'It: Welcome to Derry' Release Schedule: When Does Episode 7 Come Out?

![]() Mark Gurman / Bloomberg:

Mark Gurman / Bloomberg:

Sources: Apple's chip chief Johny Srouji told Tim Cook that he is seriously considering leaving soon; some execs floated elevating him to the CTO role — Apple Inc., long the model of stability in Silicon Valley, is suddenly undergoing its biggest personnel shake-up in decades …

This is a PSA: Please stop abusing your SSD. Mistreating it is easier to do than it might seem. We all do it to some extent, but if you do it too much, it'll eventually backfire.

Do you often feel uncomfortable with symptoms like nausea, dizziness, or headaches when you're traveling in your car or other moving vehicles? There are some tricks you can use to look at your phone without feeling sick.

While it's true that Black Friday and Cyber Monday are both over, there are still a ton of deals available if you know where to look. We've found one example that will get you an Akai MIDI keyboard controller for just $79, but you'll need to be quick - this deal won't last forever.

The post Get 20% Off This Akai MIDI Controller And Get Your Music Journey Going first appeared on Redmond Pie.

Time is running out to pick up this Canon MegaTank G3270 wireless printer with an incredible 56% discount, saving $140 off the usual asking price.

The post Save 56% Off This Canon MegaTank G3270 All-In-One Wireless Printer [Today Only] first appeared on Redmond Pie.

In a not-so-surprising turn of events, the bearish orientation of the Bitcoin price has continued into the month of December, suggesting that the premier cryptocurrency could end the year in the red. Interestingly, recent on-chain data has offered insights into the likely direction of Bitcoin based on the integrity of an important price level.

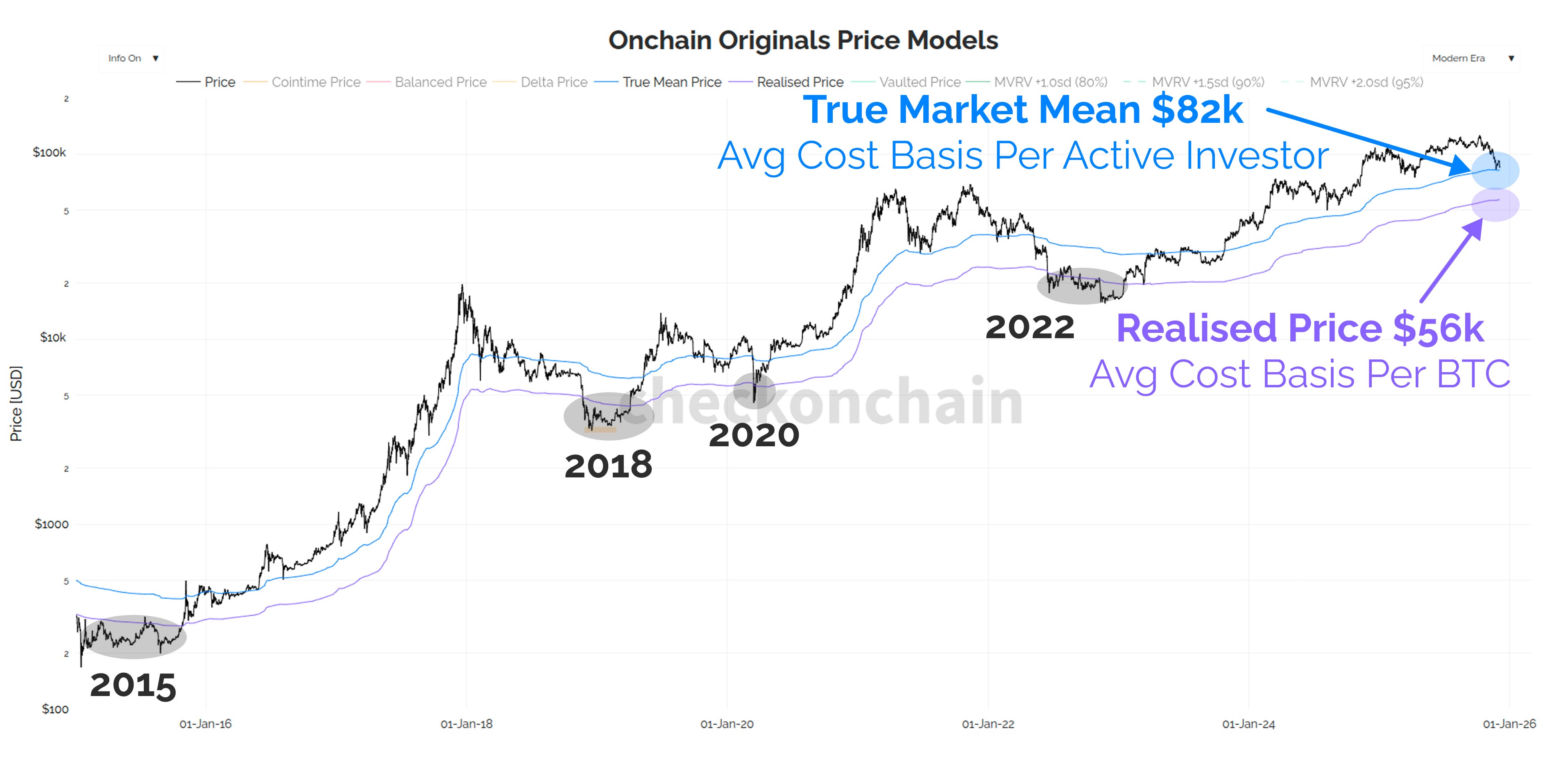

In a December 5 post on the X platform, market analyst Burak Kesmeci shared an interesting outlook on the direction of the Bitcoin price.

The analyst disclosed that whatever happens around the $82,000 mark could make or mar Bitcoin’s trajectory in the near term. To demonstrate why this price region is so important, Kesmeci pointed out that it appears to be the convergence point of two highly influential cost bases in Bitcoin’s history.

Kesmeci revealed that the Bitcoin spot exchange-traded funds have an average purchase cost of approximately $82,000. Because ETFs are one of Bitcoin’s strongest demand sources, tracking the values of their average cost-basis could serve as a good means to tell where the market stands institutionally.

The crypto pundit also referenced the Bitcoin True Market Mean metric, which monitors the cost at which active investors procured their holdings—except for mined or rarely-moved BTC. Notably, in the current market cycle, Bitcoin’s active participants mostly purchased their coins around a valuation of $82,000.

Usually, when price slips beneath any major price support, there is, in turn, an increase in overall selling pressure, as buy-side liquidity is converted to bearish momentum via losses incurred by investors. Hence, in the scenario where $82,000 fails to hold, a wave of bearish pressure is expected to ensue, as Bitcoin’s active investors try to cut their losses.

However, Kesmeci expects something even more specific to follow. According to historical data, whenever Bitcoin falls beneath its active market participant cost basis, it often falls further downwards, as though it is targeting its Realized Price.

At the moment, the Bitcoin Realized Price sits near $56,000 — a price level significantly beneath its investors’ average cost basis. Kesmeci therefore warned that a slip beneath $82,000 could precede Bitcoin’s sharp downturn towards $56,000.

This would represent an almost 40% decline from the current price point. As of this writing, the price of BTC stands at around $89,310, reflecting an over 3% dip in the past 24 hours.

According to remarks made on CNBC’s Power Lunch, Strategy’s CEO Phong Le said the company moved quickly to calm investor fears after Bitcoin fell sharply. The firm announced a $1.44 billion US dollar reserve on Monday, raised through a stock sale.

The reserve is meant to hold enough cash to cover at least 12 months of dividend payments right away, and the company says it will expand that buffer to cover 24 months over time.

Based on reports, Le said the drive was largely about stopping what he called “dividend FUD.” He added that the $1.44 billion was put together in eight and a half days and, by his count, represents about 21 months’ worth of dividend obligations.

“We’re very much are a part of the crypto and Bitcoin ecosystems. Which is why we decided a couple of weeks ago to start raising capital and putting US dollars on our balance sheet to get rid of this FUD,” Le said on Friday.

This afternoon, Phong Le, CEO of @Strategy, joined @CNBC @PowerLunch to discuss how $MSTR moves with bitcoin, how our USD reserve addresses recent FUD, the shifting Overton Window, key volatility drivers, and why bitcoin’s long-term outlook remains strong. pic.twitter.com/1t5hsfov0m

— Strategy (@Strategy) December 5, 2025

The move followed growing questions about whether Strategy could meet its payout and debt commitments if its share price plunged. Company materials also highlight a new “BTC Credit” dashboard that claims the firm now holds enough assets to service dividends for more than 70 years.

Bitcoin’s slide has been severe. Once trading above $126,000 earlier this year, BTC fell roughly 30% from that high and hit about $88,130 on Friday, after a one-day drop near 4%.

Reports tie the decline to a wave of forced liquidations and dwindling retail interest. At the same time, money has flowed into gold, silver and some large-cap stocks, leaving crypto out of the rally.

Analysts such as Stephane Ouellette of FRNT Financial say the pullback could be a normal reset after a big run, not a sign that crypto is finished.

Short Sellers, Stock Moves, And Market SignalsInvestors had been asking whether Strategy would sell Bitcoin if the stock tumbled. Le told CNBC the company would only consider selling its BTC holdings if the stock price fell below net asset value and fresh capital was unavailable.

That stance was meant to reassure holders that the firm was not planning to liquidate core assets on the first sign of trouble. Still, the recent volatility fed narratives that dividend payments and debt service might be at risk, which in turn encouraged some market participants to place bets against the company.

Company Says It Will Avoid Selling BitcoinStrategy’s public messaging emphasized access to capital as proof of strength. Raising $1.44 billion in a down cycle, the CEO said, was also designed to show the market that the company could still attract funding.

Based on reports, that was part of an effort to stop short sellers from piling into positions that bet on further declines. The company’s dashboard and the stated runway targets are clear signals aimed at easing investor anxiety.

Featured image from Unsplash, chart from TradingView

Legal experts are concerned that transforming ESMA into the “European SEC” may hinder the licensing of crypto and fintech in the region.

Bitcoin long-term holders lost interest in selling at $90,000, new research showed, as profitability of their BTC supply dried up.

-ronstik-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale)

Hey man, I don't know what message you're trying to send by plastering extremely realistic-looking billionaire faces onto robot dogs — that's between you and your higher power, or lack thereof — but no thanks. I'm good, actually, thanks for offering.

I actually do not need to witness Elon Musk's smirking visage attached to a robot that then defecates AI-generated Polaroids to the audience. I've got errands to run.

Look at these damn things.

The exhibit at Art Basel Miami Beach is called “Regular Animals.” Created by digital designer and artist Mike Winkelmann, who goes by Beeple, it features robot dog versions of Mark Zuckerberg, Elon Musk, Jeff Bezos, Andy Warhol and Pablo Picasso, according to Storyful.

— The Wall Street Journal (@wsj.com) December 5, 2025 at 11:22 AM

[image or embed]

“Regular Animals”, an art installation by Beeple 🤮 at Art Basel in Miami, features billionaire-faced robodogs that take photos of spectators & then “defecate” the so called “artistic impressions”, some of which link to NFTs. Printed “Excrement Samples” sell for $100k. Creepy af innit?

— trish (@omerta22.posts.art) December 4, 2025 at 2:13 PM

[image or embed]

The art installation I'm referring to is called Regular Animals, located in Miami during Art Basel. It's a creation by Mike Winkelmann, aka Beeple, the artist who sold his NFT art for $69 million during the 2021 NFT boom.

The penned-up billionaire dogs include Musk, Mark Zuckerberg, and Jeff Bezos, as well as art-world figures like Andy Warhol, Pablo Picasso, and Beeple himself. It's unnerving and weird to see the hyper-realistic faces wandering around on the picture-pooping dogs. Some folks might be tempted to draw some meaning from the installation. Not me, I've got laundry to do. No thanks.

SAVE $189: As of Dec. 6th, this Pre-Lit Dunhill Fir artificial Christmas tree is 66% percent off, coming in at $99. This is down from the National Tree Company’s list price of $289.99 on Amazon.

It's Dec. 6th, which means that Thanksgiving has come and gone, Black Friday and Cyber Monday spun in like the Tasmanian Devil and spun back out, and now we're more than one-fifth of the way through 25 days of Christmas. It's that time of the holiday season when many windows are filling up with the lights of beautifully decorated trees and/or menorahs. If you don't have a tree quite yet or if you've been on the fence, this weekend, the National Tree Company has a deal you might be interested in. The NTC has its Pre-Lit DunHill Fir artificial Christmas tree on sale for 66% off.

This particular Pre-Lit artificial tree measures 7.5 ft in height with a 55-inch diameter at its base. When it comes to being "Pre-Lit", that means that the tree is wrapped with lights before packaging, offering you a stress-free setup. The tree comes replete with 700 white light bulbs for sparkling holiday-season ambiance, on full-bodied branches designed to look as real as possible. The tree also features attached drop-down branches, allowing you to set it up quickly once you take it out of the box.

The instructions indicate that one should spend about 45-60 minutes fluffing and pulling apart the branches so they look extra real.

The big reveal for Meta's next mixed reality glasses is being postponed until the first half of 2027, according to a report from Business Insider. Based on an internal memo from Maher Saba, the vice president of Meta's Reality Labs Foundation, the report said that the company's project, which is codenamed "Phoenix," will no longer be scheduled for a 2026 debut.

In a separate memo, Meta execs explained that the delay would help deliver a more "polished and reliable experience." According to BI, a memo from Meta's Gabriel Aul and Ryan Cairns said this new release window is "going to give us a lot more breathing room to get this right." Meta hasn't publicly revealed many details about its Phoenix project, but The Information previously reported that it would feature a goggle-like form factor with an external power source, similar to how the Apple Vision Pro is attached to a battery pack.

In the memo from Saba, BI reported that Meta is also working on a "limited edition" wearable with the codename "Malibu 2." Yesterday, Meta announced its acquisition of Limitless, a startup that recently developed an AI wearable called Pendant. Even though Meta's current product portfolio is dominated by smart glasses and VR headsets, the Limitless acquisition and Malibu 2 project could hint at the company's plans to expand its offerings.

This article originally appeared on Engadget at https://www.engadget.com/ar-vr/meta-plans-to-push-back-the-debut-of-its-next-mixed-reality-glasses-to-2027-172437374.html?src=rss©

© Meta

Read more of this story at Slashdot.