Japan Moves Crypto to Securities Law – Tighter Rules & Platform Crackdowns Coming

Japan is preparing its most sweeping overhaul of crypto oversight in almost a decade, setting the stage for a system that would treat digital assets far more like traditional investment products.

The move follows months of government deliberations and a series of regulatory proposals that have emerged steadily across 2024 and 2025.

Together, they show a decisive shift in how the country intends to manage trading activity, exchange operations, and investor protection.

FSA Pushes for Stricter Token Disclosure to Address Speculation and Risk

The latest step came this week after the Financial Services Agency released a detailed report from the Financial System Council’s Working Group.

The document lays out a plan to move crypto regulation away from the Payment Services Act, which has governed the sector since 2016, and into the Financial Instruments and Exchange Act.

This change would place cryptocurrencies under the same legal umbrella used for securities trading, disclosures, and market conduct rules. Regulators said the shift reflects how the market has changed, noting that most users now engage with crypto as an investment.

Government data shows more than 86% of domestic users trade with an expectation of long-term price gains, while deposits across registered platforms have surpassed five trillion yen.

The Working Group concluded that the current framework no longer matches the risks posed by a sector dominated by speculative trading, large investor inflows, and complex token issuance schemes.

By placing crypto inside the securities rulebook, authorities intend to impose stricter disclosure requirements, particularly for token sales conducted by exchanges.

— 金融庁 (@fsa_JAPAN) December 10, 2025

金融審議会「暗号資産制度に関するワーキング・グループ」報告書を公表しました。#金融庁

▼詳細は以下をご覧ください。https://t.co/oNnsy4QYO9

The report singles out initial exchange offerings, stressing the need for pre-sale information, independent code audits, and clearer descriptions of who controls a project.

Even fully decentralized assets would come under closer scrutiny, with exchanges responsible for giving users neutral risk assessments based on verifiable data.

The recommendations also call for explicit insider-trading rules covering events such as token listings, major system breaches, and large-scale sales by issuers.

— Cryptonews.com (@cryptonews) November 17, 2025

Japan plans to classify crypto as financial products under insider rules, cut profit taxes and tighten disclosure on 105 listed assets.#Japan #CryptoRegulations https://t.co/i9qXS0DnJA

These provisions would apply to exchange employees, token developers, and other related parties who may access undisclosed information.

The approach mirrors ongoing reforms in Europe and South Korea, where authorities have already introduced insider-trading standards for the digital asset sector.

Japan Opens Door for Financial Giants’ Subsidiaries Under the New Rule

Exchanges operating in Japan would face standards similar to brokers dealing in securities. They would be required to assess users’ risk tolerance before permitting complex or highly volatile trading.

The plan also introduces investment limits for token offerings that have not completed financial audits, an effort to prevent retail users from being exposed to sudden selling pressure once trading begins.

Traditional financial institutions are expected to play a greater role as well. While banks and insurers will remain barred from running exchanges directly, regulators intend to let their subsidiaries offer crypto trading through highly supervised channels.

The planned transition comes alongside a series of related policies that have unfolded over recent months.

In November, the FSA proposed a registration system for custody providers and outsourced trading software firms after last year’s DMM Bitcoin breach exposed weaknesses in third-party systems.

— Cryptonews.com (@cryptonews) November 25, 2025

Japan intends to require crypto exchanges to hold reserves to cover customer losses, tightening safeguards against hacks and operational failures.#Japan #CryptoRegulations https://t.co/g9rmxG2kbw

Days before that, officials confirmed support for a joint stablecoin pilot involving Japan’s three largest banks, an effort that would create a shared framework for issuing yen-backed digital tokens.

Other proposals under review include allowing banking groups to register as exchange operators, expanding access for retail investors, and bringing crypto management closer to the structure used for stocks and government bonds.

Tax reform is also advancing. The government is preparing to replace the current progressive tax rate, which can rise to 55%, with a flat 20% levy on crypto gains beginning in 2026.

The post Japan Moves Crypto to Securities Law – Tighter Rules & Platform Crackdowns Coming appeared first on Cryptonews.

Federal Reserve cuts interest rates by 25bps.

Federal Reserve cuts interest rates by 25bps.

(@CoinbaseInsto)

(@CoinbaseInsto)

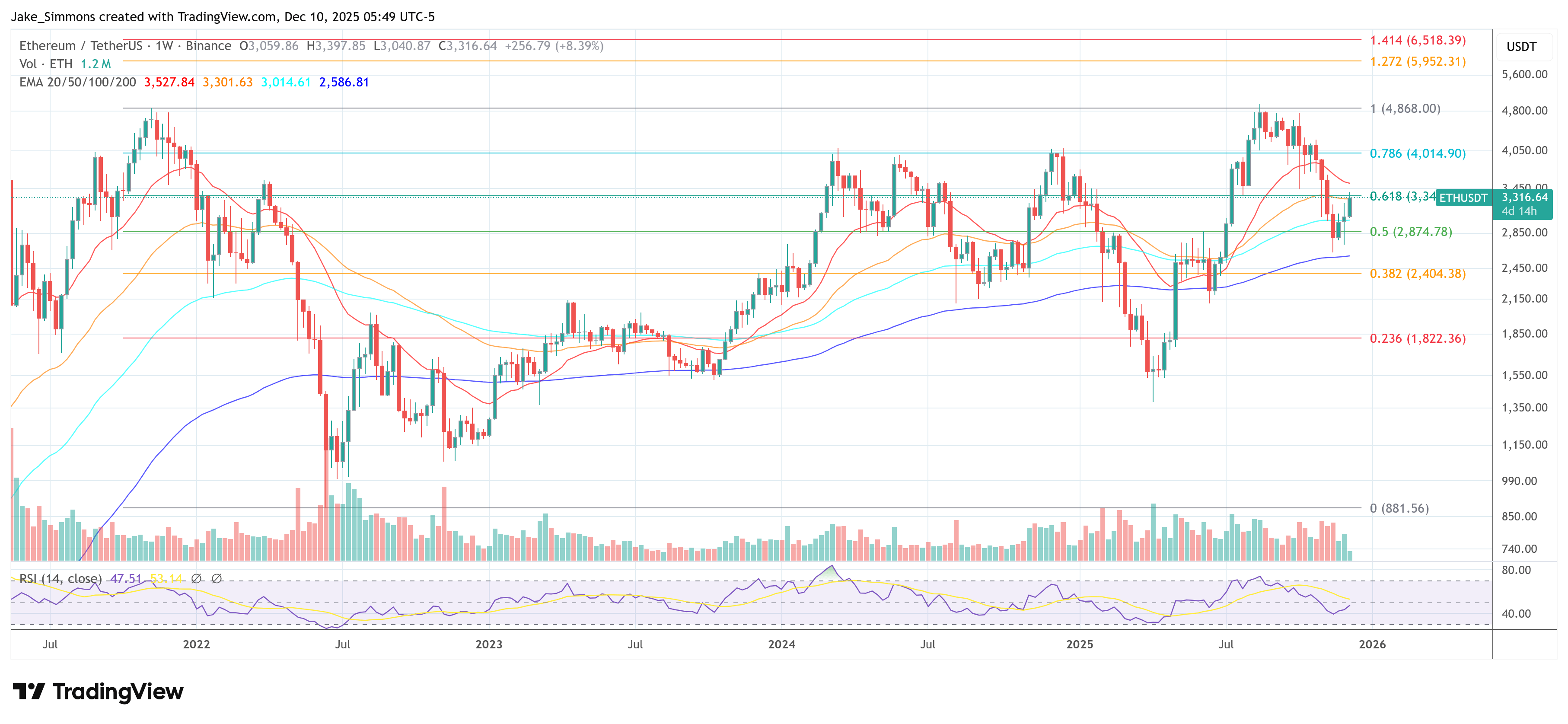

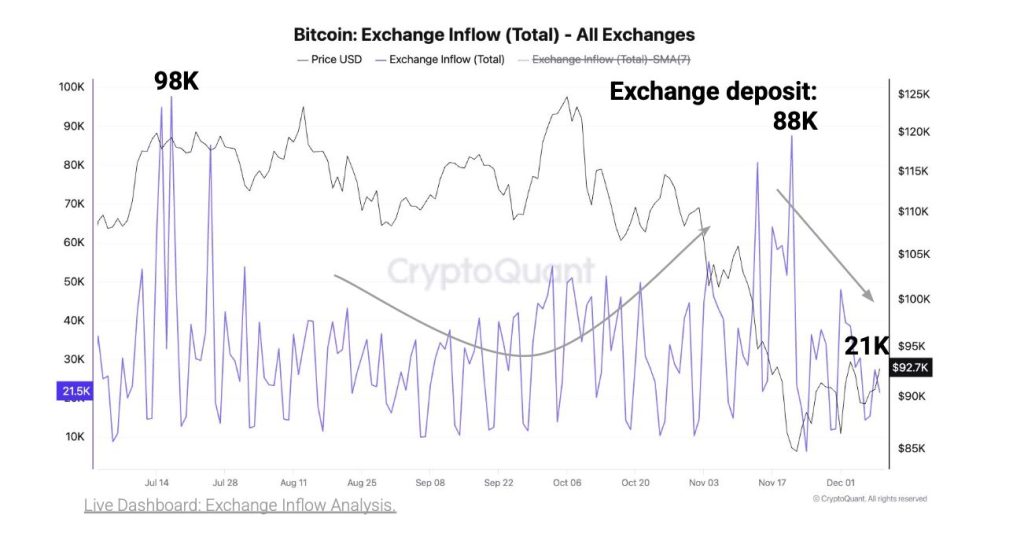

BTC neared $94K and ETH hit $3,250 early December, driven by MSTR’s buy and Fusaka anticipation, per Laser Digital.

BTC neared $94K and ETH hit $3,250 early December, driven by MSTR’s buy and Fusaka anticipation, per Laser Digital.