Harvard Bets Big on Bitcoin With $443M Stake, Outpacing Gold 2-to-1

Harvard University expanded its Bitcoin ETF holdings by 257% in the third quarter, making the iShares Bitcoin Trust its largest disclosed position with $442.8 million as of September 30.

According to Matt Hougan, Bitwise CIO, Harvard simultaneously increased its gold ETF holdings by 99% to $235 million, allocating to Bitcoin at a 2-to-1 ratio relative to gold.

Harvard ramped its bitcoin investment in Q3 from $117m ot $443m. It also boosted its gold ETF allocation from $102m to $235m.

— Matt Hougan (@Matt_Hougan) December 8, 2025

Think about that for a second: Harvard decided to put on a debasement trade and it allocated to bitcoin 2-to-1 over gold.

The $443 million position represents approximately 0.75% of Harvard’s $57 billion endowment, ranking the institution among the top 20 largest holders of the BlackRock-managed fund.

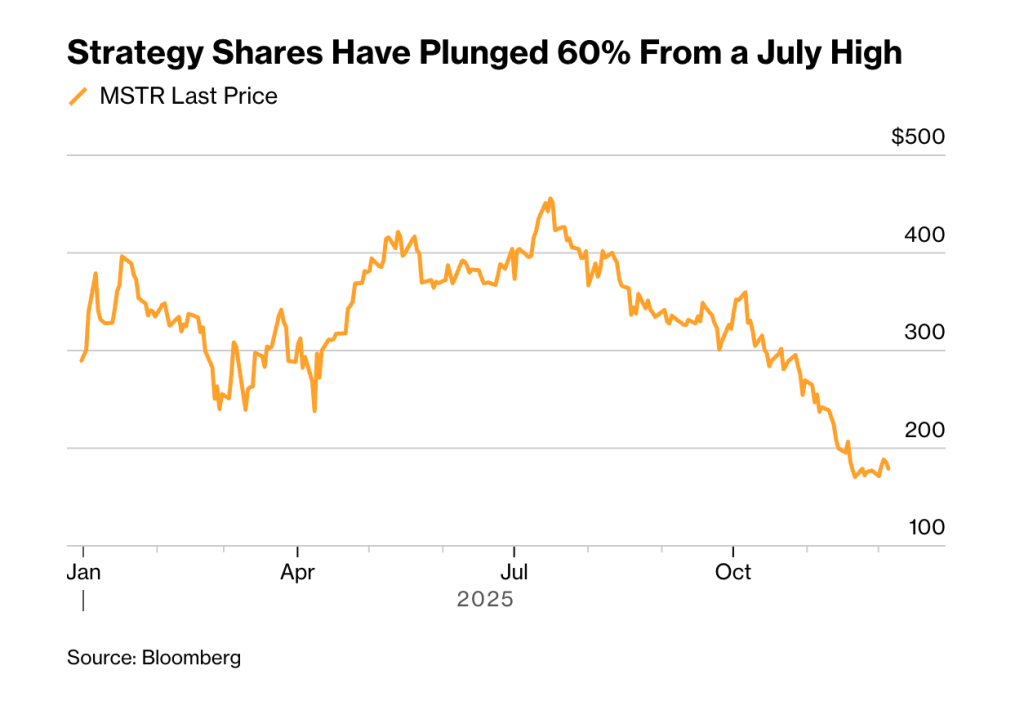

Timing Proves Problematic as Bitcoin Tumbles

Harvard’s aggressive Bitcoin accumulation came right before a sharp market correction that has erased substantial value from its cryptocurrency holdings.

Bitcoin has dropped more than 20% since the third quarter ended, falling from $114,000 to around $92,000.

The timing suggests Harvard could face a 14% loss on its third-quarter purchases in the best-case scenario, assuming shares were bought at July’s low point, which represents an $89 million paper loss on the recent position alone.

While the losses remain a fraction of Harvard’s massive endowment, the university’s annualized returns have lagged behind some Ivy League peers over the past decade, according to WSJ.

Harvard posted an 8.2% return ranking ninth out of 10 elite schools in a Markov Processes International comparison. For the year ending June 30, Harvard reported an 11.9% gain but trailed MIT’s 14.8% and Stanford’s 14.3%.

Stanford finance professor Joshua Rauh explained in an interview with The Harvard Crimson that “investors often seem to view both bitcoin and gold as hedges against a collapse of the international monetary system in general, and against a loss of the US dollar in particular.”

However, he cautioned that “the extent to which either actually protects investors from these forces is uncertain and scenario-dependent.“

Academic Skepticism Meets Institutional Validation

Harvard’s substantial Bitcoin allocation stands in stark contrast to earlier predictions from its own economics faculty.

Kenneth Rogoff, a Harvard professor and former IMF chief economist, stated in 2018 that Bitcoin would more likely trade at $100 than $100,000 within a decade.

“I think bitcoin will be worth a tiny fraction of what it is now if we’re headed out 10 years from now,” Rogoff told CNBC, arguing that removing money laundering and tax evasion would leave Bitcoin with “very small” transaction uses.

Rogoff recently acknowledged his misjudgment in his new book “Our Dollar, Your Problem,” writing, “I was far too optimistic about the US coming to its senses about sensible cryptocurrency regulation.”

— Cryptonews.com (@cryptonews) August 20, 2025

Harvard economist @krogoff admits his $100 Bitcoin crash prediction was wrong as $BTC trades above $115,000.#Bitcoin #Harvardhttps://t.co/AX8l7Aitxz

He added that he “did not anticipate a situation where regulators, and especially the regulator in chief, would be able to brazenly hold hundreds of millions (if not billions) of dollars in cryptocurrencies seemingly without consequence given the blatant conflict of interest.“

Despite growing institutional adoption, criticism of Harvard’s Bitcoin investment has intensified.

MarketWatch columnist Brett Arends called the investment an “environmental catastrophe,” noting that Bitcoin’s global computing network uses more energy than Thailand or Poland annually.

Meanwhile, Stanford professor Darrell Duffie also expressed surprise at the investment, stating, “Bitcoin does not pay dividends and has limited uses as a payment instrument.“

Bitcoin’s Path Forward Remains Uncertain

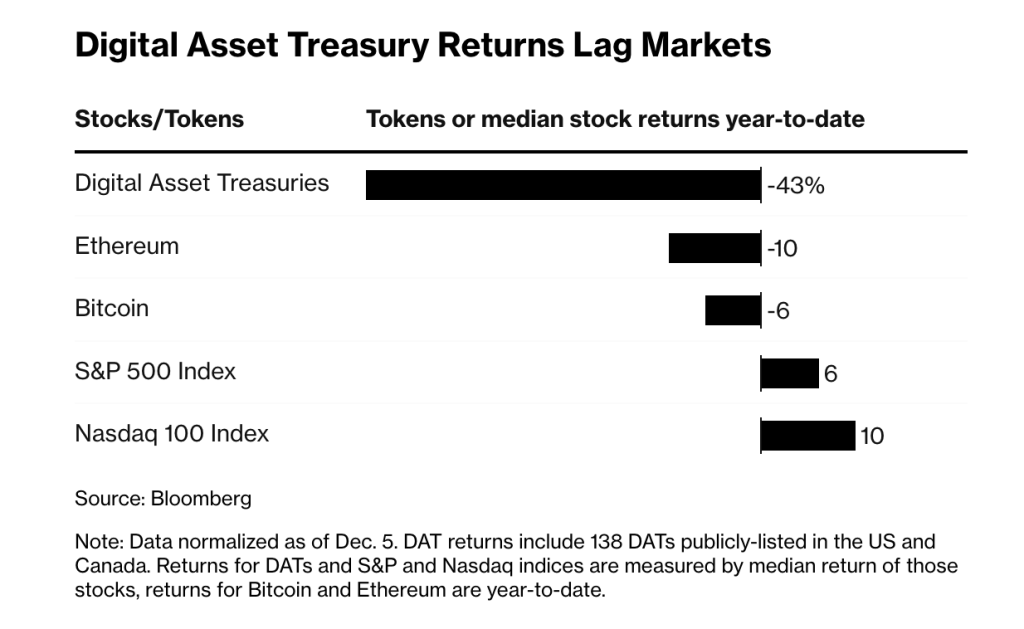

Bitcoin is struggling to find direction amid ETF outflows and weakening market sentiment, creating uncertainty about whether it can reclaim the $100,000 threshold.

More than $2.7 billion has left Bitcoin ETF products over the past five weeks.

Speaking with Cryptonews, Arthur Azizov, Founder and Investor at B2 Ventures, described the current situation as “a market that has lost its anchor at the exact moment it needed stability.“

He noted a disconnect with traditional markets, pointing out that “the S&P 500 is up more than 16% this year, while Bitcoin is down about 3%.“

Azizov identified key resistance levels ahead, explaining that “a large share of Bitcoin is currently held at a loss, so each move toward $96,000–$100,000 meets selling from holders who want to exit at break-even.”

He added that approximately $3.35 billion in Bitcoin options expire around a $91,000 area of interest, making traders cautious.

“Only a strong move above $100,000 could flip the script, restore confidence, and open the way toward $120,000+ level,” Azizov stated.

“If that fails, a deeper pullback to the broad $82,000–$88,000 zone may be needed to attempt to break the $100k ceiling once again.“

The post Harvard Bets Big on Bitcoin With $443M Stake, Outpacing Gold 2-to-1 appeared first on Cryptonews.

In 2026, we plan to deprecate ZKsync Lite (aka ZKsync 1.0), the original ZK-rollup we launched on Ethereum.

In 2026, we plan to deprecate ZKsync Lite (aka ZKsync 1.0), the original ZK-rollup we launched on Ethereum.

The

The

Global crypto exchange Coinbase has registered with India’s FIU—paving the way to resume trading and launch retail services later this year.

Global crypto exchange Coinbase has registered with India’s FIU—paving the way to resume trading and launch retail services later this year.  India stalls full crypto framework due to systemic risk fears. Officials plan to maintain partial oversight with strict taxation rules.

India stalls full crypto framework due to systemic risk fears. Officials plan to maintain partial oversight with strict taxation rules.

(@_Checkmatey_)

(@_Checkmatey_)

South Korean crypto tax may face a fourth delay to 2027 as proposed amendments fail to address framework issues.

South Korean crypto tax may face a fourth delay to 2027 as proposed amendments fail to address framework issues.

Ten European banks are building a euro stablecoin under Dutch Central Bank oversight.

Ten European banks are building a euro stablecoin under Dutch Central Bank oversight.

Sharplink Gaming added $80M in Ether to its reserves, lifting total holdings to $3.6B and cementing its spot as the second-largest corporate holder of ETH.

Sharplink Gaming added $80M in Ether to its reserves, lifting total holdings to $3.6B and cementing its spot as the second-largest corporate holder of ETH.