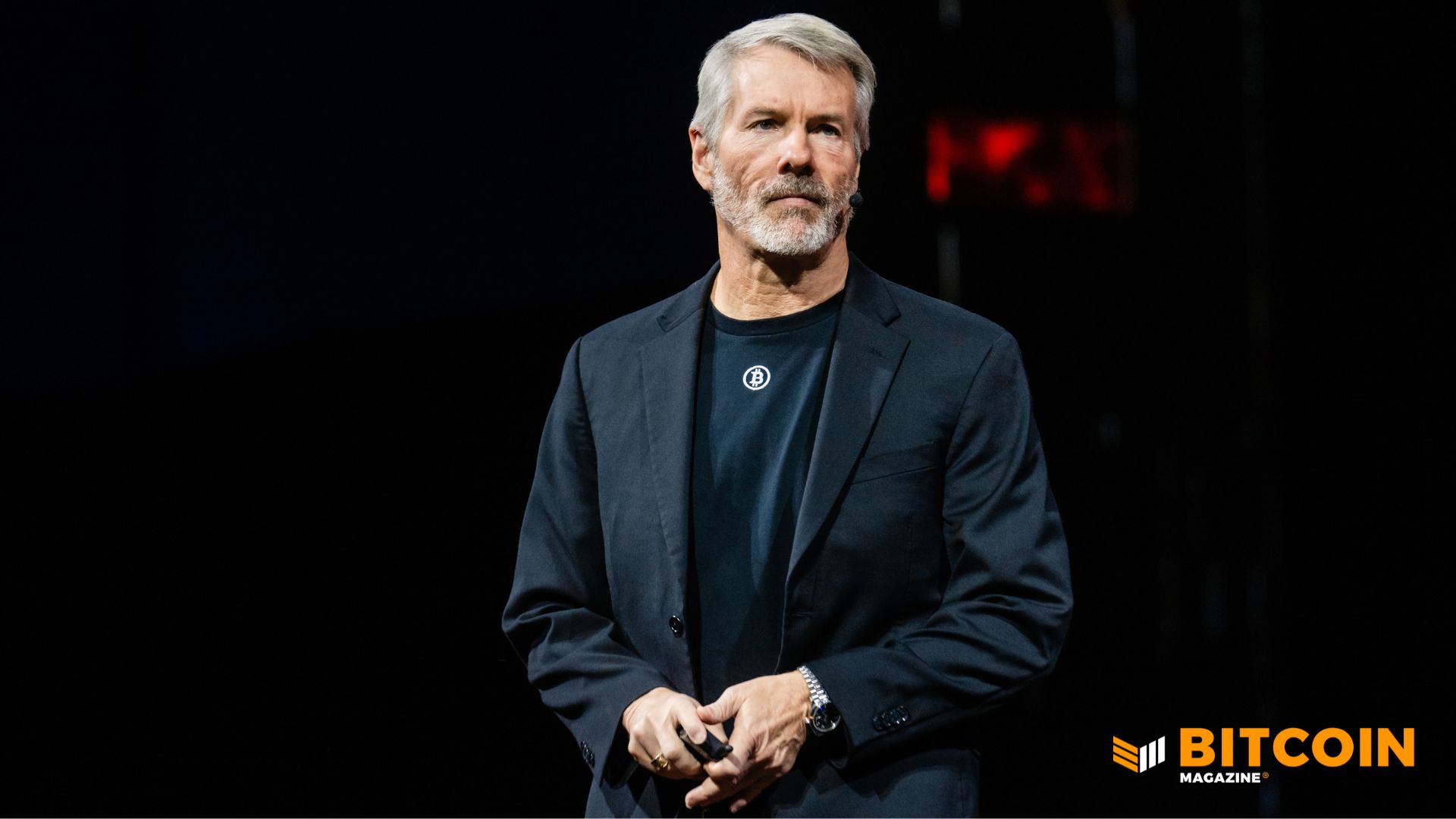

Bitcoin Price Prediction: Rich Dad Poor Dad Author Kiyosaki Ignores Price Crash – Here’s Why He’s More Bullish Than Ever

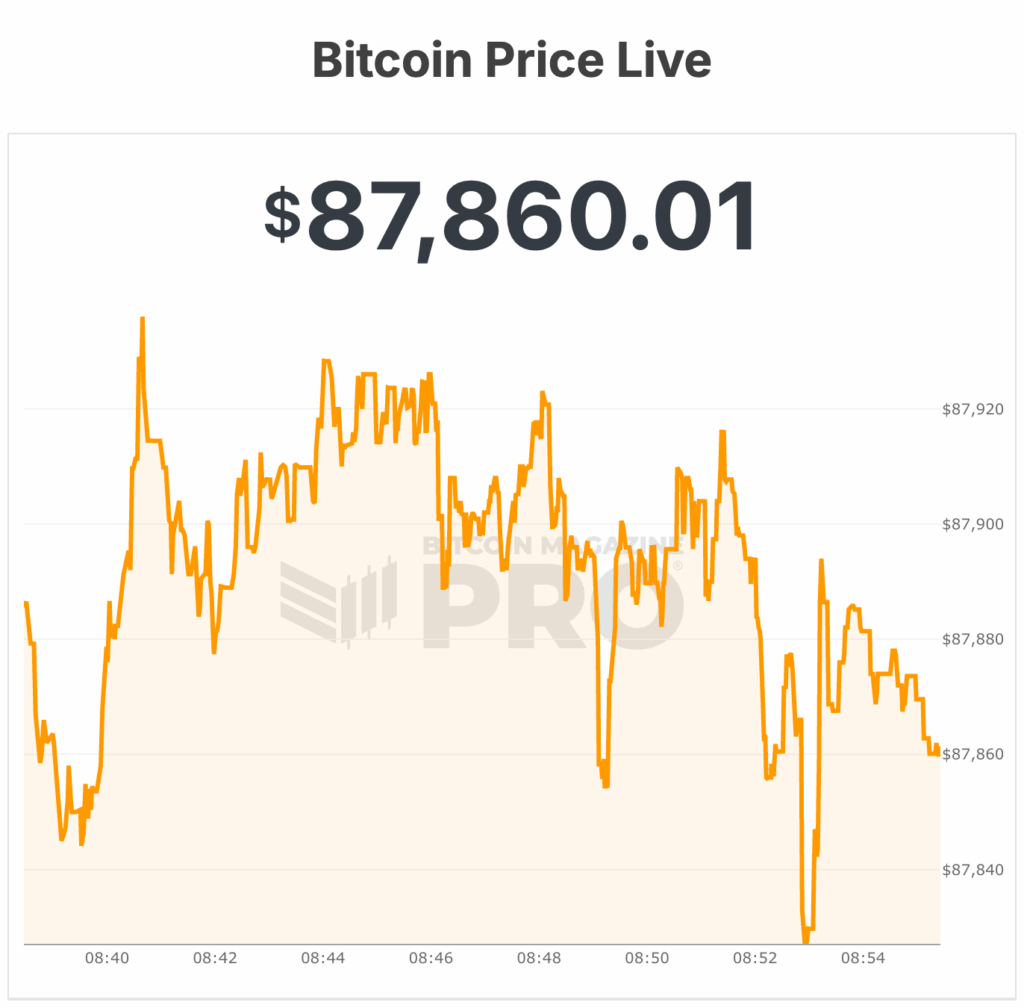

Bitcoin is trading near $87,700, down about 1% on the day, yet Robert Kiyosaki remains unmoved by short-term price swings. The Rich Dad Poor Dad author says he continues buying Bitcoin and Ethereum regardless of volatility, arguing that price matters less than the direction of the global financial system.

In a recent post, Kiyosaki pointed to two forces shaping his strategy: the rising US national debt, now above $38.4 trillion, and the steady erosion of the dollar’s purchasing power. From his perspective, daily price movements are a distraction.

As debt expands and deficits deepen, scarce assets gain relevance. As he put it bluntly, he does not worry about market fluctuations because “the national debt keeps going up and the purchasing power of the US dollar keeps going down.”

Q: Do I care when the price of gold silver or Bitcoin go up or down?

— Robert Kiyosaki (@theRealKiyosaki) January 23, 2026

A: No. I do not care.

Q: Why Not?

A: Because I know the national debt of the US keeps going up and the purchasing power of the US dollar keeps going down.

Q: Why worry about the price of gold, silver,…

That logic explains why Kiyosaki groups Bitcoin with gold and silver, often referring to BTC as “digital gold.” While he has long favored physical metals, he now sees Bitcoin and Ethereum as modern extensions of the same hedge against monetary dilution. His long-term outlook remains bold, with Bitcoin potentially reaching $1 million over the coming years or decade.

Institutional Credibility Weakens as Investors Seek Bitcoin Hedges

Kiyosaki’s stance reflects deep skepticism toward traditional financial authorities. He has repeatedly criticized institutions such as the Federal Reserve and the US Treasury, arguing that policy decisions have fueled debt growth rather than long-term stability.

This view aligns with a broader investor shift. As inflation pressures, rising interest costs, and geopolitical uncertainty persist, capital has increasingly moved toward assets outside the traditional financial system. Bitcoin’s fixed supply of 21 million coins, with more than 19.98 million already in circulation, continues to attract investors who see scarcity as protection rather than speculation.

Bitcoin Price Prediction: $87K Base Forms as Trendlines Hint at a Springboard Move

While the long-term narrative remains intact, Bitcoin’s short-term chart sits at a critical junction. After pulling back from the $95,500–$96,000 zone, BTC is consolidating between $86,000 and $88,000, an area where multiple technical levels converge.

On the 4-hour chart, price is pressing against the lower boundary of a descending wedge while still respecting a rising long-term support line that has guided the broader uptrend since late 2025. Recent candles near $86,100 show long lower wicks, suggesting dip-buying rather than forced liquidation.

Momentum remains soft, with RSI hovering near 39–40, but it has begun to turn higher. A sustained hold above $88,000 would open a path toward $90,700 and $93,300, with a potential retest of $95,500. A break below $86,000 would delay that recovery and expose $84,300, without undermining the broader structure.

Taken together, Kiyosaki’s long-term conviction and Bitcoin’s developing technical base suggest the market is pausing, not peaking. For investors focused beyond short-term noise, this consolidation may be the kind of quiet reset that precedes the next expansion phase.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the BTC ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $31 million, with tokens priced at just $0.013635 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems. If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the PresaleThe post Bitcoin Price Prediction: Rich Dad Poor Dad Author Kiyosaki Ignores Price Crash – Here’s Why He’s More Bullish Than Ever appeared first on Cryptonews.

Headline: Everyone is calculating the

Headline: Everyone is calculating the  The “base fee” (0.00001 XRP) only exists when the network is quiet. But what happens if the world actually starts using the XRPL at its 3,400 TPS limit?

The Congestion Math:

As the…

The “base fee” (0.00001 XRP) only exists when the network is quiet. But what happens if the world actually starts using the XRPL at its 3,400 TPS limit?

The Congestion Math:

As the…