‘Pay 13 Bitcoin or We Blow It Up’: Hyundai Bomb Threat Shakes South Korean Offices

Bitcoin Magazine

‘Pay 13 Bitcoin or We Blow It Up’: Hyundai Bomb Threat Shakes South Korean Offices

Hyundai Group evacuated employees from two major offices in Seoul today after receiving a bomb threat email demanding payment in bitcoin, police said.

Authorities later confirmed the threat was a hoax, but the incident added to growing concern over a recent wave of extortion, crypto and non-crypto related, threats targeting South Korea’s largest companies.

According to local reports, a 112 emergency call was received at about 11:42 a.m. The caller relayed the contents of an email sent to Hyundai. The message said an explosive device would be detonated at Hyundai Group’s building in Yeonji-dong, Jongno-gu, at 11:30 a.m.

It added that a second bomb would be taken to Yangjae-dong, Seocho-gu, where Hyundai Motor Group maintains a major office.

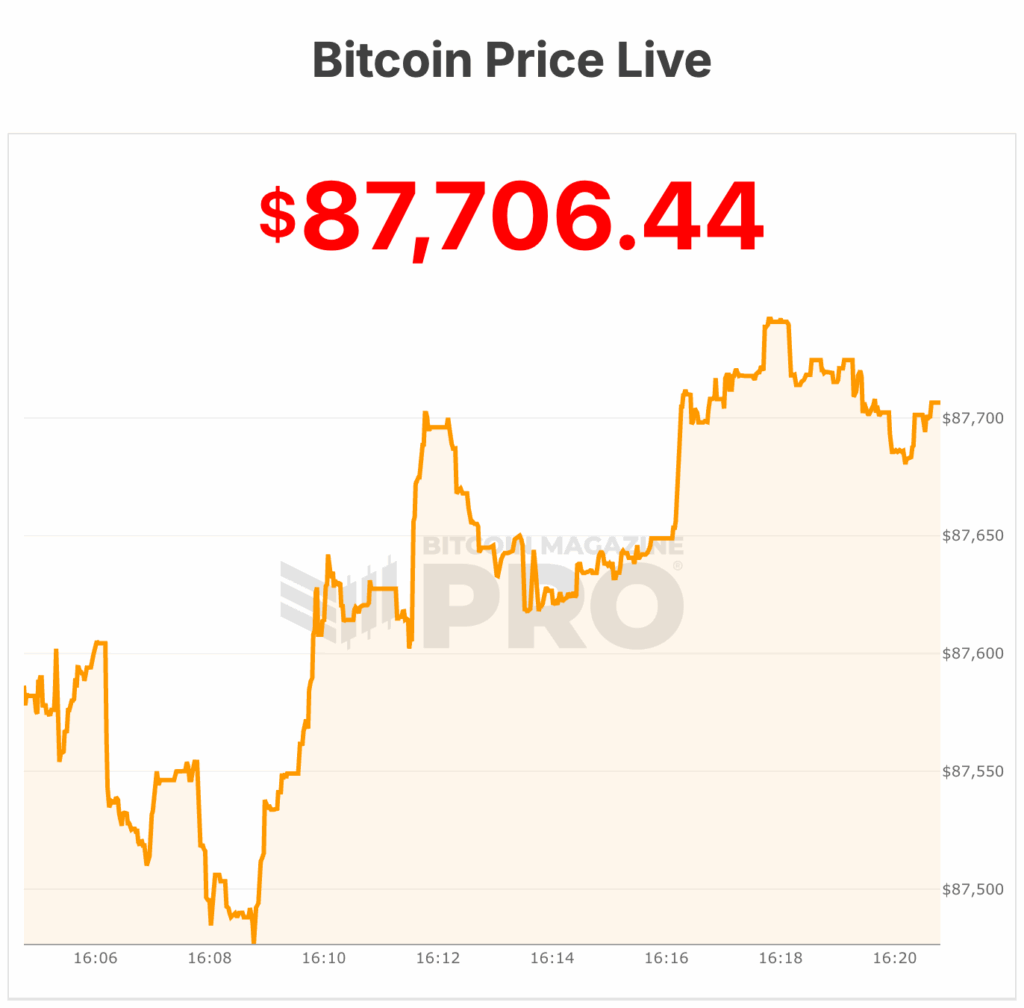

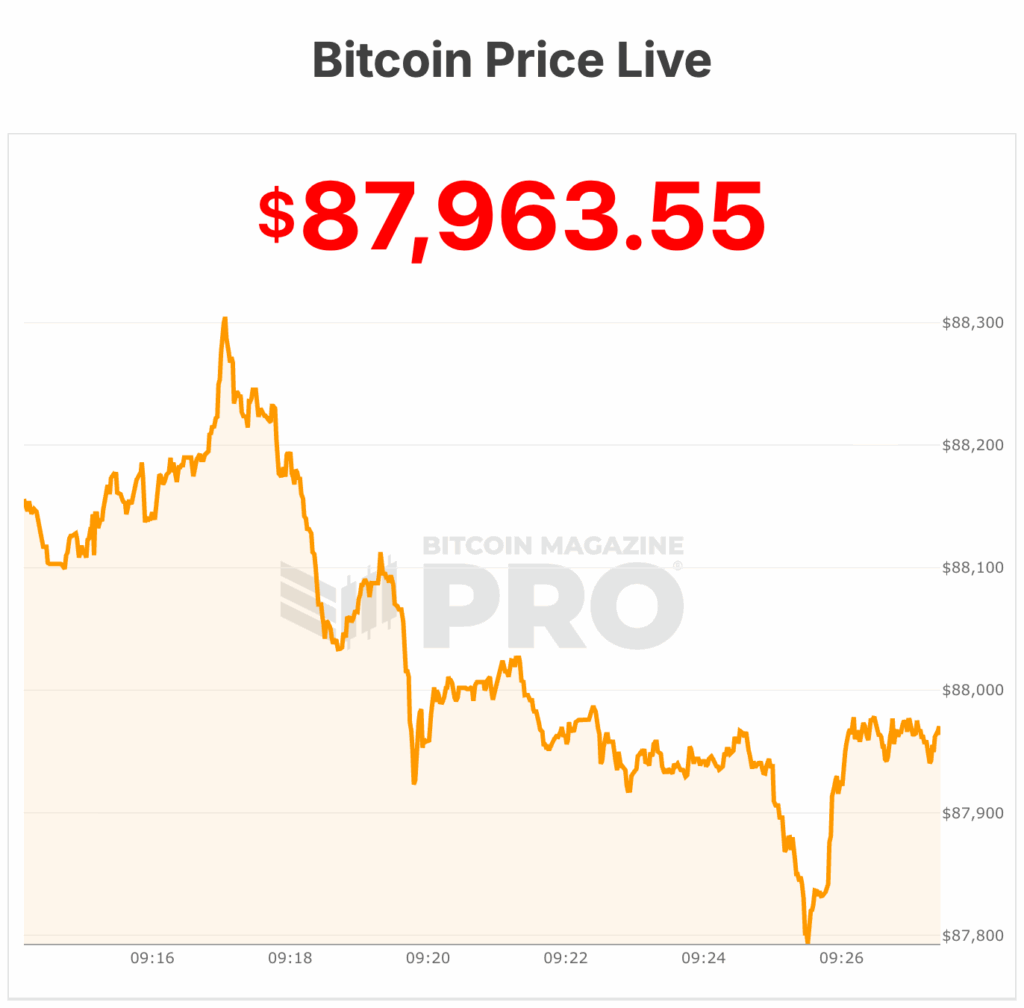

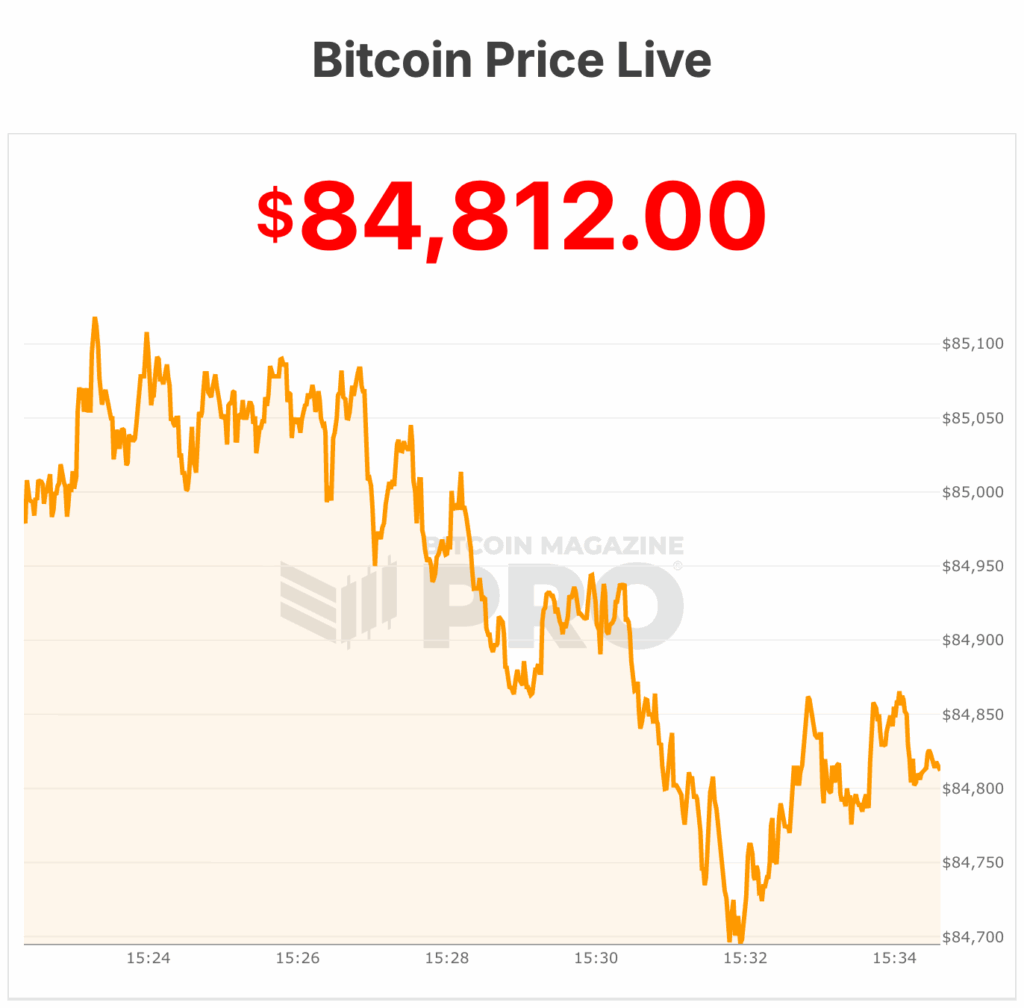

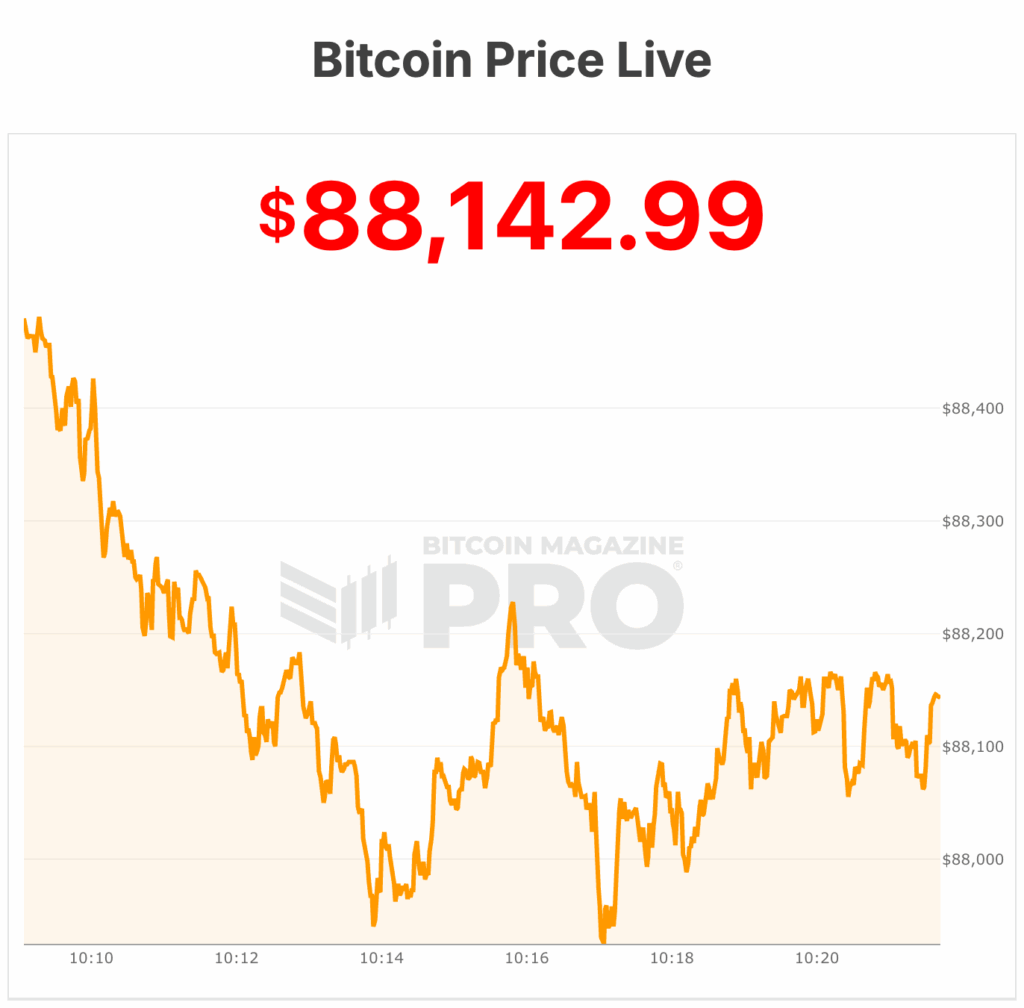

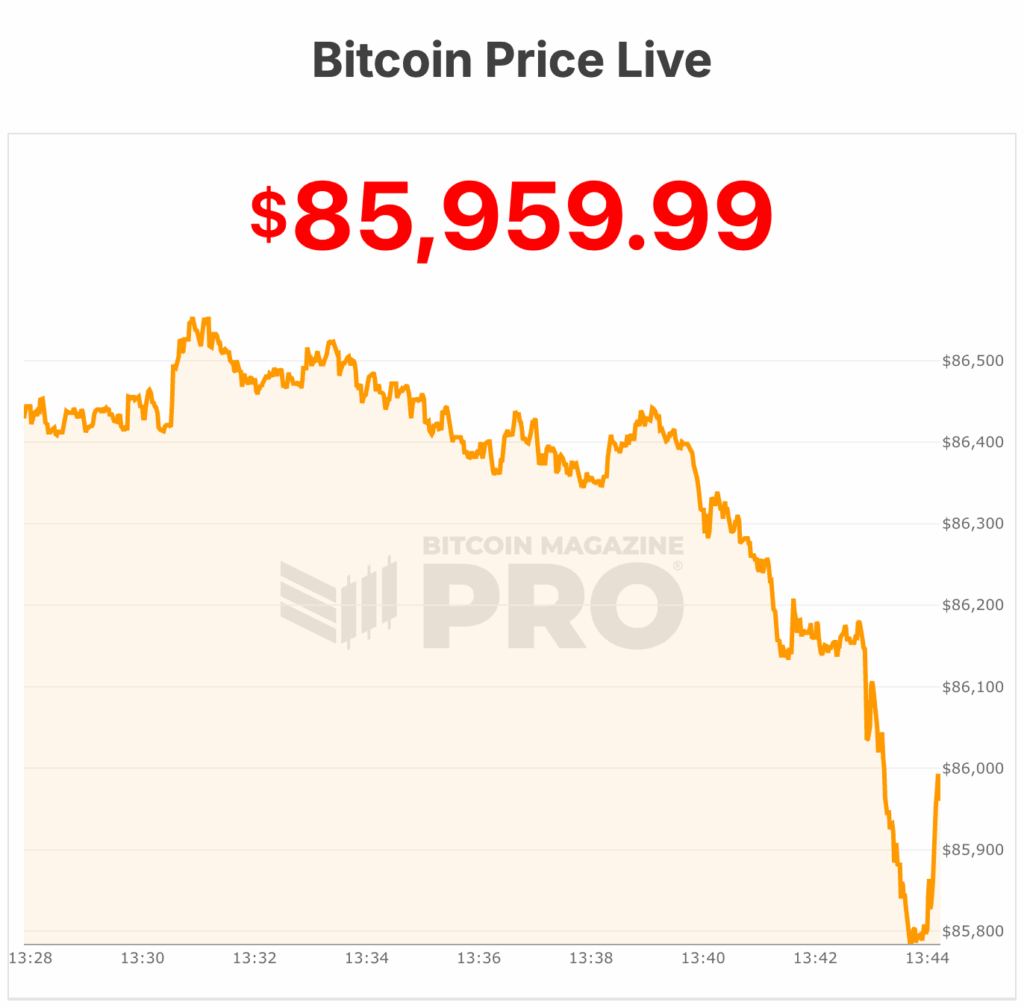

The email demanded payment of 13 bitcoins. At current bitcoin prices, the amount is valued at about $1.1 million, or roughly 16.4 billion won.

According to reports, the caller said, “If you don’t give me 13 Bitcoins, I will blow up the Hyundai Group building at 11:30 a.m. and then take a bomb to Yangjae-dong and detonate it.”

Hyundai moved to evacuate staff from both locations. Police dispatched special forces units and bomb squads to conduct searches of the buildings. Officers sealed off parts of the surrounding areas while inspections were carried out. No explosive devices were found at either site.

After several hours, authorities concluded the scam threat lacked credibility. Operations at the buildings gradually returned to normal. Police said no payment was made and no injuries or property damage were reported.

South Korean corporate threats and bitcoin crime

The Hyundai incident comes amid a series of similar threats aimed at major South Korean corporations over the past several days.

On Thursday, posts appeared on Kakao’s customer service bulletin board claiming explosives had been planted at Samsung Electronics’ headquarters in Yeongtong-gu, Suwon, as well as at Kakao’s Pangyo offices and Naver facilities. Those messages also included demands for large cash payments, per reports.

On December 17, another bomb threat was posted through KT’s online subscription application system. The message claimed an explosive device had been installed at KT’s office in Bundang, Seongnam.

Police responded by clearing the building and conducting a search. No explosives were discovered in that case either.

Authorities believe the incidents are part of a pattern of digital extortion attempts that rely on fear rather than using real devices or bombs. Investigations are ongoing to identify the individuals behind the threats and trace the origins of the messages, per the local police.

This post ‘Pay 13 Bitcoin or We Blow It Up’: Hyundai Bomb Threat Shakes South Korean Offices first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

$2.6 trillion Citi says Bitcoin could hit $189,000 in the next 12 months

$2.6 trillion Citi says Bitcoin could hit $189,000 in the next 12 months

and the upcoming Fold Bitcoin Credit Card

and the upcoming Fold Bitcoin Credit Card

The Ministry of Justice has just revealed that Taiwan now holds 210.45 Bitcoin in seized assets.

The Ministry of Justice has just revealed that Taiwan now holds 210.45 Bitcoin in seized assets.

Norway’s sovereign wealth fund just backed all the Bitcoin treasury company Metaplanet’s proposal.

Norway’s sovereign wealth fund just backed all the Bitcoin treasury company Metaplanet’s proposal.