Kryptomeny idú hore. Bitcoin posilnil o ďalších 7 % za posledných 24 hodín

Oslabujúci dolár, očakávané zníženie úrokových sadzieb americkým Fedom a rastúca aktivita na spotových ETF fondoch formujú nové podmienky pre decembrový trh. Bitcoin sa opäť obchoduje nad úrovňou 92 000 $ a aj altcoiny naznačujú zmenu trhovej dynamiky. Je december vhodným časom na nákup?

Cena Bitcoinu stúpla o viac ako 6 % za posledný týždeň

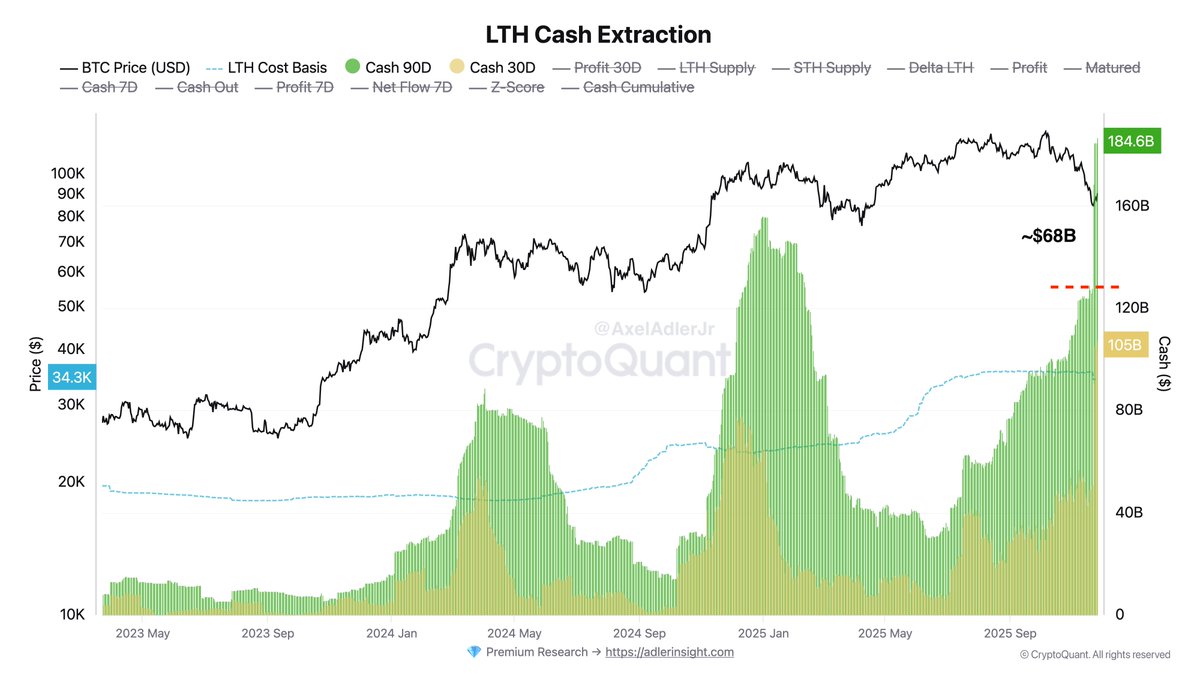

Bitcoin sa dnes obchoduje za 92 981 $. V priebehu posledných 7 dní posilnil o 6,15 % a zotavil časť novembrových strát, ktoré patrili k najvýraznejším od roku 2021. Nárast objemov v spotových ETF, najmä po tom, čo Vanguard zrušil obmedzenie obchodovania s Bitcoin ETF, podporil nový prílev kapitálu do trhu.

Len samotný fond IBIT spoločnosti BlackRock dosiahol miliardové objemy už v prvých minútach obchodovania po otvorení amerického trhu.

Zdroj: coinmarketcap.com

Zdroj: coinmarketcap.com

Prelomenie hranice 93 000 dolárov by podľa analytikov Glassnode mohlo vyvolať krátkodobý short squeeze, ktorý by cenu vystrelil smerom k 95-100 tisíc $. Zároveň platí, že pokiaľ Bitcoin zostane nad úrovňou 80 tisíc $, trh si udrží býčí výhľad. Makro faktorom dominuje očakávanie, že Fed už budúci týždeň pristúpi k zníženiu sadzieb, ktoré tradične podporuje rizikové aktíva vrátane kryptomien.

Euro posilňuje v očakávaní rozhodnutia americkej centrálnej banky. Dolár oslabil tento rok o takmer 7 %

Euro v úvode decembra posilňuje a prelomilo svoj 50-dňový kĺzavý priemer po tom, čo inflácia v eurozóne mierne prekonala očakávania. Spoločná mena sa aktuálne obchoduje pri úrovni 1,1640 dolára a smeruje k najlepšiemu ročnému výkonu od roku 2017. Trh tak reaguje na kombináciu priaznivých európskych makrodát a slabnúceho amerického dolára, ktorý v tomto roku stratil takmer 7 % hodnoty na indexe DXY.

Investori sa zároveň pripravujú na zasadnutie Federálneho rezervného systému, ktorý sa uskutoční už budúci týždeň. Podľa údajov platformy Polymarket vyskočila pravdepodobnosť, že Fed pristúpi k ďalšiemu zníženiu sadzieb až 93 %.

Práve toto očakávanie patrí medzi hlavné dôvody oslabenia dolára. Americká mena sa totiž stáva menej atraktívnou v prostredí, kde sa úrokový diferenciál medzi USA a ostatnými ekonomikami rýchlo zužuje. Odborníci upozorňujú, že aj malé náznaky holubičej rétoriky Fedu by mohli spôsobiť ďalší pokles dolára v druhej polovici decembra.

Zdroj: tradingview.com

Zdroj: tradingview.com

Naopak, Európska centrálna banka neplánuje bezprostredné znižovanie sadzieb a trhy započítavajú iba približne 25 % pravdepodobnosť uvoľnenia menovej politiky v roku 2026. Tento kontrast medzi Fedom a ECB hrá v prospech eura, ktoré zostáva podporované stabilnou politikou ECB a slabnúcou americkou menou.

Makro pohyby na devízových trhoch tak vytvárajú prostredie priaznivé pre rizikové aktíva vrátane kryptomien. Slabší dolár totiž historicky podporuje dopyt po Bitcoine, altcoinoch a ďalších volatilnejších aktívach.

Altcoiny naznačujú budúci rast. Ethereum si polepšilo o 9 %

Popri Bitcoine sa nálada zlepšuje aj v segmente altcoinov. Celková trhová kapitalizácia kryptomien stúpla na 3,14 bilióna dolárov, čo predstavuje 6,84 % denný nárast. A práve altcoiny ťahajú značnú časť tohto impulzu. Ethereum (ETH) vzrástlo za posledných 24 hodín o 8,80 % a jeho cena sa drží nad 3 052 dolármi. Rast podporuje návrat likvidity na trh a klesajúca dominancia Bitcoinu, ktorá vytvára priestor pre širšiu altcoinovú rally.

Zdroj: coinmarketcap.com

Zdroj: coinmarketcap.com

XRP taktiež potvrdzuje posilnenie sentimentu. S 8,27 % denným nárastom patrí medzi najvýkonnejšie veľké altcoiny, pričom jeho trhová kapitalizácia presiahla už 131,6 miliardy dolárov. Súčasne rastie aj dopyt po XRP ETF fondoch, ktoré pritiahli tento týždeň už viac ako 157 miliónov dolárov.

Súčasne, natívna kryptomena populárneho blockchainu pre meme coiny Solana (SOL), si pripísala za posledný deň 12 %. Celkovo si tak polepšila o takmer 4 % za týždeň. Záujem investorov podporuje vysoká aktivita v DeFi a rastúce množstvo nových aplikácií v jej ekosystéme.

Zdroj: sosovalue.com

Zdroj: sosovalue.com

Stablecoin Tether (USDT) zostáva najväčším zdrojom likvidity na trhu, čo je viditeľné z vysokého 24-hodinového objemu 128,2 miliardy dolárov Ide o jasný signál, že obchodníci aktívne rotujú kapitál medzi hlavnými altcoinmi. Súčasné trhové ukazovatele vytvárajú konzistentný obraz prostredia, v ktorom sa altcoiny presadzujú čoraz výraznejšie.

Rastový impulz v segmente altcoinov zároveň vytvára priaznivé podmienky pre nové kryptomeny, ktoré práve v tomto období vstupujú na trh. Investori po mesiacoch opatrnosti opäť rozširujú expozíciu voči projektom s vyšším potenciálom, čo zvyšuje záujem o kvalitné predpredaje. V tejto skupine aktuálne dominuje projekt Bitcoin Hyper, ktorý počas prebiehajúceho predpredaja už získal viac než 28 miliónov dolárov.

Layer 2 architektúra Bitcoin Hyper prináša pre BTC novú úroveň využitia

Základom projektu Bitcoin Hyper (HYPER) je snaha prepojiť vysokú bezpečnosť Bitcoinovej siete s výkonnosťou moderných blockchainových architektúr. HyperChain používa Solana Virtual Machine (SVM) ako výpočtovú vrstvu, no finálne osadenie transakcií sa rieši na Bitcoinovom Layer 1.

V praxi to znamená, že DeFi aplikácie môžu využívať nízke poplatky a vysoké TPS, kým Bitcoin zostáva konečnou autoritou pre zúčtovanie. Súčasťou riešenia je aj mechanizmus canonical bridge, v ktorom sa BTC uzamkne na základnej vrstve a jeho zabalená verzia sa následne používa v prostredí Bitcoin Hyper. Tým sa otvára priestor pre reálne ekonomické aktivity, ktoré Bitcoin doteraz nepodporoval.

Zdroj: bitcoinhyper.com

Zdroj: bitcoinhyper.com

Natívny token HYPER zohráva v ekosystéme ústrednú úlohu. Držitelia ho využijú ako:

- platidlo na úhradu transakčných poplatkov

- zdroj pasívnych príjmov za staking (aktuálne ponúka 40 % APY)

- hlasovacie právo pri rozhodovaní o budúcom vývoji ekosystému v rámci DAO

- investičný nástroj na zhodnotenie kapitálu v trhovom prostredí

Aktuálna cena kryptomeny HYPER v predpredaji je 0,013365 $, pričom do uzavretia predpredaja zostáva už len niekoľko dní. Silný záujem retailových investorov dopĺňajú aj výrazné kapitálové vstupy zo strany veľrýb, čo zvyšuje dôveru v dlhodobejšiu víziu projektu.

Pre mnohých investorov predstavuje Bitcoin Hyper riešenie, ktoré môže Bitcoinu priniesť funkcionalitu, aká mu doteraz chýbala. Nová Layer-2 vrstva umožňuje obchodníkom aj vývojárom využívať BTC v moderných decentralizovaných aplikáciách, pokročilých DeFi riešeniach, ekosystémoch založených na meme tokenoch či v rámci smart kontraktov.

Tvorcovia projektu zároveň stavili na výraznú vizuálnu identitu, ktorá pracuje s hravým a virálnym potenciálom značky. Novú sieť reprezentuje postava Hyper, využívaná v meme formáte s estetikou superhrdinu, ktorá sprevádza jednotlivé fázy vývoja projektu.

Markets move fast. Hyper stays ready.

https://t.co/VNG0P4GuDo pic.twitter.com/5YVWN3TnQ1

— Bitcoin Hyper (@BTC_Hyper2) December 3, 2025

Tento prístup podporuje aktívnu a angažovanú komunitu, uľahčuje odlíšenie od ostatných projektov a prispieva k rýchlemu budovaniu povedomia ešte pred uvedením tokenu na trh.

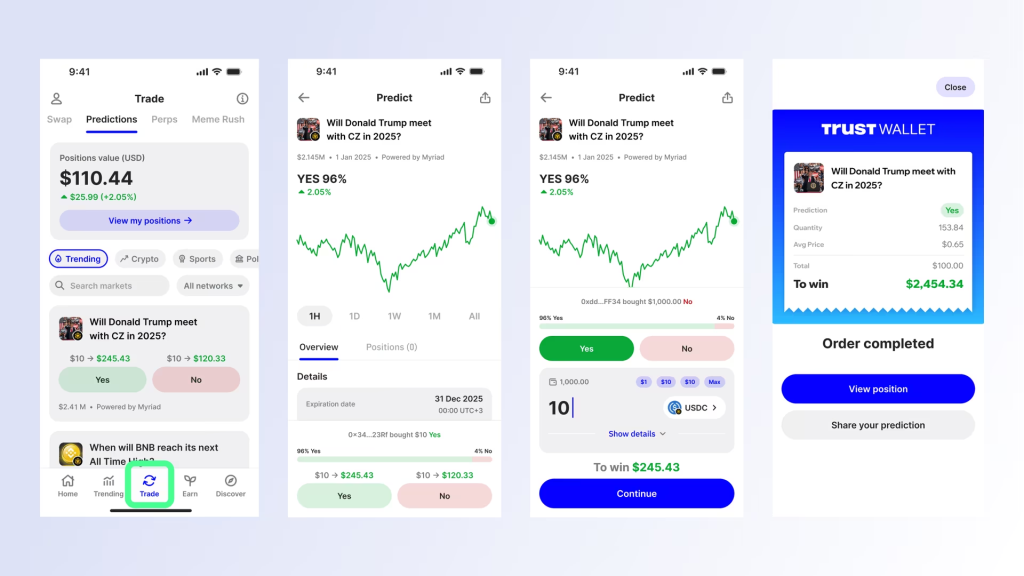

Token nájdete na domovskej stránke projektu a tiež priamo v aplikácii kryptopeňaženky Best Wallet. Nákupný widget akceptuje kryptomeny ETH, BNB, USDT a tiež platbu kartou.

Navštíviť predpredaj Bitcoin Hyper

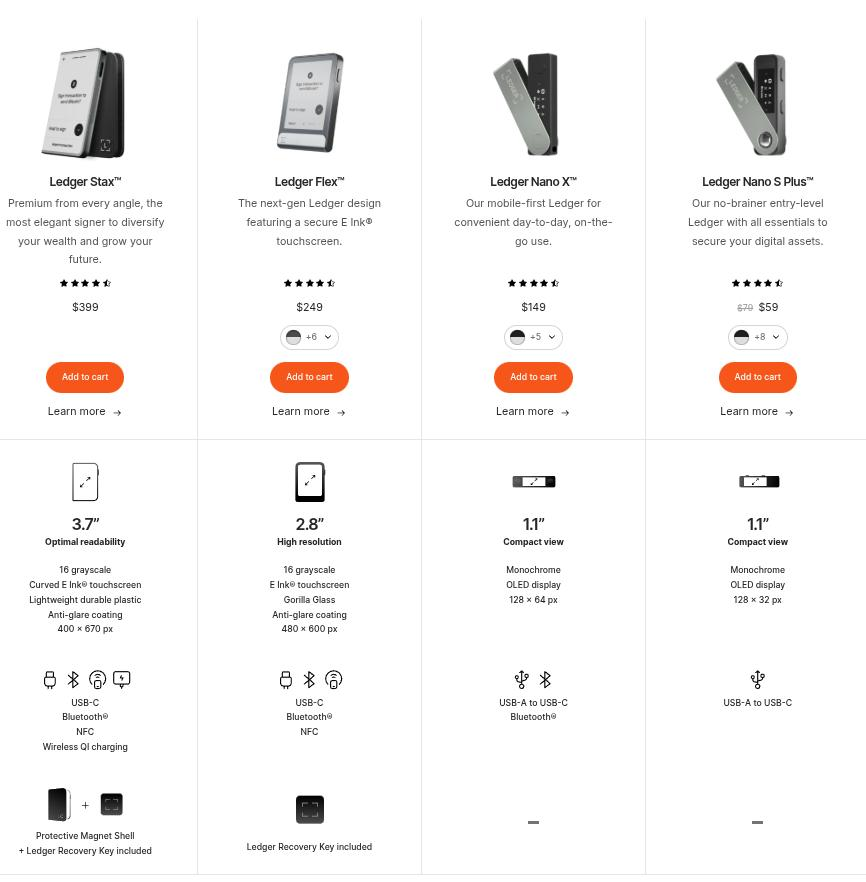

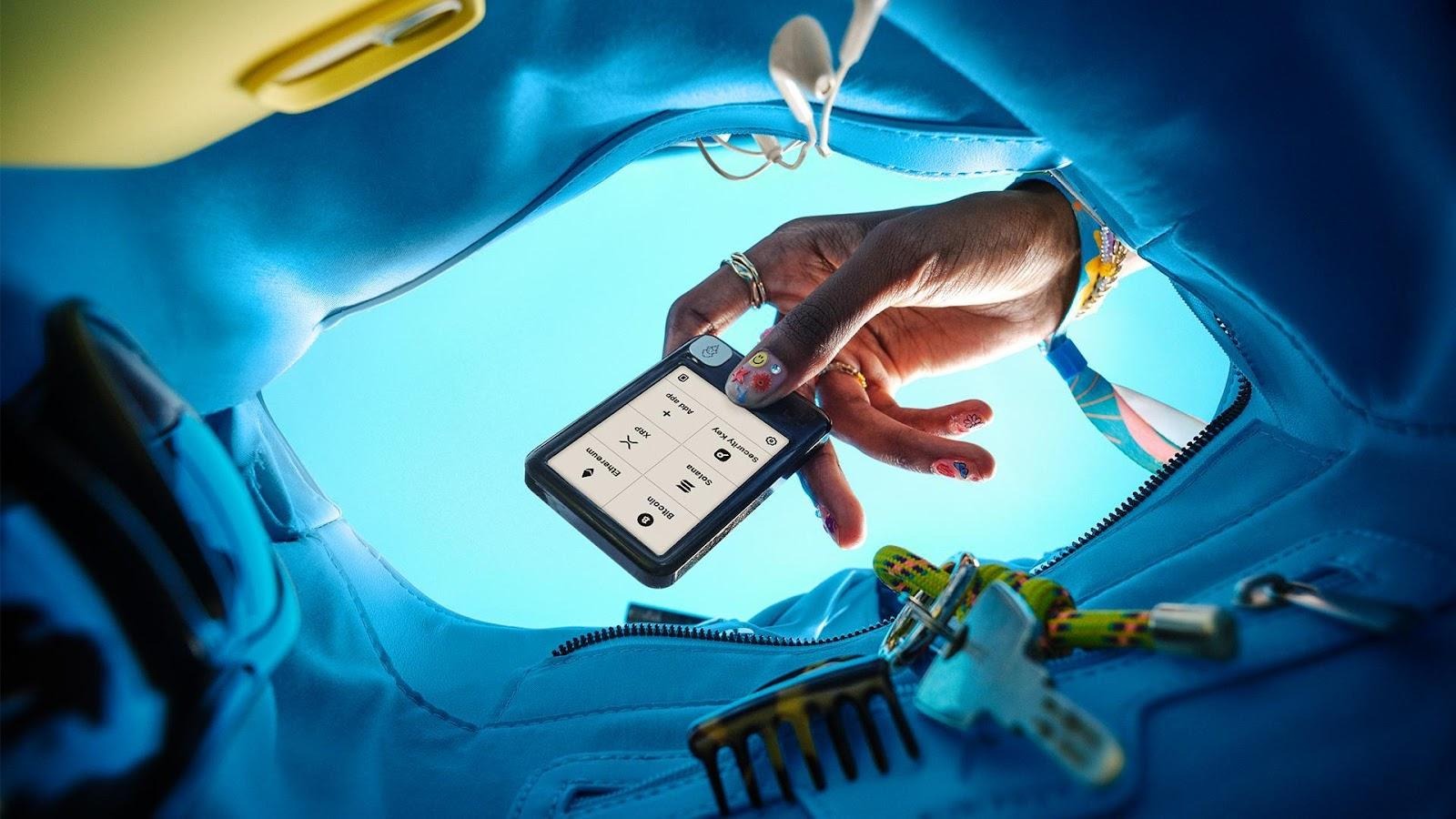

Gen5. Taking the capabilities of previous Ledger devices to the next level, the Gen5 also reaches a surprisingly low price compared to its predecessors.

Gen5. Taking the capabilities of previous Ledger devices to the next level, the Gen5 also reaches a surprisingly low price compared to its predecessors.