Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Big Update Incoming?

The Ethereum Foundation has formed a dedicated post-quantum security team, directly addressing one of the biggest threats to long-term bullish Ethereum price predictions.

It positions the Ethereum network as one of the first movers on the narrative around quantum-resistant tokens, and ETH for significant demand as the altcoin governing it.

According to commentary from Ethereum Researcher Justin Drake, quantum vulnerabilities have been declared a top strategic priority.

Today marks an inflection in the Ethereum Foundation's long-term quantum strategy.

— Justin Drake (@drakefjustin) January 23, 2026

We've formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

Existing cryptographic standards used across blockchain networks stand to become obsolete if they cannot adapt to quantum threats, placing most projects on the chopping block.

Ethereum co-founder Vitalik Buterin has previously cited estimates suggesting a 20% probability that quantum computers could break modern cryptography before the end of the decade.

With regulation pushing crypto deeper into the mainstream, getting ahead of the quantum threat could give Ethereum credibility as key infrastructure to bridge Web2 and Web3.

Real-world adoption at institutional scale will demand security frameworks that meet established protection standards, and Ethereum’s proactive approach could prove critical in securing that role.

Ethereum Price Predictions: Long-Term Potential Looks Bullish

Getting ahead of the curve on quantum resistance could help Ethereum realise the final leg of a 21-month bullish head-and-shoulders pattern.

The pattern now navigates its final push with the right shoulder now forming, and momentum indicators showing strength.

The RSI continues to compress against the 50 neutral line with a series of higher lows forming and an uptrend, suggesting strength steadily building under the surface.

The MACD is on a similar path, closing in on a cross above the signal line. On the weekly chart, this often signals a long-term trend shift into a bull run.

A fully realised right shoulder stands to see a return to previous all-time highs around $5,000, representing a 70% gain from current locations.

And as mainstream use cases for Ethereum open up to sticky real-world adoption with the assurance of quantum resistance, that push could credibly push into new price discovery, eying a 240% move to $10,000.

Bitcoin Hyper: Bitcoin Might Have Better Short-Term Potential

While Etherium plays the long game, Bitcoin could be in to lead the near-term as it addresses its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Whatever Solana can do, Bitcoin will soon be able to too – top-performing narratives like DeFi and real-world assets could be Bitcoin’s for the taking.

The project has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website HereThe post Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Big Update Incoming? appeared first on Cryptonews.

Weekly Crypto Regulation Roundup: Trump signed the GENIUS Act into law — the first major U.S. crypto bill to clear Congress.

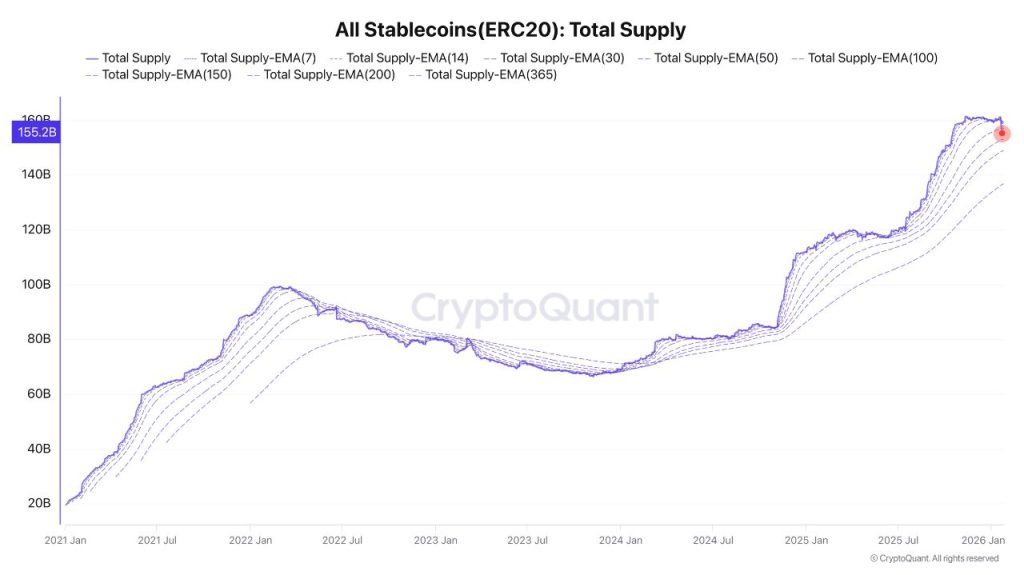

Weekly Crypto Regulation Roundup: Trump signed the GENIUS Act into law — the first major U.S. crypto bill to clear Congress. US community bankers are urging Congress to close what they see as a loophole allowing stablecoin rewards.

US community bankers are urging Congress to close what they see as a loophole allowing stablecoin rewards. Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.

Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.

Senate Agriculture Committee advances crypto bill for January 27 markup without Democratic support as Banking delays CLARITY Act over stablecoin disputes.