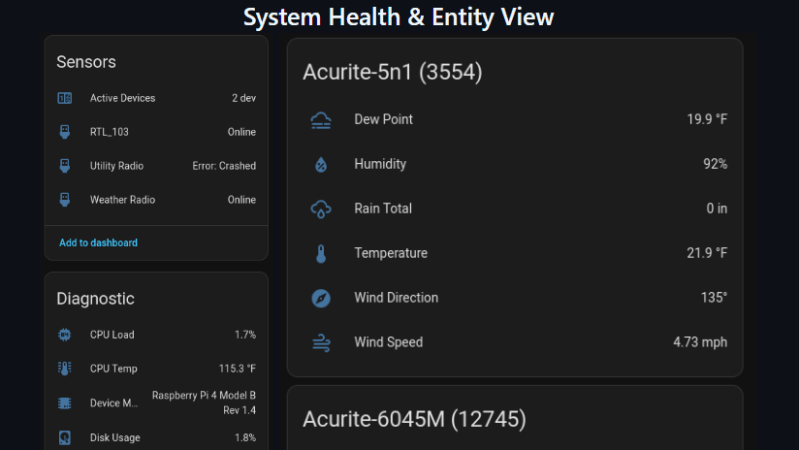

If you’ve got an RTL-SDR compatible receiver, you’ve probably used it for picking up signals from all kinds of weird things. Now, [Jaron McDaniel] has built a tool to integrate many such devices into the world of Home Assistant.

It’s called RTL-HAOS, and it’s intended to act as a bridge. Whatever you can pick up using the RTL_433 tool, you can set up with Home Assistant using RTL-HAOS. If you’re unfamiliar with RTL_433, it’s a multitalented data receiver for picking up all sorts of stuff on a range of bands using RTL-SDR receivers, as well as a range of other hardware. While it’s most closely associated with products that communicate in the 433 MHz band, it can also work with products that talk in 868 MHz, 315 MHz, 345 MHz, and 915 MHz, assuming your hardware supports it. Out of the box, it’s capable of working with everything from keyless entry systems to thermostats, weather stations, and energy monitors. You can even use it to listen to the tire pressure monitors in your Fiat Abarth 124 Spider, if you’re so inclined.

[Jaron’s] tool integrates these devices nicely into Home Assistant, where they’ll appear automatically thanks to MQTT discovery. It also offers nice signal metrics like RSSI and SNR, so you can determine whether a given link is stable. You can even use multiple RTL-SDR dongles if you’re so inclined. If you’re eager to pull some existing environmental sensors into your smart home, this may prove a very easy way to do it.

The cool thing about Home Assistant is that hackers are always working to integrate more gear into the ecosystem. Oftentimes, they’re far faster and more efficient at doing this than big-name corporations. Meanwhile, if you’re working on your own hacks for this popular smart home platform, we’d probably like to know about it. Be sure to hit up the tips line in due time.

Chromebooks have a good reputation for being low-maintenance computers with solid security and privacy. By and large, this is true. It's why we trust them for use by children and college students, or why some companies like to issue them to employees who only need a basic computer.

Ethereum is gaining momentum, and several technical signals suggest that a significant move could be on the way. With key support levels holding and bullish patterns forming, the market may be setting up for a notable upside.

In a recent update on X, analyst Luca referenced his recent market commentary, noting that Ethereum price action unfolded exactly as he had anticipated, with the price tapping into the lost high-timeframe support range. This range aligned with the golden pocket between the 0.5 and 0.618 Fibonacci retracement levels, and the price rejected there, confirming the high-risk scenario he had highlighted in advance.

Since that rejection, the price has broken below the key 0.618 Fibonacci Point of Interest (POI). However, the asset is still managing to hold above the crucial 1-Day Bull Market Support Band. Luca stressed that this band has historically served as a strong reversal spot over the last couple of months. Thus, he believes the current low-timeframe market structure is not yet fully invalidated.

Despite this technical hold, the analyst reiterated his cautious approach, stating that until he sees clear signs of strength on the low-timeframes, signs that can durably confirm the bottom is in and that key support levels are properly reclaimed, he won’t scale out of his edges.

Luca concluded that until that concrete bullish confirmation materializes, the most likely outcome for the immediate future remains further consolidation. The market needs time to absorb the recent volatility and build a new base before a more durable reversal to the upside can take hold.

Crypto analyst Paramatik outlined that a major structural event has occurred on the ETH/BTC charts: a falling trend breakout. This is a highly significant development, although Paramatik suggests that a retest of this broken trendline may occur before the upcoming Federal Reserve meeting.

The analyst provided clarity on what this breakout means for the broader market. First and foremost, this situation is interpreted as a strengthening signal for Ethereum. When ETH begins to gain value relative to Bitcoin, it typically indicates that the market’s overall risk appetite is returning, as investors shift capital from BTC to ETH.

Secondly, the gained strength in Ethereum is often the key trigger for the start of the much-anticipated altcoin season. This is because investors first shift funds from BTC to ETH, and then move capital into the riskier, smaller altcoins in hopes of achieving higher returns.

Paramatik summarized his findings by stating that this breakout in the ETH/BTC pair is not merely a technical line break; it is a harbinger of a market direction change. The analyst concluded with an analogy that the market has reached a state where every external event, even humorously irrelevant ones, could affect crypto prices.

According to remarks made at the Founders Summit, Fidelity’s chief executive Abigail Johnson offered a rare look at how the firm moved from curiosity to a full crypto business and why she keeps a personal stake in Bitcoin. The account ties early, small bets to later services now offered to advisors and clients.

Around 2013, a small group inside Fidelity began meeting to learn what Bitcoin might mean for the firm. They mapped out 52 possible uses. Most ideas did not survive testing. One early result — accepting Bitcoin donations for charity — gave the team credibility outside the company and opened doors for deeper work.

That early credibility made it easier for the firm to test bigger ideas without waiting for orders from the top.

Johnson pushed for a $200,000 purchase of Antminer hardware at a time many inside opposed the move. Reports say that mining effort became “probably the single highest IRR business” Fidelity has had.

The decision put staff into Bitcoin’s technical layers, giving them real experience with wallets, security, and the plumbing of the network long before many rivals caught up.

Company Moves Into CustodyBased on reports, demand from financial advisors drove Fidelity toward custody services. Advisors wanted secure ways to help clients hold and pass on Bitcoin, and Fidelity responded by building custody, custody-adjacent products, and support across asset management and research.

Johnson told the audience she owns Bitcoin personally and described it as a core digital asset that could play a role in people’s savings plans. She calls it crypto’s “gold standard.”

Exchange Supply Drops As Accumulation ContinuesMarket data referenced in the session showed Bitcoin trading above $89,000 while balances on centralized exchanges fell to roughly 1.8 million BTC — a level not seen since 2017, according to aggregated CryptoQuant and Glassnode figures cited by BRN Research.

Realized-cap growth stayed positive on a monthly basis, which analysts interpret as fresh capital entering the market even when price moves stay contained.

Shark Wallets And Network Growth For EthereumReports also pointed to Ethereum strength. ETH climbed past $3,200 as so-called shark wallets holding between 1,000 and 10,000 ETH resumed accumulation.

Daily new addresses briefly neared 190,000 following the Fusaka upgrade, a spike that analysts say often lines up with stronger demand for ETH.

Market Signals And What’s MissingAnalysts quoted in the briefing noted that supply leaving exchanges and steady accumulation point to longer-term holders taking control. What the market lacks, they said, is a decisive push into the roughly $96K to $106K band that would signal a broader breakout. For now, accumulation continues while prices trade in a tighter range.

Based on reports from the conference, Fidelity’s crypto path reads like a slow build: small internal experiments grew into real operations, and a handful of early bets — including a $200,000 mining play — gave the firm practical know-how.

Combined with current on-chain signs of accumulation, the picture suggests established players and patient holders are shaping market supply even as price momentum waits for a clearer trigger.

Featured image from Pexels, chart from TradingView

The largest corporate Ether holder continues to buy the dip, as the industry’s most profitable traders continue to bet millions on ETH’s short-term decline.

A federal judge has expanded on the remedies decided for the Department of Justice's antitrust case against Google, ruling in favor of putting a one-year limit on the contracts that make Google's search and AI services the default on devices, Bloomberg reports. Judge Amit Mehta's ruling on Friday means Google will have to renegotiate these contacts every year, which would create a fairer playing field for its competitors. The new details come after Mehta ruled in September that Google would not have to sell off Chrome, as the DOJ proposed at the end of 2024.

This all follows the ruling last fall that Google illegally maintained an internet search monopoly through actions including paying companies such as Apple to make its search engine the default on their devices and making exclusive deals around the distribution of services such as Search, Chrome and Gemini. Mehta's September ruling put an end to these exclusive agreements and stipulates that Google will have to share some of its search data with rivals to "narrow the scale gap" its actions have created.

This article originally appeared on Engadget at https://www.engadget.com/big-tech/judge-puts-a-one-year-limit-on-googles-contracts-for-default-search-placement-215549614.html?src=rss©

Read more of this story at Slashdot.

Read more of this story at Slashdot.

Arrowhead plants are tough, and they’re some of the hardest houseplants to kill. But that sturdiness doesn’t come at the expense of beauty - they are available in an array of colors and leaf patterns. Plus, they’re versatile and can be used in dish gardens, terrariums, and hanging pots. Read more now.

The post How to Grow and Care for Arrowhead Vine appeared first on Gardener's Path.

Is it possible to have too much of a good thing? The Kia EV9 was one of the first EVs from an established automaker truly designed for American tastes. It’s a big, boxy SUV that gives drivers a commanding view of the road, while three rows of seats and quick charging make it perfect for […]

The post The Kia EV9 is a good electric SUV, but the same company makes something better appeared first on Digital Trends.

According to the latest report, the lower house of Poland’s parliament has failed to overturn the President’s veto of the Crypto-Asset Market Act. Earlier this week, the Polish President, Karol Nawrocki, vetoed a bill aimed at setting strict rules in the country’s digital assets market.

On Friday, December 5, Bloomberg reported that the lower house of the Polish parliament couldn’t secure the required three-fifths majority vote to override the President’s veto of the Crypto-Asset Market Act. This bill, introduced in June 2025, aimed to align Poland with the European Union’s MiCA framework for the digital asset markets.

Related Reading: Key Updates On The US Crypto Market Structure Bill: What You Need To Know

However, President Nawrocki decided against signing the crypto market legislation due to concerns that it may pose a real threat to the freedom of Poles, their property, and the stability of the country. According to the country’s leader, “overregulation” is one way to drive away new companies and investors, while seriously slowing innovation.

As Bitcoinist earlier reported, the crypto community in Poland had already raised concerns about the regulation as early as September, especially as the bill surpassed the European Union (EU) minimum regulatory requirements.

For instance, the bill’s messaging read that all Crypto Asset Service Providers are required to obtain a license from the Polish Financial Service Authority (KNF). Meanwhile, the bill proposed heavy fines and potential prison time for market participants who break the law.

According to the Bloomberg report, supporters of the bill have also voiced out the need to provide regulatory oversight of Poland’s digital assets industry. Their belief is that clear, comprehensive rules are critical to fight fraud and avoid potential misuse of digital assets by bad actors.

Rafael Leskiewicz, the press secretary of the President, took to the social media platform to react to the lawmakers’ failure to override the veto. The presidential spokesperson said the Crypto-Asset Market Act is a legal fiasco, while calling the attempt to overturn the president’s veto a political maneuver.

Leskiewicz said in a statement:

The President, by vetoing this act, exposed the low quality of the legislation being created. This market should be subject to monitoring and control, but certainly, bad law should not be created that restricts the freedom to conduct business activities.

President Nawrocki, who was elected earlier in June, had always portrayed himself as a pro-Bitcoin leader who would rather veto regulatory restrictions than create new digital asset laws. According to market data, the adoption of crypto assets by Polish households has continued to grow in recent years, with the number of domestic users expected to hit 7.9 million by this year’s end.

Apple's Johny Srouji may be the latest company executive to seek greener pastures, according to a report from Bloomberg. The report said that Srouji, Apple's senior vice president of hardware technologies, told Tim Cook that he is "seriously considering leaving in the near future."

While the report didn't mention if Srouji has another job lined up, Bloomberg's sources claimed that he wants to join another company if he leaves Apple. Srouji joined the company in 2008 to develop Apple's first in-house system-on-a-chip and eventually led the transition to Apple silicon.

If Srouji leaves Apple, he would be the latest in a string of departures of longtime execs. At the start of the month, Apple announced that John Giannandrea, the company's senior vice president for machine learning and AI strategy, would be retiring from his role in spring 2026. A couple of days later, Bloomberg reported that the company's head of interface design, Alan Dye, would be leaving for a role at Meta. Adding to those exits, Apple also revealed that Kate Adams, who has been Apple's general counsel since 2017, and Lisa Jackson, vice president for Environment, Policy, and Social Initiatives, will both be leaving in early 2026.

The shakeup at the executive level comes after Bloomberg's Mark Gurman previously reported that Cook may not be preparing for his own departure as CEO next year. Gurman's prediction counters a report from the Financial Times that claimed that Apple was accelerating succession plans for Cook with an expected stepping down sometime next year.

This article originally appeared on Engadget at https://www.engadget.com/big-tech/apples-johny-srouji-could-continue-the-companys-executive-exodus-according-to-report-200750252.html?src=rss©

© REUTERS / Reuters

Read more of this story at Slashdot.