SpaceX Moves $95M in Bitcoin Ahead of Potential Mega IPO

Bitcoin Magazine

SpaceX Moves $95M in Bitcoin Ahead of Potential Mega IPO

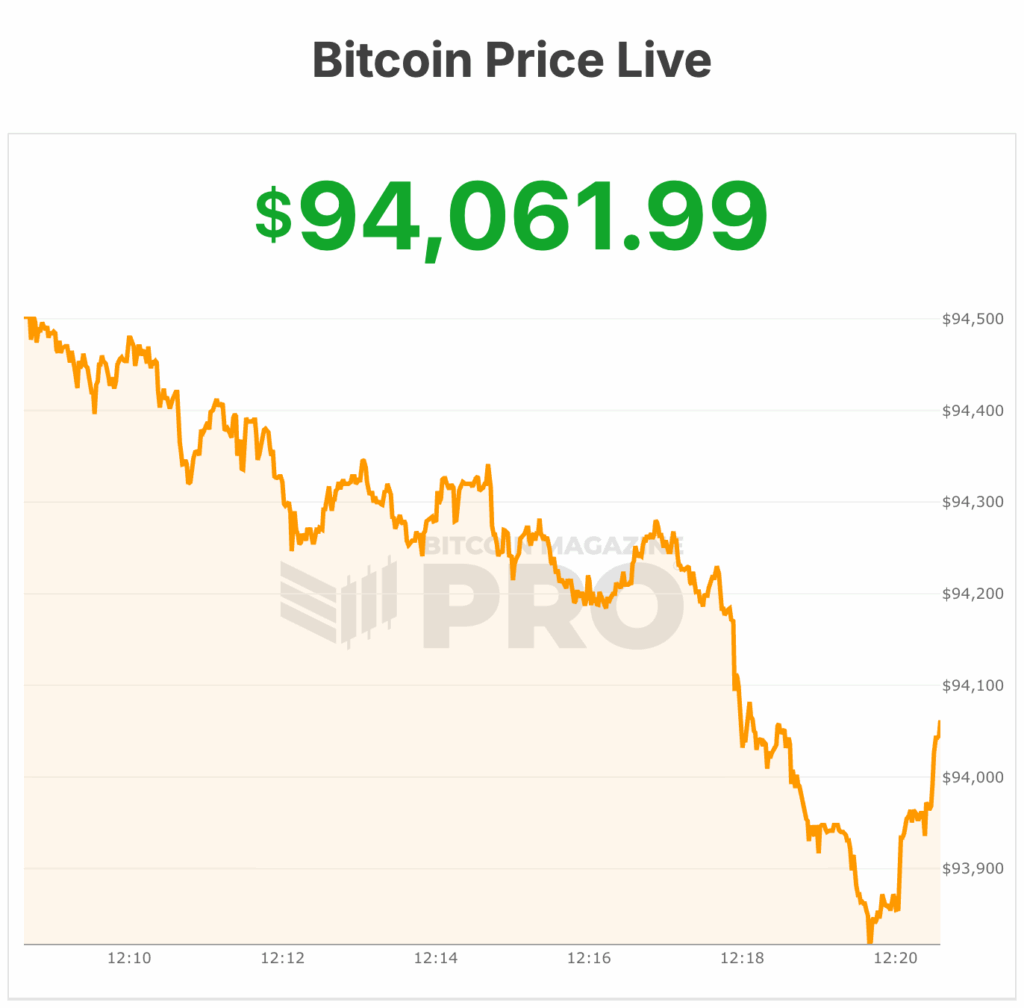

SpaceX moved another 1,021 bitcoin on Wednesday, worth about $94.5 million.

The transfer was split between two unlabeled addresses via Coinbase Prime custody. One address received 614 BTC, the other 407 BTC.

This marks the ninth such transfer by SpaceX this year. Recent movements total around 8,910 BTC, valued near $924 million. Analysts say the company is consolidating its holdings and upgrading from legacy bitcoin addresses.

SpaceX’s bitcoin holdings were tagged on-chain by Arkham Intelligence. The company currently controls about 3,991 BTC, worth roughly $367 million at current prices. Holdings have fluctuated over the past several years.

The total once peaked above $1.6 billion during the 2021 bull market. In mid-2022, SpaceX reportedly reduced its stake by about 70% after shocks from the Terra-Luna collapse, FTX bankruptcy, and market-wide turbulence.

SpaceX has made no public statement about the transactions. Tesla, another Elon Musk-run company, currently holds 11,509 BTC, worth about $1.24 billion.

SpaceX IPO?

The bitcoin reshuffle comes as SpaceX advances plans for a massive initial public offering. Bloomberg reported the company aims to raise more than $30 billion in its IPO. The target valuation is near $1.5 trillion, potentially surpassing Saudi Aramco’s record $29 billion fundraise in 2019.

SpaceX’s IPO could take place as early as mid-to-late 2026. Sources say the timing could slip into 2027 depending on market conditions. If successful, it would be the largest listing in history by valuation.

The offering would give investors exposure not only to rockets, satellites, and Starlink internet services but also to SpaceX’s crypto holdings. Musk’s companies were among the earliest institutional bitcoin adopters.

SpaceX has also used dogecoin to fund its DOGE-1 lunar mission, highlighting Musk’s influence in crypto markets.

Prediction market data show growing confidence in SpaceX’s valuation. Polymarket traders assign a 67% probability that the IPO will exceed a $1 trillion market cap.

The IPO could provide capital for Starlink expansion, space-based data centers, and other ventures intersecting with AI and crypto infrastructure, according to Bloomberg.

Analysts note the on-chain reshuffle aligns with the company’s broader treasury strategy. Moving funds to modern addresses can reduce transaction costs, improve security, and consolidate management of multiple wallets.

Most of SpaceX’s remaining bitcoin is expected to be migrated as the consolidation completes.

This post SpaceX Moves $95M in Bitcoin Ahead of Potential Mega IPO first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

Eric Trump and Donald Trump Jr. backed American Bitcoin, acquires an additional 416 BTC.

Eric Trump and Donald Trump Jr. backed American Bitcoin, acquires an additional 416 BTC.

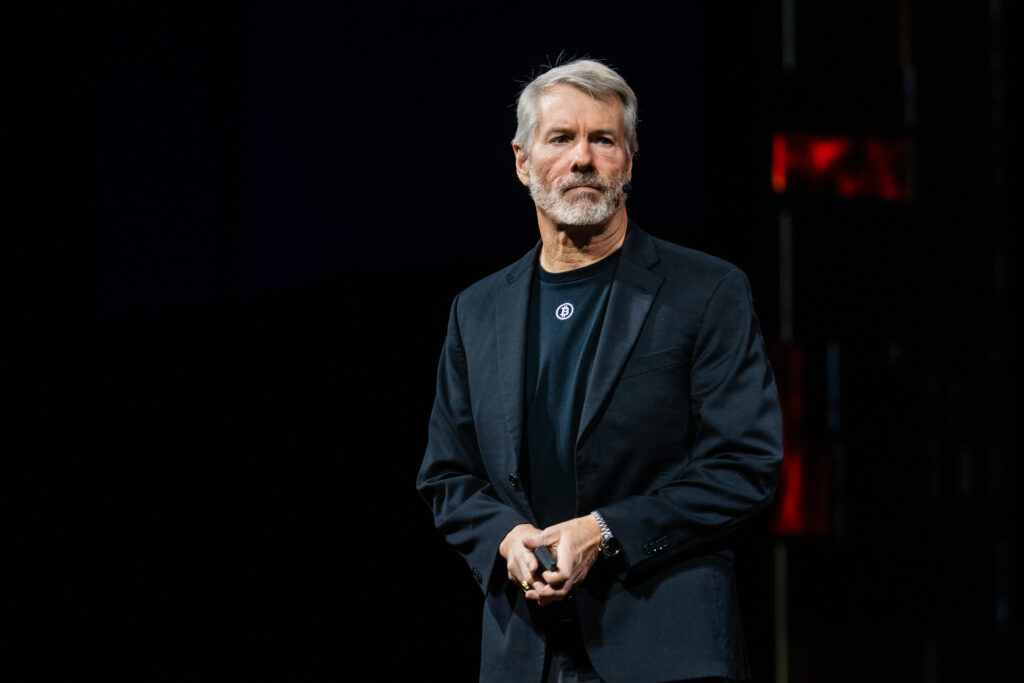

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

MICHAEL SAYLOR JUST HAD A MEETING WITH CZ AT BITCOIN MENA

Minister of State Bilal Bin Saqib says, “

Minister of State Bilal Bin Saqib says, “