The XRP Ledger Now Hosts $150M+ Worth of Tokenized U.S. Treasury Debt

The XRP Ledger now hosts over $150 million worth of tokenized U.S. Treasury Debt amid a rapid increase in RWA value over the past year.

The XRP Ledger now hosts over $150 million worth of tokenized U.S. Treasury Debt amid a rapid increase in RWA value over the past year.

Coinbase is weighing a potential equity investment in South Korea’s Coinone, as the country’s third-largest crypto exchange explores options that include selling part of its controlling shareholder’s stake, according to local media and industry sources.

A local outlet reported Sunday that Coinone has put itself on the market and is discussing scenarios tied to Chairman Cha Myung-hoon’s holdings, which total 53.44% through his personal stake and his holding company, The One Group.

Speculation around a sale picked up after Cha returned to frontline management just four months after stepping down as chief executive, a move that some observers read as preparation for a stake transaction.

Coinone, meanwhile, said Cha stepped back in to sharpen its technological edge as it nears a double-digit market share, building out areas such as artificial intelligence.

Attention has also turned to Com2uS, the gaming group that accumulated a 38.42% stake in Coinone between 2021 and 2022.

Seoul Economic Daily reports that South Korea's third-largest crypto exchange Coinone is up for sale. Major shareholder and chairman Cha Myung-hoon is considering selling part of his stake and exploring other options. Coinbase will visit Korea this week to discuss equity…

— Wu Blockchain (@WuBlockchain) January 26, 2026

Coinone’s continued losses have weighed on its book value, which Seoul Economic Daily put at 75.2B won, or about $52M, at the end of the third quarter, below Com2uS’s reported acquisition cost.

Against that backdrop, industry sources say Coinbase plans to visit South Korea this week and meet major local players, including Coinone, as it looks for partners to build products that fit Korean rules.

The talks come as dealmaking accelerates across South Korea’s crypto exchange sector, with traditional finance and big tech circling licensed platforms and won trading rails.

Regulators recently cleared Binance’s long-running effort to take over GOPAX, and the market has since seen a rush of takeover interest.

Naver Financial agreed to acquire Dunamu, the operator of market leader Upbit, in an all-stock deal, while local media have also reported Mirae Asset Securities is pursuing Korbit.

Coinone has tried to differentiate on product as well as ownership, launching what it called the country’s first flexible Bitcoin staking service in Aug. 2025, letting users earn rewards without locking up their holdings.

Coinone says discussions remain open-ended, and it has not settled on a structure, a timeline or a buyer. Still, the prospect of a Coinbase tie-up lands at a moment when Korea’s exchange map is already shifting, and when global players are watching for a way in.

The post Coinbase Weighs Investment In South Korean Exchange Coinone: Report appeared first on Cryptonews.

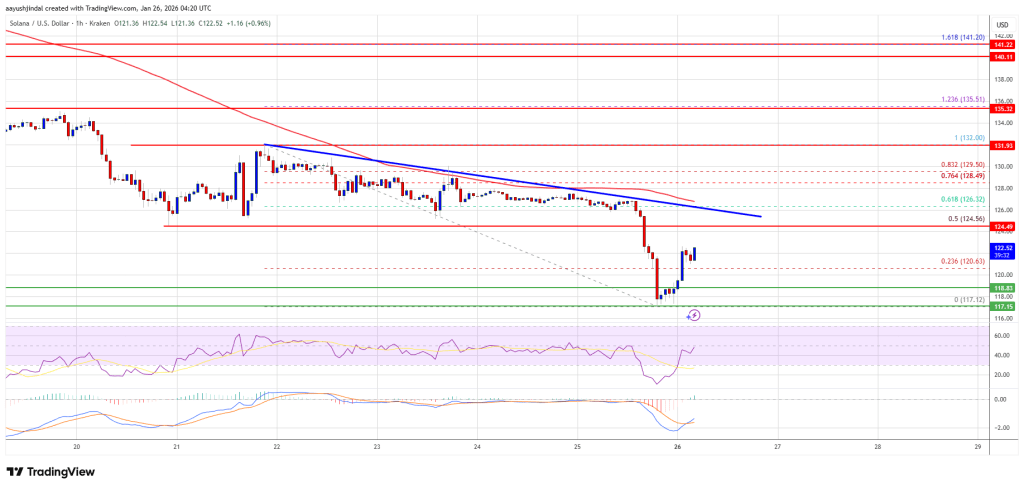

Solana failed to settle above $132 and extended losses. SOL price is now consolidating losses below $130 and might struggle to start a recovery wave.

Solana price failed to remain stable above $132 and started a fresh decline, like Bitcoin and Ethereum. SOL declined below the $130 and $126 support levels.

The price gained bearish momentum below $122. A low was formed at $117, and the price is now consolidating losses. The price recovered a few points and climbed above the 23.6% Fib retracement level of the downward move from the $132 swing high to the $117 low.

Solana is now trading below $130 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $125 level or the 50% Fib retracement level of the downward move from the $132 swing high to the $117 low.

The next major resistance is near the $126 level. There is also a key bearish trend line forming with resistance at $126 on the hourly chart of the SOL/USD pair. The main resistance could be $132. A successful close above the $132 resistance zone could set the pace for another steady increase. The next key resistance is $140. Any more gains might send the price toward the $144 level.

If SOL fails to rise above the $126 resistance, it could continue to move down. Initial support on the downside is near the $119 zone. The first major support is near the $117 level.

A break below the $117 level might send the price toward the $115 support zone. If there is a close below the $115 support, the price could decline toward the $102 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $117 and $115.

Major Resistance Levels – $126 and $132.

The Financial Conduct Authority has begun seeking final feedback on a set of proposals aiming to apply traditional finance standards to the UK crypto sector.

ETHZilla acquired two aircraft engines for $12 million, just weeks after the company said it was renewing its focus on tokenizing real-world assets.

The cryptocurrency market faced a sharp correction in the early hours of January 26, with BTC erasing its entire monthly progress. After peaking at $97,000 on January 14, Bitcoin slid approximately 10.9% to briefly dip below the $87,000 mark. This volatility has pushed the January return to -0.5%, reflecting a broader “risk-off” sentiment across the digital asset space. The pullback is being attributed largely to rising uncertainty around U.S. government shutdown, alongside broader risk-off sentiment across global markets.The GameFi sector bore the brunt of the sell-off, dropping nearly 5%, led by double-digit losses in Axie Infinity (AXS). While Ethereum fell below $2,900, some assets showed resilience; notably, River (RIVER) surged 30% and Beam (BEAM) rose 19%, suggesting that despite the macro-level decline, specific project catalysts continue to drive isolated pockets of growth.

But what else is happening in crypto news today? Follow our up-to-date live coverage below.

The post [LIVE] Crypto News Today: Latest Updates for Jan. 26, 2026 – BTC Slumps 11% From Monthly High Below $87K Amid Market Wide Slump appeared first on Cryptonews.

Bitcoin dipped under $88,000 as Asia opened to mixed trade, with investors leaning into safety and pushing gold to a record above $5,000 an ounce.

In China, stocks moved in different directions. The Shanghai index rose 0.12%, and China A50 gained 0.49%, while the SZSE Component slid 0.74% and DJ Shanghai eased 0.09%. Hong Kong’s Hang Seng edged up 0.04%.

Gold extended a rally that has reshaped the commodity market. Spot gold rose 1.79% to $5,071.96 an ounce by 0159 GMT after touching $5,085.50 earlier, and US gold futures for February delivery gained 1.79% to $5,068.70.

Investors have treated the metal as a refuge through shifting policy expectations and geopolitical stress. Prices surged 64% in 2025, and they have gained more than 17% this year, supported by safe-haven demand, expectations of easier US monetary policy, central bank buying and ETF inflows.

President Donald Trump’s trade threats stayed in focus. He abruptly stepped back on Wednesday from threats to impose tariffs on European allies as leverage to seize Greenland, and he said over the weekend he would impose a 100% tariff on Canada if it followed through on a trade deal with China.

He has also threatened to hit French wines and champagnes with 200% tariffs in an apparent effort to pressure French President Emmanuel Macron into joining his “Board of Peace” initiative.

Some observers fear the board could undermine the United Nations’ role as the main global platform for conflict resolution, though Trump has said it will work with the UN.

Currency markets also turned volatile. The yen jumped to more than a two-month high on speculation that coordinated intervention by US and Japanese authorities could be imminent, and Tokyo’s top currency diplomat left that prospect open while keeping markets guessing.

The yen rose as much as 1.2% to 153.89 per dollar, its strongest since November. The euro hit a four-month high of $1.1898 and was last up 0.4% at $1.18665, as traders trimmed dollar positions ahead of the Federal Reserve meeting and watched for a possible announcement by the Trump administration of a new Fed chairman.

Wall Street faces another busy week after a rocky stretch. US stock index futures fell modestly on Sunday evening as markets braced for the Fed decision on Wednesday and a wave of corporate earnings, after last week’s pullback tied to geopolitical strains and trade uncertainty.

The post Asia Market Open: Bitcoin Dips Under $88K, Gold Hits Record Above $5K As Yen Hits Two-Month Peak appeared first on Cryptonews.

XRP price extended losses and traded below $1.880. The price is now consolidating and might decline further if it remains below $1.920.

XRP price failed to stay above $1.950 and started a fresh decline, like Bitcoin and Ethereum. The price declined below $1.920 and $1.90 to enter a short-term bearish zone.

The price even spiked below $1.850. A low was formed at $1.810, and the price is now consolidating losses. There was a recovery wave above $1.850. The price cleared the 23.6% Fib retracement level of the downward move from the $1.963 swing high to the $1.810 low, but the bears remained active.

The price is now trading below $1.90 and the 100-hourly Simple Moving Average. If there is a fresh upward move, the price might face resistance near the $1.8850 level and the 50% Fib retracement level of the downward move from the $1.963 swing high to the $1.810 low. There is also a key bearish trend line forming with resistance at $1.885 on the hourly chart of the XRP/USD pair.

The first major resistance is near the $1.90 level. A close above $1.90 could send the price to $1.950. The next hurdle sits at $2.00. A clear move above the $2.00 resistance might send the price toward the $2.050 resistance. Any more gains might send the price toward the $2.120 resistance. The next major hurdle for the bulls might be near $2.20.

If XRP fails to clear the $1.90 resistance zone, it could start a fresh decline. Initial support on the downside is near the $1.840 level. The next major support is near the $1.820 level.

If there is a downside break and a close below the $1.820 level, the price might continue to decline toward $1.780. The next major support sits near the $1.750 zone, below which the price could continue lower toward $1.70.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now near the 50 level.

Major Support Levels – $1.840 and $1.820.

Major Resistance Levels – $1.8850 and $1.90.

Bitcoin has fallen nearly 30% since a major market crash in October, while traditional safe havens like gold and silver have soared.

Gold reached a record over $5,000 amid trade tensions while Bitcoin fell to $86,000, marking a sharp divergence as the precious metal surged 17% in January.

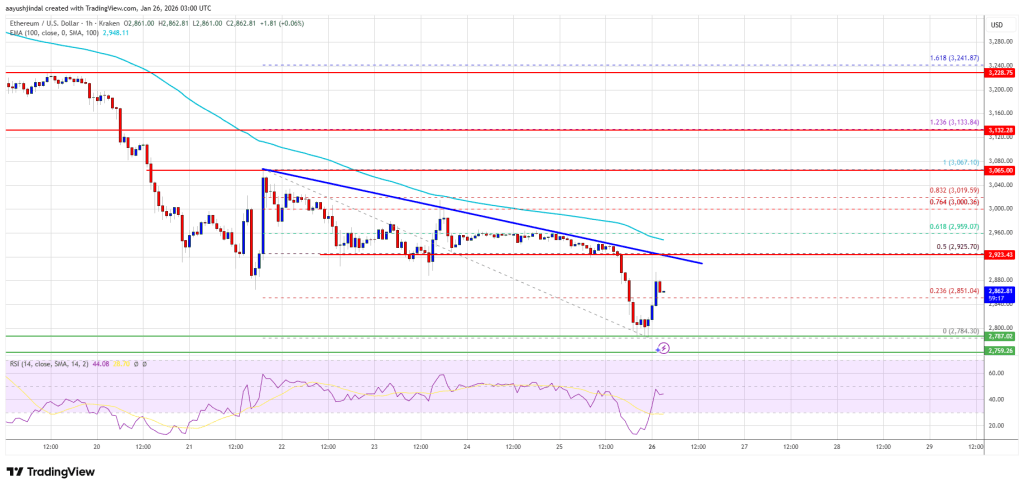

Ethereum price extended losses and traded below the $2,865 zone. ETH is now consolidating losses and might aim for a recovery if it clears $2,920.

Ethereum price failed to remain stable above $2,950 and extended losses, like Bitcoin. ETH price declined below $2,880 and $2,865 to enter a bearish zone.

The bears even pushed the price below $2,840. The price finally tested $2,800 and is currently consolidating losses. There was a minor upside above the 23.6% Fib retracement level of the downward wave from the $3,067 swing high to the $2,784 swing low.

Ethereum price is now trading below $2,900 and the 100-hourly Simple Moving Average. If the bulls can protect more losses below $2,800, the price could attempt another increase.

Immediate resistance is seen near the $2,920 level. There is also a bearish trend line forming with resistance at $2,920 on the hourly chart of ETH/USD. The first key resistance is near the $2,960 level or the 61.8% Fib retracement level of the downward wave from the $3,067 swing high to the $2,784 swing low. The next major resistance is near the $3,000 level. A clear move above the $3,000 resistance might send the price toward the $3,065 resistance.

An upside break above the $3,065 region might call for more gains in the coming days. In the stated case, Ether could rise toward the $3,120 resistance zone or even $3,150 in the near term.

If Ethereum fails to clear the $2,920 resistance, it could start a fresh decline. Initial support on the downside is near the $2,840 level. The first major support sits near the $2,800 zone.

A clear move below the $2,800 support might push the price toward the $2,780 support. Any more losses might send the price toward the $2,720 region. The main support could be $2,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $2,800

Major Resistance Level – $2,920

Bitcoin price extended losses and traded below $88,500. BTC is consolidating losses and might attempt a recovery wave if it clears $88,500.

Bitcoin price failed to stay above the $89,000 support and extended losses. BTC declined sharply below the $88,500 and $87,000 support levels.

The bears even pushed the price below $86,500. A low was formed at $86,007, and the price is now attempting a recovery wave. There was a move above the 23.6% Fib retracement level of the downward move from the $91,099 swing high to the $86,007 low.

Bitcoin is now trading below $88,500 and the 100 hourly Simple moving average. If the price remains stable above $86,500, it could attempt a fresh increase. Immediate resistance is near the $88,000 level. There is also a new bearish trend line forming with resistance at $88,000 on the hourly chart of the BTC/USD pair.

The first key resistance is near the $88,500 level since it is close to the 50% Fib retracement level of the downward move from the $91,099 swing high to the $86,007 low.

A close above the $88,500 resistance might send the price further higher. In the stated case, the price could rise and test the $89,200 resistance. Any more gains might send the price toward the $90,000 level. The next barrier for the bulls could be $91,000 and $91,500.

If Bitcoin fails to rise above the $88,500 resistance zone, it could start another decline. Immediate support is near the $86,700 level. The first major support is near the $86,200 level.

The next support is now near the $85,500 zone. Any more losses might send the price toward the $83,500 support in the near term. The main support sits at $82,500, below which BTC struggle to recover in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $86,700, followed by $86,000.

Major Resistance Levels – $88,500 and $89,200.

Entropy founder and CEO Tux Pacific says that, after four years and multiple pivots, the project was unable to find a scalable business model.

Entropy, a decentralized crypto custody startup backed by Andreessen Horowitz (a16z), is winding down and plans to return remaining capital to investors, according to founder and chief executive Tux Pacific.

Pacific wrote on X over the weekend, “I am winding-up Entropy.” They added, “After four years, several pivots, and two rounds of layoffs, I’ve decided to wind-up Entropy and return capital to our investors.”

The shutdown follows a late-stage push in 2025 to reposition the company around a crypto automations platform, which Pacific described as “basically n8n/zapier/etc for crypto,” with automated signing via threshold cryptography, secure computation using trusted execution environments, and “deep AI integrations.”

I am winding-up Entropy.

— tux pacific (@__tux) January 24, 2026

After four years, several pivots, and two rounds of layoffs, I’ve decided to wind-up Entropy and return capital to our investors.

For the latter half of 2025, the Entropy team was hard at work on a crypto automations platform (basically n8n/zapier/etc…

That product direction still failed to clear a venture-style growth bar. “After an initial feedback request revealed that the business model wasn’t venture scale, I was left with the choice to find a creative way forward or pivot once more,” Pacific wrote.

Entropy first drew attention in 2022 when it raised $25M in a seed round led by a16z crypto, with participation including Dragonfly Capital, Coinbase Ventures, Robot Ventures, Ethereal Ventures, Variant and Inflection. The company had earlier raised a $1.95M pre-seed round.

At launch, Entropy pitched itself as a decentralized alternative to custody providers such as Fireblocks and Coinbase, leaning on cryptographic approaches like multi-party computation to let users control how funds could move, including rule-based constraints.

Pacific also thanked a16z crypto and Guy Wuollet for helping steer the wind-down, calling their guidance “invaluable.”

The closure lands in a tougher funding climate for early-stage crypto startups. Crypto venture deal count fell about 60% year-on-year in 2025, dropping to roughly 1,200 transactions from more than 2,900 in 2024.

Next, Pacific said they plan to step back before deciding what comes after Entropy. “My time in crypto might be coming to an end, as I feel myself drawn specifically into pharmaceuticals,” they wrote, adding they want to work on hormone delivery and validate research on new estradiol drug formulations.

The post a16z-Backed Crypto Custody Startup to Shut Down, Return Investor Funds appeared first on Cryptonews.

Gold breaks above $5,000 for the first time on geopolitical and economic risks, while silver hits records and crypto slips.

The post Gold surges past $5,000 for first time as silver tops $107 on safe-haven buying appeared first on Crypto Briefing.

Crypto traders often assume that meaningful gains need long timelines to take place, and they often give up during the wait and silence. However, crypto has a habit of shattering that belief without warning. History shows that when conditions line up, altcoins do not grind higher over years. They release and erase multiple years of drawdowns in a matter of weeks.

That memory was highlighted by a crypto commentator known as Waterman on the social media platform X, who noted a familiar seasonal window between February and late April to early May for an altcoin explosion.

The most notable example of an altcoin rally season was in 2021, when the entire altcoin market went on a rally to new all-time highs, many of which are still unbroken for some cryptocurrencies.

The 2021 cycle delivered some of the clearest reminders of just how fast capital can rotate once momentum takes hold. Solana moved from roughly $20 to $200 in about 50 days, a clean tenfold run. Although Solana has since broken above this peak to register a new all-time high of $293 in January 2025, this was still Solana’s most explosive rally to date.

Dogecoin followed an even sharper trajectory, climbing from $0.07 to a peak of $0.73 in under a month due to speculative interest that flowed into other memecoins like Shiba Inu. Unlike Solana, Dogecoin is yet to reclaim or surpass this peak price.

Avalanche went further, rallying from around $3 to $60 in less than 40 days, a twentyfold expansion that unfolded faster than most long-term projections ever anticipate. None of these moves required years of development or prolonged accumulation.

Notably, February through late April or early May has more often than not been the period where altcoin performance increases the most. If that pattern repeats, the coming weeks may matter far more than the years that came before them.

At the time of writing, the notion of an altcoin season is still impeded by strong Bitcoin dominance. Much of that comes down to how the entire crypto industry ecosystem has changed massively since 2021, especially after the launch of crypto-based ETFs. That steady demand has kept capital inflows concentrated around Bitcoin and slowed the usual rotation into altcoins.

Meme coins like Dogecoin and Shiba Inu have struggled to keep up in terms of price action, even with the launch of Dogecoin ETFs. Although the ETF has boosted visibility, it has not yet resulted into sustained upside.

At the same time, investors have become more selective, favoring cryptocurrencies tied to clearer utility. As a result, many crypto communities have been working to create utility for their meme coins.

Nonetheless, as noted by Waterman, you only need about four to six weeks for an altcoin to wipe out three to four years of suffering. You don’t need one to two years for altcoins to make massive gains.

Featured image from YouHodler, chart from TradingView

Senate Democrats have threatened to block a funding bill if it includes money for the Department of Homeland Security, making traders fearful of another possible US government shutdown.

Winter storm Fern is currently sweeping across the United States and has already left 1 million residents without electrical power.