Solana Price Prediction: Bullish Pattern + 6 Weeks of ETF Inflows – Is SOL About to Break Out Big?

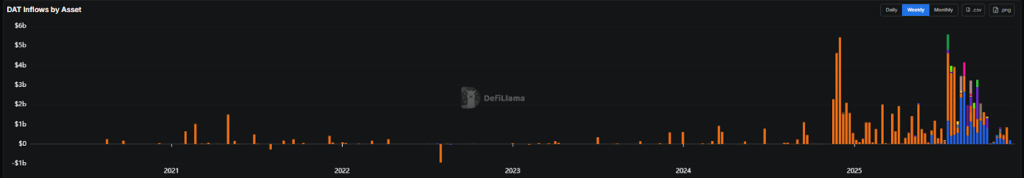

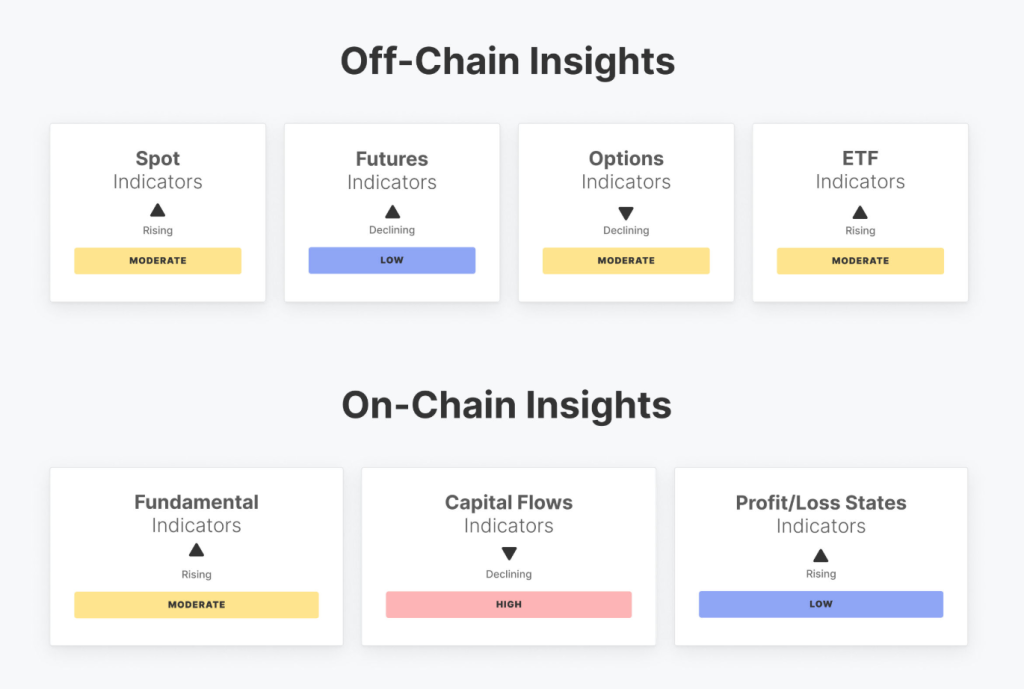

Investors have been steadily pouring capital into SOL-linked exchange-traded funds (ETFs) for six consecutive weeks.

With technical indicators also flashing buy signals, the question now is whether this consistent inflow will fuel a breakout and shift the current Solana price prediction toward new highs.

Last week, $20 million flowed to Solana ETFs despite the latest decline that the token has experienced.

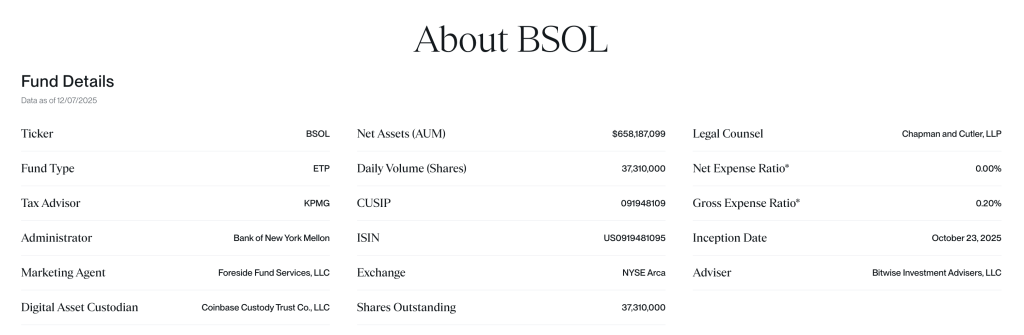

The Bitwise Solana Staking ETF (BSOL) is currently the largest of these vehicles with assets under management of $660 million, followed by Grayscale’s Solana Trust ETF (GSOL), with nearly $160 million in assets.

The staking rewards offered by the Solana blockchain make these vehicles quite attractive for passive investors, especially now that the token has hit an 8-month low at around $125.

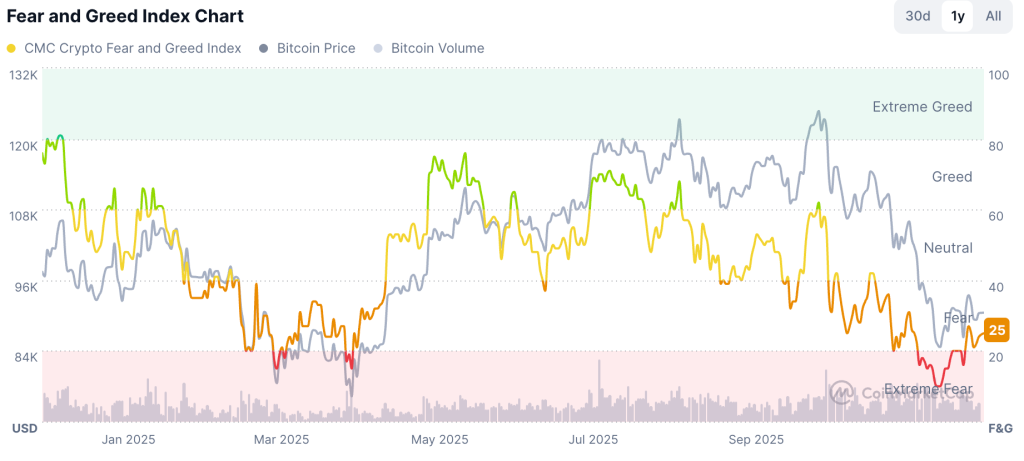

The odds that the downturn will continue are much lower than they were a couple of months ago.

Hence, buying Solana at this level could offer both an attractive opportunity to generate passive income and capital gains if the token starts to recover after the upcoming FOMC meeting.

Solana Price Prediction: SOL Needs a Bullish Breakout Above $160 to Start Recovering

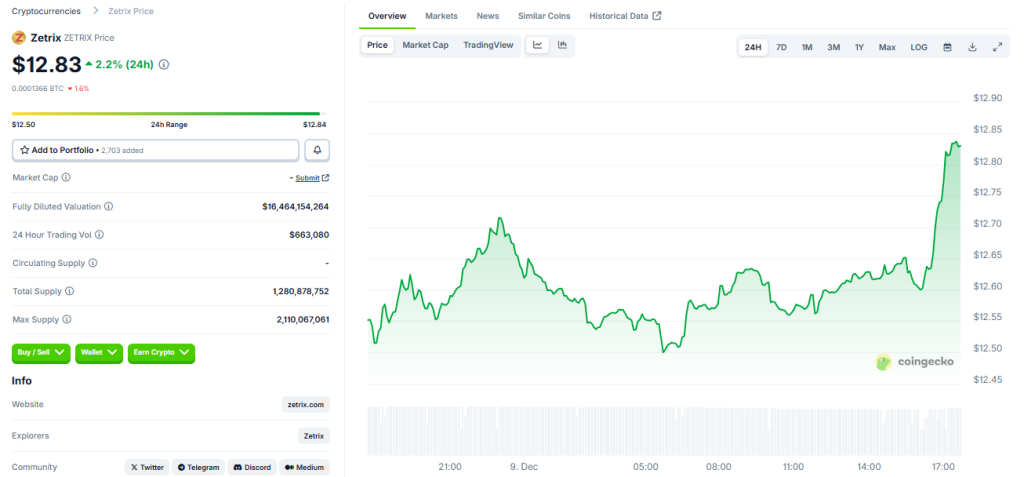

SOL rose near the $140 level yesterday, but the selling pressure is once again pushing the token back to the low 130s.

Trading volumes remain relatively low at $4 billion, accounting for less than 6% of the asset’s circulating market cap.

Historically, SOL needs trading volumes above $10 billion to get moving.

Thus far, SOL has found strong support at $130. However, volumes need to confirm that buying interest is picking up its pace before jumping to conclusions.

Ideally, the price should break through the $160 level to reverse its downtrend and confirm a bullish outlook for the next few weeks.

If that happens, the next stop will likely be $200 as SOL may commence a new uptrend as a result of this move.

Top meme coins in the Solana ecosystem had their moment earlier this year, and now seems to be the time for crypto presales to shine. One of this cycle’s hidden gems could be Maxi Doge ($MAXI), a project that has raised $4 million by tapping into the same energy as Dogecoin’s early days.

Maxi Doge Is Reviving Dogecoin’s Early Hype And $4 Million Says It’s Working

Maxi Doge ($MAXI) has already raised $4 million by channeling the same breakout energy that fueled Dogecoin in its early days.

More than just a meme coin, MAXI is creating a hub where holders can share early opportunities, trading setups, and alpha.

By building a high-energy, community-driven ecosystem, MAXI is designed to thrive in the next crypto cycle.

Through fun competitions like Maxi Ripped and Maxi Gains, traders will get the chance to earn rewards and bragging rights by sharing their best-yielding traders.

In addition, the project plans to invest up to 25% of the presale’s proceeds in promising projects, using the returns to reinvest in Maxi Doge for marketing purposes.

To buy $MAXI and join the pump, simply head to the official Maxi Doge website and link up your wallet (e.g. Best Wallet).

You can either swap USDT or ETH for this token or use a bank card to invest in seconds.

Visit the Official Maxi Doge Website HereThe post Solana Price Prediction: Bullish Pattern + 6 Weeks of ETF Inflows – Is SOL About to Break Out Big? appeared first on Cryptonews.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

GENIUS Act, Anti-CBDC Act, and CLARITY Act pass crucial procedural vote 215-211 in Congress after Trump's decisive Oval Office intervention rescues stalled crypto agenda.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model. China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.

China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.