Analyst Maps Shiba Inu Roadmap With 1,800% Upside If Altseason Plays Out

Crypto analyst Quantum Ascend has published a weekly-chart “roadmap” for Shiba Inu (SHIB) in a new video, laying out three upside targets for a potential altcoin cycle, while warning that SHIB’s deep multi-year drawdown could cap the move if macro conditions deteriorate.

The Base Case For Shiba Inu Price

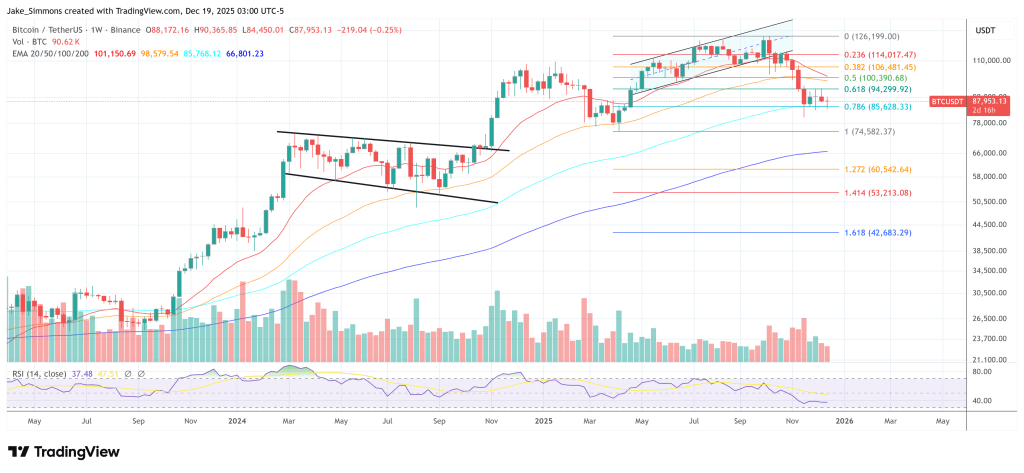

In his X post, Quantum Ascend listed “Altseason Targets” as a conservative level (“$0.47 e-8,” as written), a “Primary” target of $0.00014, and a “Blow-Off” target of $0.00035. In the video, the analyst anchored the roadmap to Elliott Wave-style structure and Fibonacci extensions, and emphasized that the bullish path is conditional, not guaranteed.

Starting from SHIB’s 2021 peak and the subsequent collapse, the analyst said the drawdown returned price to a historically meaningful zone: “Count out the five wave moves there pretty cleanly, but since then, nothing but a drawdown… Came back down right into this wave four low.”

From that setup, Quantum Ascend argued the decline can be read as a “crashing pattern” that often resolves with a reversal back toward prior highs.

“So you have your five waves down, and typically what’ll happen, price will roll back up to the fourth wave, and then what it does is it’s going to come take out this fifth wave. This is six, come take out that fifth wave, even if it’s just a little for a wave seven, then it’s done and it turns back the other direction, right? So when we’re looking at it from this perspective, we can see pretty textbook for the level it went to,” the analyst said.

“So now that you see the case for a new high… we got to start taking these fibs into play here and figure out, all right, where’s some logical price levels for this thing to end up.”

Quantum Ascend then flagged the biggest constraint: SHIB’s magnitude of drawdown relative to prior-cycle behavior. “The one thing that’s stopping me from saying, yep, 100%, we’re going to see new highs, is going back to 2021, price is down 93% at the worst and right now down 92%,” the analyst said.

“Back in 2021, coins that set their highs in 2017 and had a 90% plus drawdown did not set new highs in the 2021 cycle… So this is a four-year range down 90 plus percent. It fits the parameter of some of those other coins that never ended up going off into a new all-time high.”

If that historical analog holds, the analyst said SHIB could be tracing a larger corrective structure rather than a fresh impulse. “If that’s the case, then this count would be five waves up and then we have an A, B into the retracements, and then C would start taking us much lower. That coincides with a recession-depression type feel,” the analyst said, adding: “And I do believe that that is the base case moving forward here… It’s just really important to understand the broader macro climate. Like this Shiba isn’t going unless everything else is lined up.”

The Bullish Case For SHIB Price

Even so, Quantum Ascend laid out upside zones using confluence between broader and nearer-term Fibonacci ranges. The analyst’s stated primary target for an “altseason environment” is the 1.618 Fibonacci extension at roughly $0.00014 which translates to a 1,800% rally from the current price. He added: “My blow-off is going to be a full 4.236 extension here of this range.” The blow-off scenario hits $0.00035, but was presented by him as technically possible but unlikely.

Market-cap math was used as a reality check. “The thing I’ll say about SHIB is it’s at a $4.2 billion market cap right now. That’s pretty big, especially for what it is,” the analyst said, estimating that a move to the conservative area would imply roughly a $25 billion valuation and that the most extreme scenario would push into triple-digit billions. “That is massive getting up there… That’s like a 50x from where we’re at. And at that point, you’re talking 200 billion for a coin that doesn’t really do anything… In no way, shape, or form is this my base case.”

Macro Structure Points to New Highs

Altseason Targets

➤➤ Conservative: $0.47 e-8 ➤➤ Primary: $0.00014

➤➤ Blow-Off: $0.00035

Here’s the Roadmap

pic.twitter.com/nWxQsVtLvv

— Quantum Ascend (@quantum_ascend) December 18, 2025

Despite publishing upside targets, Quantum Ascend stressed exit discipline over maximal upside capture, noting he does not hold SHIB. “I don’t own this coin, but if I did, I would be layered out all in this area [from the 0.5 Fibonacci level at $0.00004699] … I’d be done by the time it got up to that 1.618 Fibonacci at $0.00014,” the analyst said, arguing that “dollar cost averaging both in and out is a great strategy” in a meme-coin trade that ultimately depends on broader liquidity and risk appetite.

At press time, SHIB traded at $0.00000738.

(@david_eng_mba)

(@david_eng_mba)

: Silver soars to $66 for the first time in history

: Silver soars to $66 for the first time in history