Massive Bitcoin Awakening: 2 Physical Coins Unlock $179 Million After 13 Years

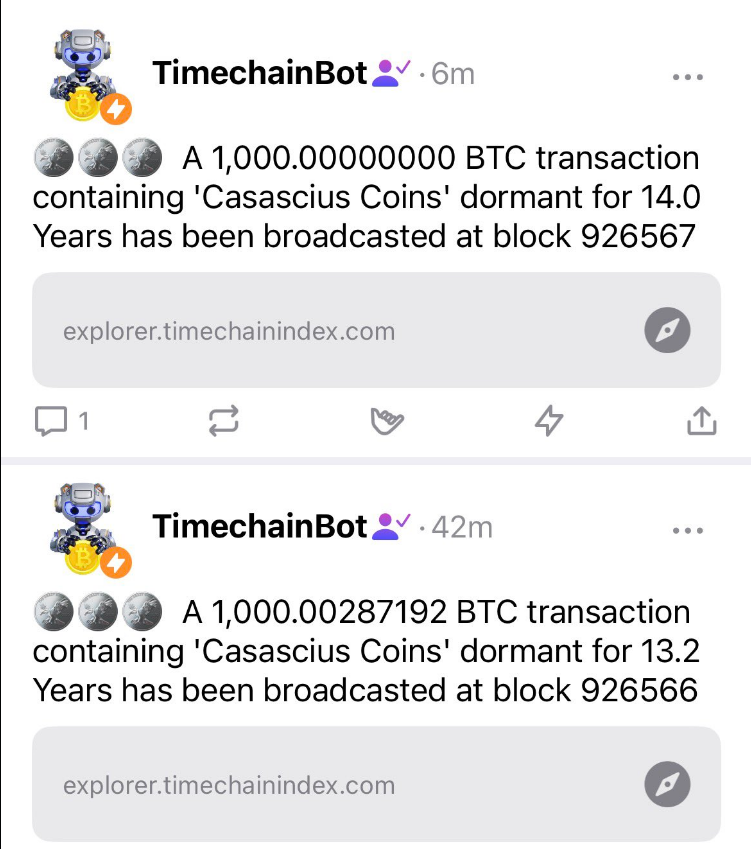

Two long-dormant Casascius coins, each loaded with 1,000 Bitcoin, were activated on Friday, unlocking more than $179 million that had sat untouched for over 13 years.

According to onchain data, one of the coins was minted in October 2012 when Bitcoin traded at $11.69. The other dates back to December 2011, when BTC was worth $3.88, giving that piece a theoretical gain near 2.3 million% since minting.

Historic Physical Coins Activated

Based on reports, Casascius coins (metal coins) were produced between 2011 and 2013 by Utah entrepreneur Mike Caldwell as physical representations of Bitcoin. Each coin or bar concealed a paper with a private key, and a tamper-resistant hologram covered that key.

Two Casascius coins, each containing 1,000 BTC, have just moved after being dormant for more than 13 years. pic.twitter.com/nlFUy39MkD

— Sani | TimechainIndex.com (@SaniExp) December 5, 2025

Records show only 16 of the 1,000 BTC bars and 6 of the 1,000 BTC coins were ever made, making these items both rare and historically important.

Caldwell shut down the operation after receiving a letter from FinCEN that raised questions about whether his business qualified as an unlicensed money transmitter.

How The Coins Worked

The mechanism was simple in practice but strict in outcome: whoever removed the hologram and revealed the private key could claim the full Bitcoin value stored beneath it.

Once that sticker was lifted and the private key used, the coin no longer carried any Bitcoin value. Based on reports, collectors treat that moment as irreversible. Some owners chose to move funds off the physical coins without cashing out.

Numbers here show why collectors and investors watch these events closely. Two coins at 1,000 BTC each represent a huge hoard when prices are high. Even leaving aside the cost of minting, the December 2011 coin’s rise from $3.88 to current market valuations yields a headline-grabbing multiple.

But experts warn that turning the private key into spendable Bitcoin is only the first step; what happens next depends on the holder’s choices. Some will hold. Others may move funds into cold storage. Selling is not guaranteed.

Derivatives Market ShockMeanwhile, the spot and derivatives markets are experiencing high volatility. Based on CoinGlass data, today’s derivatives activity showed an 11,588% liquidation imbalance that overwhelmingly wiped out long positions.

Bitcoin, at the time of writing, was trading below $90,000, and more than $20 million in BTC long liquidations occurred in minutes while short positions barely budged. That kind of one-sided pressure happens when many traders are crowded in the same direction and conditions change quickly.

Featured image from Unsplash, chart from TradingView

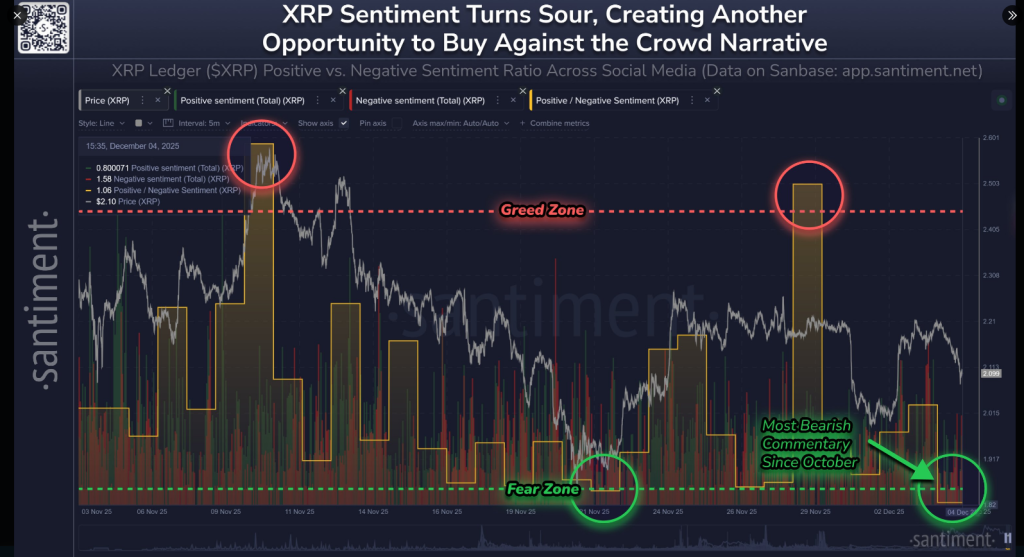

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data.

XRP (-31% in the past 2 months), unlike Bitcoin, is seeing the most fear, uncertainty, & doubt (FUD) since October, according to our social data. Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

Circles indicate days where there are abnormally higher BULLISH comments compared to BEARISH comments, about XRP (Greed Zone)…

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

THE FED JUST DOUSED THE FLAMES: $13.5B repo injection, 2nd-largest since C@#$D

After months of burning through liquidity (QT), they’re flooding the system again.

Here’s the pattern: When the Fed brings water,

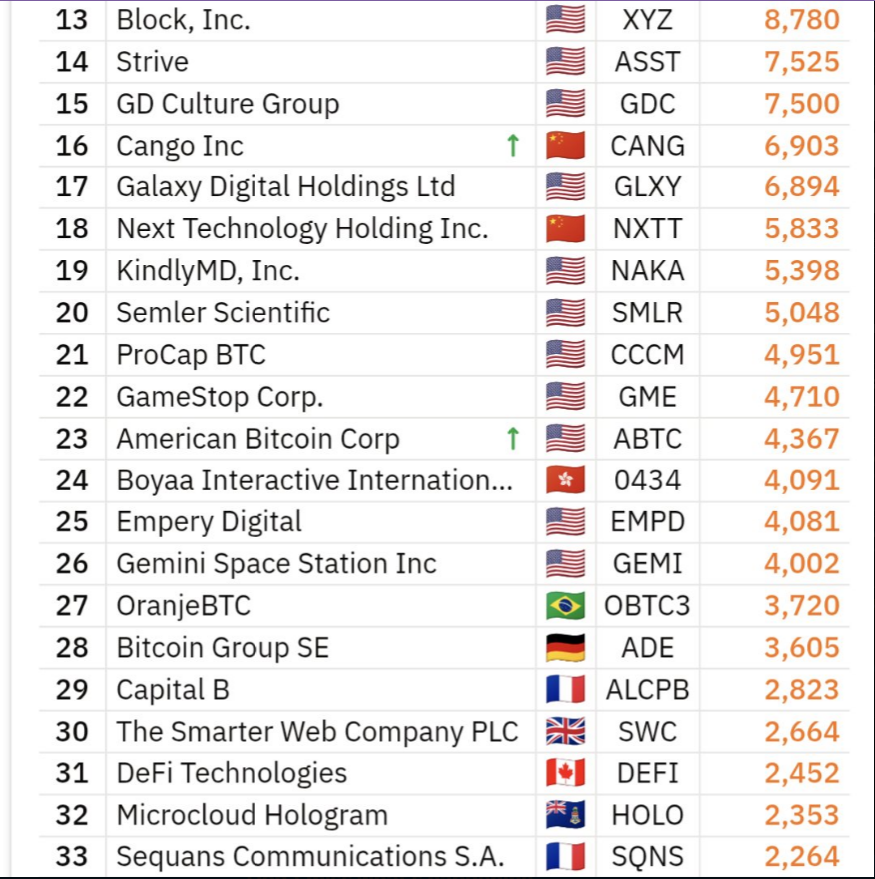

Bitcoin 100 Ranking: 23

Bitcoin 100 Ranking: 23