Bitcoin Price Prediction: US Bank Now Lets Clients Buy BTC Directly – Could This Be the Start of a Banking Domino Effect?

PNC Bank, the sixth-largest commercial bank in the United States, has launched direct spot Bitcoin trading for eligible private bank clients, becoming the first major U.S. bank to offer native Bitcoin exposure.

Crypto analysts say the domino effect of this direct custody could positively impact the trajectory of the Bitcoin price prediction.

U.S Banks Break Down Barriers to Bitcoin Access

The new PNC bank service enables qualified private banking clients to purchase, hold, and sell Bitcoin without relying on external cryptocurrency exchanges.

Today marks a major milestone for institutional crypto adoption.@Coinbase’s Crypto-as-a-Service platform is now powering @PNCBank’s launch of direct bitcoin trading for PNC Private Bank clients – the first to market with such an offering among the major U.S. banks. pic.twitter.com/wwuOIRuBfK

— Coinbase Institutional(@CoinbaseInsto) December 9, 2025

This development follows a crucial regulatory milestone from the Office of the Comptroller of the Currency, which recently confirmed that national banks may conduct riskless principal crypto-asset transactions.

The decision permits U.S. banks to function as intermediaries in crypto trades by simultaneously buying from one customer and selling to another without maintaining inventory.

Last week, Bank of America authorized its 15,000 wealth management advisers to recommend 1%–4% crypto allocations for client portfolios, signaling a broader institutional embrace of mainstream Bitcoin exposure.

In October, Citibank announced plans to launch crypto custody services in 2026, after developing the infrastructure over two to three years.

Meanwhile, Cryptonews reported in September that BNY Mellon is advancing toward offering custody services for Bitcoin and Ethereum, specifically targeting exchange-traded product clients.

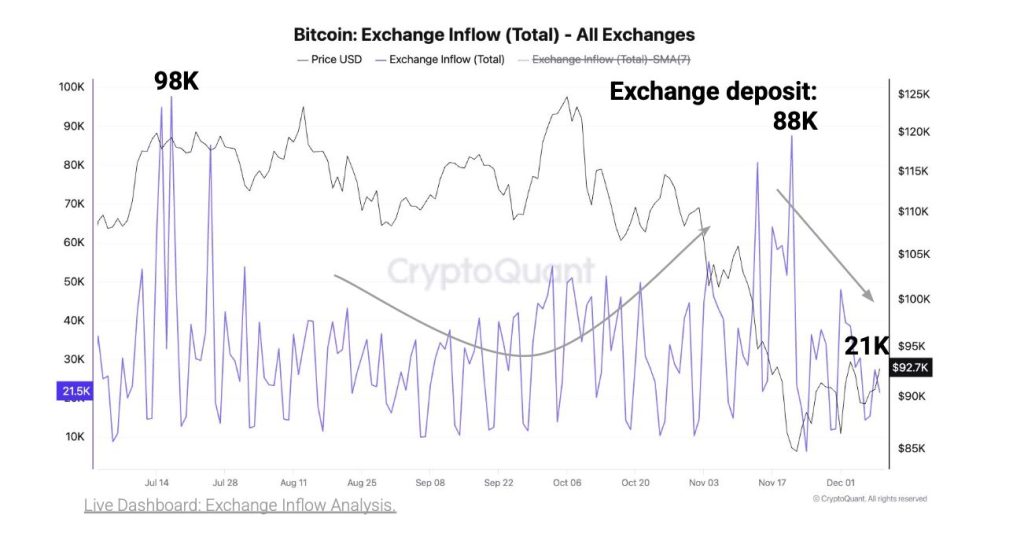

If other major banks replicate PNC’s approach, BTC could establish stronger support levels in the coming months and position itself for a further push toward the $100,000–$130,000 range heading into 2026.

Bitcoin Price Prediction: Breakout Targets $105K, $110K, $120K

Bitcoin is attempting to escape a multi-week descending channel after defending critical support near $83,000.

The recent bounce pushed the price back above the 9-day simple moving average, demonstrating early momentum, though it remains near the channel’s upper boundary.

The RSI has climbed out of oversold territory and is now approaching the mid-50s, indicating recovering bullish momentum following a prolonged downtrend.

If Bitcoin closes decisively above the descending channel and maintains support above $90,000–$92,000, charts suggest upside continuation toward resistance clusters at $105,000, $110,000, and potentially $120,000.

However, failure to sustain this breakout zone risks a retest of $83,000 support.

This New Meme Coin Raised $4.3M Fast – Is It the Next Dogecoin?

As Bitcoin gears up for its next major move, early-stage projects like Maxi Doge ($MAXI) are quickly gaining traction among investors looking for high-upside plays.

Inspired by Dogecoin’s explosive 1,000x rally, $MAXI is building a high-energy community where traders share alpha, early setups, and hidden gems before they go mainstream.

Since launching only a few months ago, the presale has already pulled in over $4.3 million, with strong momentum.

This could be one of the cycle’s most relatable, community-first opportunities, and early backers still have time to get in before the next price increase kicks in.

To buy early, visit the official Maxi Doge website and connect a crypto wallet like Best Wallet.

You can swap existing crypto or use a bank card to make the purchase in seconds.

Visit the Official Maxi Doge Website HereThe post Bitcoin Price Prediction: US Bank Now Lets Clients Buy BTC Directly – Could This Be the Start of a Banking Domino Effect? appeared first on Cryptonews.

BTC neared $94K and ETH hit $3,250 early December, driven by MSTR’s buy and Fusaka anticipation, per Laser Digital.

BTC neared $94K and ETH hit $3,250 early December, driven by MSTR’s buy and Fusaka anticipation, per Laser Digital.

Trump signs bill ending 43-day shutdown. ETFs await approvals, and markets eye potential weekend momentum.

Trump signs bill ending 43-day shutdown. ETFs await approvals, and markets eye potential weekend momentum.