22-Year-Old Pleads Guilty in $263 Million Bitcoin and Crypto Theft

Bitcoin Magazine

22-Year-Old Pleads Guilty in $263 Million Bitcoin and Crypto Theft

A 22-year-old California resident has pleaded guilty to his role in a multi-state social engineering scheme that stole roughly $263 million in crypto.

Evan Tangeman of Newport Beach, California, admitted laundering $3.5 million in crypto for the criminal enterprise, the U.S. Attorney’s Office announced Monday.

Tangeman pleaded guilty to participating in a Racketeer Influenced and Corrupt Organizations (RICO) conspiracy before U.S. District Court Judge Colleen Kollar-Kotelly.

Sentencing is scheduled for April 24, 2026. He is the ninth defendant to enter a guilty plea in this specific investigation.

The court also unsealed the Second Superseding Indictment, adding three more defendants. Nicholas Dellecave, also known as “Nic” or “Souja,” Mustafa Ibrahim, also known as “Krust,” and Danish Zulfiqar, also known as “Danny” or “Meech,” face charges of RICO conspiracy along with the other members of the Social Engineering Enterprise (SE Enterprise).

Dellecave was arrested in Miami on Dec. 3, 2025. Ibrahim and Zulfiqar were recently arrested in Dubai.

According to prosecutors, the enterprise began in October 2023 and continued through at least May 2025. It originated from friendships formed on online gaming platforms. The group included individuals in California, Connecticut, New York, Florida, and abroad.

Details of the rampant crypto crime

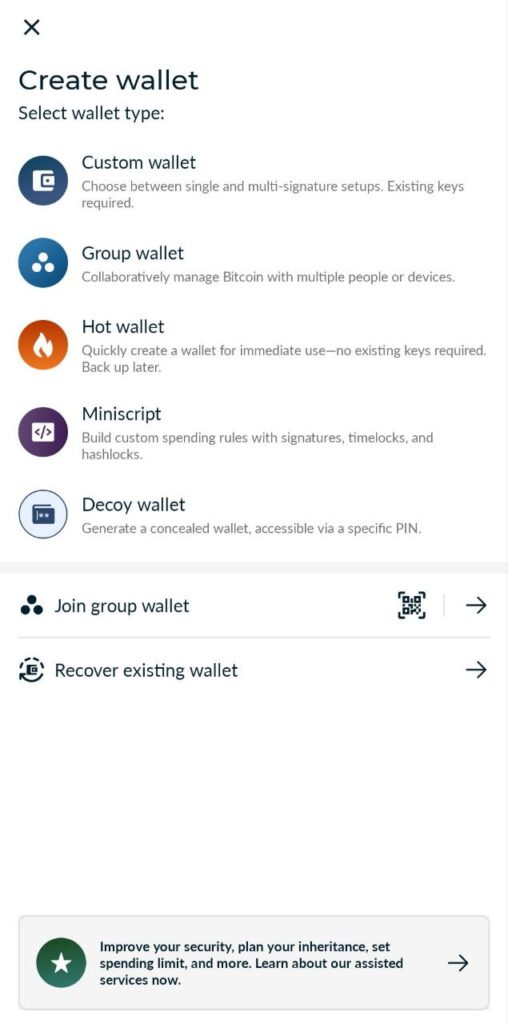

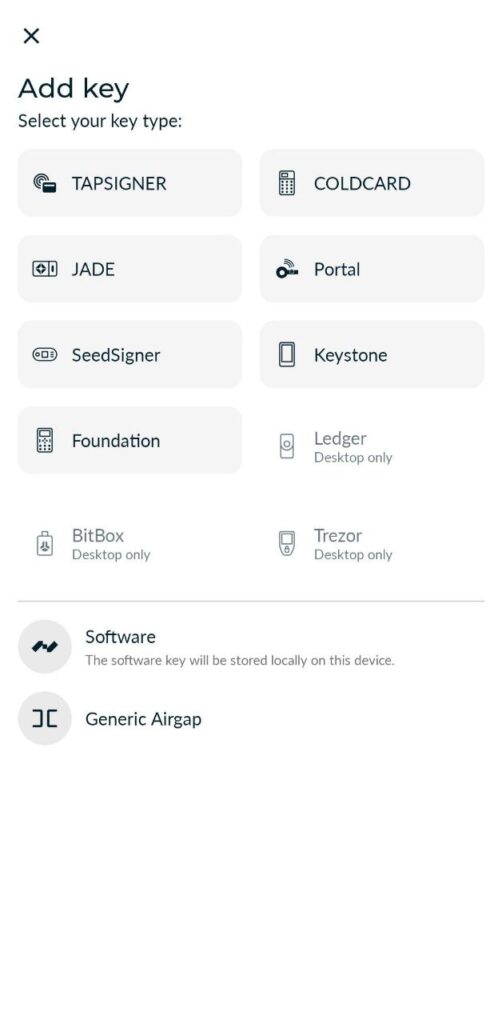

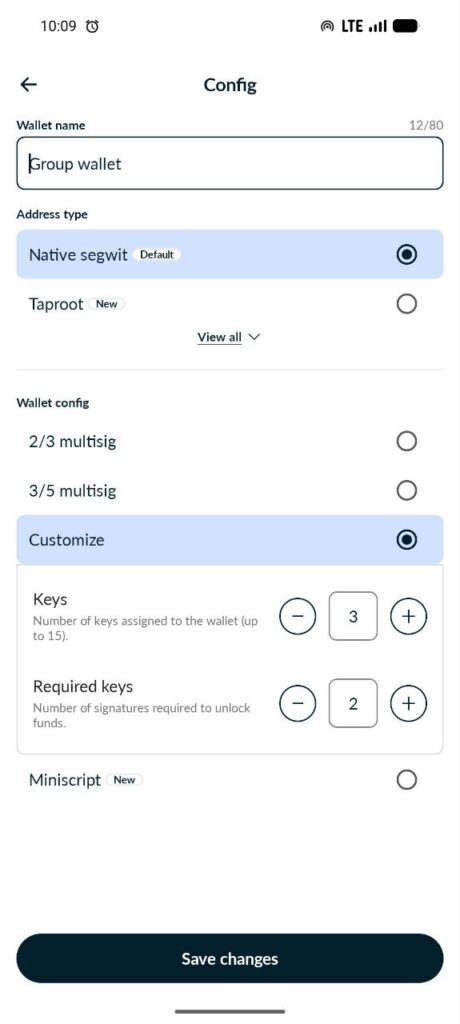

The scheme involved database hackers, organizers, target identifiers, callers, and residential burglars who targeted hardware wallets containing cryptocurrency. Hackers used stolen databases to identify high-value targets.

Callers impersonated crypto exchange staff or email providers to trick victims into revealing account credentials.

Burglars physically broke into homes to steal hardware wallets.

Tangeman acted as a money launderer. He converted stolen cryptocurrency into cash using a bulk-cash converter. Tangeman then used the cash to obtain rental homes for members of the group, often listing false names on the leases.

Some properties rented for $40,000 to $80,000 per month. He secured homes in Los Angeles and Miami.

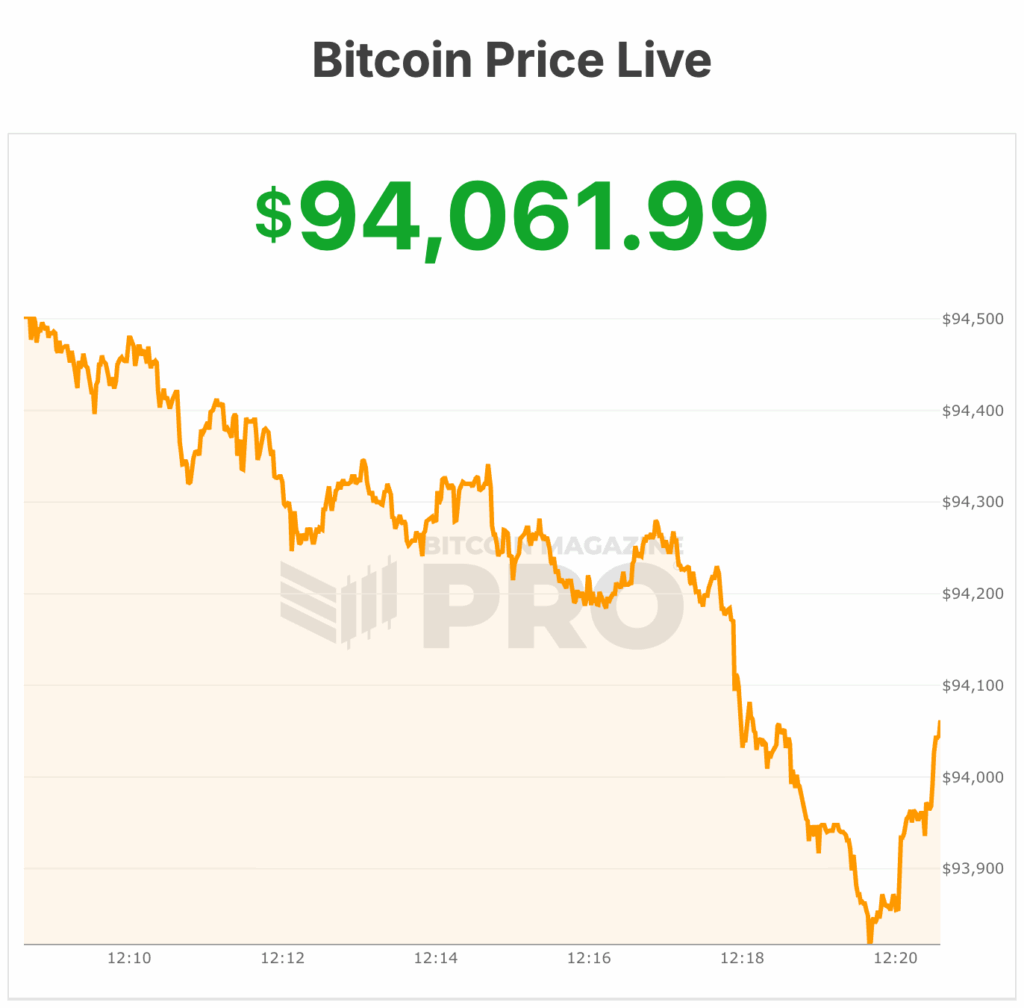

The largest known theft occurred on Aug. 18, 2024. Tangeman’s co-conspirators, including Malone Lam and Danish Zulfiqar, deceived a victim in Washington, D.C., into transferring over 4,100 Bitcoin. At the time, the crypto was valued at $263 million. The same amount is now worth more than $368 million.

Tangeman also helped Lam obtain roughly $3 million in cash from stolen cryptocurrency to secure a rental property.

After Lam’s arrest on Sept. 18, 2024, Tangeman accessed home security systems to screenshot FBI agents during searches. He also asked another member to retrieve and destroy digital devices from Lam’s Los Angeles residence.

Prosecutors said the enterprise spent stolen funds on a lavish lifestyle. Purchases included nightclub services up to $500,000 per night, luxury handbags, watches valued between $100,000 and $500,000, designer clothing, rental homes, private jets, security guards, and a fleet of at least 28 exotic cars ranging from $100,000 to $3.8 million.

Three additional defendants unsealed

With Tangeman’s guilty plea, prosecutors have unsealed charges against three additional defendants. The Second Superseding Indictment shows the investigation is ongoing. Authorities have not disclosed whether any of the stolen Bitcoin has been recovered or whether restitution will be sought.

The SE Enterprise relied on social engineering rather than sophisticated hacking techniques. The group’s operations originated from online friendships, but the stolen funds funded high-profile purchases and drew attention.

Authorities said the defendants’ extravagant spending played a role in exposing their activities.

Tangeman remains free pending sentencing.

Federal penalties for RICO conspiracy and money laundering carry significant prison terms. The Justice Department has indicated that additional charges may follow as the investigation continues.

A RICO conspiracy occurs when individuals agree to take part in a pattern of criminal activity, or racketeering, through an ‘enterprise.’ Under the Racketeer Influenced and Corrupt Organizations Act (RICO), prosecutors can connect separate crimes and individuals under a single charge.

The focus is on proving a shared criminal objective, not that every participant committed every act.

This post 22-Year-Old Pleads Guilty in $263 Million Bitcoin and Crypto Theft first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Public company Twenty One Capital CEO Jack Mallers says: We're going to buy "as much Bitcoin as we possibly can"

Public company Twenty One Capital CEO Jack Mallers says: We're going to buy "as much Bitcoin as we possibly can"

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

Minister of State Bilal Bin Saqib says, “

Minister of State Bilal Bin Saqib says, “