Why Is Crypto Down Today? – December 5, 2025

After nearly a full week of rising prices, the crypto market is down today, with the cryptocurrency market capitalisation falling by 1.1%, now standing at $3.23 trillion. 90 of the top 100 coins have gone up over the past 24 hours. At the same time, the total crypto trading volume is at $114 billion.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have seen their prices rise over the past 24 hours. Two recorded double-digit increases.

Bitcoin (BTC) fell by 1.2% since this time yesterday, currently trading at $92,227.

Ethereum (ETH) is down by 0.6%, now changing hands at $3,169. This is the smallest decrease among the ten.

XRP saw the highest fall, going down by 3.9% to $2.09.

It’s followed by Solana (SOL)’s 3% to $139.

The only coin to see an increase is Tron (TRX), having gone up 2.4% and currently standing at $0.2868.

Looking at the top 100 coins, we find that only 10 appreciated over the past day.

Provenance Blockchain (HASH) increased the most in the category: 18.5% to the price of $0.02584.

Zcash (ZEC) follows with a 10.2% increase to $396. The rest are up below 4%.

On the other hand, Hyperliquid (HYPE) and Pump.fun (PUMP) fell the most. The former is down 5.6% to $33, while the latter fell 5.4% to $0.003101.

The shift in the market follows a mix of labour data, central bank moves, and choppy equity markets in Asia, Europe and the US.

Meanwhile, major Korean Woori Bank has begun displaying BTC prices inside its main trading room in Seoul. This is the first time a commercial bank in the country has integrated a crypto price feed directly into its main dealing space.

“As digital assets continue to grow in prominence and influence in global financial markets, we determined that they should be monitored as a key indicator to better read overall market trends,” an official said.

— Vivek Sen (@Vivek4real_) December 5, 2025

SOUTH KOREAN BANKING GIANT WOORI BANK JUST STARTED DISPLAYING #BITCOIN PRICE IN THEIR DEALING ROOM

BANKS ARE COMING!! pic.twitter.com/NBiXXhBLe0

‘Holding $96K–$106K Is Critical’

According to Glassnode, Bitcoin stabilized above the critical valuation anchor, the True Market Mean (the cost basis of all non-dormant coins).

“This level often marks the dividing line between a mild bearish phase and a deep bear market,” the analysts explain.

However, the broader market structure is still increasingly mirroring the dynamics of Q1 2022, with over 25% of supply underwater.

“This creates a fragile balance between the risk of top-buyer capitulation and the potential for seller exhaustion to form a bottom. Nevertheless, the current structure remains highly sensitive to macro shocks until the market can reclaim the 0.85 quantile (~$106.2K) as support.”

Importantly, holding $96,000–$106,000 is critical to avoid further downside, says the report.

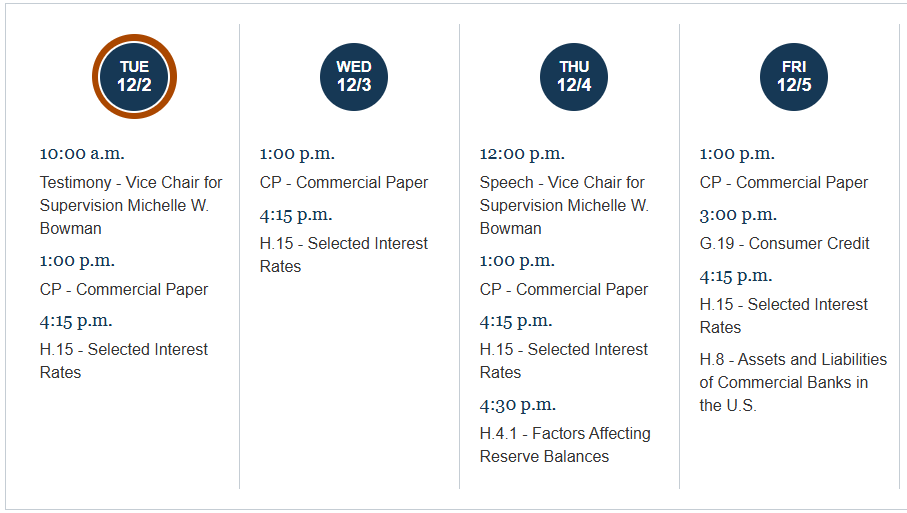

Furthermore, Bitunix analysts noted that the US will release the September PCE inflation data today. The result will directly influence the December rate decision. The probability of a 25-basis-point rate cut currently stands at 87%, the analysts say.

Ahead of this release, “the market has entered a compressed-volatility, wait-and-see structure, with BTC’s key battleground concentrated between $91,000–$95,000. If the data confirm continued disinflation, the probability of a year-end rebound will rise; otherwise, the choppy structure is likely to persist, with capital flows shifting back toward defensive and short-duration positioning.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC stood at $92,227. It started the day with the high of $93,577, gradually decreasing to the current price. Very briefly, it fell to the intraday low of $91,029.

Looking at the past week, we’ve seen the price increase just below 1%. In this period, BTC moved between $84,553 and $93,855.

If the price continues falling, it could go back to the $90,000 level, possibly below. On the other hand, a bullish shift could push it to $96,500 and towards the $100,000 mark.

Ethereum is currently changing hands at $3,169. It initially jumped to the intraday high of $3,217 before briefly plunging to the low of $3,076. It has recovered quickly.

ETH has outperformed BTC in the 1-week timeframe. It’s up 5%, trading in the $2,736-$3,222 range.

A bullish breakout of the $3,350 resistance could confirm a bullish trend reversal. This would clear a path for the price to move above $3,500 and then towards $4,000. However, should the decline continue, we may see a pullback towards $2,900.

Meanwhile, after a couple of days of increases, the crypto market sentiment reversed course and dropped again within the fear territory. The crypto fear and greed index stands at 25 today, compared to 27 yesterday.

Given the level of uncertainty among the market participants at the moment, it wouldn’t be surprising if the index drops back into the extreme fear zone. It would take a significant push from major macroeconomic news for it to quickly move out of the fear and into the neutral zone in the short term. Therefore, it will likely take time.

ETFs Go Red

On Thursday, 4 December, the US BTC spot exchange-traded funds (ETFs) saw a second straight day of outflows with $194.64 million. The total net inflow pulled back to $57.56 billion.

Of the twelve BTC ETFs, five recorded outflows, and none saw inflows. BlackRock accounts for the majority of the negative flows, letting go of $112.96 million. Fidelity follows with $54.2 million.

The US ETH ETFs also posted negative flows on Thursday. They saw $41.75 million in outflows. The total net inflow now stands at $12.95 billion.

Of the nine funds, one recorded inflows, and three saw outflows. BlackRock took in $28.35 million, while Grayscale let go of $30.96 million.

Notably, Strategy, the world’s largest corporate BTC holder, has earmarked a $1.44 billion US dollar reserve as a liquidity buffer against a prolonged market downturn. CryptoQuant argues that this move signals preparation for a potential bear market phase.

Strategy said it may also sell BTC or BTC derivatives as part of its risk-management toolkit if market conditions deteriorate.

Strategy’s Bitcoin buying has collapsed through 2025.

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

Monthly purchases fell from 134K BTC at the 2024 peak to just 9.1K BTC in November 2025, only 135 BTC so far this month.

A 24-month buffer makes one thing clear: they’re bracing for the bear market. pic.twitter.com/qEwXR3JQ82

Meanwhile, quantitative trading firm Jane Street took a stake in the company called Antithesis, which claims to have strengthened the Ethereum blockchain. Jane Street led the company’s Series A funding round, where it received $105 million in total.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market recorded a decrease over the past 24 hours, while the US stock market saw a mixed session on Thursday. By the closing time on 4 December, the S&P 500 was up by 0.11%, the Nasdaq-100 decreased by 0.097%, and the Dow Jones Industrial Average fell by 0.067%. This followed a fresh set of data on the US labour market and preceded a key inflation reading set for today.

- Is this drop sustainable?

Minor drops are common for the markets, and today’s is not out of the ordinary. Analysts argue that we could still see the rally continue, at least in the next few weeks, unless the market is hit by a major macro shock.

The post Why Is Crypto Down Today? – December 5, 2025 appeared first on Cryptonews.

1/5

1/5

EU’s new crypto data-sharing rules will force exchanges and service providers to share user data and transaction records.

EU’s new crypto data-sharing rules will force exchanges and service providers to share user data and transaction records.