Can Bitcoin Price Still Hit $140,000? What The Global M2 Money Supply Says

The Bitcoin price outlook remains under scrutiny as market analysts assess whether the world’s largest cryptocurrency can still reach $140,000. Given BTC’s recent downturn and fluctuating price, it’s understandable that a dramatic surge to $140,000 could be viewed skeptically. However, the analyst points to global M2 Money Supply, highlighting its correlation with Bitcoin and its support for a significant upside move.

New discussions have emerged in the crypto space about the relationship between the Bitcoin price action and the global M2 Money Supply. Pseudonymous crypto analyst ‘MoneyLord’ has projected a massive price surge to $140,000 for BTC based on M2 data. The analyst noted that many people are skeptical about the relevance of M2 Money Supply, likely questioning whether it still holds predictive value for Bitcoin’s performance.

Global M2 Money Supply To Fuel $140,000 Bitcoin Price Surge

According to MoneyLord, the recent disconnect between Bitcoin and M2 data should not be viewed as a failure of the model, but rather as a consequence of aggressive market interference and increased stress across global financial systems. In his technical report released on X, he argued that, without heavy manipulation and the collapse and insolvency of major entities, Bitcoin would have continued to track global liquidity growth.

Related Reading: Is It More Profitable To Hold Bitcoin For The Short-Term? 2025 Numbers Are Here

MoneyLord believes that those shocks temporarily suppressed BTC’s price expansion, likely contributing to its recent decline and slow momentum. With market conditions somewhat stabilizing, the analyst suggests that Bitcoin is poised to realign with global M2 Money Supply trends, potentially setting the stage for renewed upward momentum.

From this perspective, the current phase is viewed as a delayed reaction rather than a failed cycle. MoneyLord predicts that if Bitcoin begins to catch up with M2 data, the cryptocurrency’s price could hit a target above $140,000 sooner than the market expects. The accompanying chart illustrates this bullish outlook, showing global liquidity, represented by the blue line, continuing to rise toward the projected price.

With Bitcoin trading near $90,000 after a more than 6% decline this month, a rally to $140,000 would require a gain of at least 55%. Reaching this level would set a new all-time high, exceeding its present peak of over $126,000 by more than 10%.

Bitcoin Shows Resilience Amid Market Sell-Offs

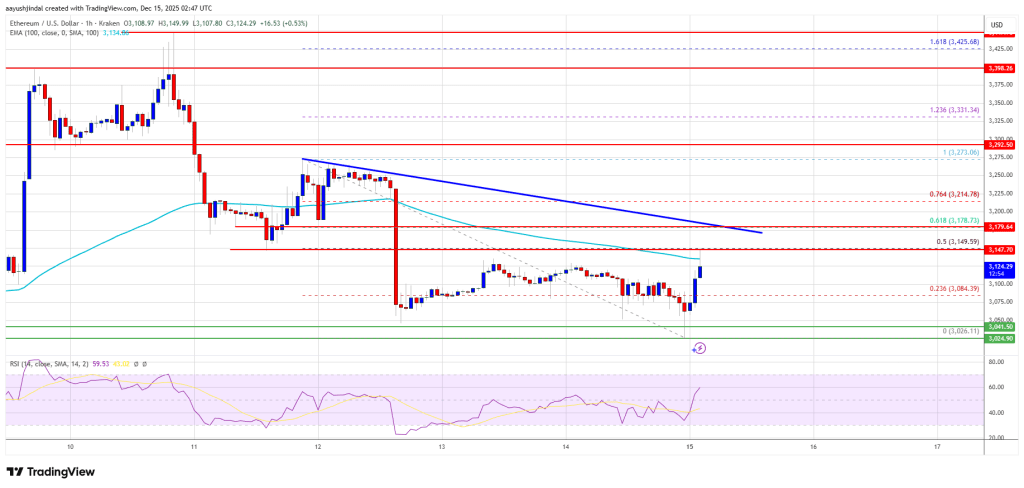

According to crypto analyst Don, Bitcoin has bounced back after a period of sharp sell-offs that shook out many traders and triggered widespread liquidations. The analyst noted that bulls have stepped in to reclaim critical support and restore confidence in the market as BTC resumes trading within a well-defined ascending triangle pattern.

The chart shows that the triangle has an upper boundary near $94,324 and a lower boundary around $89,241. Price action inside the formation suggests that Bitcoin is consolidating and likely building momentum for a potential breakout.