The Unbanked Billion: Why AGI Will Choose Bitcoin Over Dollars

Software agents now plan travel, shop online, and negotiate subscriptions; the next step extends that autonomy from clicks to settlement, since a wallet can be created in code and funded without manual steps.

That shift recasts payments as an API call, and it places public chains and stablecoins in the centre of a new transaction layer that never sleeps.

The idea is not science fiction for distant horizons; it follows directly from how agents already fetch data, route tasks, and make bounded choices, which means a wallet simply gives those choices a way to clear. Once an agent can hold value, it can pay for compute, storage, and data, and it can accept income for work completed, such as labeling, scraping, modelling, or orchestration.

The practical consequence lands in market microstructure rather than marketing slogans, because autonomous clients transact in small bursts at high frequency, and that behaviour rewards always-on rails with low fees, programmable controls, and finality that does not depend on banking hours.

AI Agents and On-Chain Wallets

An agent that operates through a browser or a scripted environment can generate an address, set spending rules, and move funds under policy constraints defined by its owner, and that capability removes the need for a traditional account in many machine contexts.

Bitcoin and major stablecoins already settle value at any hour, and they provide deterministic outcomes that agents can reason about, which reduces operational risk for machine workflows.

In this setting, the wallet becomes a permissions system as much as a purse, since owners can impose daily limits, permitted counterparties, and audit trails, while services can demand proof of funds, time-locked payments, or escrow before fulfilling requests.

Machine wallets then pay other machines for access to GPUs, curated datasets, retrieval bandwidth, or specialised tools, with pricing expressed in tokens that settle quickly and atomically.

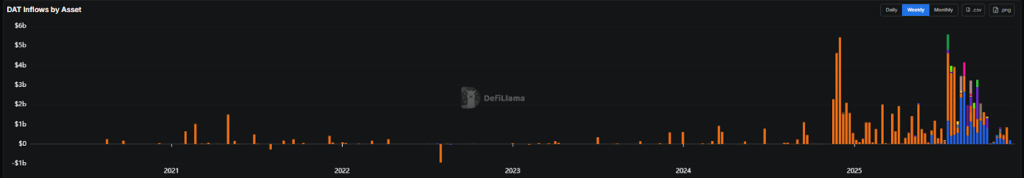

A parallel economy can emerge from these loops, because agents often trade with other agents rather than with people, which creates a constant order flow that ties token liquidity to the cost of compute and the value of data.

— Cryptonews.com (@cryptonews) September 25, 2025

Nansen launches @Nansen_AI a mobile agent bringing onchain data, portfolio insights & soon trading—AI-driven markets. #Crypto #AIhttps://t.co/IEk2JBvVUV

Policy, KYC, and the Fiat-Crypto Bridge

Rules will decide the shape of this market as surely as code will, since financial regulators must map identity, liability, and records to transactions that no banker keys in by hand.

A workable pattern places a verified human or company at the perimeter, delegates spend authority to an agent, and binds the wallet to controls that can be inspected, suspended, or revoked when thresholds or alerts trigger.

Consumer protection fits into that model through disclosures and limits that mirror card frameworks, while anti-abuse controls track flows without forcing every low-value machine payment through manual review.

Payment companies can bridge fiat and crypto by linking fiat balances to on-chain rails for settlement, and by allowing agents to draw against prefunded sources that are tied to known principals.

The result is a system where Bitcoin and major stablecoins clear routine tasks and periodic invoices, banks remain central for fiat entry and exit, and auditability improves because policies live in code rather than policy binders.

The post The Unbanked Billion: Why AGI Will Choose Bitcoin Over Dollars appeared first on Cryptonews.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model. China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.

China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

US agrees to recommend a 12-year prison sentence and a $19m fine for Do Kwon after he has pleaded guilty to wire fraud and conspiracy

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda. Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

Democratic lawmakers have launched a new probe into former President Donald Trump’s growing involvement in the crypto industry.

(@shieldedmark)

(@shieldedmark)

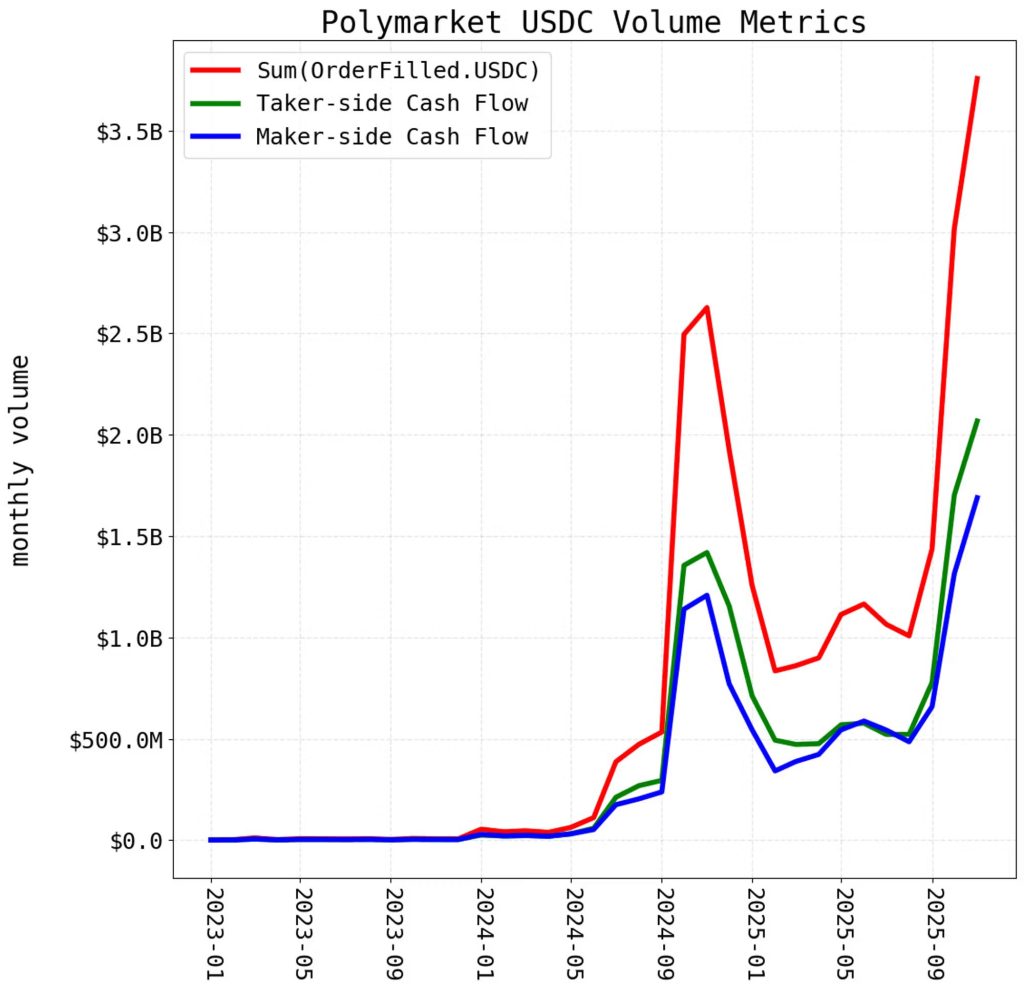

Polymarket is building an internal trading desk to bet against customers as it relaunches in U.S. markets following CFTC regulatory clearance.

Polymarket is building an internal trading desk to bet against customers as it relaunches in U.S. markets following CFTC regulatory clearance.