Next Crypto to Explode as Solana Hits $140 Ceiling

What to Know:

- Solana stalls near $140 and ETF flows reshape liquidity as DEX volumes cool off.

- Money starts to rotate into projects with real narratives or structural links to Bitcoin’s liquidity base.

- Bitcoin Hyper brings SVM-powered smart contracts and ultra-fast execution to Bitcoin, aiming to unlock DeFi and dApps for BTC holders.

- Maxi Doge channels trader culture into a meme token with competitions, dynamic staking, and a growing presale-backed war chest.

Solana’s the talk of the town.

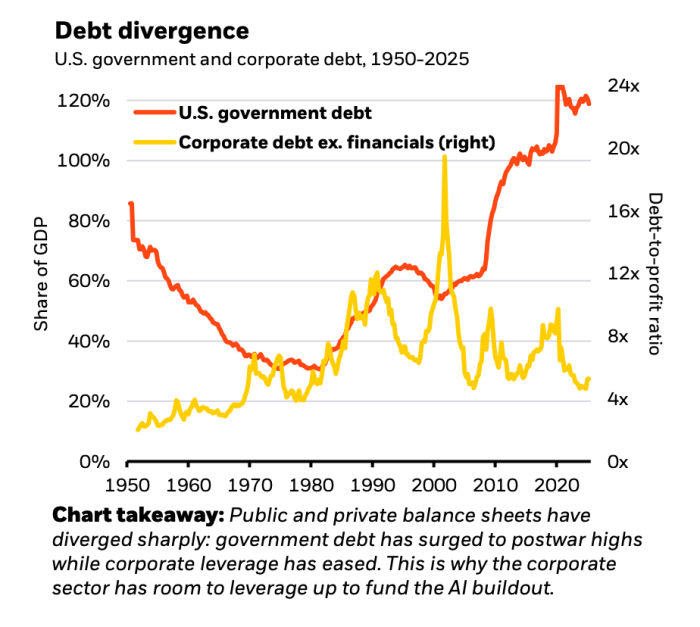

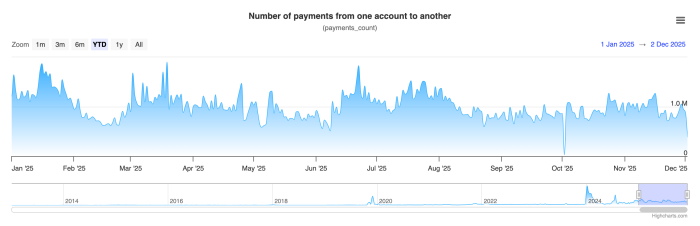

$SOL has been grinding against the $140 ceiling as spot altcoin ETFs soak up liquidity and DEX volumes cool off. Perps funding has normalized, leverage is bleeding out, and the easy ‘buy-any-SOL-ecosystem-name’ trade looks tired for now.

When that happens, the hot money usually rotates. You start to see flows move away from the obvious beta plays and into projects with real narratives, cleaner tokenomics, or structural links to Bitcoin’s liquidity base. In 2021, it was EVM sidechains. In 2024, it was Solana DeFi. This post-SOL catch-up phase feels different.

Regulated ETFs pulling in capital make it harder for pure meme beta to sustain parabolic runs without substance. Traders are suddenly asking annoying questions again: what does this chain actually do; what’s the throughput, where does yield come from; why does this token need to exist?

That backdrop is exactly where three very different plays stand out as the next crypto to explode: 1. Bitcoin Hyper ($HYPER) as a high-throughput Bitcoin Layer 2. 2. Maxi Doge ($MAXI) as a leverage-obsessed meme. 3. Dogwifhat ($WIF) as Solana’s culture coin that already proved it can run when conditions align.1. Bitcoin Hyper ($HYPER): SVM Powered Bitcoin Layer 2

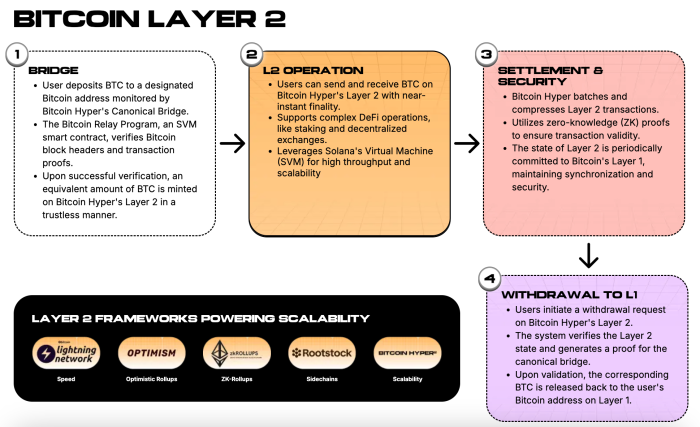

Bitcoin Hyper ($HYPER) is bridging the gap between Bitcoin’s security and Solana’s speed. By using Solana Virtual Machine technology to run a Layer 2 on top of Bitcoin. It delivers the holy grail of crypto: sub-second transaction times and penny fees, all secured by the Bitcoin network.

Why it matters:

- $BTC Deployed: It turns ‘store of value’ Bitcoin into programmable money for DeFi, NFTs, and Gaming.

- Dev-Ready: Uses familiar Rust-based tools, inviting the vast Solana developer community to build on Bitcoin.

We break down the project in more detail in our ‘What is Bitcoin Hyper’ guide, but this magic stems from the use of a canonical bridge to ensure your wrapped $BTC is transferred safely between layers.

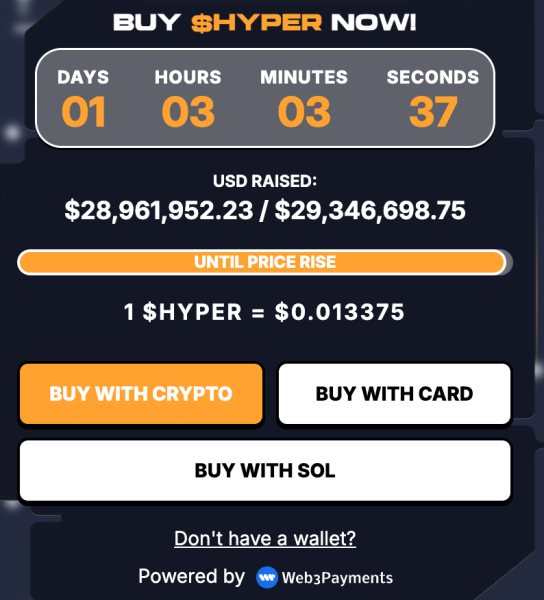

The market is taking notice. The presale has already smashed past $29M. Even more telling? On-chain sleuths have spotted heavy whale activity, with one buy hitting $500K. Liquidity is loading up, and smart money is getting in early.

Our experts see $HYPER potentially hitting $0.08625 by the end of 2026, which could mean an ROI of 544% if you invested at today’s price. And with 40% staking rewards for those in get in early, there are even more ways to potentially see a return.

Buy your $HYPER today for $0.013375.2. Maxi Doge ($MAXI): Meme Play for the 1000x Leverage Mindset

Maxi Doge ($MAXI) is built around one idea: never skip leg day, never skip a pump. The project leans hard into a ‘240-lb canine juggernaut’ persona, channeling the 1000x leverage mentality that still defines a big slice of crypto trading culture.

Maxi Doge’s future could be gamified speculation. Holder-only trading competitions, leaderboards, and rewards will create a meta-game where traders flex their PnL and grind for status.

The ‘Leverage King Culture’ branding turns what many people already do, degenerate trading, into a community sport instead of an isolated experience on a sterile exchange screen. Want in? We’ve got you covered, ‘bro’, with our ‘How to Buy Maxi Doge’ guide.

Under the hood, the Maxi Fund treasury is designed to support liquidity and partnerships, giving the team ammunition for CEX listings, marketing pushes, and cross-ecosystem collabs if momentum builds. That matters in a meme cycle where visibility and depth can make or break a token once the initial hype fades.

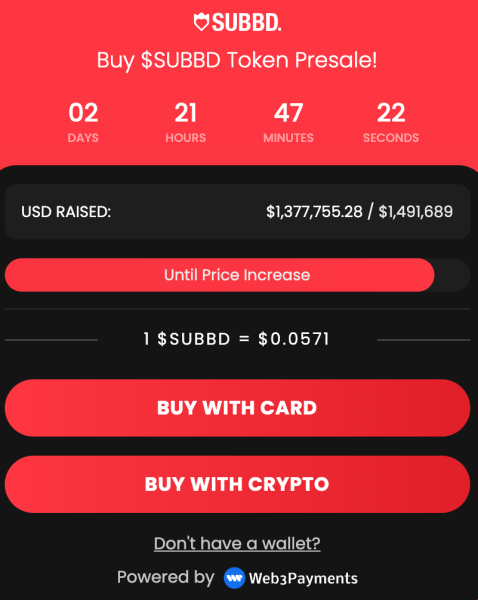

The Maxi Doge presale has raised over $4.2M with tokens currently available at $0.0002715, putting it firmly in micro-cap territory where even modest inflows can move the needle. Staking offers a dynamic APY currently at 72%, rewarding early believers willing to lock in and help stabilize the base.

If you want meme exposure aligned with trader culture rather than pure randomness, check out the $MAXI presale.3. Dogwifhat ($WIF): Solana’s Culture Coin With Robinhood Reach

Dogwifhat ($WIF) is already a proven name in the Solana meme sector, less about utility and more about culture, branding, and community. It’s a meme coin that doesn’t pretend to solve DeFi fragmentation or reinvent infrastructure; it leans fully into being a digital totem for Solana’s fun side.

It couldn’t be simpler. It’s a dog… ’wif’ a hat.

Built on Solana, $WIF benefits from high-speed, low-fee transactions, making it easy for retail traders to rotate in and out without worrying about gas overhead on smaller tickets. That’s critical in meme rotations, where traders often ladder in with many small buys and social sentiment moves fast.

The project’s ecosystem is driven heavily by its community, with fun tools like ‘WIF Hat Generators’ helping push the brand into every corner of Crypto Twitter and beyond. Significant whale and retail interest have translated into deep liquidity and high trading volumes during peak cycles, proving that culture plus liquidity is still a powerful combination.

A major inflection point came in May 2025, when Robinhood listed $WIF, triggering a sharp price spike and cementing it among the leading Solana meme coins. Today, $WIF is frequently cited as a top contender for traders who still want Solana exposure but prefer pure meme beta over infrastructure narratives.

Get your $WIF on top exchanges like Binance.Recap: With Solana pinned near $140 and altcoin ETFs soaking up attention, traders are rotating into clearer narratives. Bitcoin Hyper, Maxi Doge, and Dogwifhat each target different slices of that demand.

Remember, this isn’t intended as financial advice, and you should always do your own research before investing.

Authored by Aaron Walker , NewsBTC — https://www.newsbtc.com/news/next-crypto-to-explode-as-sol-hits-140-ceiling

Check out our

Check out our

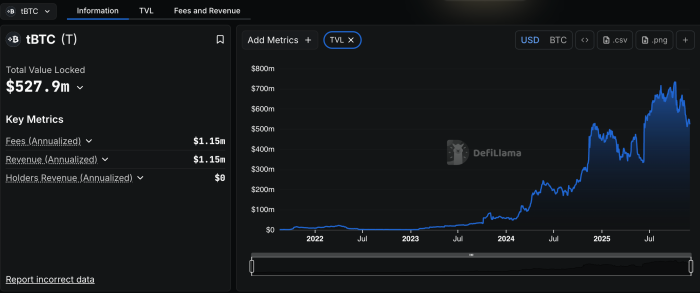

That’s why we’re suddenly seeing more attention on Bitcoin Layer-2 infrastructure, especially projects that claim to unlock real programmability and throughput without abandoning Bitcoin’s base-layer security.

That’s why we’re suddenly seeing more attention on Bitcoin Layer-2 infrastructure, especially projects that claim to unlock real programmability and throughput without abandoning Bitcoin’s base-layer security.

As interest grows, we’re here to explain

As interest grows, we’re here to explain

In that landscape,

In that landscape,  That combination of throughput and familiarity appears to be resonating with early participants. The presale has already raised over $28.8M, suggesting meaningful demand for a Bitcoin-secured, SVM-powered environment.

That combination of throughput and familiarity appears to be resonating with early participants. The presale has already raised over $28.8M, suggesting meaningful demand for a Bitcoin-secured, SVM-powered environment.