XRP Price Prediction: Panic Sets In as XRP Drops Again – But This Signal Says a Massive Bounce Could Be Coming

Panic has gripped XRP holders after the token slid back to the $2 mark, triggering a fresh wave of fear across the market.

But when sentiment hits extremes like this, it often signals the opposite of what traders expect and could favor a bullish XRP price prediction.

Santiment data shows social sentiment has plunged into “Extreme Fear,” while CoinMarketCap’s Fear and Greed Index dropped to just 16.

From Wednesday to Friday, XRP slipped from $2.20 to $2, capping off three days of selling pressure.

Yet behind the scenes, investor interest appears to be building.

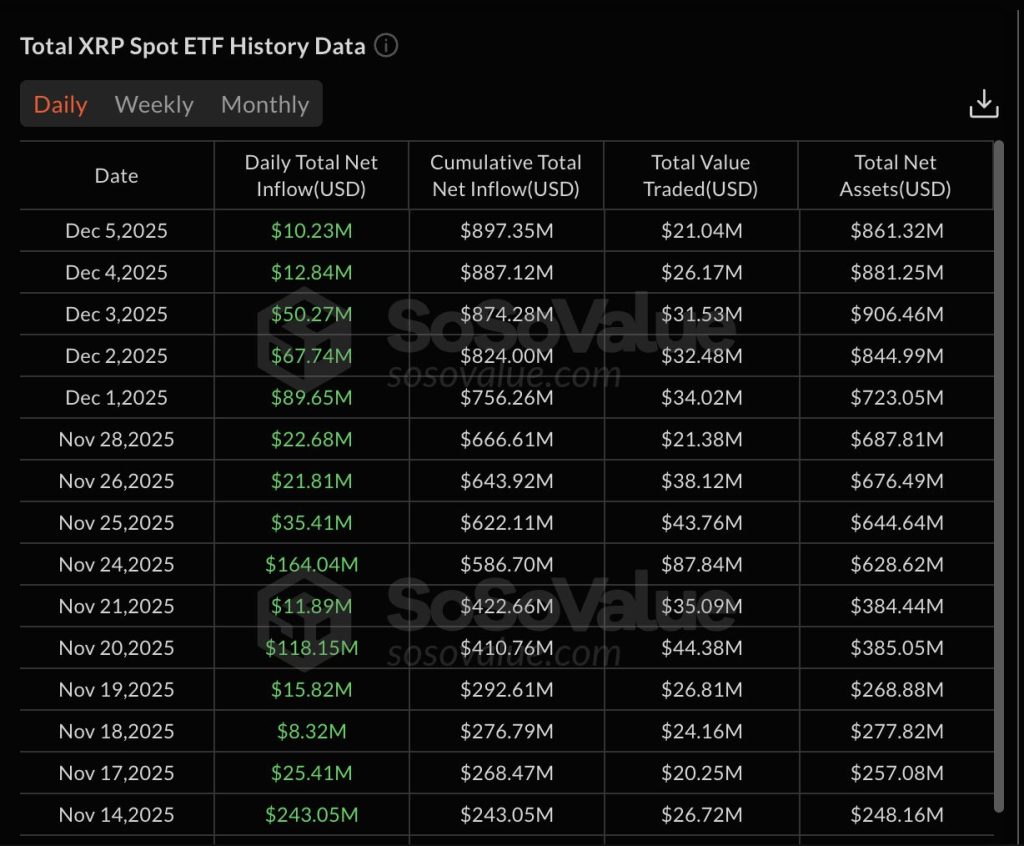

XRP-linked ETFs have now recorded 15 consecutive days of net inflows, according to SoSo Value, totaling nearly $900 million in fresh capital.

Combined assets under management for these funds now sit at $861 million, suggesting that both retail and institutional investors are positioning for a rebound.

With fear rising and big money flowing in, this could be the early stage of a major reversal.

XRP Price Prediction: XRP Is Forming a Bullish Falling Channel Pattern

XRP has bounced off the $1.95 support zone and is now forming a series of higher lows, signaling a potential trend reversal.

The next key level to watch is $2.20. A breakout above this resistance, followed by a successful retest, could confirm a bullish reversal pattern and open the door to a rally toward $3+.

In the past 24 hours, XRP has gained 3.3%, with trading volume jumping nearly 90%.

With momentum building, the token could be positioning itself for a major breakout.

As broader crypto sentiment begins to shift, some of the most promising new projects have continued to gain traction.

One project in particular is Bitcoin Hyper ($HYPER), a presale project building a Solana-powered layer-2 solution for Bitcoin.

By combining Bitcoin’s security with Solana’s speed and scalability, $HYPER is creating a new level of utility for Bitcoin, and investors have taken notice, with millions raised so far.

Bitcoin Hyper ($HYPER) Lets Investors Earn Passive Income on BTC

Bitcoin Hyper ($HYPER) was created to address the Bitcoin blockchain’s long-standing scalability issues by introducing a Solana-powered infrastructure that reduces transaction fees and speeds up transaction speeds.

What makes Bitcoin Hyper so powerful is its seamless bridge between Bitcoin and next-gen applications.

Using the Hyper Bridge, BTC holders can safely send tokens from the Bitcoin blockchain and instantly receive an equivalent amount on Hyper’s high-speed Layer 2.

This unlocks access to lightning-fast DeFi tools, payment platforms, and more, all without ever leaving the original Bitcoin network.

For developers, it means the ability to build scalable dApps on Bitcoin for the first time, powered by Solana-grade performance.

As adoption spreads across major wallets and exchanges, demand for $HYPER could skyrocket.

To buy $HYPER before the presale ends, simply head to the Bitcoin Hyper official website and link up a compatible wallet like Best Wallet.

You can either swap USDT or SOL or use a bank card instead.

Visit the Official Bitcoin Hyper Website HereThe post XRP Price Prediction: Panic Sets In as XRP Drops Again – But This Signal Says a Massive Bounce Could Be Coming appeared first on Cryptonews.