Ethereum Shows Strength: Indicators Suggest Bigger Moves Ahead

Ethereum is gaining momentum, and several technical signals suggest that a significant move could be on the way. With key support levels holding and bullish patterns forming, the market may be setting up for a notable upside.

Golden Pocket Rejection: Confirming The High-Risk Scenario

In a recent update on X, analyst Luca referenced his recent market commentary, noting that Ethereum price action unfolded exactly as he had anticipated, with the price tapping into the lost high-timeframe support range. This range aligned with the golden pocket between the 0.5 and 0.618 Fibonacci retracement levels, and the price rejected there, confirming the high-risk scenario he had highlighted in advance.

Since that rejection, the price has broken below the key 0.618 Fibonacci Point of Interest (POI). However, the asset is still managing to hold above the crucial 1-Day Bull Market Support Band. Luca stressed that this band has historically served as a strong reversal spot over the last couple of months. Thus, he believes the current low-timeframe market structure is not yet fully invalidated.

Despite this technical hold, the analyst reiterated his cautious approach, stating that until he sees clear signs of strength on the low-timeframes, signs that can durably confirm the bottom is in and that key support levels are properly reclaimed, he won’t scale out of his edges.

Luca concluded that until that concrete bullish confirmation materializes, the most likely outcome for the immediate future remains further consolidation. The market needs time to absorb the recent volatility and build a new base before a more durable reversal to the upside can take hold.

ETH/BTC Trendline Breakout: Market Risk Appetite Returns

Crypto analyst Paramatik outlined that a major structural event has occurred on the ETH/BTC charts: a falling trend breakout. This is a highly significant development, although Paramatik suggests that a retest of this broken trendline may occur before the upcoming Federal Reserve meeting.

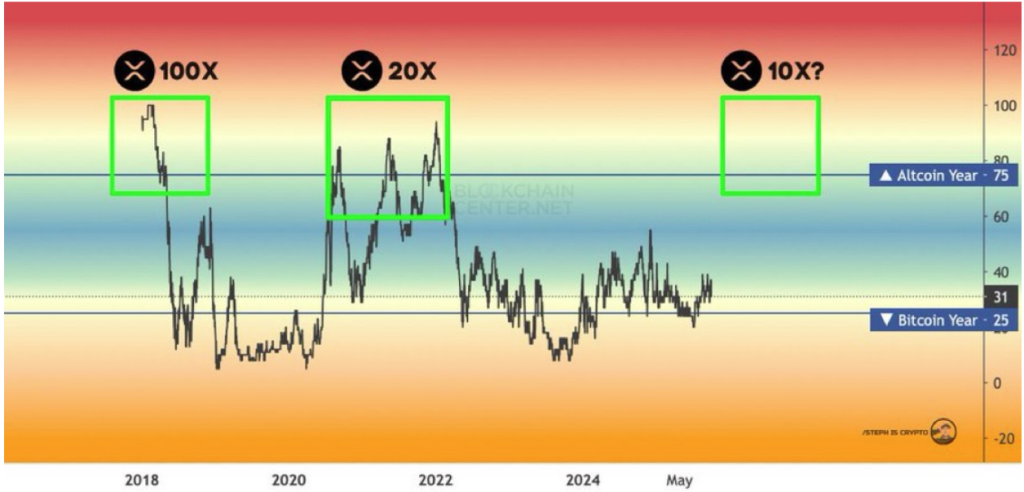

The analyst provided clarity on what this breakout means for the broader market. First and foremost, this situation is interpreted as a strengthening signal for Ethereum. When ETH begins to gain value relative to Bitcoin, it typically indicates that the market’s overall risk appetite is returning, as investors shift capital from BTC to ETH.

Secondly, the gained strength in Ethereum is often the key trigger for the start of the much-anticipated altcoin season. This is because investors first shift funds from BTC to ETH, and then move capital into the riskier, smaller altcoins in hopes of achieving higher returns.

Paramatik summarized his findings by stating that this breakout in the ETH/BTC pair is not merely a technical line break; it is a harbinger of a market direction change. The analyst concluded with an analogy that the market has reached a state where every external event, even humorously irrelevant ones, could affect crypto prices.

The United States State Department has approved a possible Foreign Military Sale (FMS) to the Government of Lebanon for Medium Tactical Vehicles and associated support, with an estimated cost of $90.5 million. The Defense Security Cooperation Agency (DSCA) formally notified Congress of the proposed sale on December 5, 2025. According to DSCA, the Government of […]

The United States State Department has approved a possible Foreign Military Sale (FMS) to the Government of Lebanon for Medium Tactical Vehicles and associated support, with an estimated cost of $90.5 million. The Defense Security Cooperation Agency (DSCA) formally notified Congress of the proposed sale on December 5, 2025. According to DSCA, the Government of […]  The United States Navy’s Strategic Systems Programs (SSP) office has announced its intent to award a sole-source contract to General Dynamics Mission Systems (GDMS) for engineering and technical services supporting fire control systems for the nuclear‑armed, sea‑launched cruise missile (SLCM‑N) program. According to a presolicitation notice posted on December 4, the proposed agreement is being […]

The United States Navy’s Strategic Systems Programs (SSP) office has announced its intent to award a sole-source contract to General Dynamics Mission Systems (GDMS) for engineering and technical services supporting fire control systems for the nuclear‑armed, sea‑launched cruise missile (SLCM‑N) program. According to a presolicitation notice posted on December 4, the proposed agreement is being […]  The United States Army is seeking potential U.S.-based producers for a next-generation 155mm artillery projectile designed to replace aging stockpiles of Dual-Purpose Improved Conventional Munitions (DPICM). A sources sought notice, released by the Army Contracting Command-New Jersey on December 5, outlines the service’s effort to identify qualified manufacturers for the XM1208 Advanced Submunitions projectile. According […]

The United States Army is seeking potential U.S.-based producers for a next-generation 155mm artillery projectile designed to replace aging stockpiles of Dual-Purpose Improved Conventional Munitions (DPICM). A sources sought notice, released by the Army Contracting Command-New Jersey on December 5, outlines the service’s effort to identify qualified manufacturers for the XM1208 Advanced Submunitions projectile. According […]

The State Department has approved two major Foreign Military Sales (FMS) to Denmark, authorizing the transfer of advanced U.S. air-to-air missiles and a ground-based air defense system with an estimated combined value of $3.73 billion. According to a press release from the Defense Security Cooperation Agency (DSCA), Denmark has been cleared to purchase 200 AIM-120C-8 […]

The State Department has approved two major Foreign Military Sales (FMS) to Denmark, authorizing the transfer of advanced U.S. air-to-air missiles and a ground-based air defense system with an estimated combined value of $3.73 billion. According to a press release from the Defense Security Cooperation Agency (DSCA), Denmark has been cleared to purchase 200 AIM-120C-8 […]  BAE Systems has secured a new $198.4 million contract modification from the U.S. Army to produce an additional 240 Armored Multi-Purpose Vehicles (AMPVs). The award is a fixed-price-incentive modification to contract W56HZV-23-C-0024, and brings the total value of the agreement to just under $2.48 billion. The Army Contracting Command at Detroit Arsenal, Michigan, is managing […]

BAE Systems has secured a new $198.4 million contract modification from the U.S. Army to produce an additional 240 Armored Multi-Purpose Vehicles (AMPVs). The award is a fixed-price-incentive modification to contract W56HZV-23-C-0024, and brings the total value of the agreement to just under $2.48 billion. The Army Contracting Command at Detroit Arsenal, Michigan, is managing […]