Bitcoin Price Surged Above $106,000 As Strategy Buys 487 More Bitcoin

Bitcoin Magazine

Bitcoin Price Surged Above $106,000 As Strategy Buys 487 More Bitcoin

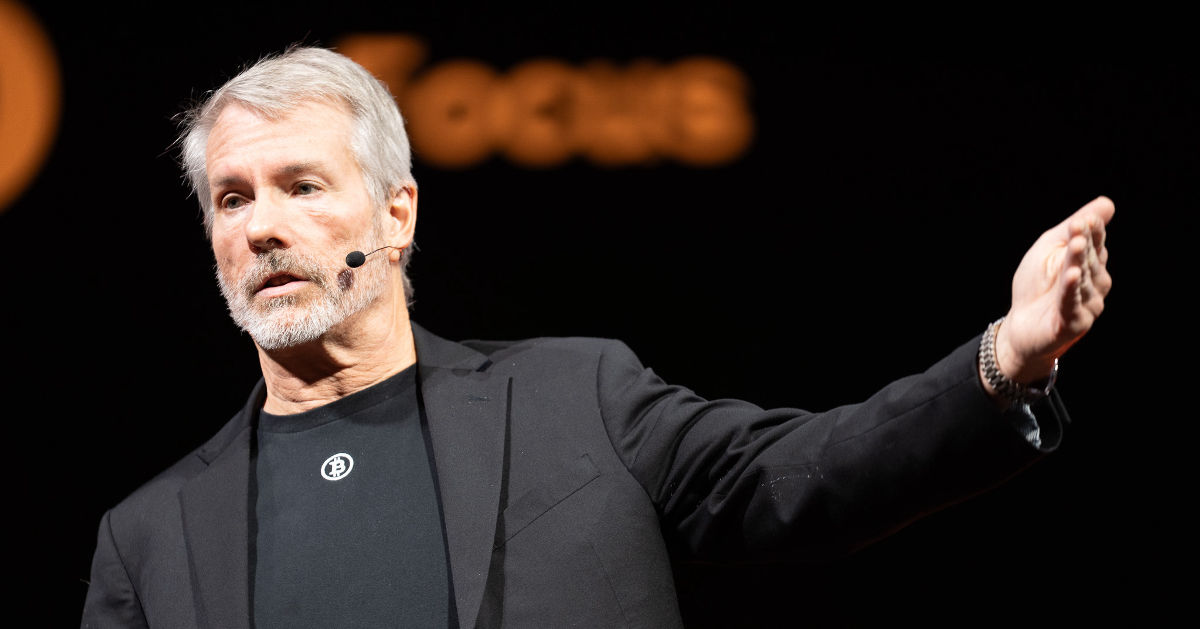

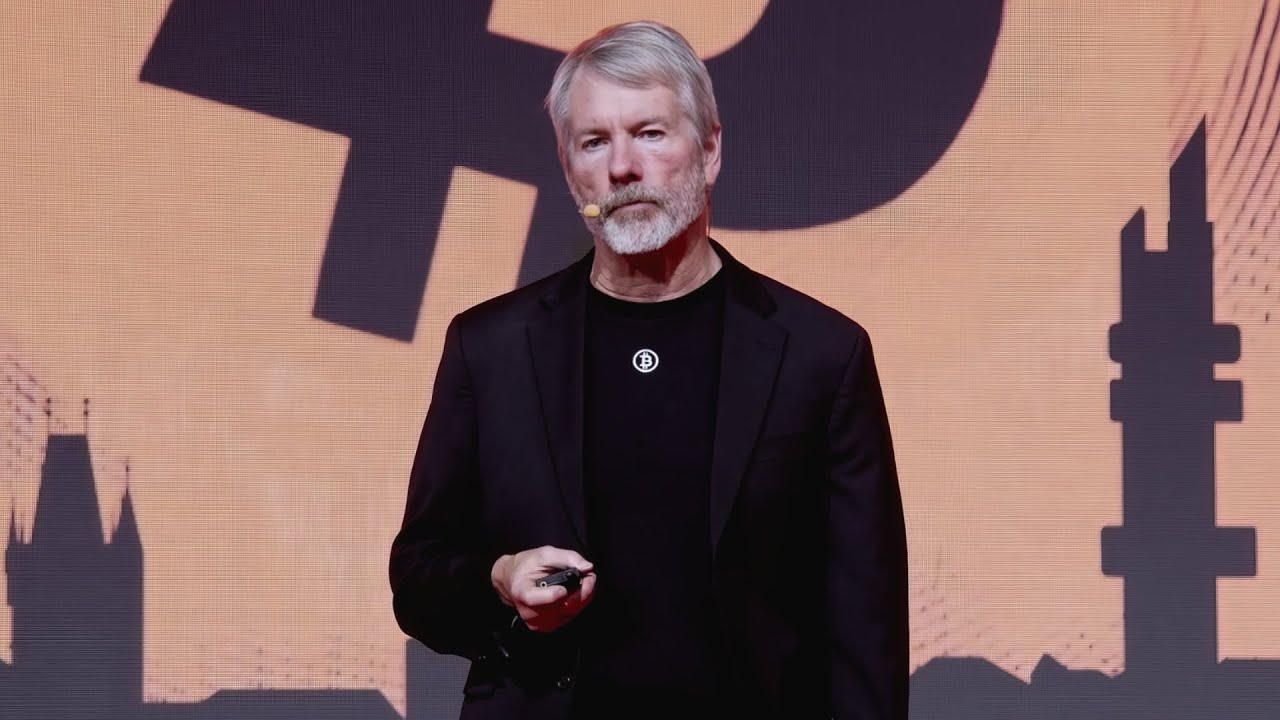

Bitcoin’s price climbed above $106,000 on Monday as Strategy, the world’s largest corporate holder of Bitcoin, announced its latest acquisition of 487 BTC for approximately $49.9 million.

According to an SEC filing, the purchases were made between November 3 and November 9 at an average price of $102,557 per Bitcoin, inclusive of fees and expenses.

The business intelligence firm’s total Bitcoin holdings have now reached 641,692 BTC, acquired for an aggregate purchase price of $47.54 billion at an average price of $74,079 per Bitcoin. This latest purchase marks Strategy’s largest Bitcoin acquisition since late September, demonstrating the company’s continued commitment to its Bitcoin treasury strategy.

The recent purchase was funded through multiple preferred stock offerings under Strategy’s at-the-market (ATM) programs. Notably, the company utilized its STRC “Stretch” preferred stock series for the first time, raising $26.2 million through the sale of 262,311 shares. Additional funding came from other preferred stock series, including $18.3 million from STRF “Strife” shares, $4.5 million from STRK “Strike” shares, and $1 million from STRD “Stride” shares.

BREAKING:

— Bitcoin Magazine (@BitcoinMagazine) November 10, 2025STRATEGY BUYS ANOTHER 487 #BITCOIN FOR $49.9 MILLION pic.twitter.com/54eCrIrH3Z

Strategy’s innovative approach to financing Bitcoin acquisitions through various preferred stock offerings has created a sustainable model for corporate Bitcoin accumulation. The company recently increased the STRC series’ annualized dividend rate to 10.5%, paid monthly, to attract investors.

Bitcoin price rebound

Bitcoin’s price responded positively to the announcement, trading at $106,219 as of press time, up 3.12% in the past 24 hours. The market has shown increased stability and maturity, with institutional adoption continuing to grow despite recent market volatility.

Despite recent criticism and a decline in Strategy’s stock price, market sentiment appears to be shifting. Notable short-seller Jim Chanos recently announced the closure of his position against MSTR, while contrarian investors are noting potential bottom signals in Bitcoin treasury companies.

The company’s aggressive accumulation strategy comes amid broader institutional acceptance of Bitcoin as a treasury reserve asset. Recent regulatory clarity regarding the treatment of Bitcoin in corporate treasury operations has further strengthened institutional confidence.

Strategy maintains significant capacity for future Bitcoin purchases. The company’s systematic approach to Bitcoin accumulation, combined with transparent reporting and regulatory compliance, continues to provide a blueprint for other corporations entering the space.

The corporate Bitcoin treasury model has evolved beyond early adoption into a mainstream treasury management strategy. We’re seeing unprecedented interest from companies across various sectors and regions.

As more corporations adopt Bitcoin treasury strategies and regulatory frameworks become clearer, the trend appears poised to accelerate through 2026. With Strategy leading the way and new entrants like Germany’s aifinyo AG joining the space, corporate Bitcoin adoption has become an established feature of the institutional Bitcoin landscape, potentially setting the stage for the next phase of Bitcoin’s mainstream integration.

This post Bitcoin Price Surged Above $106,000 As Strategy Buys 487 More Bitcoin first appeared on Bitcoin Magazine and is written by Vivek Sen.