Bitcoin Volatility Squeeze Signals Directional Move Ahead – What To Expect

Bitcoin is once again entering a critical phase as volatility contracts, and BTC price continues to coil within a tightening range. This volatility squeeze reflects a market in temporary balance, where neither buyers nor sellers have full control, but pressure continues to build under the surface. With macro catalysts and derivatives positioning near the key technical levels, the current compression suggests that BTC may be approaching a decisive expansion.

Bitcoin is being held in place, but is about to break. In an X post, an analyst known as NoLimit revealed data showing why BTC feels stuck between $85,000 and $95,000. While everything else is moving up, the magnetic pull that is holding BTC back will expire in 4 days. BTC is currently trapped inside a massive options web, and the chart shows the concentration around January 30 is nearly double that of any other date.

Why Low Volatility Often Precedes Big Moves

Currently, the market makers are sitting in a Long Gamma position in this range, which will completely change how the price behaves. When BTC price rises, dealers are forced to sell to stay hedged, and when it dips, they’re forced to buy to stay hedged. This setup reveals why every pump is immediately rejected and why every dump is bought up instantly, not weak buyers, but forced dealer activity.

Related Reading: Bitcoin Price Mirroring Key Patterns From 2021 – Is History About To Repeat?

The data has also shown a massive gamma unwind on January 30. As BTC approaches that expiration, the magnetic force holding the price in this range will start to fade. Once those options expire, the hedges and the mechanical selling pressure that have been suppressing BTC rallies would disappear. Thus, the market would move from a pinned to a released market. When that much gamma leaves the system at once, the move is usually fast and aggressive.

NoLimit noted that he will share an update in 4 days of the expiration of the magnetic pull holding BTC back. The analyst emphasized that he has been an analyst for over 10 years, and called every major market top and bottom publicly, including the $126,000 BTC all-time high. When the next move is set up, he ensures to post it publicly for everyone to see.

How Bitcoin Price Holds Structure Despite Sell Pressure

Bitcoin is bullish on Cumulative Volume Delta (CVD) divergences, and the price is starting to build up, which could be an early sign of absorption by a larger entity. A full-time trader known as CEDOZXBT has pointed out that the market structure in CVD and price action is the key setup.

At the same time, open interest (OI) has continued to rise, showing that shorts are entering the market at the point of order. This is an early stage for full validation, but if this structure continues to build up, it could be interesting and great for a long setup.

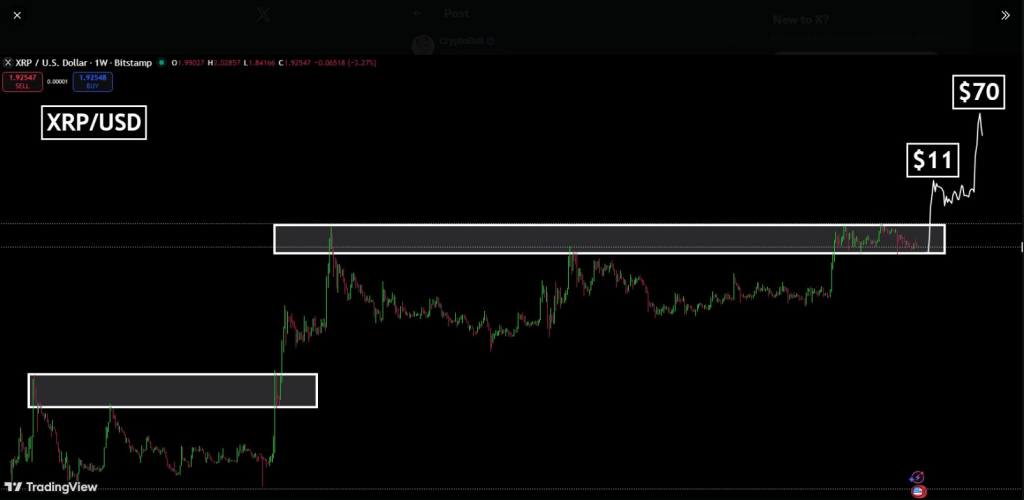

Headline: Everyone is calculating the

Headline: Everyone is calculating the  The “base fee” (0.00001 XRP) only exists when the network is quiet. But what happens if the world actually starts using the XRPL at its 3,400 TPS limit?

The Congestion Math:

As the…

The “base fee” (0.00001 XRP) only exists when the network is quiet. But what happens if the world actually starts using the XRPL at its 3,400 TPS limit?

The Congestion Math:

As the…