Altcoin Rally Alert: 4 Bullish Signals To Watch Out For – Analyst

Prominent market analyst Michael Van de Poppe has shared four market conditions that would confirm an altcoin market rally. Meanwhile, the cryptocurrency market continues to experience a widespread correction, weighing down the price growth of several assets.

Ethereum Outperforms Bitcoin: A Positive Sign For Altcoins?

Ethereum has shown more resilience in the last month than Bitcoin, which is largely interpreted as a bullish signal for altcoin enthusiasts. In the last week alone, the prominent altcoin reported a slight market gain of 0.86% compared to Bitcoin’s loss of 1.95%. When Ethereum outperforms Bitcoin, it encourages increased altcoin activity, as investor confidence spreads beyond the market leader into the broader crypto ecosystem.

However, a full altcoin market takeover only comes into effect after the following technical developments. Firstly, de Poppe explains that Bitcoin, as the market leader, must achieve a breakthrough above $92,000 resistance, potentially testing the $100,000 mark, to signal renewed market strength. Additionally, the analyst states the ETH/BTC ratio must stay above its 20-day moving average (MA), indicating Ethereum’s continued dominance and further encouraging altcoin accumulation. Together, these signals could set the technical bedrock for a significant altcoin rally.

Macro Factors Could Amplify Altcoin Gains

Beyond crypto-specific indicators, de Poppe also touches on broader financial market plays that could initiate the next altcoin move. The analyst suggests that a 5-10% correction in gold prices, coupled with a peak in silver, could encourage capital to flow into riskier assets like cryptocurrencies including cryptocurrencies.

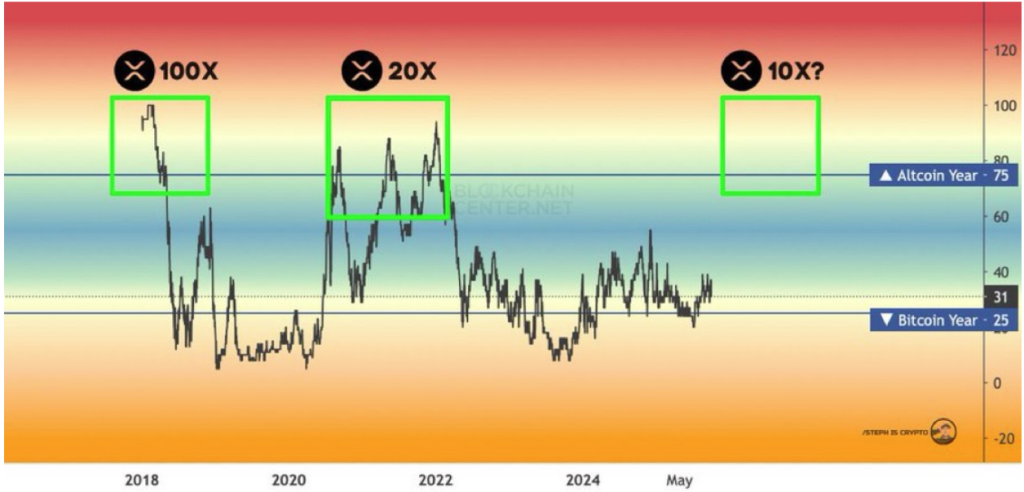

Meanwhile, a strong upward movement in the Nasdaq would indicate increased investor risk appetite, a development that often translates into heightened activity in the crypto markets. When combined with positive momentum in Bitcoin and Ethereum, these macro signals could create an environment ripe for a substantial altcoin rally. According to de Poppe, the fulfillment of these conditions indicates that altcoins could achieve market gains of 200%-300% in the present market cycle.

Market OverviewAt the time of writing, the total cryptocurrency market is valued at $3.04 trillion, following a significant 15.5% decline over the past month. Meanwhile, the altcoin market cap stands at $1.26 trillion, accounting for 41.44% of all circulating digital assets. In tandem, data from CoinMarketCap shows the altseason index at 20/100, as Bitcoin still maintains a dominant grip on overall market performance, with a 58.6% dominance.

In short, the conditions for a full-scale altcoin breakout have yet to materialize, but the key indicators highlighted above suggest that scenario may be approaching if momentum shifts decisively toward risk assets.