Ripple President Monica Long Says Stablecoins to Move From Pilot to Production by 2026

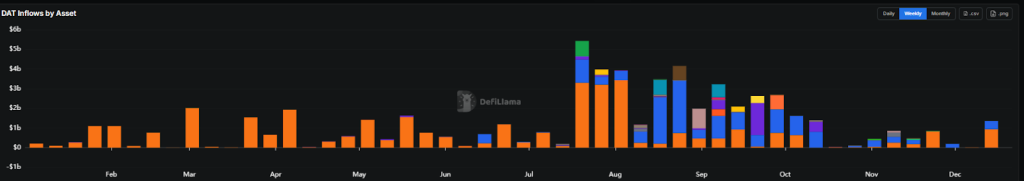

Stablecoins are poised to become a foundational layer of global finance over the next two years, according to Ripple President Monica Long, who says the asset class is shifting from experimental pilots to full-scale production across mainstream payments.

In commentary outlining her expectations through 2026, Long argues that stablecoins are no longer a niche crypto innovation but are on track to become the default infrastructure for cross-border payments, embedded directly into legacy financial rails used by banks, merchants, and corporates worldwide.

Stablecoins Embedded Into Global Payment Rails

Long points to recent developments from traditional payment giants as evidence that stablecoins are being “hard-wired” into incumbent systems.

Visa and Stripe going live with USDC settlement for merchants, she says, marks a turning point where blockchain-based rails are being adopted within existing corporate payment flows rather than operating in parallel.

— Cryptonews.com (@cryptonews) December 16, 2025

Visa Inc. is set to allow stablecoin-based settlement across its US payments network, expanding its suite of crypto-related services.$USDC #Visa https://t.co/i6vVCqWAiH

“In 2026, stablecoins will integrate with legacy financial rails and, within the next five years, become fully integrated into global payment systems,” Long said, adding that cross-border payments are likely to be the first area where stablecoins emerge as the default settlement mechanism.

B2B Payments Drive the Next Adoption Wave

While early stablecoin growth was dominated by retail trading and remittances, Long said she expects business-to-business payments to lead the next phase of adoption.

B2B payments already account for the majority of stablecoin flows, a trend she believes will accelerate as corporates seek efficiency gains.

Beyond faster settlement, Long highlighted the impact on corporate balance sheets, particularly in Europe, where she estimates €1.3 trillion remains trapped in working capital across payables, receivables, and inventory.

Stablecoins, she said, have the potential to unlock this capital by enabling real-time settlement and improved cash-flow management.

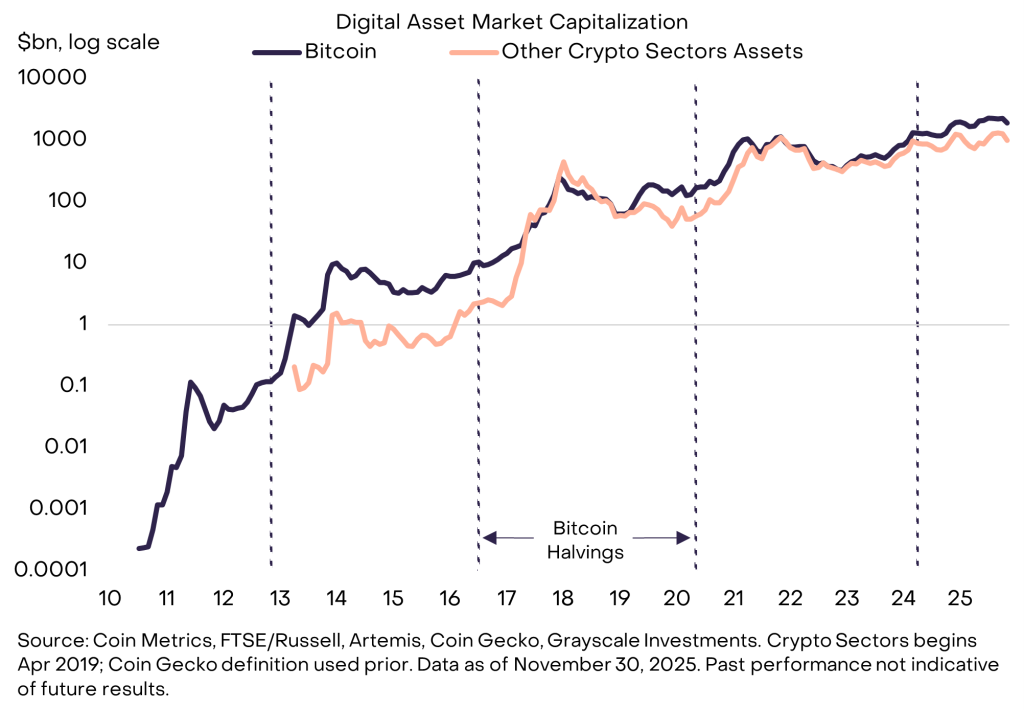

Crypto Shifts From Speculative to Structural

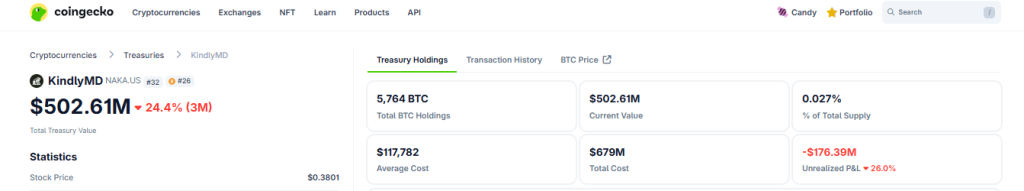

Long also outlines a structural shift underway across the crypto sector. She expects crypto to evolve from an alternative asset class into the operating layer of modern finance, with institutional balance sheets holding more than $1 trillion in tokenized and digital assets by the end of 2026.

Regulatory clarity is a key enabler of this transition. Long cites frameworks such as the EU’s Markets in Crypto-Assets (MiCA) regulation as laying the legal groundwork for a compliant stablecoin market.

By 2027, she expects banks and financial institutions in regulated regions to issue and hold their own regulated stablecoins.

Custody and M&A to Accelerate

As institutional interest grows, Long predicts increased consolidation across crypto infrastructure, particularly in custody services.

The commoditisation of custody, she explains, is likely to drive a new wave of mergers and acquisitions as traditional banks, service providers, and crypto firms seek to accelerate their blockchain strategies.

She expects more than half of the world’s top 50 banks to formalise at least one new digital asset custody relationship in 2026.

Looking ahead, Long believes crypto M&A will increasingly extend beyond the sector itself as firms pursue usability and scale.

“To acquire the next billion users, especially institutions, crypto must get radically easier to use and move outside the echo chamber,” she said.

The post Ripple President Monica Long Says Stablecoins to Move From Pilot to Production by 2026 appeared first on Cryptonews.

CATHIE WOOD SAYS THE BITCOIN

CATHIE WOOD SAYS THE BITCOIN

Strategy’s spot

Strategy’s spot

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA.

The UK Treasury said that it will implement “firm and proportionate” rules for crypto regulation overseen by the UK FCA. The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

The UK has formally recognized cryptocurrencies and stablecoins as legal property through a new Act of Parliament.

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

A federal appeals court in Denver has upheld the Federal Reserve’s right to deny crypto-focused bank

JPMorgan is launching its first tokenized money-market fund on Ethereum, reports the WSJ.

JPMorgan is launching its first tokenized money-market fund on Ethereum, reports the WSJ.

(@MetaMask)

(@MetaMask)