Citi Analysts Project Bitcoin Price Could Reach $189,000 Next Year In Bullish Scenario

The Bitcoin price has experienced a significant correction after reaching all-time highs above $126,000 in October, currently trading just above $87,900. This marks a notable 30% decline over the past few months.

Despite this setback, analysts at Citi express optimism for the cryptocurrency’s future, forecasting that its value will continue to rise through 2026.

Optimistic Bitcoin Price Predictions

According to Citi’s analysts, the base case for the Bitcoin price is set at $143,000, reflecting a potential 62% increase from current levels. In a more bullish scenario, the cryptocurrency could surge to over $189,000, indicating a substantial 114% increase.

Conversely, the analysts also present a bear case for the leading crypto, with an estimated price around $78,500, which would represent an additional 10.6% decline from current trading levels.

The forecast from Citi relies on the assumption that investor adoption will persist, particularly with an influx of funds into exchange-traded funds (ETFs) projected to reach $15 billion. This influx is seen as a catalyst that could significantly boost the Bitcoin price.

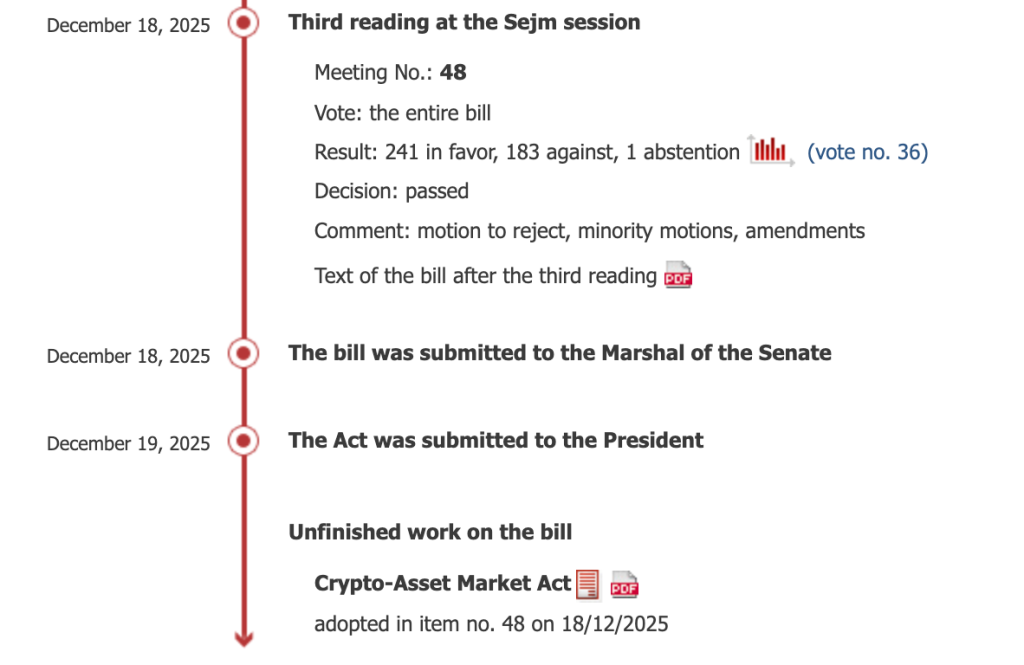

Furthermore, ongoing negotiations in the US Senate regarding their version of the crypto market structure bill, namely the CLARITY Act, which aims to regulate Bitcoin under the Commodity Futures Trading Commission (CFTC), is anticipated to enhance market adoption.

In contrast to Bitcoin, analysts express concerns regarding Ethereum’s (ETH) potential for growth. They argue that Ethereum, being viewed more as “programmable money,” has seen decreased activity, which has resulted in its current trading price of just below $3,000—40% below its all-time high of $4,964.

Additional Catalyst For Price Growth

Chris Neiger, an analyst at The Motley Fool, also attaches bullish predictions to the Bitcoin price future, highlighting that recent US job data reflects an unemployment rate increase to 4.6%, the highest since 2021.

He asserted that if the Federal Reserve (Fed) chose to lower interest rates by 2026, the Bitcoin price could benefit since lower rates typically enhance the cryptocurrency’s value by making borrowing more affordable.

In November, JPMorgan provided a more conservative estimate, suggesting that Bitcoin could reach $170,000 by 2026, with potential upside expected over the next six to twelve months.

Meanwhile, even more aggressive predictions from market researcher Fundstrat forecast the Bitcoin price could soar between $200,000 and $250,000 by the end of 2026, largely driven by the mainstream adoption of ETFs.

Additionally, the establishment of the Strategic Bitcoin Reserve by the federal government has encouraged states to consider similar initiatives.

Neiger concludes that just as ETFs have contributed to the credibility of cryptocurrencies and facilitated price increases, the formation of state-level Bitcoin reserves could serve as another critical driver propelling Bitcoin’s value higher in 2026.

Featured image from DALL-E, chart from TradingView.com

Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”

Poland has elected Karol Nawrocki, a conservative who says crypto should be “born in freedom, not buried in red tape.”

ECB President Christine Lagarde said that the digital euro is technically ready and is now awaiting legislative approval.

ECB President Christine Lagarde said that the digital euro is technically ready and is now awaiting legislative approval.

July 2027 triggers a compliance countdown for blockchain companies in the EU who must shut down anonymous crypto accounts or risk expulsion.

July 2027 triggers a compliance countdown for blockchain companies in the EU who must shut down anonymous crypto accounts or risk expulsion. A new European Central Bank (ECB) report highlights Europeans' reluctance to adopt the digital euro, posing challenges for its planned rollout.

A new European Central Bank (ECB) report highlights Europeans' reluctance to adopt the digital euro, posing challenges for its planned rollout.

The Senate finally confirms

The Senate finally confirms

Among top cap assets, here are the amount of non-empty wallets on each network currently:

Among top cap assets, here are the amount of non-empty wallets on each network currently: Ethereum

Ethereum