Malaysia’s Crown Prince Launches $121M Crypto Treasury – Despite Bubble Fears

Malaysia’s Crown Prince has formally stepped into the digital-asset sector with a new state-backed stablecoin initiative and a large crypto-treasury plan, even as concerns grow over whether the global digital-asset treasury boom has already entered a fragile phase.

Bullish Aim Sdn. Bhd., chaired and owned by His Royal Highness Tunku Ismail Ibni Sultan Ibrahim, the Regent of Johor, announced the launch of RMJDT, a ringgit-backed stablecoin issued on Zetrix, the Layer-1 blockchain that powers Malaysia’s national Malaysia Blockchain Infrastructure.

The rollout took place under the supervision of the country’s regulated sandbox, which is overseen by both the Securities Commission and Bank Negara Malaysia, to test financial innovations ranging from stablecoins to programmable payment systems.

— Cryptonews.com (@cryptonews) March 24, 2025

Malaysia's central bank will explore asset tokenization and digital assets, collaborating with the private sector on potential use cases for tokenized deposits and CBDCs.#BankNegaraMalaysia #CBDChttps://t.co/FAnsrg2yY6

Crown Prince Drives RMJDT Rollout With $121M Digital Asset Reserve

RMJDT is intended to strengthen the ringgit’s profile in cross-border settlements and attract foreign direct investment, echoing Malaysia’s broader push into tokenization and digital-asset modernization.

The Crown Prince said the initiative is part of Johor’s effort to align with the country’s Digital Asset National Policy, which encourages real-world asset tokenization and experiments in supply-chain finance.

Alongside the stablecoin launch, Bullish Aim confirmed plans to establish a Digital Asset Treasury Company with an initial allocation of 500 million ringgit, roughly $121 million, in Zetrix tokens.

The firm intends to expand the treasury to one billion ringgit over time. The treasury will be used to stabilize gas fees for RMJDT transactions and to support up to 10% of validator nodes within the national blockchain infrastructure.

The move draws inspiration from high-profile corporate treasury strategies such as those employed by Strategy, which has accumulated more than 660,000 Bitcoin since 2020.

Additionally, Ismail’s reported $2.7 billion bid for a land deal in Singapore back in August shows how some well-capitalized players are still willing to take major swings, even as worries grow about others mimicking the same strategies.

The Regent of Johor said the Zetrix reserve was necessary to ensure predictable operations and tighter alignment with the national blockchain.

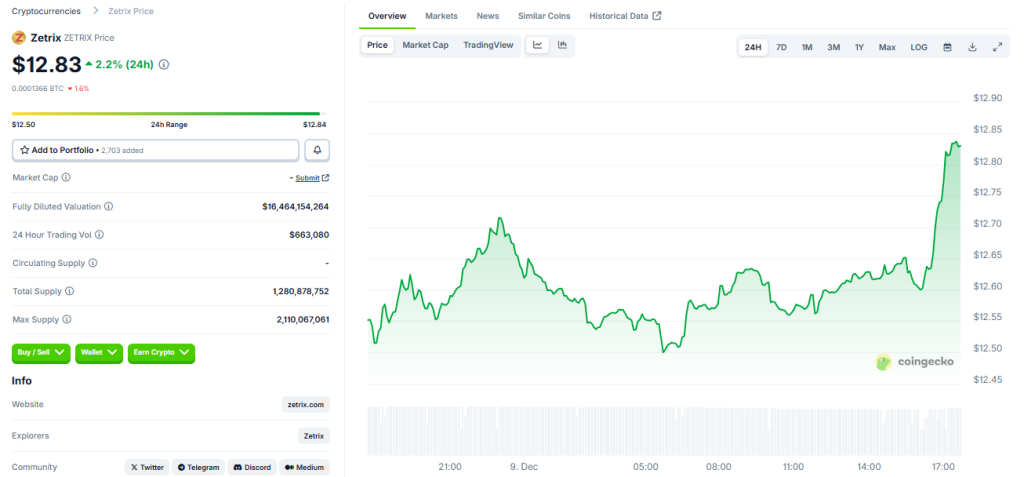

The launch comes at a time when Zetrix trades around $12.60, well below its peak above $20 recorded roughly a year earlier, according to CoinGecko data.

Malaysia Ramps Up Crypto Treasuries Even as Global Inflows Slow

The timing also places Johor’s initiative inside a broader regional shift. In recent months, Malaysia has seen a series of digital-asset treasury announcements.

On November 12, VCI Global said it would acquire $100 million worth of OOB tokens in a deal that will make Tether the company’s largest shareholder.

— Cryptonews.com (@cryptonews) November 12, 2025

VCI Global has announced plans to acquire $100 million worth of OOB tokens, the native asset of Tether-backed crypto payments company Oobit.#Malaysia #Cryptohttps://t.co/OLLT57dQ9T

VCI Global plans to fold the token into its AI and fintech platforms and establish its own digital treasury division.

The firm had already purchased $50 million worth of tokens through a restricted share issuance and intends to buy another $50 million on the secondary market after Oobit completes its migration from Ethereum to Solana.

These developments are unfolding as Malaysia’s regulators accelerate reforms to support a more active digital-asset ecosystem.

— Cryptonews.com (@cryptonews) July 1, 2025

@SecComMalaysia proposes regulatory enhancements to the digital asset exchange framework by accelerating token listings. #DigitalAssets #Malaysiahttps://t.co/EV3L8ir6m1

The Securities Commission has proposed an overhaul of exchange rules after trading volumes more than doubled in 2024 to nearly 14 billion ringgit.

The new framework would allow certain tokens to be listed without prior approval, provided they meet strict criteria, while requiring operators to adopt tighter governance and risk controls.

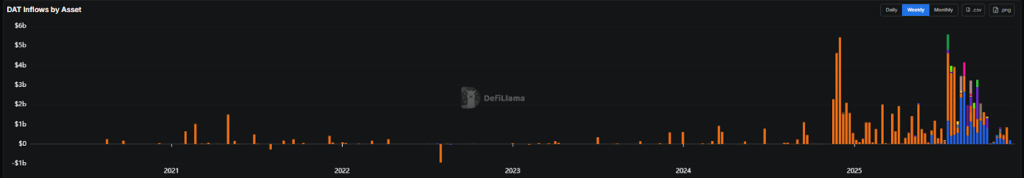

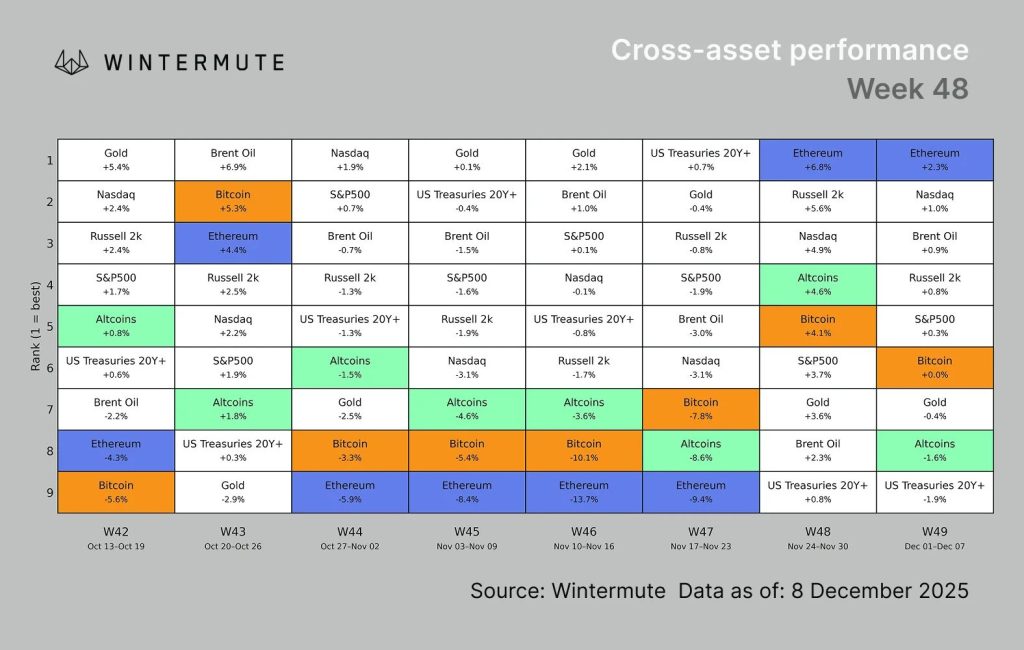

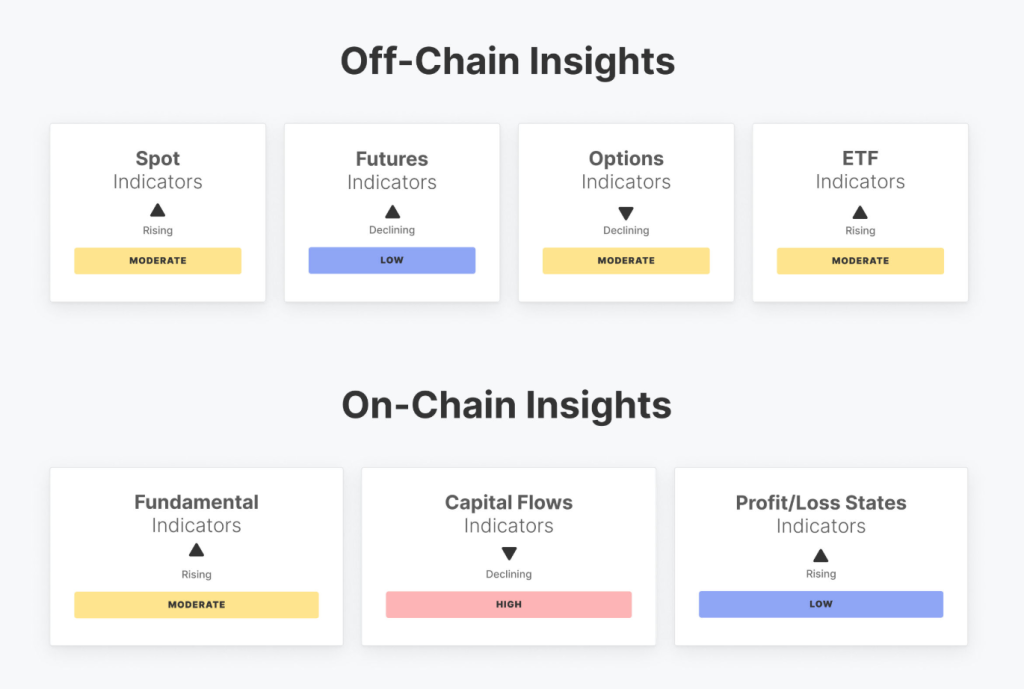

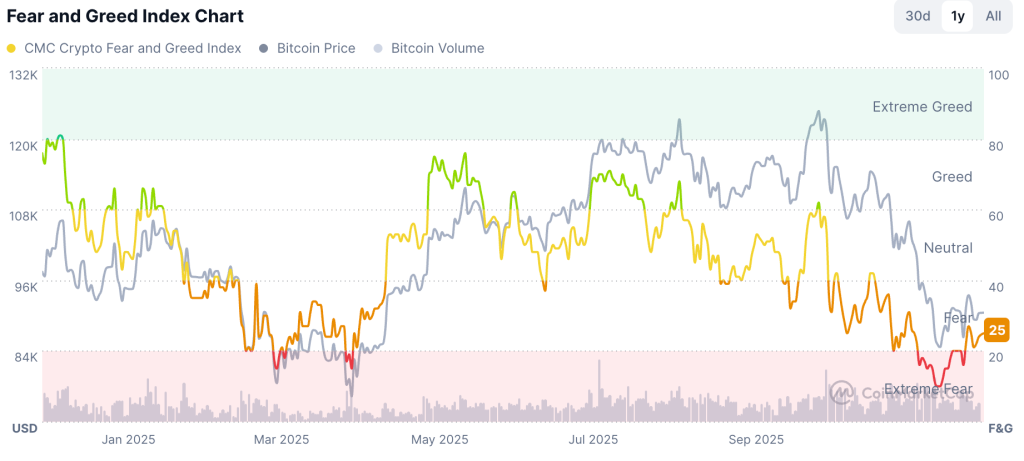

But the broader digital-asset treasury sector is showing signs of fatigue. Data from DefiLlama shows corporate crypto treasuries recorded their slowest month of the year in November, with inflows dropping to $1.32 billion, down sharply from September’s peak.

Galaxy Research described the market as entering a “Darwinian phase,” with leverage unraveling and several treasury-backed stocks trading at deep discounts.

Even major players like Strategy, despite adding nearly $1 billion in Bitcoin last week, have seen their equity fall more than 35% over the past month.

The post Malaysia’s Crown Prince Launches $121M Crypto Treasury – Despite Bubble Fears appeared first on Cryptonews.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model.

Hong Kong will allow licensed crypto exchanges to connect with global order books, ending its current isolated trading model. China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.

China reinforces crypto ban with renewed enforcement targeting stablecoins as Hong Kong stocks with digital asset exposure drop sharply following central bank warning.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026.

Australia requires stablecoin and digital asset providers to obtain financial services licenses under new ASIC guidance effective June 2026. Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.

Australia is set to slap crypto platforms with fines as steep as 10% of turnover under tough new draft rules, the Treasury said Thursday.