SEC Chair Says Tokenization Could Transform U.S. Financial System Within “Couple of Years”

The U.S. financial system may transition to blockchain far sooner than many expect, according to SEC Chair Paul Atkins.

The U.S. financial system may transition to blockchain far sooner than many expect, according to SEC Chair Paul Atkins.

Historical context supports an analysis suggesting that Shiba Inu could explode from here as it retests a crucial support area. Notably, the analysis came from Crypto Patel, who forecasts that Shiba Inu could reverse recent price underperformance.

Professional investors can now trade XRP directly against the Hong Kong Dollar (HKD) after its listing on a licensed crypto exchange in the region. In a recent announcement, OSL, a regulated digital asset trading platform in Hong Kong, expanded its trading offerings by listing XRP for professional investors on its Flash Trade platform.

Recent data from Coinglass reveals that traders are piling into short positions on XRP at a far more aggressive pace than any other major asset. Despite this pressure, the asset has held surprisingly firm, posting gains over the past day.

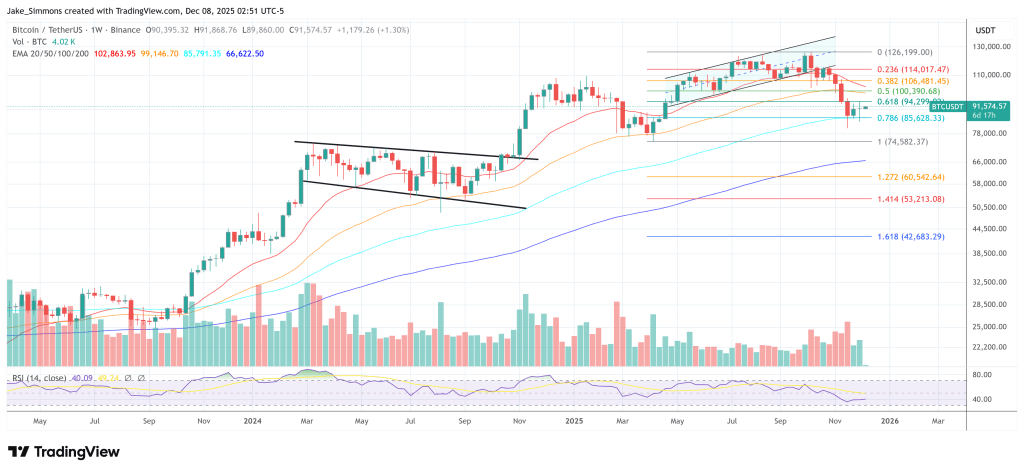

Bitcoin is trading at a pivotal level that analysts say could determine whether the market holds its broader uptrend or slips back toward spring lows.

Key Takeaways:

In a recent post on X, crypto trader Daan Crypto Trades said the 0.382 Fibonacci retracement zone is the line bulls must defend, warning that a breakdown could send BTC back to April levels near $76,000.

“It’s also pretty much the last major support before testing the April lows again, which would break this high time frame market structure,” he said.

Over the weekend, Bitcoin briefly dipped below $88,000 during another round of leverage washouts before rebounding above $91,500.

Analyst “Bull Theory” described the move as typical low-liquidity weekend manipulation aimed at flushing both longs and shorts.

The market now turns its attention to this week’s Federal Open Market Committee meeting, where a 0.25% rate cut is widely expected.

BREAKING: Bitcoin dumped $2,000 from $89.7k to $87.7k and liquidated $171 million worth of longs.

— Bull Theory (@BullTheoryio) December 7, 2025

But then it pumped $3,500 from $87.7k to $91.2k and liquidated $75 million worth of shorts.

All this happened in the last 4 hours.

This is another example of manipulation on the… pic.twitter.com/1JxZ3rSWmu

Still, crypto markets have cooled since the October cut, as Fed Chair Jerome Powell emphasized a data-dependent path rather than a predictable easing cycle.

Markus Thielen of 10x Research noted that traders expect a similar tone this week, cautious and potentially hawkish, keeping pressure on risk assets.

With ETF inflows softening and trading volumes thinning into December, Thielen said upside participation remains limited, while volatility compression leaves BTC more vulnerable to downside moves in the near term.

“Bulls will point to the Treasury General Account rebuild, the end of Quantitative Tightening, and looming rate cuts as a liquidity windfall for Bitcoin,” Thielen wrote.

He added that hypothetical macro tailwinds are “irrelevant if the underlying message lacks conviction and the market structure fails to support a sustained move.”

Nick Ruck of LVRG Research said upcoming U.S. jobs data and inflation figures may prove just as influential.

If they reinforce expectations for continued easing, he believes renewed liquidity inflows could fuel a broader recovery across digital assets.

As reported, a key on-chain indicator known as “liveliness” is climbing again, even as Bitcoin’s price action remains subdued.

Analysts say the divergence suggests renewed underlying demand, with dormant coins moving at levels not seen in years, a sign that long-term holders may be re-entering the market.

The indicator’s steady rise points to a major rotation of capital beneath the surface despite cautious sentiment.

Liveliness measures the balance between coins being transacted and those being held, weighted by age. It tends to rise during bull markets as older coins move at higher prices, reflecting fresh inflows and greater conviction.

Last week, Bitfinex said the market is showing “seller exhaustion” following a period of heavy deleveraging and panic-driven exits by short-term holders.

“The combination of extreme deleveraging, capitulation among short-term holders, and early signs of seller exhaustion has created the conditions for a stabilisation phase and a relief bounce,” the firm wrote.

The post Bitcoin Tests Key Fibonacci Support as Analysts Warn of Drop to $76K appeared first on Cryptonews.

Ethereum co-founder Vitalik Buterin has suggested a trustless, onchain futures market for gas to bring greater predictability to Ethereum transaction costs.

Key Takeaways:

In a post on X over the weekend, Buterin said repeated questions about whether Ethereum’s roadmap can guarantee low fees inspired him to outline how such a market could work.

Buterin argued that an onchain gas futures system would give users the ability to lock in gas prices for future time windows, offering greater certainty as Ethereum scales.

The concept mirrors traditional futures markets, such as those for commodities, where buyers and sellers agree on a fixed price for a future date to hedge risk or speculate on price movements.

Applied to Ethereum, it would allow users to prepay for a specific amount of gas during a chosen time period, protecting them from unexpected fee spikes.

“People would get a clear signal of expectations for future gas fees, and would even be able to hedge against future gas prices,” Buterin wrote.

He suggested that a market-built signal for future base fees could help traders, developers, and heavy network users plan with far more confidence, especially those managing large volumes of transactions or operating decentralized applications.

We need a good trustless onchain gas futures market.

— vitalik.eth (@VitalikButerin) December 6, 2025

(Like, a prediction market on the BASEFEE)

I've heard people ask: "today fees are low, but what about in 2 years? You say they'll stay low because of increasing gaslimit from BAL + ePBS + later ZK-EVM, but do I believe you?"…

Gas costs have eased this year, with basic Ethereum transfers averaging around 0.474 gwei, roughly one cent, according to Etherscan.

However, more complex activity still comes at a higher cost, including token swaps ($0.16), NFT transactions ($0.27), and cross-chain bridging ($0.05).

Despite the overall decline, fee volatility remains a challenge. YCharts data shows average Ethereum fees started 2025 near $1 before falling to $0.30, punctuated by swings as high as $2.60 and as low as $0.18.

Buterin’s proposal aims to smooth these fluctuations by giving users a mechanism to anticipate and manage costs, particularly ahead of high-demand periods.

As reported, Ether held on centralized exchanges has dropped to an all-time low, with balances falling to just 8.7% of total supply, the smallest share since Ethereum launched in 2015.

The decline marks a 43% drop since July, a shift analysts say is tightening liquid supply and setting the stage for a potential market squeeze.

The rapid drawdown is linked to structural changes in how ETH is being used. More tokens are flowing into staking, restaking protocols, layer-2 networks, DeFi collateral loops, digital-asset treasury holdings, and long-term self-custody, all destinations that rarely send ETH back to exchanges.

Research outlet Milk Road said ETH is now in its “tightest supply environment ever,” noting that Bitcoin’s exchange balance remains significantly higher.

The post Vitalik Buterin Proposes Onchain Gas Futures Market for Predictable Fees appeared first on Cryptonews.

EMJ Capital CEO Eric Jackson has laid out one of the most aggressive long-term bitcoin targets in the space yet, arguing in an interview with reporter Phil Rosen that the cryptocurrency could reach $50 million per coin by 2041. His projection is tied to a thesis that bitcoin will evolve from “digital gold” into the core collateral layer of the global financial system.

Jackson said his thinking grows out of the same “hundred bagger” framework he used when buying beaten-down equities like Carvana. He recalled entering Carvana after its share price collapsed from around $400 to roughly $3.50 in 2022, at a time when sentiment was almost universally hostile. “You would hear things like, that’s run by a bunch of criminals. This is what a bunch of idiots. Like you’d have to be an idiot to let your company go from $400 this year to $450 or $350 rather,” he told Rosen.

For Jackson, that period illustrated how markets behave at extremes. “It’s human nature almost that when you’re in the moment of max pain or pessimism, you can only see what’s right in front of you,” he said. Yet the underlying product remained strong: “It wasn’t a broken platform. It wasn’t a broken service […] they would tell you they loved it. It was so easy. It was the best customer experience they had.” From there, he could “envision how they were going to be like a much more profitable business” once the company focused on profitability and addressed its debt.

He applies the same long-horizon lens to bitcoin, arguing that the day-to-day ticker and polarized narratives obscure its structural potential. “We get so tied to turning on the TV and just seeing, like, what’s the price of Bitcoin today […] Some people are bearish and they say, oh, it’s a Ponzi scheme. And some people are bullish and they just, you know, throw these like kind of pie in the sky targets that you can’t really tie to reality,” Jackson said. “It’s kind of hard to latch on to like, what is the value of this thing?”

Jackson begins with the common “digital gold” framing. He asks how large the gold market is, how many central banks and sovereigns hold it and why. “Could Bitcoin be as big as gold one day? That seems like a safe assumption,” he argued, adding that because it is “digital” and “programmable” rather than a “hunk of rock,” younger generations may prefer it as a store of value. But he stresses that this is only part of the story, as bitcoin has not become a medium for daily transactions “since the guy who bought pizza with Bitcoin back in like 2011.”

The “penny dropped,” he said, when he began to think in terms of what he calls the “global collateral layer” that underpins borrowing by sovereigns and central banks. Historically, that base layer moved from gold to the Eurodollar system from the 1960s onward, and today is heavily intertwined with sovereign debt. “All the countries around the world issue debt and then they kind of borrow against that and they do their daily like government transactions,” he noted, but “there are problems with that.”

In Jackson’s “Vision 2041,” bitcoin replaces the Eurodollar and, functionally, becomes the neutral asset that other balance sheets are built upon. He argues that bitcoin is “much superior” as collateral because it is digital and “apolitical,” sitting outside central banks and the influence of “whoever the latest treasury secretary here is in the US.”

As with the Eurodollar, he does not see this as a direct attack on the dollar or Treasuries, but as a new underlying layer: “There’s some underlying thing that a lot of other countries and the financial systems borrow against to kind of do things.”

Eric Jackson (@ericjackson) expects bitcoin to hit $50 million by 2041.

He compares his thesis to how he knew Carvana, $CVNA, would be a 100-bagger stock pick. pic.twitter.com/CA9BWoR4zF

— Phil Rosen (@philrosenn) December 7, 2025

Looking ahead 15 years, Jackson envisions sovereigns that currently issue and roll debt instead “rely on Bitcoin,” because “over time, like that’s much more logical.” Given the “enormous” scale of the sovereign debt world, he argues that if bitcoin becomes the dominant collateral substrate, its price per coin would need to reach orders of magnitude above current levels—hence his $50 million-by-2041 target.

At press time, Bitcoin traded at $91,574.

Coinbase has reopened India app registrations, with local fiat on-ramps planned for 2026 following a rocky exit more than two years ago.

A crypto market analyst and trader has projected how much lower XRP could still drop from here, identifying what he believes is behind the current market struggles. The crypto market tried to rebound earlier this month, but that momentum faded prematurely.

Despite Shiba Inu bearish performance, early community member Zach Humphries argues that SHIB still has a realistic path back to its explosive 2021 momentum. In a nine-minute video shared on X, Humphries outlined critical changes he believes the team must implement for SHIB to break out of its prolonged stagnation and regain the 2021 price levels that defined its legendary rise.

Coinbase has reinstated new user registrations in India after more than two years of suspension. This initiative represents its most concerted effort to reestablish a significant presence in one of the world’s most active cryptocurrency markets.

Coinbase has reopened registration in India following a two-year operational hiatus, marking the crypto giant’s return to the world’s second-largest internet market with plans to introduce fiat currency integration by 2026.

The exchange currently offers crypto-to-crypto trading while working toward full-service restoration, which will allow Indian customers to deposit rupees and purchase digital assets directly on the platform.

The San Francisco-based company first entered India in April 2022 but was forced to suspend operations within days after the National Payments Corporation refused to recognize its use of the Unified Payments Interface.

By September 2023, Coinbase had withdrawn entirely from India, requiring existing customers to liquidate their holdings and transfer funds elsewhere.

— Cryptonews.com (@cryptonews) May 11, 2022

@coinbase suspended trading service in India “because of some informal pressure from the Reserve Bank of India”, said Coinbase CEO Brian Armstrong.

Coinbase’s willingness to completely exit the market represented a significant commercial risk, John O’Loghlen, the exchange’s Asia-Pacific regional director, told TechCrunch.

Speaking at India Blockchain Week, O’Loghlen explained that forcing existing customers to close their accounts ran counter to typical business strategy but established a clean regulatory slate.

The company subsequently engaged with India’s Financial Intelligence Unit throughout 2024, securing approval for registration and launching early access in October before expanding to general availability.

— Cryptonews.com (@cryptonews) March 11, 2025

Global crypto exchange Coinbase has registered with India’s FIU—paving the way to resume trading and launch retail services later this year. #India #Coinbase https://t.co/fEEOzAC4aT

The exchange now joins other global platforms like Binance, KuCoin, and Bybit in receiving Financial Intelligence Unit authorization.

These competitors faced similar regulatory obstacles after the government agency cracked down on offshore exchanges in January 2024 for violating anti-money laundering provisions, blocking their websites, and removing their applications from digital storefronts.

Most secured compliance approvals and paid substantial penalties to resume operations.

Coinbase has simultaneously deepened its financial commitment to the Indian market by investing additional capital in local exchange CoinDCX at a $2.45 billion valuation.

The American firm employs over 500 people nationwide. It continues hiring for positions serving both domestic and international operations, while chief legal officer Paul Grewal recently joined the U.S.-India Business Council board to strengthen bilateral commercial relationships.

India’s cryptocurrency taxation framework remains among the world’s most punitive, imposing a 30% levy on profits without allowing traders to offset losses against gains.

The government additionally deducts 1% from every transaction, discouraging frequent trading activity and pushing an estimated 90% of Indian crypto volume to offshore platforms.

When combined with mandatory surcharges and additional fees, the effective tax burden reaches 42.7% for high-income traders.

O’Loghlen acknowledged these fiscal barriers while expressing hope that authorities will eventually ease restrictions to make digital asset ownership less burdensome.

The Reserve Bank of India has consistently opposed cryptocurrencies, citing concerns about macroeconomic stability, financial system risks, and vulnerabilities to money laundering.

A recently disclosed government document revealed that Indian officials remain reluctant to implement comprehensive crypto legislation, fearing that formal recognition might encourage mainstream adoption and create systemic financial exposure.

— Cryptonews.com (@cryptonews) September 10, 2025

India stalls full crypto framework due to systemic risk fears. Officials plan to maintain partial oversight with strict taxation rules. #Crypto #India #RBIhttps://t.co/hH14ySucmR

Despite these regulatory headwinds, India consistently ranks among the top countries in global crypto adoption indices, with citizens holding approximately $4.5 billion in digital assets.

Tax authorities have recently intensified scrutiny, investigating over 400 high-net-worth individuals suspected of evading payment obligations through peer-to-peer transactions on platforms like Binance and demanding regional office reports by mid-October.

Coinbase aims to differentiate itself through security and accessibility, according to O’Loghlen, who emphasized the need for intuitive interfaces comparable to popular Indian consumer applications.

“We want to be known as that trusted exchange, ensure that your funds are safe with us,” he stated.

“We’re not going to get out to the masses if you can’t have a really nice UI, a trusted experience that allows you to onboard in a matter of minutes.“

The company’s return coincides with India’s emergence as a major blockchain development hub, with its share of global Web3 developers growing substantially in recent years.

However, the operational environment remains complex, as government officials continue promoting the Reserve Bank’s digital rupee while heavily taxing private cryptocurrencies that lack sovereign backing.

The post Coinbase Returns to India After 2-Year Pause, Fiat Access Coming 2026 appeared first on Cryptonews.

Robinhood Markets has announced two key acquisitions, marking its official entry into the Indonesian market. The American financial services firm has entered into agreements to acquire Indonesian brokerage Buana Capital and OKJ-licensed crypto trader PT Pedagang Aset Kripto.

Announced Monday, the move expands Robinhood’s presence in one of the leading crypto markets in the Southeast Asian region.

“Indonesia represents a fast-growing market for trading, making it an exciting place to further Robinhood’s mission to democratize finance for all,” said Patrick Chan, Head of Asia at Robinhood.

Besides, Pieter Tanuri, the majority owner at both Buana Capital and PT Pedagang Aset Kripto, will serve as the strategic advisor to Robinhood.

However, the company did not disclose the deal price, which is expected to close in H1 2026, Reuters reported.

Robinhood is coming to Indonesia. We're excited to work with the Buana Capital and PT Pedagang Aset Kripto teams to democratize finance for this fast-growing market.

— Steve Quirk (@SteveQuirk_) December 8, 2025

Indonesia already has more than 19 million capital market investors and 17 million crypto investors, and we look…

Indonesia is home to about 17 million crypto traders and has more than 19 million capital market investors, per a recent report.

Besides, Chainalysis ranks Indonesia as a top global crypto market, placing it 7th in the world and 1st in Southeast Asia for crypto adoption in its 2025 index.

Further, the World Bank’s report on Global Findex 2025 noted that financial account ownership in Indonesia has increased from about 20% of adults in 2011 to roughly 60% by 2024.

With the expansion, Robinhood aims to bring its crypto trading services to Indonesia.

“We look forward to bringing Indonesians the same innovative services that have earned the trust of Robinhood customers globally,” Patrick Chan added.

The nation recently tightened its grip on crypto trading with a tax overhaul, hitting offshore platforms with a fivefold rate increase.

Additionally, crypto mining operations saw VAT rates double from 1.1% to 2.2%, along with an increase in taxes on domestic crypto sales and overseas exchange transactions separately.

The Indonesian government is also exploring Bitcoin as a reserve asset to benefit the country’s long-term financial stability.

The post Robinhood Sets Indonesia Footprint Through Crypto Trader, Brokerage Firms Acquisition appeared first on Cryptonews.

GoTyme Bank, one of the Philippines’ fastest-growing digital banks, has launched crypto trading for its 6.5 million customers through a new partnership with US fintech firm Alpaca.

Key Takeaways:

The rollout allows users to buy and store 11 crypto assets directly inside the GoTyme mobile app, with purchases auto-converted from Philippine pesos to US dollars.

Supported assets include Bitcoin (BTC), Ether (ETH), Solana (SOL), Polkadot (DOT) and several other major altcoins.

While GoTyme has not indicated whether more advanced trading tools will be added later, the bank says the service is intentionally designed for newcomers.

“Our product focuses on simplicity and reliability, designed for people who want to buy crypto confidently without complicated technical analysis or managing multiple apps,” CEO Nate Clarke said.

GoTyme, launched in October 2022 through a joint venture between Singapore’s Tyme Group and the Philippines’ Gokongwei Group, has seen rapid user growth.

The bank promotes a frictionless onboarding process, allowing users to open a bank account and debit card in as little as five minutes, a feature that now extends to crypto access as well.

The digital bank is also setting its sights beyond the Philippines. Clarke recently said GoTyme plans to expand into Vietnam and Indonesia, aiming to capture a larger share of Southeast Asia’s fast-growing digital banking market.

GoTyme Bank Launches Crypto Trading in the Philippines in Partnership with Alpaca https://t.co/ffWy6OGBil pic.twitter.com/ZX4zjGsE4Q

— Latest News from Business Wire (@NewsFromBW) December 8, 2025

He noted that profitability is not yet a priority. “We are very much still in a growth phase. We are not optimizing for profitability at the moment.

What matters to us is building a growing and engaged customer base,” Clarke told The Digital Banker.

The Philippines continues to be one of the most active crypto markets globally. It ranks ninth on Chainalysis’ 2025 Global Crypto Adoption Index, while local policymakers are considering a proposal to create a national strategic reserve backed by 10,000 BTC.

As reported, Philippine Senator Bam Aquino is preparing a bill that would place the country’s entire national budget and government financial transactions on a blockchain system, aiming to make public spending fully transparent and easily traceable by citizens.

In August, Aquino said the proposal would allow “every peso” to be logged on-chain, creating what he hopes will become the world’s first fully blockchain-based national budget.

The Philippines is emerging as a testing ground for public-sector blockchain initiatives.

Congressman Miguel Luis Villafuerte recently introduced a separate bill to establish a strategic Bitcoin reserve of up to 10,000 BTC over five years.

According to the bill, the holdings could only be sold under strict conditions, such as retiring sovereign debt, and no more than 10% of the reserve may be liquidated in any two-year period after the minimum holding period expires.

As of November 2024, the Philippines’ debt had risen to ₱16.09 trillion ($285 billion), with domestic obligations accounting for nearly 68% of the total.

The post Philippines’ GoTyme Bank Rolls Out Crypto Trading for its 6.5M Users appeared first on Cryptonews.

Trong khi mọi ánh mắt đổ dồn vào các ETF Solana (SOL) với tổng dòng vốn vào khoảng $682 triệu, thì ETF XRP âm thầm vượt mặt với $874 triệu — dù các sản phẩm SOL ra mắt trước. Cùng lúc đó, một loạt ETF altcoin mới liên quan đến LTC, HBAR, DOGE và LINK cũng đã chính thức gia nhập cuộc chơi, mỗi quỹ đều ghi nhận dòng vốn khiêm tốn nhưng ổn định kể từ khi ra mắt.

Thực đơn “Altcoin Buffet” chính thức xuất hiện trên Wall StreetBảy ETF Solana riêng biệt đã tạo ra $618,62 triệu dòng vốn ròng kể từ khi niêm yết, và với $915,08 triệu tổng tài sản quản lý, các quỹ này hiện chiếm khoảng 1,15% vốn hóa Solana.

Trong khi đó, XRP đã thu hút $874,28 triệu, theo dữ liệu từ sosovalue.com.

Chỉ có bốn ETF XRP xuất hiện trên bảng điều khiển của nền tảng này — do Grayscale, Franklin Templeton, Canary và Bitwise quản lý. ETF của Canary, với mã XRPC, dẫn đầu với $357 triệu dòng vốn kể từ ngày đầu tiên. Riêng ngày hôm qua, cả nhóm thu hút $50,27 triệu, trong đó Grayscale GXRP đóng góp lớn nhất.

Tổng cộng, bốn ETF này đang nắm giữ $906,46 triệu giá trị XRP, tương đương 0,68% vốn hóa của XRP.

Đối với các nhà đầu tư muốn tiếp cận LINK, HBAR, LTC và DOGE, những ETF mới ra mắt này cũng đã ghi nhận tổng cộng $133,46 triệu dòng vốn ròng. Riêng DOGE có hai ETF — Grayscale GDOG và Bitwise BWOW — thu hút $2,85 triệu.

ETF Floodgates Open: Altcoin ngập tràn lựa chọnGrayscale GLNK đã thu hút khoảng $40,90 triệu, trong khi LTCC của Canary (theo dõi Litecoin) thu về $7,67 triệu. ETF HBAR của Canary (HBR) đã ghi nhận $82,04 triệu dòng vốn ròng.

Khi nhà đầu tư có thể dễ dàng “nhảy giữa các quỹ”, thị trường nhiều khả năng sẽ biến động mạnh hơn khi dòng vốn luân chuyển liên tục.

Và mặc dù XRP và SOL ETF đang bám đuổi sát sao nhau, cả hai vẫn còn rất xa so với BTC và ETH ETF — những quỹ đã được triển khai sớm hơn một năm và đang tiến gần mốc hai năm hoạt động.

Khi ngày càng nhiều ETF altcoin được tung ra thị trường, dòng vốn sẽ tiếp tục phân tán. Thách thức lớn nhất sẽ là liệu sự hào hứng của nhà đầu tư có theo kịp tốc độ mở rộng của danh sách quỹ hay không. Hiện tại, các ETF mới đang cạnh tranh quyết liệt với nhau, nhưng hành trình để đạt tới tầm vóc của BTC và ETH ETF vẫn còn rất dài.

Tuy nhiên, sự mở rộng này cho thấy thị trường đang chuyển sang giai đoạn mới — một giai đoạn của sự lựa chọn đa dạng, cạnh tranh mạnh mẽ và dòng vốn mới tràn vào.

Bitcoin Hyper – ứng viên altcoin tiềm năng giữa làn sóng ETF mớiDù bài toán ETF đang chi phối dòng tiền tổ chức, nhà đầu tư nhỏ lẻ và trung hạn vẫn đang tìm kiếm altcoin tiềm năng có thể bứt phá ngoài phạm vi ETF truyền thống.

It's time to Blast Off with $HYPER.

Are you ready?

https://t.co/VNG0P4FWNQ pic.twitter.com/JNHbJ8wzTn

— Bitcoin Hyper (@BTC_Hyper2) November 16, 2025

Một trong những cái tên ngày càng nổi bật là Bitcoin Hyper (HYPER) — dự án Bitcoin Layer-2 chạy trên Solana Virtual Machine (SVM), tạo ra sự kết hợp giữa tốc độ Solana và bảo mật Bitcoin.

Với gần $29 triệu huy động được từ presale, tổng cung cố định 21 tỷ token, và APY staking 40%, HYPER đang thu hút sự chú ý mạnh mẽ từ cả trader lẫn nhà đầu tư tổ chức nhỏ.

Mô hình này mở ra khả năng giúp lượng BTC “nằm im” có thể tham gia DeFi — điều mà các nhà phân tích coi là một trong những cơ hội tăng trưởng mạnh nhất ngoài ETF, giúp Bitcoin Hyper trở thành một trong những đồng altcoin tiềm năng đáng theo dõi nhất trong năm tới.

FAQ

ETF crypto nào đang thu hút dòng vốn lớn nhất hiện tại? XRP và SOL dẫn đầu trong nhóm altcoin, trong khi BTC và ETH vẫn vượt xa về tổng dòng vốn.

ETF nào mới ra mắt cho nhà đầu tư? Các ETF gắn với LINK, HBAR, LTC và DOGE vừa được niêm yết, cung cấp thêm lựa chọn cho thị trường.

Tổng dòng vốn vào các ETF altcoin mới là bao nhiêu? Hơn $133 triệu cho DOGE, HBAR, LINK và LTC — trong khi XRP và SOL cao hơn nhiều do ra mắt sớm hơn.

XRP và SOL ETF so với BTC và ETH ra sao? Mặc dù đang phát triển mạnh, chúng vẫn còn rất xa mới đạt được quy mô khổng lồ của BTC và ETH ETF.

A new a16z crypto research paper argues that apocalyptic narratives about quantum computers instantly killing Bitcoin are badly misaligned with reality, and that the real risk for blockchains lies in long, messy migrations rather than a sudden “Q-Day” collapse. The piece has already triggered a sharp rebuttal on X from investors who say the threat is closer and harder than a16z suggests.

In the article “Quantum computing and blockchains: Matching urgency to actual threats,” a16z research partner and Georgetown computer science professor Justin Thaler sets the tone early, writing that “Timelines to a cryptographically relevant quantum computer are frequently overstated — leading to calls for urgent, wholesale transitions to post-quantum cryptography.” He argues that this hype distorts cost–benefit analyses and distracts teams from more immediate risks such as implementation bugs.

Thaler defines a “cryptographically relevant quantum computer” (CRQC) as a fully error-corrected machine capable of running Shor’s algorithm at a scale where it can break RSA-2048 or elliptic-curve schemes like secp256k1 in roughly a month of runtime. In his assessment, a CRQC in the 2020s is “highly unlikely,” and public milestones do not justify claims that such a system is probable before 2030.

He stresses that across trapped-ion, superconducting and neutral-atom platforms, no device is close to the hundreds of thousands to millions of physical qubits, with the required error rates and circuit depth, that would be needed for cryptanalysis.

Instead, the a16z piece draws a sharp line between encryption and signatures. Thaler argues that harvest-now-decrypt-later (HNDL) attacks already make post-quantum encryption urgent for data that must remain confidential for decades, which is why large providers are rolling out hybrid post-quantum key establishment in TLS and messaging.

But he insists that signatures, including those securing Bitcoin and Ethereum, face a different calculus: they do not protect hidden data that can be retroactively decrypted, and once a CRQC exists, the attacker can only forge signatures going forward.

On that basis, the paper claims that “most non-privacy chains” are not exposed to HNDL-style quantum risk at the protocol level, because their ledgers are already public; the relevant attack is forging signatures to steal funds, not decrypting on-chain data.

Thaler still flags Bitcoin as having “special headaches” due to slow governance, limited throughput and large pools of exposed, potentially abandoned coins whose public keys are already on-chain, but he frames the time window for a serious attack in terms of at least a decade, not a few years.

“Bitcoin changes slowly. Any contentious issues could trigger a damaging hard fork if the community cannot agree on the appropriate solution,” Thaler writes, adding “another concern is that Bitcoin’s switch to post-quantum signatures cannot be a passive migration: Owners must actively migrate their coins.”

Moreover, Thalen flags a “final issue specific to Bitcoin” which is its low transaction throughput. “Even once migration plans are finalized, migrating all quantum-vulnerable funds to post-quantum-secure addresses would take months at Bitcoin’s current transaction rate,” Thaler says.

He is equally skeptical of rushing into post-quantum signature schemes at the base-layer. Hash-based signatures are conservative but extremely large, often several kilobytes, while lattice-based schemes such as NIST’s ML-DSA and Falcon are compact but complex and have already produced multiple side-channel and fault-injection vulnerabilities in real-world implementations. Thaler warns that blockchains risk weakening their security if they jump too early into immature post-quantum primitives under headline pressure.

Industry Split On The RiskThe most forceful pushback has come from Castle Island Ventures co-founder Nic Carter and Project 11 CEO Alex Pruden. Carter summed up his view on X by saying the a16z work “wildly underestimates the nature of the threat and overestimates the time we have to prepare,” pointing followers to a long thread from Pruden.

Pruden begins by stressing respect for Thaler and the a16z team, but adds, “I disagree with the argument that quantum computing is not an urgent problem for blockchains. The threat is closer, the progress faster, and the fix harder than how he’s framing it & than most people realize.”

He argues that recent technical results, not marketing, should anchor the discussion. Citing neutral-atom systems that now support more than 6,000 physical qubits, Pruden points out that “we now have a non annealing system with more than 6000 physical qubits in the neutral atom architecture,” directly contradicting any implication that only non-scalable annealing architectures have reached that scale. He notes that work such as Caltech’s 6,100-qubit tweezer array shows large, coherent, room-temperature neutral-atom platforms are already a reality.

On error correction, Pruden writes that “surface code error correction was experimentally demonstrated last year, moving it from a research problem into an engineering problem,” and points to rapid advances in color codes and LDPC codes.

He highlights Google’s updated “Tracking the Cost of Quantum Factoring” estimates, which show that a quantum computer with about one million noisy physical qubits running for roughly a week could, in principle, break RSA-2048 — a twenty-fold reduction from Google’s own 2019 estimate of twenty million qubits. “Resource estimates for a CRQC running Shor’s algorithm have dropped by two orders of magnitude in six months,” he notes, concluding, “To say that this trajectory of progress might potentially deliver a quantum computer before 2030 is not an overstatement.”

Where Thaler emphasizes HNDL as an encryption problem, Pruden reframes blockchains as uniquely attractive quantum targets. He stresses that “public keys used in digital signatures are just as easy to harvest as encrypted messages,” but in blockchains those keys are directly tied to visible value. He points out that “these public keys are distributed & directly associated with value ($150B for Satoshi’s BTC alone),” and that once a quantum adversary can forge signatures, “If you can forge a signature, you can steal the asset regardless of when that original UTXO/account was created.”

For Pruden, this economic reality means “the economic incentives simply and clearly point to blockchains as being the first cryptographically relevant quantum use case,” even if other sectors also face HNDL risks. He adds that “blockchains will be far slower to migrate than centralized systems. A bank can upgrade its stack. Blockchains must reach global consensus, absorb performance trade-offs from PQ signatures, and coordinate millions of users to migrate their keys.”

Invoking Ethereum’s multi-year shift from proof of work to proof of stake, he writes, “The closest thing was the ETH 1.0 to 2.0 transition which took years, and as complex as that was, a PQ migration is much harder. Anyone who thinks this is a matter of swapping a few lines of signature code has simply never shipped, deployed, or maintained a production blockchain.”

Pruden agrees with Thaler that panic is dangerous, but flips the conclusion: “I agree that rushing is dangerous. But that is exactly why work must begin now. The most likely failure mode is that the industry waits too long, and then a major QC milestone triggers a panic.” He closes by saying he disagrees that “quantum computing is progressing slowly,” that “blockchains are less vulnerable than systems exposed to HNDL risk,” or that “the industry has years of slack before action is needed,” arguing that “All three assumptions are at odds with reality.”

At press time, Bitcoin stood at $91,616.