Strategy CEO Says $1.44B Cash Reserve Aims to Calm Bitcoin-Slump Fears

Strategy CEO Phong Le says the company’s newly built $1.44 billion cash reserve is designed to quiet investor anxiety over its ability to withstand a sharp downturn in Bitcoin.

Key Takeaways:

- Strategy built a $1.44B cash reserve to ease investor fears about its ability to meet dividend and debt obligations.

- The firm raised the funds in just eight and a half days, aiming to show it can still attract capital without selling any Bitcoin.

- Strategy says it will only consider selling BTC if its stock falls below NAV.

Speaking on CNBC’s Power Lunch, Le said the move followed weeks of speculation about whether the firm could continue meeting its dividend and debt commitments if market conditions worsened.

“We’re very much a part of the crypto ecosystem and Bitcoin ecosystem,” Le said. “Which is why we decided a couple of weeks ago to start raising capital and putting US dollars on our balance sheet to get rid of this FUD.”

Strategy Builds Cash Buffer to Avoid Selling Bitcoin in Market Slump

The reserve, announced Monday and funded via a stock sale, is intended to secure at least 12 months of dividend payments, with plans to stretch that buffer to 24 months.

The company emphasized that the stock-funded buildup gives Strategy breathing room without having to sell any Bitcoin during a turbulent period for the market.

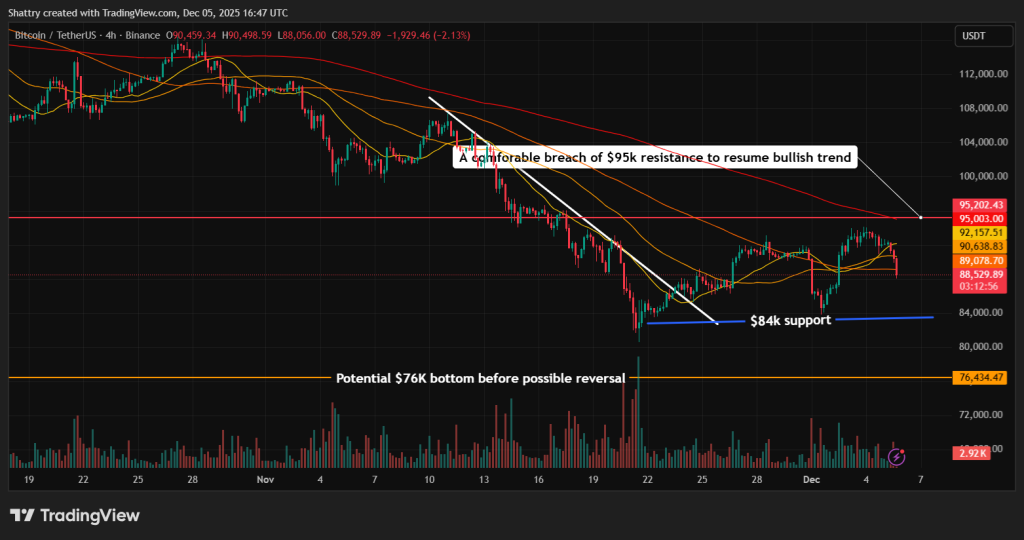

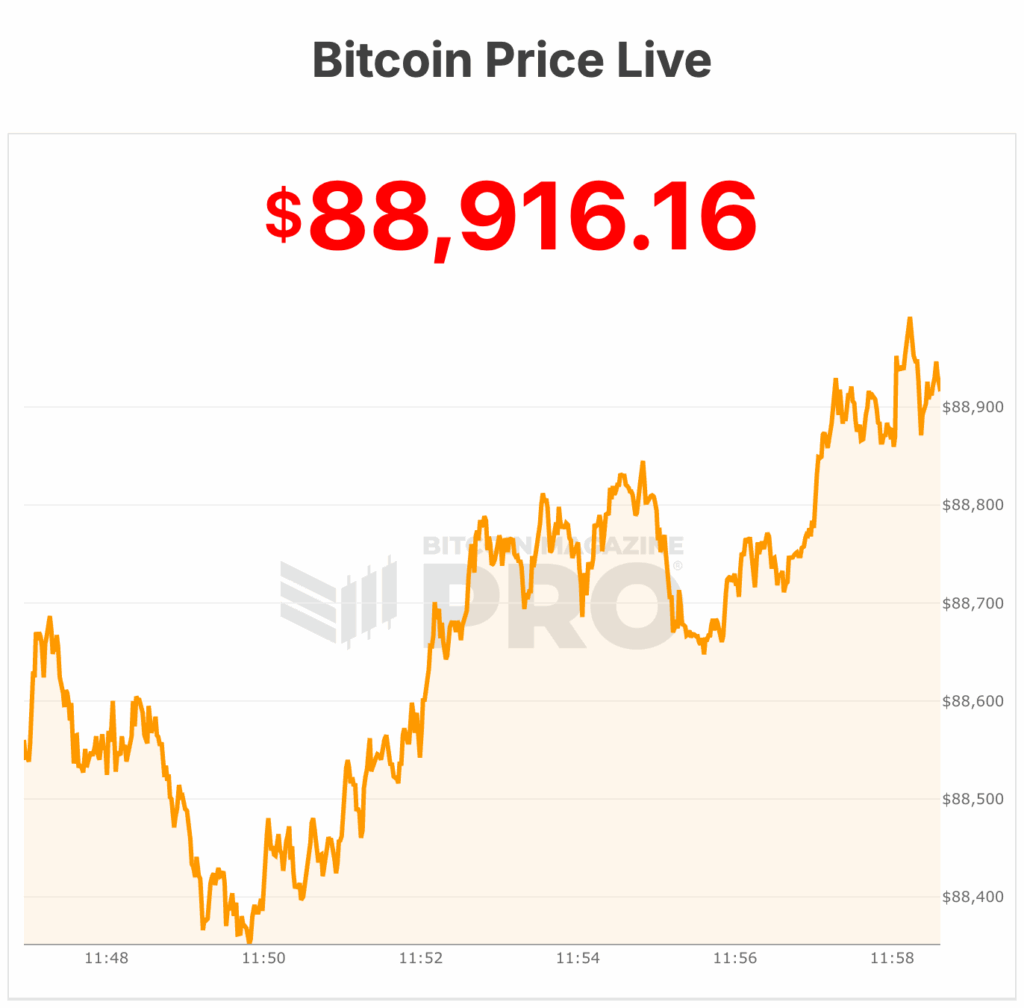

Concerns over Strategy’s dividend stability had grown louder in recent weeks as Bitcoin retreated from its highs.

Le acknowledged the market chatter but dismissed it as exaggerated. “We weren’t going to have an issue paying dividends, and we weren’t likely going to have to tap into selling our Bitcoin,” he said.

“But there was FUD that was put out there that we wouldn’t be able to meet our dividend obligations, which causes people to pile into a short Bitcoin bet.”

This afternoon, Phong Le, CEO of @Strategy, joined @CNBC @PowerLunch to discuss how $MSTR moves with bitcoin, how our USD reserve addresses recent FUD, the shifting Overton Window, key volatility drivers, and why bitcoin’s long-term outlook remains strong. pic.twitter.com/1t5hsfov0m

— Strategy (@Strategy) December 5, 2025

The CEO said raising $1.44 billion in just eight and a half days was intended as a direct response, showing the firm can still attract capital even in a downcycle.

“We did it to address the FUD, and to show people we’re still able to raise money when Bitcoin is under pressure.”

Last week, Le said Strategy would only consider selling Bitcoin if the stock dropped below net asset value and the company lost the ability to raise additional funds.

Strategy has also introduced a new “BTC Credit” dashboard, which it says shows the company holds enough assets to service dividends for more than 70 years.

Strategy Adopts Dual-Reserve Model as BTC Buying Slows

As reported, Strategy has shifted from its long-standing “buy Bitcoin at all costs” approach to a dual-reserve treasury model that pairs long-term BTC holdings with a growing dollar buffer.

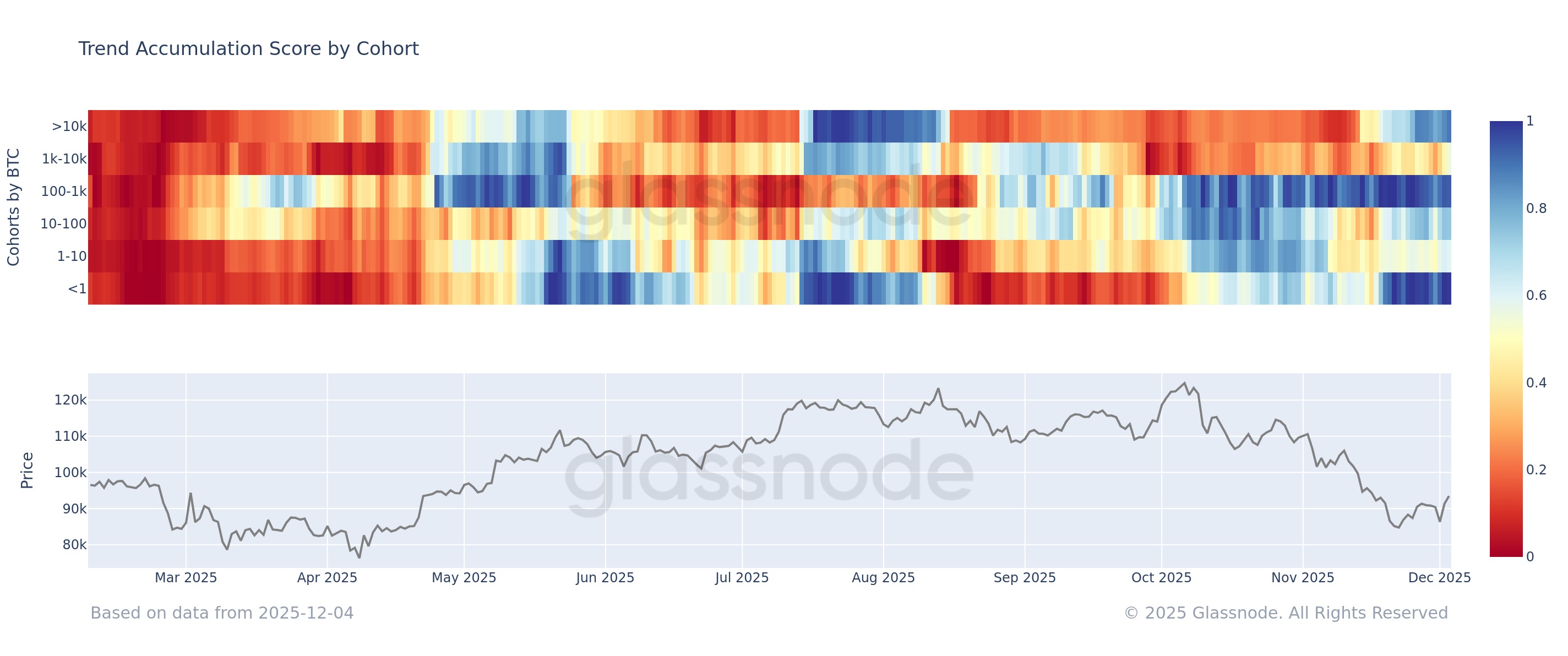

The move follows a dramatic slowdown in the firm’s accumulation pace, from 134,000 BTC per month at its 2024 peak to just 9,100 BTC in November, signaling preparation for a potentially prolonged bear market.

Despite the slowdown, the company remains one of the world’s largest Bitcoin holders, with roughly 650,000 BTC on its balance sheet.

The post Strategy CEO Says $1.44B Cash Reserve Aims to Calm Bitcoin-Slump Fears appeared first on Cryptonews.

BREAKING:

BREAKING:

yesterday.

yesterday.