Bonk Price Prediction: BONK ETP Launches in Europe – Could This Spark the First Institutional Meme Coin Run?

The Bonk price has risen to $0.000009452 today, marking an 8.5% gain in a week as the market prepares for a possible FOMC rate cut on Wednesday.

BONK is now also up by 5.5% in the past fortnight, yet it remains down by 28% in a month and by a worrying 79% in a year.

However, there are strong signs that it may be about to turn a corner, with Bonk partnering with Bitcoin Capital to launch Europe’s first-ever BONK exchange-traded product last week.

This could invite substantial institutional investment in the token, allowing for a very positive Bonk price prediction as we move into 2026.

Bonk Price Prediction: BONK ETP Launches in Europe – Could This Spark the First Institutional Meme Coin Run?

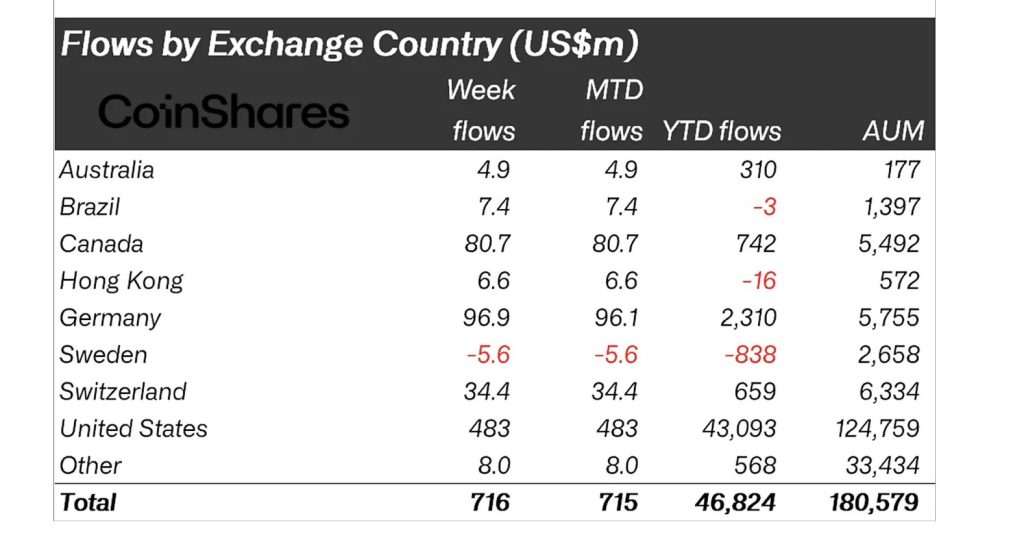

Bonk and Switzerland-based ETP issuer Bitcoin Capital launched the Bonk Exchange Traded Product on SIX Swiss Exchange, which is the third-largest stock exchange in Europe.

As Bitcoin Capital explains in its accompanying blog, the new ETP enables institutional and retail investors to buy and sell Bonk just like a traditional stock, something which could help to expand demand for the popular meme coin, which first launched in December 2022.

Bonk highlights a major ecosystem milestone!

— Bonk, Inc. (@bonkincBNKK) December 8, 2025Launch of regulated BONK ETP on SIX Swiss Exchange (@sixgroup) powered by @Bitcapital_ch!

Another step in bridging the gap between traditional finance and the BONK ecosystem.Read the press release for full details:… pic.twitter.com/K19pwwdf3z

The ETP’s arrival may have come at just the right time, since the Solana-based BONK has declined by 83.7% since reaching an ATH of $0.00005825 in November 2024, not long after Donald Trump won the U.S. presidential election.

Since then, it has gone through two cycles of boom and bust, with the coin rising to a seven-month high of $0.00003877 in July, only to its current level.

If we look at its chart today, we see that it has been in a heavily oversold position since August.

However, its relative strength index (yellow) has begun to rise towards 50 after plunging below 30 in late November, a sign of an impending recovery.

We can say something similar about its MACD (orange, blue), which has also been negative since August.

Normally, this would mean that a more positive phase of growth is long overdue, and the launch of the Bonk ETP may be the catalyst that sets off a recovery.

The aforementioned FOMC meeting could be another catalyst, with analysts expecting the Fed to cut rates by another 0.25% Wednesday.

Combined with the ETP launch, and with the arrival of other altcoin ETFs in the States, this could help push the Bonk price higher.

It has the potential to reach $0.0000150 by the end of January, and to pass its current ATH of $0.00005825 by H2 2026.

PEPENODE Raises $2.3 Million As Presale Hots Up: Is This 2026’s Big Winner?

While BONK certainly has the potential to recover strongly in the coming months, unconvinced traders may want to seek alternatives.

One possibility is to look at presale coins, since these can rally strongly when they list for the first time, especially if they’ve had popular sales.

An example that fits this bill is PEPENODE ($PEPENODE), a new Ethereum-based token that’s planning to shake up cryptocurrency mining.

Whatever it takes to get the Node Upgrade.

— PEPENODE (@pepenode_io) December 1, 2025https://t.co/FaKIaBpf4I pic.twitter.com/oxKHfS1QBY

It has now raised just over $2.3 million in its presale, which will end in 30 days.

PEPENODE will enable users to participate in mining without having to invest in expensive mining hardware and facilities, as you’d have to with proof-of-work tokens such as Bitcoin.

Instead, PEPENODE invites users to build and operate their own virtual mining rigs, which they can expand by spending PEPENODE tokens on more virtual nodes.

More nodes result in greater words, while users can also upgrade their nodes and combine them in novel ways, increasing their rewards even further.

PEPENODE will pay out mining rewards in the form of external tokens, such as the original Pepe and Fartcoin (more coins will be added in the future).

This should create a strong incentive to buy more PEPENODE tokens, pushing its price up over time.

Investors can buy it now, before it potentially surges, by going to the official PEPENODE website and connecting a compatible wallet (e.g. Best Wallet).

The token currently costs $0.0011873, which is its final presale price before the sale ends.

Interested investors should therefore act quickly, since the available signs suggest that PEPENODE could be one of 2026’s biggest new coins.

Visit the Official Pepenode Website Here

The post Bonk Price Prediction: BONK ETP Launches in Europe – Could This Spark the First Institutional Meme Coin Run? appeared first on Cryptonews.

Metaplanet approves the issuance of new Class B shares via a third-party allotment.

Metaplanet approves the issuance of new Class B shares via a third-party allotment.

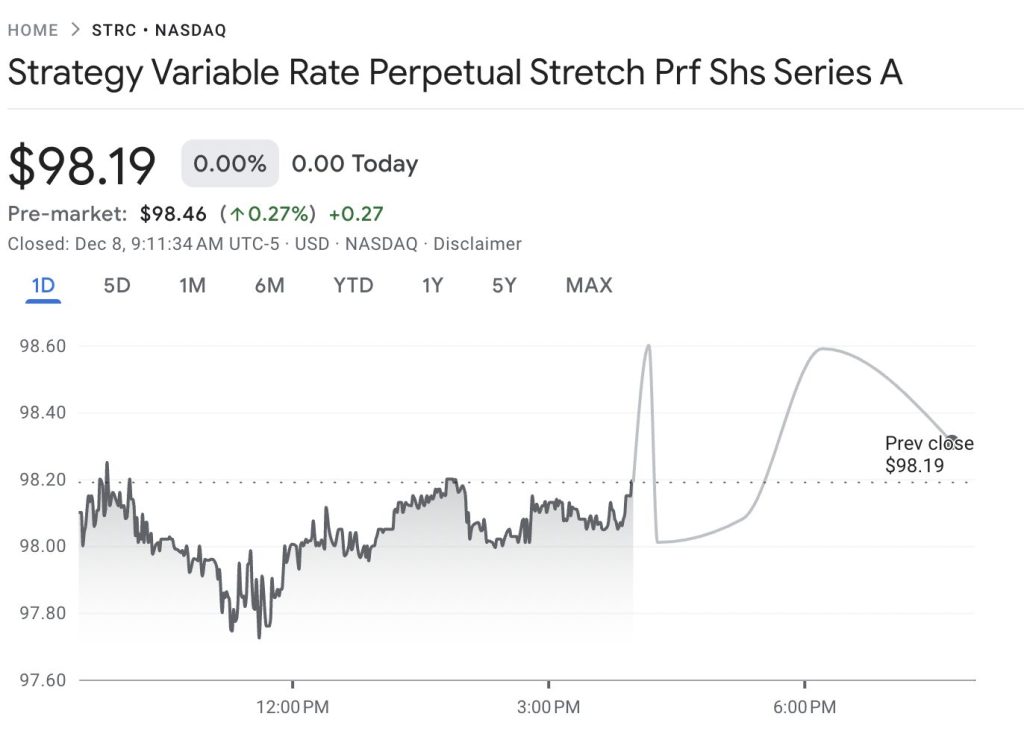

Strategy's business model is unraveling, and it may have to sell off some of its Bitcoin. What would happen if it did?

Strategy's business model is unraveling, and it may have to sell off some of its Bitcoin. What would happen if it did?

Paul Atkins was sworn in as SEC Chairman on Monday, and is expected to have a private ceremony with President Trump at the Oval Office today.

Paul Atkins was sworn in as SEC Chairman on Monday, and is expected to have a private ceremony with President Trump at the Oval Office today. The

The  Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in.

Ondo opens tokenized U.S. stocks and ETFs to global users via Ethereum, with real-time pricing and DeFi compatibility built in. The SEC is weighing an “innovation exemption” to boost tokenization, just as the House passes a landmark stablecoin bill reshaping US crypto policy.

The SEC is weighing an “innovation exemption” to boost tokenization, just as the House passes a landmark stablecoin bill reshaping US crypto policy.

(@paoloardoino)

(@paoloardoino)

Canada’s financial intelligence agency

Canada’s financial intelligence agency

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

Coinbase returns to India after two-year absence, with plans to introduce rupee deposits and fiat trading by 2026.

Harvard economist

Harvard economist

In 2026, we plan to deprecate ZKsync Lite (aka ZKsync 1.0), the original ZK-rollup we launched on Ethereum.

In 2026, we plan to deprecate ZKsync Lite (aka ZKsync 1.0), the original ZK-rollup we launched on Ethereum.