UK Financial Watchdog Enters Final Consultation Phase on Crypto Regulations

The UK’s Financial Conduct Authority (FCA) has moved into the final stage of consultations on a sweeping set of proposed crypto regulations, as it advances the government’s broader plan to bring digital assets firmly within the country’s regulatory perimeter.

Key Takeaways:

- The FCA has entered the final consultation phase on 10 proposed rules to regulate the UK crypto market.

- The regulator aims to boost trust and transparency while acknowledging that crypto investment risks will remain.

- A new licensing regime for crypto firms is planned, with applications expected to open in September 2026.

In a recent statement, the FCA said it is seeking feedback on 10 proposed rules, describing the move as the “final step” in its consultation process.

The proposals are designed to shape how crypto firms operate in the UK, while aligning the sector more closely with standards applied across traditional financial markets.

FCA Says New Crypto Rules Aim to Build Trust Without Eliminating Risk

“These proposals continue our progress towards an open, sustainable and competitive crypto market that people can trust,” the regulator said.

At the same time, the FCA stressed that crypto investing will always carry risk, and regulation is intended to improve transparency and consumer understanding rather than eliminate volatility altogether.

The consultation package spans a wide range of market activity.

It includes proposed rules on business conduct standards, restrictions on using credit to purchase crypto, regulatory reporting requirements, asset safeguarding, and how retail collateral is treated when borrowing digital assets.

Stakeholders have until March 12 to submit feedback.

— Ryan (King) Solomon (@IOV_OWL) January 23, 2026

BREAKING: The UK Just Moved to Fully Integrate Crypto Firms Into the FCA Rulebook pic.twitter.com/mGBJ61hLLB

The proposals were first outlined in December, when the FCA signaled its intention to regulate crypto in a manner broadly consistent with conventional financial services.

Since then, the regulator says it has made “significant progress” in refining the framework as part of the government’s crypto roadmap.

Earlier this month, the FCA also published an indicative timeline for a new licensing regime covering crypto asset service providers.

Under the current plan, the application window for firms seeking authorization is expected to open in September 2026, though the regulator noted that details will be confirmed at a later date.

Once in force, the licensing regime would impose tighter oversight on crypto businesses operating in the UK, requiring FCA approval and ongoing compliance with regulatory standards.

UK Weighs Ban on Crypto Donations

As reported, the UK government is considering a ban on cryptocurrency donations to political parties, a move that could directly affect Reform UK, which recently became the first party in the country to accept digital assets.

The proposal is under review as part of the upcoming Elections Bill, according to people familiar with internal discussions, though officials have yet to formally confirm the plan.

The debate follows Reform UK’s push to present itself as Britain’s most crypto-friendly party under the leadership of Nigel Farage.

Furthermore, the UK government has moved a step closer to overhauling how decentralized finance activity is taxed, backing a new framework that would spare users from triggering capital gains each time they deposit tokens into lending protocols or liquidity pools.

The post UK Financial Watchdog Enters Final Consultation Phase on Crypto Regulations appeared first on Cryptonews.

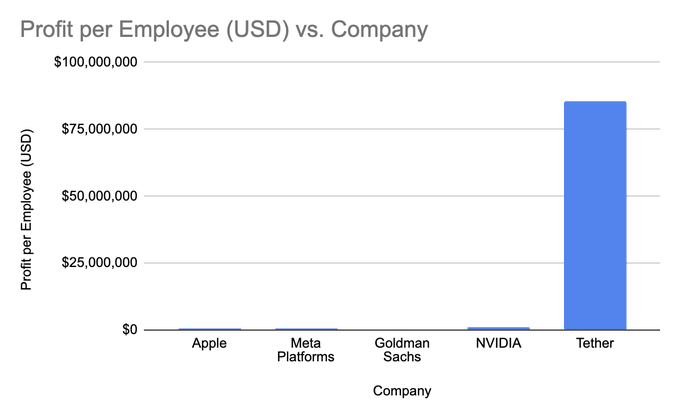

@Tether_to has launched an all-cash bid to acquire Italy’s

@Tether_to has launched an all-cash bid to acquire Italy’s

Changpeng Zhao

Changpeng Zhao

Hackers are exploiting trusted Snap Store packages to steal cryptocurrency by hijacking existing publisher accounts.

Hackers are exploiting trusted Snap Store packages to steal cryptocurrency by hijacking existing publisher accounts.

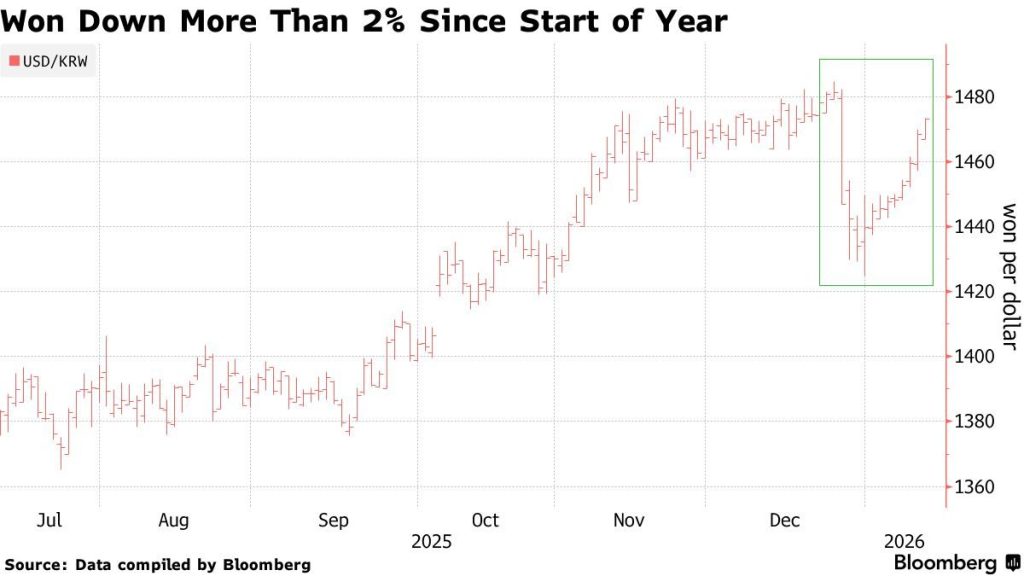

South Korea has launched guidelines, allowing listed companies and professional investors to invest up to 5% of their equity capital crypto.

South Korea has launched guidelines, allowing listed companies and professional investors to invest up to 5% of their equity capital crypto.