Are Dogecoin ETFs Dead On Arrival? Dwindling Volume Suggests Investors Are Not Interest – Details

The Dogecoin ETFs have continued to record low demand since they launched last month, indicating the lack of interest from institutional investors in the meme coin. Notably, DOGE has also seen the lowest demand through these ETFs among the top coins by market cap.

Dogecoin ETFs Record Dwindling Volume And Inflows

SoSoValue data shows that the Dogecoin ETFs have continued to see their daily volume and inflows decline since they launched last month. On December 10, the Grayscale and Bitwise DOGE ETFs recorded a trading volume of $125,100. Meanwhile, these funds as a group saw a total net inflow of $171,920 on the day.

Further data from SoSo Value shows that the Dogecoin ETFs trading volume has been on a decline since December 2, when they recorded a daily trading volume of $1.09 million. These funds have recorded only three 7-figure trading volume days out of 12 trading days since November 24, when Grayscale’s Dogecoin fund launched.

This is relatively low and signifies little demand for the DOGE ETFs among institutional investors. For context, Grayscale’s Chainlink ETF, the only LINK fund at the moment, has outperformed the Dogecoin ETFs despite launching at the start of this month. Grayscale’s LINK ETF has a total net asset of $77.71 million, while the DOGE ETFs have total net assets of $6.01 million.

The net flows also highlight the underperformance of these Dogecoin ETFs. Since launching, Bitwise’s DOGE fund has recorded a net outflow of $972,840. Meanwhile, Grayscale’s fund has taken in just over $3 million. The funds, as a group, have recorded net inflows on five of 12 trading days.

Possible Reason For The Underperformance

Bloomberg analyst Eric Balchunas had warned before now that crypto ETFs like the Dogecoin ETFs would record fewer assets given their distance from Bitcoin in terms of market cap. “’The further away you get from BTC, the less asset there will be,’ he said. Notably, DOGE funds have the lowest net assets among the top 10 cryptos by market cap with ETF wrappers.

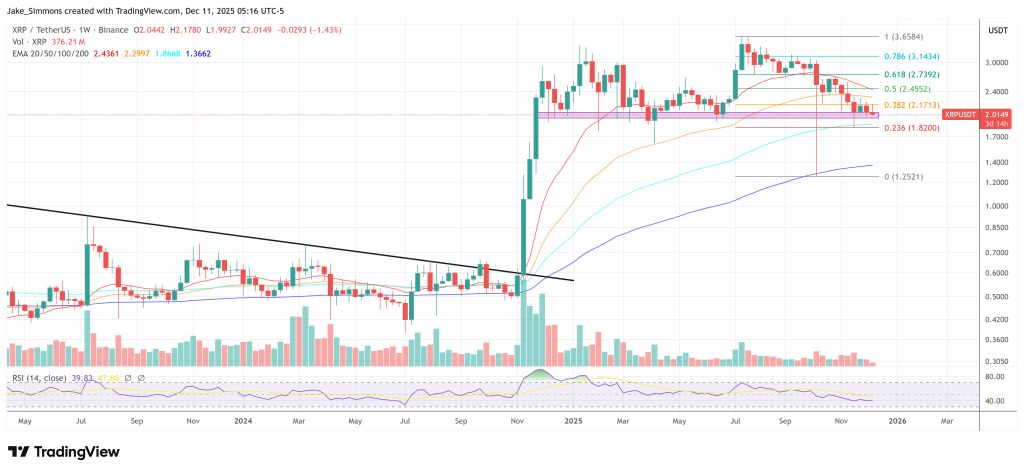

The Solana and XRP ETFs, which also just launched last month, have outperformed the Dogecoin ETFs, although there are more funds offering SOL and XRP. Meanwhile, Balachunas’ theory hasn’t applied to the LINK ETF, as it has outperformed DOGE funds despite Chainlink having a lower market cap than Dogecoin.

Furthermore, the Hedera and Litecoin ETFs also boast larger net assets than the Dogecoin ETFs, indicating that institutional investors are simply not bullish on DOGE, possibly due to its meme coin status and lack of utility. DOGE is, so far, the only meme coin with an ETF wrapper.

At the time of writing, the DOGE price is trading at around $0.138, down over 6% in the last 24 hours, according to data from CoinMarketCap.

Bitcoin 2. slāņa mērogošana, izmantojot Solana ātruma infrastruktūru.

Bitcoin 2. slāņa mērogošana, izmantojot Solana ātruma infrastruktūru.

Kanoniskais tilts, kas nodrošina ātru un drošu BTC pārskaitījumu starp ķēdēm ar ”staking” atlīdzību.

Kanoniskais tilts, kas nodrošina ātru un drošu BTC pārskaitījumu starp ķēdēm ar ”staking” atlīdzību.

Augsta caurlaidspēja un zemas komisijas maksas, kas paredzētas Web3 lietotnēm un maksājumiem.

Augsta caurlaidspēja un zemas komisijas maksas, kas paredzētas Web3 lietotnēm un maksājumiem.

Līdz 40 % ”staking” atlīdzība agrīniem tīkla dalībniekiem.

Līdz 40 % ”staking” atlīdzība agrīniem tīkla dalībniekiem.

Spēcīgs ICO impulss, jau piesaistot vairāk nekā 29 miljonus dolāru.

Spēcīgs ICO impulss, jau piesaistot vairāk nekā 29 miljonus dolāru.

South Korea is the second-largest crypto market…

South Korea is the second-largest crypto market…