Silver is crushing crypto as ‘digital gold’ narrative unravels

World Liberty Financial (WLFI), a crypto project backed by US President Donald Trump, moved a chunk of its Bitcoin exposure into Ethereum this week. Reports say the group sold wrapped Bitcoin holdings and picked up a large amount of Ether in the same set of transactions.

According to blockchain trackers, about 93.77 WBTC was sold, which worked out to roughly $8 million at the time of the swap. The proceeds were used to buy around 2,868 ETH, with an average price of about $2,813 per unit.

The trade was executed from a wallet that on-chain analysts link to WLFI’s treasury. That wallet activity was visible on public ledgers and has been shared across several crypto news sites and data monitors.

Prices were modestly lower for ETH when the purchase happened, which some traders see as a buying chance. Reports say this move comes as Ethereum trading ranges have made some holders rethink where to park large sums.

The World Liberty Finance (@worldlibertyfi) has sold 93.77 $WBTC ($8.07M) for 2,868.4 $ETH at a price of $2,813.

Address: 0xee7f7f53f0d0c8c56a38e97c5a58e4d321a174dc

Data @nansen_ai pic.twitter.com/yhh7IvYLLz

— Onchain Lens (@OnchainLens) January 26, 2026

WBTC is a tokenized form of Bitcoin that inhabits the Ethereum chain, so swapping it for native ETH changes how those funds can be used within decentralized finance.

The funds were moved through a public wallet tied to WLFI. This was confirmed by on-chain evidence that was circulated by data platforms.

Strategic Reasons Behind The ShiftSeveral reasons could explain the swap. Holding ETH gives direct access to smart contracts, staking, and DeFi tools that WBTC cannot offer on its own.

Some market watchers think WLFI may be positioning to use ETH for on-chain services, staking, or profit from future network activity.

Others suggest it could be a way to rebalance risk between stores of value and utility tokens. Reports say no single motive can be proved from the chain itself, only the movement of funds.

Traders reacted with curiosity rather than panic. Prices barely moved on the news, showing the market may have already priced in similar flows.

Smaller investors watched closely because such a swap by a high-profile, politically linked project draws attention. The wallet activity was tracked publicly, and analysts noted the timing matched a period of calmer ETH price action.

What This Could Mean For InvestorsReports note that big reallocations like this can change short-term sentiment, though they do not always lead to lasting rallies. For holders who prefer simplicity, swapping WBTC for ETH changes the way capital can be used, moving from a Bitcoin peg to native network participation.

Featured image from Unsplash, chart from TradingView

Entropy, a startup that tried to build a safer way to hold and move crypto, is shutting down and sending most money back to investors.

The company’s leader said the business could not reach the size investors wanted. Reports say the team will return roughly $25–$27 million that had been put into the project.

According to reports, Entropy began with tools for decentralized custody aimed at big holders who wanted more control.

Over time the group changed course and tried to build automation features that would make crypto workflows easier.

The company raised capital from well-known backers, including Andreessen Horowitz and Coinbase Ventures. It ran for about four years and weathered two rounds of layoffs as the team tested different ideas.

In a Saturday post on X, Entropy founder and CEO Tux Pacific said the crypto automation platform has reached the end of the road after years of trying to find a workable future.

I am winding-up Entropy.

After four years, several pivots, and two rounds of layoffs, I’ve decided to wind-up Entropy and return capital to our investors.

For the latter half of 2025, the Entropy team was hard at work on a crypto automations platform (basically n8n/zapier/etc…

— tux pacific (@__tux) January 24, 2026

Two clear facts pushed the move. First, buyers and customers did not grow fast enough for the kind of return venture backers expect.

Second, the team struggled to find a steady, repeatable business model that could support rapid growth and hire plans.

Leaders tried product tweaks and new directions, but the pace of change stayed slow and revenue did not climb as hoped. In some cases the product was kept alive by small wins; in others it felt stalled.

Investors will get back most of the money they put in. That makes this shutdown cleaner than some collapses where user funds were at risk.

Reports say refunds will be handled through formal steps and planners are working out the details.

The company’s founder has suggested they may shift their career focus away from crypto, possibly into fields like medical research, though that path is not certain.

Featured image from Pexels, chart from TradingView

Bitcoin has fallen nearly 30% since a major market crash in October, while gold and silver have soared to new highs.

The Ethereum Foundation has formed a dedicated post-quantum security team, directly addressing one of the biggest threats to long-term bullish Ethereum price predictions.

It positions the Ethereum network as one of the first movers on the narrative around quantum-resistant tokens, and ETH for significant demand as the altcoin governing it.

According to commentary from Ethereum Researcher Justin Drake, quantum vulnerabilities have been declared a top strategic priority.

Today marks an inflection in the Ethereum Foundation's long-term quantum strategy.

— Justin Drake (@drakefjustin) January 23, 2026

We've formed a new Post Quantum (PQ) team, led by the brilliant Thomas Coratger (@tcoratger). Joining him is Emile, one of the world-class talents behind leanVM. leanVM is the cryptographic…

Existing cryptographic standards used across blockchain networks stand to become obsolete if they cannot adapt to quantum threats, placing most projects on the chopping block.

Ethereum co-founder Vitalik Buterin has previously cited estimates suggesting a 20% probability that quantum computers could break modern cryptography before the end of the decade.

With regulation pushing crypto deeper into the mainstream, getting ahead of the quantum threat could give Ethereum credibility as key infrastructure to bridge Web2 and Web3.

Real-world adoption at institutional scale will demand security frameworks that meet established protection standards, and Ethereum’s proactive approach could prove critical in securing that role.

Getting ahead of the curve on quantum resistance could help Ethereum realise the final leg of a 21-month bullish head-and-shoulders pattern.

The pattern now navigates its final push with the right shoulder now forming, and momentum indicators showing strength.

The RSI continues to compress against the 50 neutral line with a series of higher lows forming and an uptrend, suggesting strength steadily building under the surface.

The MACD is on a similar path, closing in on a cross above the signal line. On the weekly chart, this often signals a long-term trend shift into a bull run.

A fully realised right shoulder stands to see a return to previous all-time highs around $5,000, representing a 70% gain from current locations.

And as mainstream use cases for Ethereum open up to sticky real-world adoption with the assurance of quantum resistance, that push could credibly push into new price discovery, eying a 240% move to $10,000.

While Etherium plays the long game, Bitcoin could be in to lead the near-term as it addresses its biggest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s security with Solana tech, creating a new Layer-2 network that unlocks scalable, efficient use cases Bitcoin couldn’t support on its own.

Whatever Solana can do, Bitcoin will soon be able to too – top-performing narratives like DeFi and real-world assets could be Bitcoin’s for the taking.

The project has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s massive trading volume could send its valuation significantly higher.

Bitcoin Hyper is fixing the slow transactions, high fees, and limited programmability that have long capped Bitcoin’s potential – just as the market turns bullish.

Visit the Official Bitcoin Hyper Website HereThe post Ethereum Price Prediction: Ethereum Developers Prepare for Quantum Computers – Big Update Incoming? appeared first on Cryptonews.

Looking at the crypto market these days is nothing but pain. The question is how much longer this pain will last before we finally see XRP, Shiba Inu, and PEPE rise again.

It all depends on Bitcoin. With some geopolitical stability, we could see more moves toward risk-on assets.

XRP, Shiba Inu, and PEPE, technically, are still in a weak phase. Below is how things could play out for the three as we head into 2026.

Ripple (XRP) is currently not in the best position price-wise, yes. However, it is holding its 18-month support and could reverse at any time.

The relative strength index (RSI) is leaning bearish right now, which is worrying for bulls if they do not regain momentum.

At the time of writing, XRP is trading at $1.91 and just bounced off the $1.81 dip. If it continues this bounce, $2.00 and $2.25 are the first psychological resistance levels. Breaking above those levels would confirm a bullish shift.

This scenario and the target of $3.00 remain valid for XRP as long as it holds above the $1.80 support. A break below it would invalidate the setup and ruin the structure.

At the beginning of the year, PEPE price fooled everyone into believing memecoins were back after 5 days of constant pumping and a rally of over 60%.

This ended shortly after topping near $0.000007, and the price has been trending down since. It is still up around 20% on the monthly chart, but expectations were much higher.

If we talk purely technically, PEPE respected the upper boundary of the descending channel. A bullish outlook would be anticipated if a breakout above the $0.000006 resistance occurs.

If the dump continues, the horizontal support at $0.000004 is important to hold. There have been repeated reactions at this same price level. If a candle closes near its low, things could turn ugly, as there is very little historical support below.

Shiba Inu is the worst performer among the top memecoins. The burn mechanism is in constant decline, and the narrative being “dog-themed-memecoin” is considered old now.

The Shiba Inu chart is basically a clean descending channel that has been respected for a long time, with lower highs and lower lows grinding price down in a very orderly way.

Right now, the price is sitting right on the lower boundary of the channel, which is an important area. Historically, this is where short-term relief bounces can start if buyers step in.

RSI is sitting around the mid-40s, which backs that up. It is not oversold, but it does show bearish momentum cooling rather than speeding up.

Until SHIB breaks and holds above the channel resistance, this remains a bearish structure with bounce potential, not a confirmed reversal. In short, the trend is still weak, the price is sitting at support, and this is an interesting spot, but confirmation is everything.

While XRP, SHIB, and PEPE are all stuck grinding lower and waiting on Bitcoin to finally flip sentiment back to risk-on, some traders are already looking past the pain and positioning early. That is where Bitcoin Hyper starts to stand out.

Bitcoin Hyper is being built for exactly this kind of market environment. When majors are weak, momentum is dead, and confidence is low, capital tends to rotate into new narratives that are not tied to broken charts or long downtrends. That rotation almost always starts quietly, before Bitcoin and altcoins wake up.

The project has already raised 31M, showing conviction even while the broader market struggles. On top of that, Bitcoin Hyper offers 38% staking rewards, giving holders a reason to stay positioned instead of chasing short-term pumps elsewhere.

Historically, the biggest upside opportunities show up when the market feels the worst. If Bitcoin stabilizes and risk appetite returns heading into 2026, projects that were accumulated during these painful phases tend to move first.

For traders tired of watching XRP, SHIB, and PEPE bleed while waiting on Bitcoin to save the market, Bitcoin Hyper is shaping up as a high-risk, high-reward alternative worth keeping on the radar.

Visit the Official Bitcoin Hyper Website HereThe post Crypto Price Prediction Today 26 January – XRP, PEPE, Shiba Inu appeared first on Cryptonews.

The global stablecoin market has crossed $284 billion in circulation, reviving a long debate about whether the growth of stablecoin poses a real threat to traditional banks or simply reflects a new layer of financial infrastructure evolving alongside them.

That question took center stage this week after historians and economists Niall Ferguson and Manny Rincon-Cruz argued that fears of bank destabilization are overstated, even as banking groups intensify their opposition to stablecoin rewards.

"No one is surprised when banks and other financial incumbents argue against measures that might promote innovation. But the argument that stablecoins are a source of instability — and interest-bearing ones especially so — is a bad one. The opposite is quite likely to be true."

— Niall Ferguson (@nfergus) January 26, 2026

In an opinion piece published by Bloomberg, Ferguson and Rincon-Cruz framed stablecoins as fundamentally different from volatile crypto assets such as Bitcoin.

While speculative tokens behave more like financial derivatives, they argued, fiat-backed stablecoins function as payment instruments whose growth has accelerated following the passage of the U.S. GENIUS Act last summer.

— Cryptonews.com (@cryptonews) July 18, 2025

Weekly Crypto Regulation Roundup: Trump signed the GENIUS Act into law — the first major U.S. crypto bill to clear Congress.#CryptoRegulation #GeniusActhttps://t.co/fSH8DZnCIo

The legislation established the first comprehensive federal framework for payment stablecoins, limiting reserves to cash, bank deposits, and short-dated U.S. Treasuries, while prohibiting issuers from making loans or paying interest directly to tokenholders.

Since the law took effect, the stablecoin sector has expanded quickly.

Treasury Borrowing Advisory Committee data cited in the opinion piece showed that fiat-backed stablecoins have surpassed $284 billion, dominated by Tether’s USDT and Circle’s USDC, which together account for more than 90% of the supply.

The payments, trading liquidity, and demand for cross-border settlements are projected to reach between $2 trillion and $3 trillion in the market by 2028, as cited by Treasury officials.

Banks, however, have pushed back, as industry groups have warned that stablecoins, particularly when paired with rewards offered by exchanges or platforms, could draw deposits away from the banking system.

The American Bankers Association and the Bank Policy Institute have argued that large-scale migration of deposits would raise banks’ funding costs and reduce credit availability/

— Cryptonews.com (@cryptonews) January 7, 2026

US community bankers are urging Congress to close what they see as a loophole allowing stablecoin rewards.#Crypto #bankshttps://t.co/2uuk96PfXH

JPMorgan executives have referred to interest-bearing digital dollars as the establishment of a parallel banking system that lacks the same levels of protection.

The push by banking lobbyists to change the proposed CLARITY Act, an expanded crypto market structure bill, provoked resistance by crypto companies and led to delays in Senate hearings.

Coinbase Chief Legal Officer Paul Grewal publicly rejected claims that stablecoin rewards threaten financial stability, saying there is no evidence of systemic risk and that competition should not be conflated with instability.

No question @nfergus is right. There is zero evidence–zero–that stablecoin interest, yield or rewards destabilizes the banking system. There is tons of evidence that they provide real competition to banks. Those are two very different things. https://t.co/XPrwVu5TCX

— paulgrewal.eth (@iampaulgrewal) January 26, 2026

Ferguson and Rincon-Cruz countered the banks’ narrative by turning to history.

They said that stablecoins were more like bank notes than deposits, and that historically, notes and deposits increased together, as opposed to crowding out.

They referred to some statistics indicating that since the introduction of the USDC in 2018, American bank deposits have grown by over $6 trillion, while stablecoins increased by roughly $280 billion, and both have been increasing in the same direction.

They observed that stablecoin rewards are not new and have not caused deposit flight even in times when banks were paying close to no interest.

The same sentiments were recently reiterated by the Circle CEO, Jeremy Allaire, in Davos at the World Economic Forum.

— Cryptonews.com (@cryptonews) January 22, 2026

Circle CEO rejects bank warnings on stablecoin yields as "absurd," citing money market precedent as transaction volumes reach $33 trillion in 2025.#Stablecoin #Circlehttps://t.co/kPQw5xYpBh

Allaire rejected speculations that a stablecoin reward might disrupt banking, asserting that it was the same as loyalty programs provided in regular finance.

Data support the scale of stablecoin usage beyond speculation. Global stablecoin transaction value reached $33 trillion in 2025, up 72% year-over-year.

Circle-issued digital dollar USDC processed $18.3 trillion worth of transactions, leading the stablecoin transaction boom that totalled $33 trillion in 2025.#StablecoinTransaction #CircleUSDC #USDThttps://t.co/8qYgLMVfmX

— Cryptonews.com (@cryptonews) January 9, 2026

USDC processed $18.3 trillion in payments, while USDT handled $13.3 trillion.

The International Monetary Fund has acknowledged the efficiency gains stablecoins offer in cross-border payments, while cautioning about risks in emerging markets and the need for regulatory coordination.

The post Stablecoins Hit $284B – Are Banks Really at Risk? Analysts Weigh In appeared first on Cryptonews.

Those anticipating that the start of 2026 would usher in a decisive breakthrough for mass crypto adoption may need to reset their expectations in the short-to-mid-term.

Coinbase recently withdrew its support for the CLARITY Act, a legislative proposal intended to define regulatory oversight of digital assets in the United States. Following this reversal, the U.S. Senate Banking Committee has postponed deliberations on the bill by several weeks.

That said, comprehensive crypto regulation in the U.S. still could happen this quarter. If lawmakers deliver, the three biggest cryptos will all be nothing new all-time highs (ATHs).

XRP ($XRP), currently valued at approximately $116 billion by market capitalization, continues to stand out as one of the most widely used cryptocurrencies for global payments, prized for its fast transaction finality and minimal fees.

The XRP Ledger (XRPL) was purpose-built for banks and financial institutions, positioning it as a next-generation alternative to slower, more expensive legacy systems such as SWIFT.

Ripple’s expanding footprint has earned recognition from prominent organizations, including the UN Capital Development Fund and the White House, strengthening XRP’s standing as a potentially game-changing payments network.

After finally resolving its prolonged legal battle with the U.S. Securities and Exchange Commission, XRP surged to a new all-time high of $3.65 in mid-2025. Since then, broader market weakness has driven a pullback of roughly 48%, with the token now trading around $1.90.

Despite the retracement, XRP’s time below $2 is likely limited. One of the most notable recent catalysts has been the approval of spot XRP ETFs in the U.S., giving both institutional and retail investors regulated access to the asset.

Additional ETF launches and clearer regulatory guidance could help propel XRP toward the $5 mark by the second quarter.

Bitcoin ($BTC), the world’s largest cryptocurrency, remains front and center after setting a new record high of $126,080 on October 6.

Should U.S. regulators move forward with Project Crypto, an initiative aimed at updating securities rules for digital assets, or if the Trump administration delivers on its pledge to establish a U.S. Strategic Bitcoin Reserve, Bitcoin could feasibly approach $250,000 this year.

Even without major policy-driven catalysts, Bitcoin has already notched several new milestones this year and may post a new high watermark at the $150,000 level before the quarter ends.

Frequently described as “digital gold,” Bitcoin continues to draw interest from both retail and institutional investors who see it as a long-term store of value and an inflation hedge.

At present, Bitcoin accounts for more than $1.7 trillion of the global crypto market’s roughly $3 trillion total valuation, underscoring its role as the cornerstone of the blockchain ecosystem.

Ethereum ($ETH) remains the backbone of decentralized finance and much of the broader Web3 landscape, supported by a market capitalization of around $349 billion.

With over $69 billion locked across its applications, Ethereum continues to dominate the DeFi sector, cementing its status as the most economically active blockchain network.

In a strong bullish environment, ETH could test the $5,000 resistance level by March, surpassing its previous all-time high of $4,946 set last August. A decisive breakout could then open the door to a move toward $7,500 by the end of the quarter, representing a potential 2.5x increase from its current price near $3,000.

Longer term, Ethereum’s path toward five-figure valuations will depend heavily on clearer U.S. regulation and supportive macroeconomic conditions, both of which are key to unlocking deeper institutional participation.

From a technical perspective, ETH confirmed a bullish flag breakout last year, rallying from around $1,800 to new highs. Another bullish flag formed toward the end of the year, suggesting the potential for a sharp upside move if broader market conditions align.

Bitcoin Hyper ($HYPER) is an emerging Bitcoin Layer-2 project designed to accelerate transactions, lower fees, and introduce advanced smart contract functionality to the Bitcoin network.

Leveraging the Solana Virtual Machine, Bitcoin Hyper incorporates decentralized governance and a Canonical Bridge that allows seamless cross-chain Bitcoin transfers.

The project’s presale has already raised more than $31 million, with some influencers speculating about potential returns ranging from 10x to 100x once the token becomes available on exchanges. A recent audit by Coinsult reported no critical vulnerabilities in the smart contract.

The HYPER token serves as the backbone of the ecosystem, acting as the medium for transaction fees, governance participation, and staking incentives.

Early backers can stake tokens during the presale to earn yields of up to 38% APY, although returns gradually decrease as more participants enter the pool.

With exchange listings anticipated later this year, Bitcoin Hyper’s presale offers early access to what could be the next evolutionary step for Bitcoin.

Visit the official website or follow Bitcoin Hyper on X and Telegram for more information.

Visit the Official Website HereThe post Best Crypto to Buy Now January 26 – XRP, Bitcoin, Ethereum appeared first on Cryptonews.

When given the right prodding, OpenAI’s ChatGPT issues some astonishing price projections for XRP, Solana, and Dogecoin over the next eleven months.

The model suggests that an extended bull run, supported by clearer and more favorable regulation in the United States, could drive leading altcoins to fresh record highs over the coming years.

Below are ChatGPT’s predictions for three of the most popular cryptocurrencies heading into the next year.

Ripple’s XRP ($XRP) entered 2026 on a strong footing, rising 19% during the first week of the year alone. From its current level near $1.90, ChatGPT estimates that a bull market could push XRP as high as $12 by the end of 2026, representing upside of roughly 532%, or more than sixfold returns.

XRP was among the top-performing large-cap cryptocurrencies last year. In July, it recorded its first new all-time high in seven years, reaching $3.65 after Ripple secured a landmark legal win against the U.S. Securities and Exchange Commission.

That decision significantly eased regulatory pressure surrounding XRP and reduced fears that the SEC would escalate enforcement across the broader altcoin space. Market sentiment also improved following Donald Trump’s return to the White House, which reignited optimism for a more crypto-friendly policy environment.

From a technical perspective, XRP’s Relative Strength Index is hovering around 44, indicating heavier selling than buying at the time of writing.

Since early January, price action has formed a bullish flag pattern. Supportive macro conditions and clearer regulation could catalyze the sustained post-flag surge needed to reach ChatGPT’s upper $12 target.

Adding to the bullish case, newly approved spot XRP ETFs in the U.S. are beginning to attract capital from traditional investors, mirroring the institutional inflows that followed the launch of Bitcoin and Ethereum ETFs.

The Solana ($SOL) network currently supports over $8 billion in total value locked and holds a market capitalization above $70 billion, alongside constant developer and user growth.

Interest in SOL has increased following the launch of Solana-focused ETFs by major asset managers, including Bitwise and Grayscale.

After a steep pullback toward the end of 2025, SOL has been consolidating around a critical support zone and is now trading near $125. A sustained move higher may hinge on Bitcoin reclaiming the $100,000 level, a milestone that could arrive sooner rather than later.

In ChatGPT’s most optimistic scenario, Solana could rally to $650 by 2027. That would represent approximately 420% upside from current prices and more than double SOL’s previous all-time high of $293, set last January.

Rising institutional involvement further strengthens Solana’s long-term outlook. Growing adoption of the network for real-world asset tokenization by firms such as Franklin Templeton and BlackRock highlights Solana’s increasing relevance within traditional finance.

What began in 2013 as a parody has evolved into one of crypto’s largest digital assets. Dogecoin ($DOGE) now carries a market capitalization of nearly $21 billion, representing close to half of the $44 billion meme coin sector.

DOGE formed several constructive technical patterns in late summer and early autumn of 2026, though momentum weakened following a sharp, market-wide sell-off in October.

Dogecoin reached an all-time high of $0.7316 during the retail-driven bull market of 2021. While the long-discussed $1 target remains a symbolic goal for the Doge Army, ChatGPT forecasts that DOGE may top out near $0.90 this year. From its current price of around $0.12, that would still equate to an almost 7.5x increase.

Dogecoin has also gained traction as a medium of exchange. Tesla accepts DOGE for select merchandise, while payment platforms such as PayPal and Revolut now support Dogecoin transactions, reinforcing its utility beyond meme culture.

Outside of ChatGPT’s blue-chip forecasts, Maxi Doge ($MAXI) is one of January’s most talked-about meme coin presales, raising more than $4.5 million ahead of its planned exchange debuts.

The project presents an over-the-top, gym-bro parody of Dogecoin. Loud, irreverent, and intentionally excessive, Maxi Doge leans fully into the high-octane meme culture that originally propelled meme coins into the spotlight.

After years of Dogecoin dominance, Maxi Doge is building its own Maxi Doge Army, united by meme coin degeneracy, high-risk trading behavior, and an appetite for sharp price swings.

MAXI is issued as an ERC-20 token on Ethereum’s proof-of-stake network, giving it a lower environmental footprint compared with Dogecoin’s proof-of-work structure.

Presale participants can stake MAXI tokens for yields of up to 69% APY, though rewards decrease as additional users join the pool. The token is currently priced at $0.00028 in the latest presale phase, with automatic price increases scheduled at each new funding milestone. Purchases are supported via MetaMask and Best Wallet.

Say goodbye to Dogecoin. Maxi Doge is the new dog in town!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here

The post We Hacked ChatGPT to Predict the Price of XRP, Solana and Dogecoin By the End of 2026 appeared first on Cryptonews.

Solana has once again bounced off the key $120 support level, but the latest price action may cast short-term doubt on a bullish Solana price prediction.

The Asian session opened with sharp losses, though a swift rebound at this critical threshold shows buyers are still defending key levels.

Trading volumes have gone up by an eye-popping 278%, currently sitting at $6.3 billion and accounting for 9% of the token’s market cap. This confirms the technical relevance of this specific price zone.

From Monday to Thursday last week, SOL ETFs brought in $10 million in assets, pushing the total to $1.1 billion.

As Wall Street’s interest in Solana continues to be strong, this bounce off the $120 level could catalyze the token’s next leg up.

However, it could also result in a sharp correction if this support area is lost.

The daily chart shows that SOL experienced significant selling pressure once again upon hitting the $145 resistance.

The Relative Strength Index (RSI) shows that negative momentum has accelerated as it fell below the 14-day moving average.

If SOL’s $120 support falters, the lower bound of the descending price channel would be the next demand zone to watch.

Meanwhile, the token’s downside risk would increase if that line fails to hold, increasing the odds of a move to $97 for the first time since April last year.

Even though top altcoins are struggling to recover, top crypto presales in the Solana ecosystem, like Bitcoin Hyper ($HYPER), have managed to keep investors excited. This project brings Solana’s high speeds, low costs, and smart contracts support to the Bitcoin blockchain.

Since the presale kicked off, it has raised $30 million to launch the scaling solution, setting the stage for a successful launch.

Bitcoin Hyper ($HYPER) is a red-hot crypto presale bringing Solana’s powerful tech to Bitcoin.

This unlocks a new era of speed, scalability, and passive income potential for BTC holders.

For the first time, Bitcoin users will be able to do more than just HODL.

With Bitcoin Hyper, they’ll be able to earn yield, stake, lend, and trade assets using fast and efficient smart contracts.

All of this happens without leaving the Bitcoin ecosystem.

By combining Solana’s low-cost infrastructure with Bitcoin’s massive network, Bitcoin Hyper makes it possible to launch Bitcoin-native DeFi apps, NFT platforms, and advanced payment solutions.

At the center of it all is the $HYPER token.

More than $30 million has already been raised, and investor interest continues to grow.

Demand for the token is expected to rise as the Hyper L2 gains traction, giving early backers a major advantage.

To buy $HYPER before the presale ends, head to the official Bitcoin Hyper website and connect a compatible wallet like Best Wallet.

You can swap USDT, USDC, or ETH, or use a bank card to purchase tokens quickly and easily.

Visit the Official Bitcoin Hyper Website HereThe post Solana Price Prediction: All Eyes on Critical Price Level – One Move Below Could Trigger a Rapid Sell-Off appeared first on Cryptonews.

The Shiba Inu price has dropped to $0.00000765 today, marking a 3% decline in a week as the crypto market continues to wobble in the face of ongoing geopolitical concerns.

SHIB’s current price also makes for 9% fall in the past fortnight, and while the meme token is actually up by 7% in the last 30 days, it has suffered a 61% depreciation in the past year.

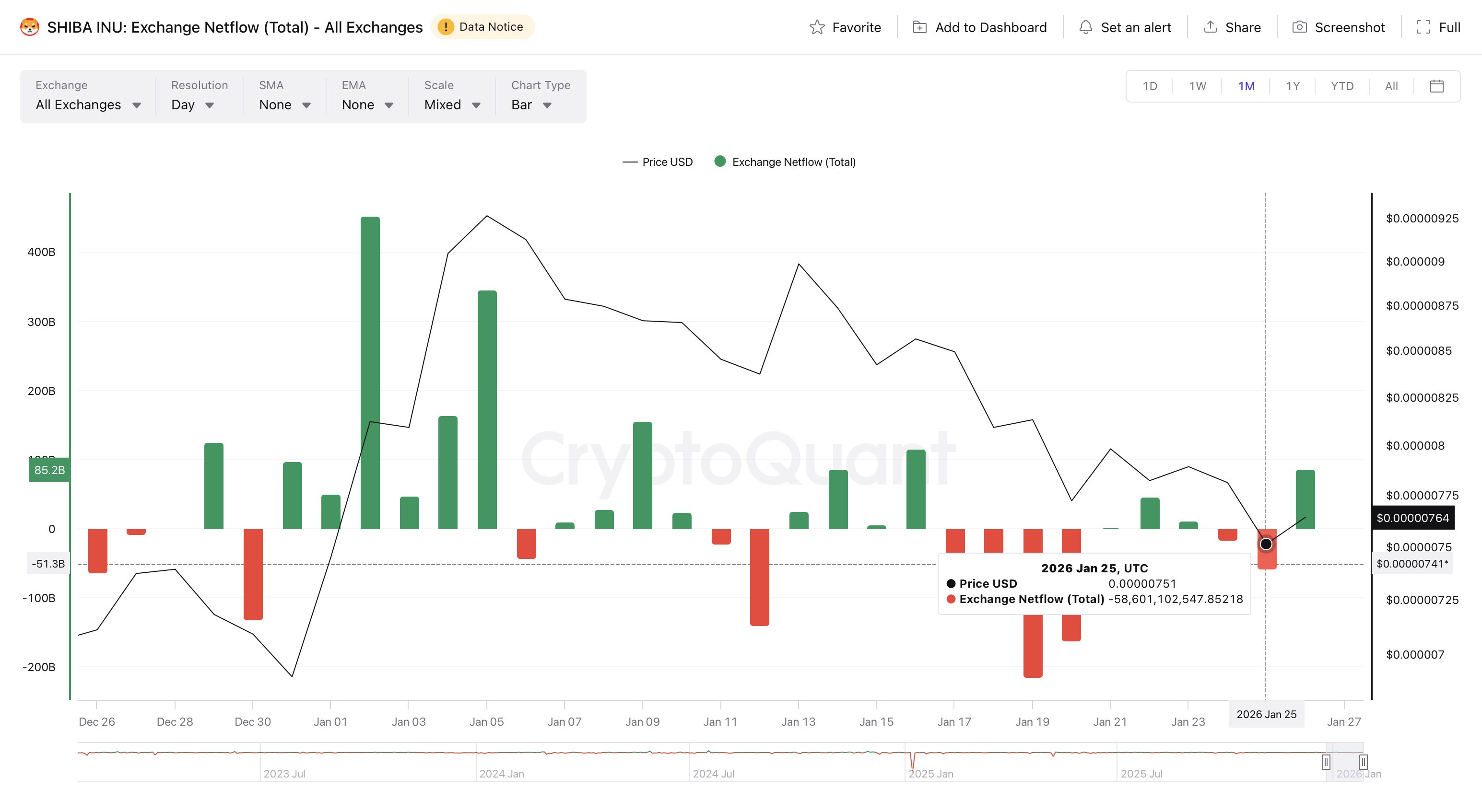

These are disappointing percentages, yet data from CryptoQuant indicates that exchanges have witnessed outflows of SHIB in the past couple of days, after a period of selling pressure.

In other words, whales may be stocking up on the meme token, something which points to a bullish medium- and long-term Shiba Inu price prediction.

If we look at SHIB’s exchange flow data, there was actually an outflow of 58.6 billion SHIB (c. $450,000) yesterday, as well as an outflow of 16.8 billion SHIB the day before.

Last week also saw four consecutive days of outflows, as whales seemingly took advantage of low prices to stock up on the meme coin.

This is arguably very bullish for the Shiba Inu price, although traders should bear in mind that the token’s 24-hour volume is still pretty low, at $105 million today.

However, this potentially sets the stage for one big buy to send the Shiba Inu price flying upwards.

Its chart today suggests that it may need to fall a little further before experiencing a pronounced rally, with its RSI (yellow) on its way towards 30.

Its MACD (orange, blue) has just turned negative after several weeks of positivity, so we may see a rebound once this decline bottoms out.

After bottoming, we could see the Shiba Inu price reach $0.000010 by Q2, before hitting $0.0000250 by H2.

From there, the ongoing growth of the Shiba Inu ecosystem could see it burst out of medium-term ranges and push back towards its ATH of $0.00008616.

In addition to established meme tokens like SHIB, traders may also want to diversify into newer tokens, since these can outpace the market during initial periods of growth.

This can also be the case with presale tokens, with one of the most interesting presale coins available now being SUBBD ($SUBBD), an ERC-20 token that has raised over $1.46 million in its sale.

Earn easily with AI Agents

— SUBBD (@SUBBDofficial) January 7, 2026

Create your own AI Agent here: https://t.co/9jJM0SyyiQpic.twitter.com/F8deXUUYc8

SUBBD is about to launch an adult content creation platform that harnesses AI and crypto to provide creators with a better deal.

Its AI tools can help users generate content, including images and videos, and even the AI performers who will star in them.

At the same time, the use of its native token and of the Ethereum blockchain will ensure that payments to creators remain transparent and fair.

Investors can join its sale by going to the SUBBD website, where it currently costs $0.0574825.

Visit the Official SUBBD Website HereThe post Shiba Inu Price Prediction: SHIB Price Crashes, But 26 Billion Tokens Just Turned Bullish – Do Whales Know Something Big? appeared first on Cryptonews.

Bitcoin is once again entering a critical phase as volatility contracts, and BTC price continues to coil within a tightening range. This volatility squeeze reflects a market in temporary balance, where neither buyers nor sellers have full control, but pressure continues to build under the surface. With macro catalysts and derivatives positioning near the key technical levels, the current compression suggests that BTC may be approaching a decisive expansion.

Bitcoin is being held in place, but is about to break. In an X post, an analyst known as NoLimit revealed data showing why BTC feels stuck between $85,000 and $95,000. While everything else is moving up, the magnetic pull that is holding BTC back will expire in 4 days. BTC is currently trapped inside a massive options web, and the chart shows the concentration around January 30 is nearly double that of any other date.

Currently, the market makers are sitting in a Long Gamma position in this range, which will completely change how the price behaves. When BTC price rises, dealers are forced to sell to stay hedged, and when it dips, they’re forced to buy to stay hedged. This setup reveals why every pump is immediately rejected and why every dump is bought up instantly, not weak buyers, but forced dealer activity.

Related Reading: Bitcoin Price Mirroring Key Patterns From 2021 – Is History About To Repeat?

The data has also shown a massive gamma unwind on January 30. As BTC approaches that expiration, the magnetic force holding the price in this range will start to fade. Once those options expire, the hedges and the mechanical selling pressure that have been suppressing BTC rallies would disappear. Thus, the market would move from a pinned to a released market. When that much gamma leaves the system at once, the move is usually fast and aggressive.

NoLimit noted that he will share an update in 4 days of the expiration of the magnetic pull holding BTC back. The analyst emphasized that he has been an analyst for over 10 years, and called every major market top and bottom publicly, including the $126,000 BTC all-time high. When the next move is set up, he ensures to post it publicly for everyone to see.

Bitcoin is bullish on Cumulative Volume Delta (CVD) divergences, and the price is starting to build up, which could be an early sign of absorption by a larger entity. A full-time trader known as CEDOZXBT has pointed out that the market structure in CVD and price action is the key setup.

At the same time, open interest (OI) has continued to rise, showing that shorts are entering the market at the point of order. This is an early stage for full validation, but if this structure continues to build up, it could be interesting and great for a long setup.

Bitcoin has slipped below the $87,000 level, extending its pullback as selling pressure and macro uncertainty keep traders on the defensive. After multiple failed attempts to regain key resistance zones, BTC is now trading in a fragile range where momentum remains weak, and liquidity conditions can amplify short-term moves. With risk appetite fading, the market is once again questioning whether this decline is a temporary shakeout or the start of a deeper corrective phase.

At the same time, the US dollar has been weakening, reigniting a familiar debate across financial markets: Does a softer dollar automatically lift Bitcoin? The answer is not that simple. A falling dollar can support BTC, but only under the right macro conditions. The driver is not the dollar itself, but why it is falling, and how investors interpret that shift in terms of risk.

In inflation-driven environments, dollar weakness can push capital toward hard assets, allowing Bitcoin to behave more like a “digital gold” narrative. In liquidity-driven cycles, rate cuts and easier financial conditions can also push investors into higher-beta assets like crypto.

But when the dollar declines due to stress, intervention fears, or escalating uncertainty, capital often rotates into traditional safe havens instead—leaving Bitcoin to trade like a risk asset alongside equities.

A CryptoQuant report argues that the relationship between a falling US dollar and Bitcoin is indirect and conditional, not mechanical. In other words, a weaker dollar can support BTC, but only under specific macro regimes. The key variable is not the dollar move itself, but the underlying driver behind that devaluation and the broader risk environment investors are reacting to.

CryptoQuant outlines three scenarios. First, if dollar weakness reflects persistent inflation and a growing search for protection, Bitcoin can benefit as investors treat it like a form of “digital gold.” Second, if the decline is driven by rate cuts and excess liquidity, risk assets typically outperform, and cheaper capital can rotate into crypto as investors seek upside in higher-beta markets. In both cases, the dollar weakness aligns with conditions that can lift Bitcoin.

The third scenario, however, is the most important for the current market. If the dollar is weakening due to a confidence shock and extreme risk aversion—such as the present episode tied to rumors of yen intervention—crypto tends to fall alongside equities. In that environment, the weak dollar is only a backdrop, not a bullish engine.

The conclusion is clear: the market is rotating from the dollar into gold, while Bitcoin ETFs see heavy outflows, showing that in panic, investors still choose the traditional refuge. For Bitcoin to thrive, dollar weakness must come from risk appetite, not fear.

Bitcoin is trading around $87,900 after a volatile decline that dragged price below the $90,000 psychological level and kept bulls under pressure. The chart shows BTC is still trapped in a corrective structure that began after the late-2025 peak, with the downtrend accelerating into November before transitioning into a choppy consolidation phase. Even though price has stabilized above the mid-$80K area, rebound attempts continue to lose strength, suggesting demand remains cautious.

From a trend perspective, Bitcoin is now trading below its major moving averages, reinforcing bearish momentum across multiple timeframes. The 50-period moving average (blue) has turned sharply downward and sits well above the price, acting as dynamic resistance and capping short-term rallies.

The 100-period moving average (green) is also sloping lower, confirming that the broader recovery structure has weakened since BTC failed to sustain moves above $95K. Meanwhile, the 200-period moving average (red) remains the highest overhead level near the low-$100K range, highlighting how much upside would be required to shift the market back into a stronger macro trend.

The recent bounce toward the low-$90K region was rejected quickly, and the price has slipped back into its compression zone. For bulls, reclaiming $90K and then breaking above $92K–$95K is necessary to rebuild momentum. If BTC fails to hold the $87K–$88K region, downside risk remains open toward $84K and potentially the low-$80K zone.

Featured image from ChatGPT, chart from TradingView.com

Discussions are still rampant about which cryptocurrencies could outperform Bitcoin as the entire industry looks ahead to what 2026 has to offer. According to a recent commentary on X, X Finance Bull noted that XRP, HBAR, and Litecoin are a few cryptocurrencies that can outpace Bitcoin.

The crypto commentator pushed back against claims that XRP and Hedera have lost relevance, arguing instead that both are increasingly positioned as foundational blockchain infrastructure. These are based on recent events that have seen both the XRP Ledger and Hedera leading crypto enterprise infrastructure.

According to the commentary shared by X Finance Bull, XRP, Hedera, and Litecoin are a few of the top cryptocurrency ecosystems to watch in 2026. Notably, the crypto commentator grouped XRP and Hedera (HBAR) in the same group to watch due to their growing presence in financial infrastructure. This means these two cryptocurrencies are increasingly leaving the realm of pure speculative assets and are now being considered as important players in financial rails.

Based on this, investors can expect upside divergence from Bitcoin in 2026 as these coins start to go on bullish momentum on their own. This view is based on the investor outlook shown in the image below, which identifies financial infrastructure as an important area of focus for 2026. XRP and HBAR anchor the infrastructure structure, while Litecoin is in the privacy-assets category.

Litecoin’s optional privacy features place it alongside established privacy-focused networks like Monero and Canton. As it stands, you can easily argue that privacy assets are currently underappreciated, especially now that regulatory clarity and digital payments growth are bringing attention to data protection. Based on this context, Litecoin is another top coin to look forward to upside divergence from Bitcoin in 2026.

Interestingly, tokenization platforms and stablecoins are other important themes for 2026. Ethereum and Solana are the primary networks for tokenized assets, while newer platforms such as Sui, Sei, and Injective are beginning to see higher adoption. At the same time, stablecoin supply has grown to over $300 billion, with USDT, USDC, USDE, and RLUSD expanding due to maturing payments infrastructure around stablecoins.

X Finance Bull supported his XRP outlook in a separate post by pointing to the XRP Ledger’s cost structure. The Ledger charges just 0.00001 XRP per transaction, and this places total daily fees across the entire network at around 650 XRP. Furthermore, the Ledger has maintained low and predictable fees since 2012, even during periods of heavy activity, which is in contrast to Ethereum’s variable gas fees and Bitcoin’s congestion pricing.

All transaction fees generated by the Ledger are permanently burned, and this adds a deflationary element to the network. According to the crypto commentator, this combination of speed, low cost, and reliability is what makes its infrastructure the best for long-term institutional use.

The publicly traded Ether treasury has more than 2 million ETH staked, with total holdings of more than 4.2 million, or 3.5% of the outstanding supply.

The past week has seen price action flatten out after the previous saw steep, uninterrupted downside, placing Dogecoin price predictions at a crossroads between a local bottom and another leg down.

Risk appetite has grown increasingly selective, pushing DOGE to the sidelines as speculative capital rotates toward meme coins more detached from macro narratives.

Still, derivatives market activity could point to e a liquidity flush rather than a structural breakdown. Open interest has reset to its October baseline near $1.4 billion, signalling that excess leverage has largely been cleared from the market.

Following such a sharp drawdown, the stabilization of speculative demand points to underlying confidence rather than a cascade of de-risking.

If price can begin forming higher lows from here, DOGE may yet re-enter the bull cycle — but failure to attract fresh momentum could see it lag as capital concentrates elsewhere.

That said, fundamentals could put it back in the conversation as DOGE permeates deeper into mainstream TradFi markets with inclusion in the first S&P-linked crypto index ETF.

Technicals emphasize current levels as key to the bull run, as the lower boundary of a year-long falling wedge pattern comes under pressure.

Momentum indicators paint the setup as a potential launchpad. The RSI nears oversold levels around 30, suggesting that any further downside may be limited as sellers near exhaustion.

The MACD has also levelled off and started rising towards a golden cross above the signal line, suggesting a deep and brief correction over a complete trend flip.

This all lines up with what appears to be an early double bottom reversal.

With a second bottom forming along the $0.115 support, a sharp rebound above the reversal structure’s neckline at $0.15 could put the key $0.28 wedge breakout threshold under test.

If $0.28 flips to support, a confirmed wedge breakout eyes a 550% push past the previous $0.50 all-time high, into new price discovery targeting $0.80.

Still, a breakdown scenario could see a return to lows around $0.09.

As capital rotation becomes selective, speculative demand is concentrating on high-beta plays. While coins like $PENGUIN and $WHITEWHALE lead, momentum almost always circles back to one thing: Doge.

History makes the pattern clear: Dogecoin started the trend, Shiba Inu ran with it in 2021, followed by Floki, Bonk, Dogwifhat, and Neiro. Every bull cycle eventually crowns a new Doge-inspired frontrunner.

This time around, Maxi Doge ($MAXI) is tapping into those early Dogecoin vibes with a community built around sharing early alpha, trading ideas, and competitive engagement.

Participation is at its core. Weekly Maxi Ripped and Maxi Pump competitions reward top performers with leaderboard recognition, incentives, and bragging rights.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.5 million, while early backers are earning up to 69% APY through staking rewards.

For those who missed the Doge wave before, Maxi Doge could be the next chance to catch a meme coin before it enters the mainstream.

Visit the Official Maxi Doge Website HereThe post Dogecoin Price Prediction: What’s About to Happen Could Make or Break DOGE Forever appeared first on Cryptonews.

Bitcoin holders have experienced over $4.5 billion in realized losses following the cryptocurrency’s dramatic decline from above $120,000 to below $90,000, which marks the highest level of capitulation since the 2022 bear market.

The Bitcoin price prediction indicator shows that the price might be bracing for another drop below $80k because the last time this much realized losses occurred in Bitcoin, the price dropped more than 50% to $28,000 from $69k.

The exodus from Bitcoin continues through institutional channels, with U.S.-based Bitcoin ETFs recording $1.33 billion in net outflows over one week, the largest withdrawal since February 2025.

This substantial capital flight shows weakening institutional confidence in the cryptocurrency’s near-term prospects.

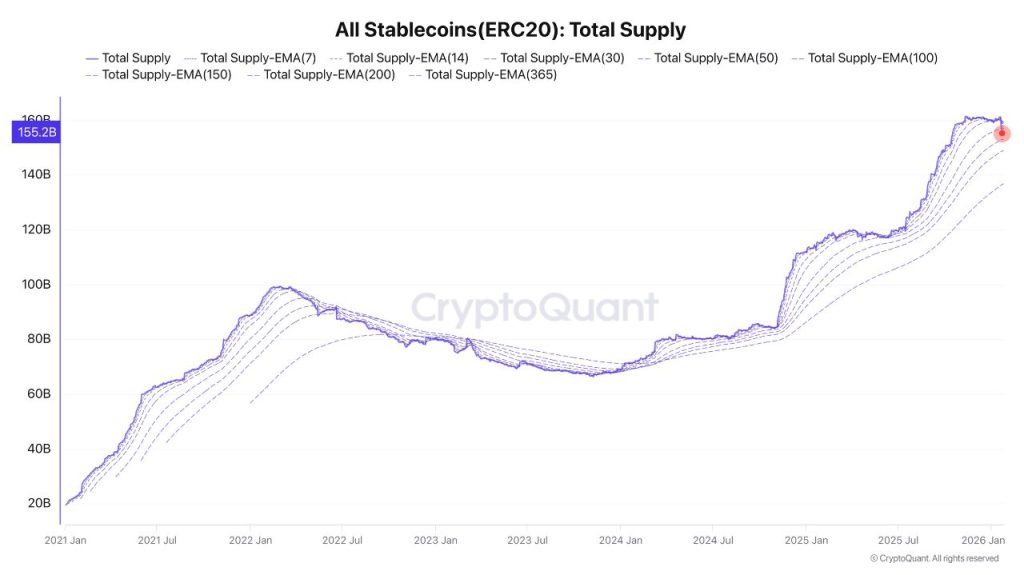

Adding to the bearish sentiment, stablecoin market capitalization has contracted significantly.

According to CryptoQuant researcher Darkfost, the Ethereum-based stablecoin total market cap declined by $7 billion in just seven days, dropping from $162 billion to $155 billion.

Darkfost characterized this development as “a very negative signal,” explaining that investors are completely exiting the crypto market as it continues correcting, while precious metals surge and equity markets maintain strong upward trends.

This migration of liquidity explains the persistent weakness across cryptocurrency markets.

The analyst drew parallels to 2021, noting that similar stablecoin market cap declines confirmed Bitcoin’s entry into bear market territory, though the Terra Luna collapse amplified that downturn.

Darkfost emphasized that current conditions must improve rapidly, or Bitcoin risks confirming a bearish trajectory with a breakdown well below $80,000.

The weekly BTC/USDT chart shows Bitcoin consolidating after a sharp rejection from the $100,000–$103,000 supply zone, which is clearly identified as a bearish invalidation area.

Price currently trades in the mid-to-high $80,000 range, positioned just beneath the 9-week Simple Moving Average, which has transformed into short-term dynamic resistance following the recent breakdown.

Repeated failures to reclaim the $100,000 level confirm that sellers remain aggressive at elevated prices, establishing that zone as a formidable ceiling for any sustained recovery attempts.

The $80,000 level represents critical psychological and structural support. Bitcoin has demonstrated positive reactions near this zone, indicating buyers are defending it vigorously.

As long as Bitcoin maintains weekly closes above $80,000, the broader market structure remains corrective rather than definitively bearish.

Technical momentum indicators suggest caution in the near term.

The Relative Strength Index hovers around the low-40s and has printed multiple bearish divergences during the previous rally, signaling deteriorating momentum and validating the ongoing consolidation phase.

The chart suggests Bitcoin occupies a range-bound corrective phase, with $80,000 serving as the crucial line in the sand.

Holding above this level preserves the possibility of base-building and potential recovery toward $90,000–$95,000 initially.

A decisive weekly close above $100,000 would invalidate the bearish structure and signal trend continuation.

Conversely, losing $80,000 support would likely accelerate downside momentum toward the $70,000 region before establishing a more meaningful bottom.

If Bitcoin successfully breaches the $100,000 psychological barrier, established BTC-beta projects like Bitcoin Hyper stand to benefit substantially.

Bitcoin Hyper ($HYPER) is developing the first functional Layer 2 solution for Bitcoin, leveraging Solana-based technology to provide speed and scalability while maintaining Bitcoin’s security framework.

The project has raised over $31million to facilitate Bitcoin-native decentralized applications, offering BTC holders opportunities to deploy assets productively through purpose-built on-chain tools.

Interested investors can participate in the presale by visiting the official Bitcoin Hyper website and connecting their wallet (such as Best Wallet).

The token is currently available for $0.013645 each and could be purchased via USDT or SOL swaps, or directly through a bank card.

Visit the Official Bitcoin Hyper Website HereThe post Bitcoin Price Prediction – $4.5B Realized Loss Is The Biggest Since 2022: Sub-$80K Next? appeared first on Cryptonews.