[LIVE] Crypto News Today: Latest Updates for Jan. 26, 2026 – BTC Slumps 11% From Monthly High Below $87K Amid Market Wide Slump

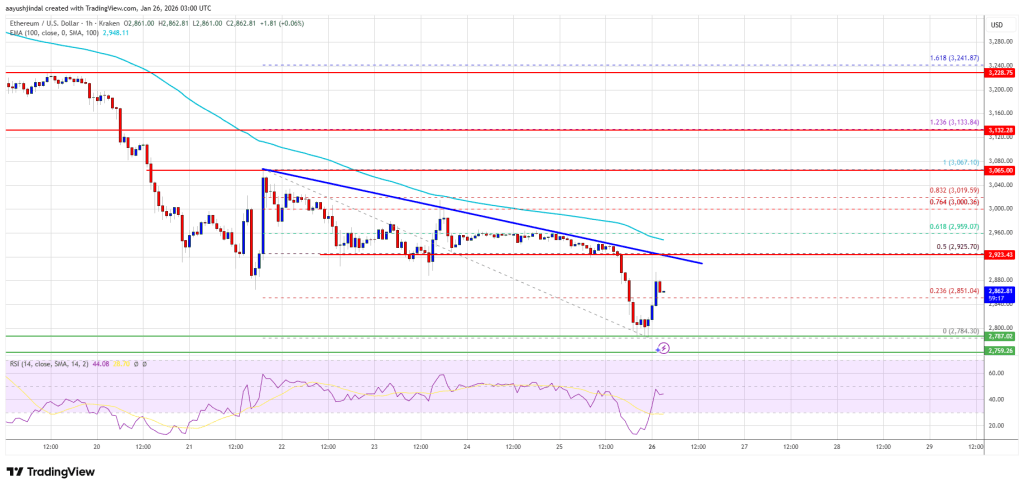

The cryptocurrency market faced a sharp correction in the early hours of January 26, with BTC erasing its entire monthly progress. After peaking at $97,000 on January 14, Bitcoin slid approximately 10.9% to briefly dip below the $87,000 mark. This volatility has pushed the January return to -0.5%, reflecting a broader “risk-off” sentiment across the digital asset space. The pullback is being attributed largely to rising uncertainty around U.S. government shutdown, alongside broader risk-off sentiment across global markets.The GameFi sector bore the brunt of the sell-off, dropping nearly 5%, led by double-digit losses in Axie Infinity (AXS). While Ethereum fell below $2,900, some assets showed resilience; notably, River (RIVER) surged 30% and Beam (BEAM) rose 19%, suggesting that despite the macro-level decline, specific project catalysts continue to drive isolated pockets of growth.

But what else is happening in crypto news today? Follow our up-to-date live coverage below.

The post [LIVE] Crypto News Today: Latest Updates for Jan. 26, 2026 – BTC Slumps 11% From Monthly High Below $87K Amid Market Wide Slump appeared first on Cryptonews.

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…

En primicia, Valora Analitik conoció que Protección se prepara para lanzar desde Colombia un fondo con exposición a Bitcoin. El producto no estará enfocado en la especulación de corto plazo, sino en ampliar las opciones de diversificación con una gestión integral de riesgos y…